Market Summary

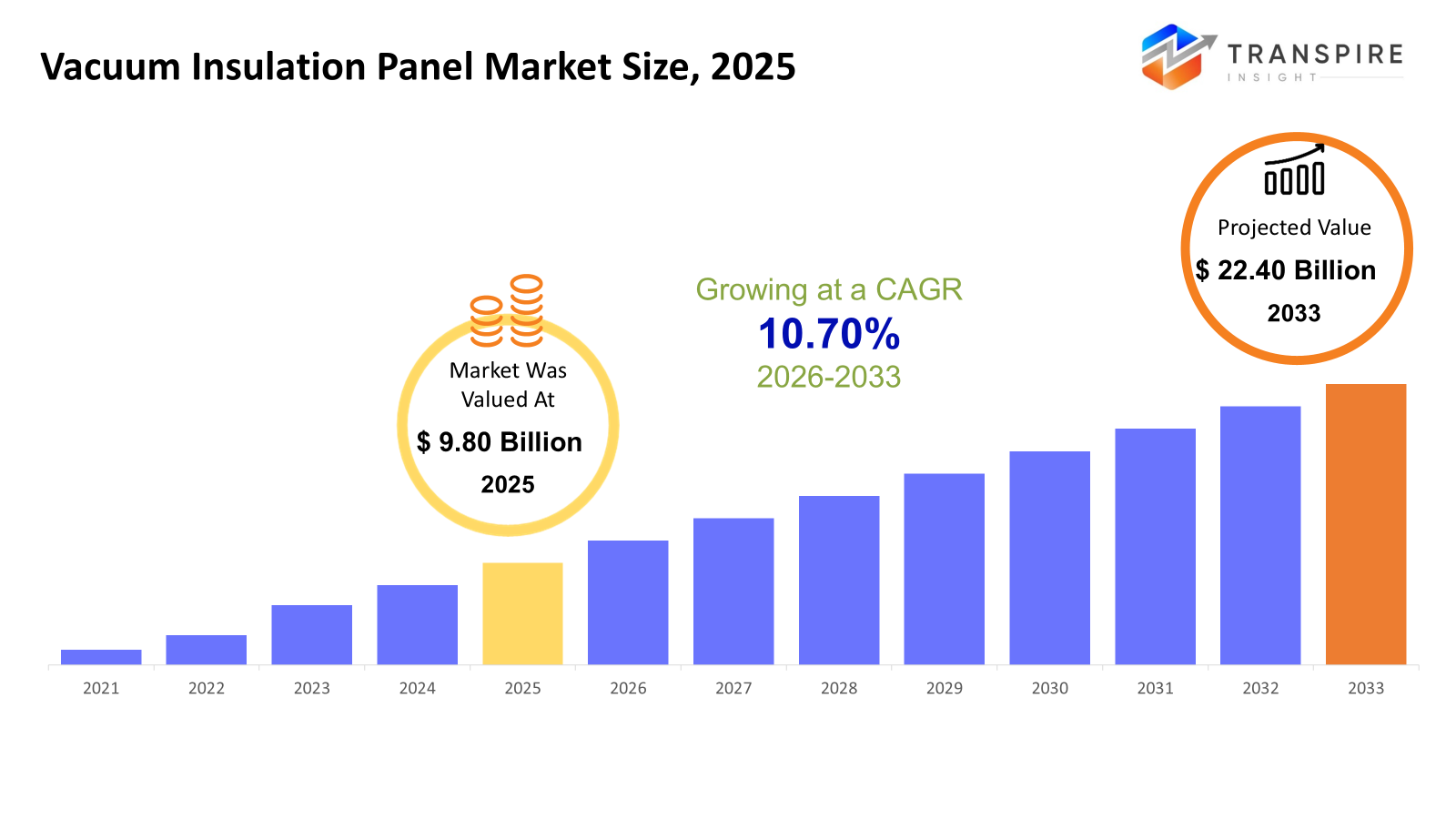

The global Vacuum Insulation Panel market size was valued at USD 9.80 billion in 2025 and is projected to reach USD 22.40 billion by 2033, growing at a CAGR of 10.70% from 2026 to 2033. Vacuum insulation panels have a growing market due to the rising global focus on energy efficiency and the reduction of carbon emissions in the construction, refrigeration, and appliance industries. Regulatory demands for the use of advanced insulation materials have also driven the market in both developed and emerging economies.

Market Size & Forecast

- 2025 Market Size: USD 9.80 Billion

- 2033 Projected Market Size: USD 22.40 Billion

- CAGR (2026-2033): 10.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is showing high adoption rates due to stringent energy efficiency regulations, modernization of cold chain infrastructure, and increased adoption of high-performance insulation materials. Technological advancements are contributing to sustained demand growth rates for vacuum insulation panels.

- The United States is showing sustained growth rates due to green building initiatives, advanced refrigeration manufacturing, and increased demand for high-performance energy-efficient appliances. Manufacturers are focusing on improving thermal efficiency and reducing operational energy consumption through advanced insulation materials.

- Asia Pacific is showing high growth rates due to high demand from urbanization, industrialization, and infrastructure development. Increased construction activity and rising demand for high-performance energy-efficient appliances are contributing to high adoption rates of vacuum insulation panels.

- There is a high demand for silica core materials due to high thermal insulation performance, long-term durability, and suitability for high-performance applications. Manufacturers are able to achieve long-term energy savings and comply with stringent energy efficiency regulations.

- Flat panels account for the majority of panel type due to standardized manufacturing, cost efficiency, and compatibility with large-scale building and appliance designs.

- The construction industry remains the largest application segment, driven by the need for energy efficiency regulations and sustainable building practices, which promote the use of high-end insulation materials that minimize energy consumption and maximize space utilization in modern building structures.

- Commercial end-use industry remains the major driver of panel type usage, fueled by the need for energy-efficient infrastructure, growth of cold storage facilities, and cost efficiency through enhanced thermal insulation performance.

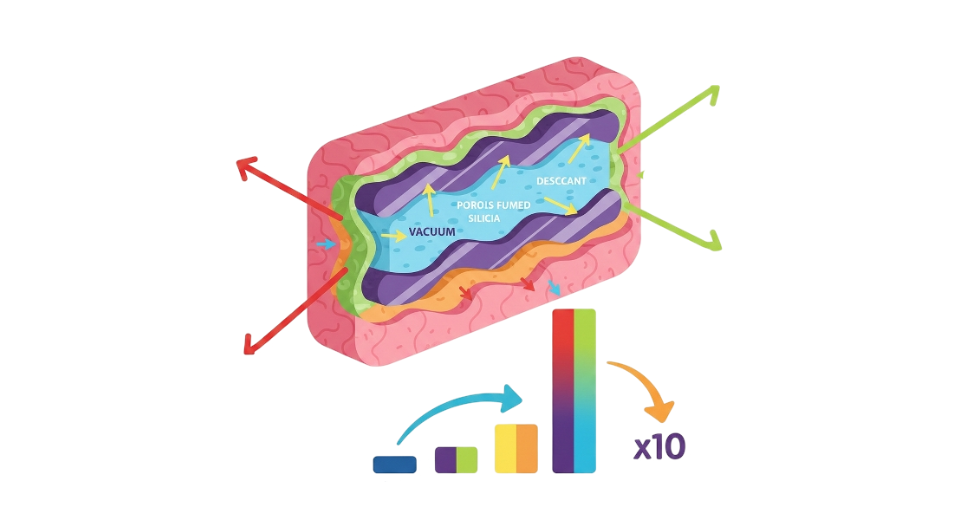

So, The vacuum insulation panel market refers to the market for the manufacture of high-performance insulation materials that use a vacuum-sealed core to achieve a high reduction in heat transfer. These panels have better thermal resistance than other insulating materials, thus enabling better energy efficiency in construction, refrigeration systems, appliances, and transport applications. The growth of the market is mainly driven by the increasing global need for green building materials and efficient energy-saving technologies. The use of vacuum insulation panels is driven by the need for energy savings due to the improvement in the panels' thermal performance and the reduction in the required panel thickness for better architectural designs. In addition, the market is driven by the need for efficient building regulations and refrigeration systems. Advancements in technology regarding the materials used and the manufacturing process for panels are also making products more durable and consistent in their performance. The expansion of cold chain infrastructure, especially for the transportation of food and pharmaceutical products, is creating new opportunities for market players, and innovations in the field continue to make it more cost-efficient and expand its scope of usage.

Vacuum Insulation Panel Market Segmentation

By Core Material

- Silica

Silica-based vacuum panel materials lead the pack due to their excellent thermal insulation properties and durability. Their low thermal conductivity and moisture resistance make them suitable for building and refrigeration applications that require high energy efficiency and space optimization.

- Fiberglass

Fiberglass-based core materials provide cost advantages and acceptable insulation performance for applications requiring moderate levels of thermal performance. These materials are widely used for applications that prioritize cost and lightweight characteristics over high levels of thermal insulation efficiency.

- Fumed Silica

Fumed silica-based panel materials provide excellent levels of low thermal conductivity and durability. These materials are suitable for high-end applications such as advanced refrigeration and building insulation applications.

- Perlite

Perlite-based panel materials are used for specific applications due to their relatively lower cost and efficient insulation performance. These materials are used for industrial applications where the performance requirements for insulations are moderate and the budget constraints are high.

- Others

Hybrid cores and other mineral-based composition materials are included in the list of others. These materials are attracting the attention of the manufacturing sector for the development of sustainable and recyclable insulations.

To learn more about this report, Download Free Sample Report

By Panel Type

- Flat Panels

Flat panels have the largest market share due to their ease of installation and compatibility with standard construction and appliance designs. Flat panels have a standard structure, making it easier to manufacture on a large scale while providing the same level of thermal performance.

- Special Shape Panels

Special shape panels are used in applications where the product shape is a requirement, and the space available is limited. This type of insulation product has a growing demand in the automotive and appliance manufacturing industry.

By Application

- Construction

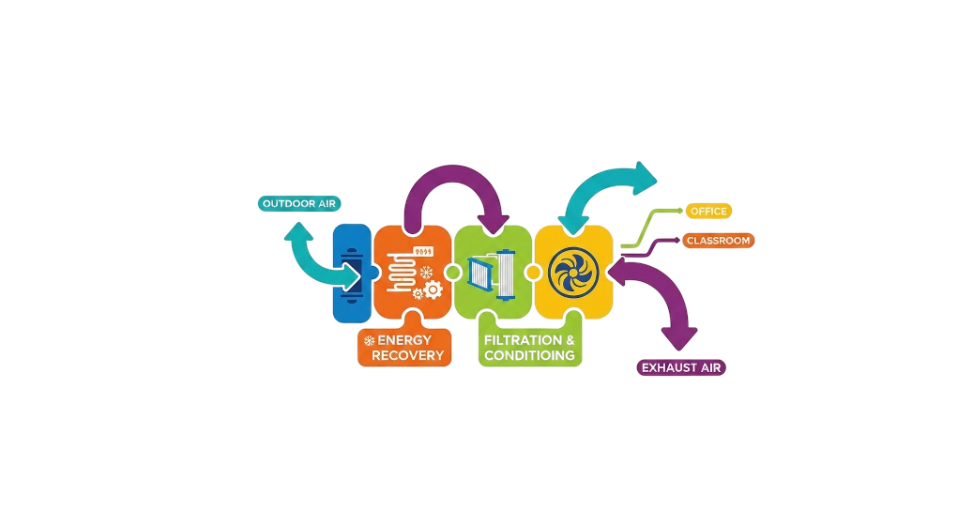

Because regulations for building energy efficiency are pushing people to utilize high-performance materials for insulating buildings, the construction part of the market has the largest demand for insulating materials. The use of vacuum insulation panels allows for a reduction in the thickness of wall structures while maintaining a high degree of insulating value. Thus, they aid in achieving sustainable construction.

- Cold Chain and Logistics

As there is an increasing demand for temperature-sensitive transportation, cold chain and logistics are growing rapidly. Because VIPs provide increased thermal retention, there is reduced energy consumption and spoilage of products due to longer distances travelled.

- Refrigeration and Freezers

VIPs are being used in refrigeration and freezer applications to help reduce energy consumption and to allow for greater internal volume in the refrigeration/freezer unit. Manufacturers are increasingly using VIPs to comply with the stringent energy efficiency requirements of their products and reduce the operational costs associated with running the refrigeration/freezer unit.

- Automotive

The automotive industry is seeing rapid growth because electric vehicles and thermal management systems are now requiring better insulating solutions. VIPs help to improve both the efficiency and maintain the thermal integrity of the vehicle's battery system, which will improve the performance and safety of these vehicles.

Others

- Other applications that utilize VIPs include medical storage, aerospace and specialized industrial operations that require very precise temperature control and the least egregious thermal loss.

By End-Use Industry

- Residential

The adoption of residential vacuum insulation panels is rising with the increasing awareness of energy-efficient housing and space-saving insulation materials. The panels ensure enhanced indoor thermal comfort with reduced long-term energy consumption in modern housing schemes.

- Commercial

Vacuum insulation panels are employed in commercial buildings to attain sustainability requirements. Offices, retail outlets, and cold storage facilities benefit from the energy savings provided by these panels.

- Industrial

Vacuum insulation panels are employed in industrial processes to attain efficient processes in manufacturing and storage facilities. The panels are employed in environments with stable thermal conditions.

Regional Insights

The North American market, which includes the US, Canada, and Mexico, shows high adoption rates owing to factors like energy efficiency norms, advanced construction techniques, and established refrigeration industry infrastructure. The US is the primary contributor in this market. Europe, which includes countries like Germany, the UK, France, Spain, Italy, and the rest of Europe, is a mature market with high environmental regulations and a strong emphasis on green building. The renovation of existing buildings and the reduction of carbon footprint continue to fuel demand in tier 1 countries.

Asia Pacific, which comprises Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific, is the fastest-growing market due to urbanization and growth in the industrial sector. South America, which comprises Brazil and Argentina, is showing gradual growth due to the expansion of the logistics and refrigeration sector. The Middle East & Africa, which comprises Saudi Arabia, UAE, South Africa, and the rest of the Middle East & Africa, is showing increasing growth due to the modernization of the construction sector.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 2025, va-Q-tec introduced new vacuum-insulated transport boxes integrating vacuum insulation panels and phase change materials for temperature-controlled logistics. The development targets cost reduction in cold-chain transportation by maintaining stable temperatures without refrigerated vehicles, highlighting expanding VIP adoption in logistics and food delivery applications.

(Source:https://www.va-q-tec.com/en/launch-va-q-box)

- In May 2025, Panasonic announced that it would showcase its next-generation ADVANC-R®vacuum insulation panel at the AIA Conference on Architecture & Design 2025. The product was positioned as a high-performance insulation solution for low-slope roofing applications, offering high thermal efficiency in a thin profile to support energy-efficient building design and space optimization in modern construction.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 9.80 Billion |

|

Market size value in 2026 |

USD 11.00 Billion |

|

Revenue forecast in 2033 |

USD 22.40 Billion |

|

Growth rate |

CAGR of 10.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Panasonic Corporation, Kingspan Group plc, va-Q-tec AG, LG Hausys Ltd., Porextherm Dämmstoffe GmbH, Knauf Insulation, Etex Group, Mitsubishi Gas Chemical Company, Inc., Sekisui Chemical Co., Ltd., Owens Corning, Armacell International S.A., Vaku-Isotherm GmbH, Recticel Group, Fujian SuperTech Advanced Material Co., Ltd., and ThermoCor Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Core Material (Silica, Fiberglass, Fumed Silica, Perlite, Others), By Panel Type (Flat Panels, Special Shape Panels), By Application (Construction, Cold Chain & Logistics, Refrigeration & Freezers, Appliances, Automotive, Others) and By End-Use Industry (Residential, Commercial, Industrial) |

Key Vacuum Insulation Panel Company Insights

Panasonic Corporation has a good market position in the VIP market with its diversified base of technologies and capabilities. Panasonic makes use of its expertise in thermal management technologies, which allows the company to create highly efficient VIPs with enhanced durability and low thermal conductivity. The company’s global footprint in manufacturing and high R&D investments ensure the constant innovation of its products. Panasonic’s efforts in creating efficient and environmentally friendly insulation solutions also match the increasing demand for efficient building designs, which in turn supports the adoption of Panasonic’s VIPs in the construction industry.

Key Vacuum Insulation Panel Companies:

- Panasonic Corporation

- Kingspan Group plc

- va-Q-tec AG

- LG Hausys Ltd.

- Porextherm Dämmstoffe GmbH

- Knauf Insulation

- Etex Group

- Mitsubishi Gas Chemical Company, Inc.

- Sekisui Chemical Co., Ltd.

- Owens Corning

- Armacell International S.A.

- Vaku-Isotherm GmbH

- Recticel Group

- Fujian SuperTech Advanced Material Co., Ltd.

- ThermoCor Inc.

Global Vacuum Insulation Panel Market Report Segmentation

By Core Material

- Silica

- Fiberglass

- Fumed Silica

- Perlite

- Others

By Panel Type

- Flat Panels

- Special Shape Panels

By Application

- Construction

- Cold Chain & Logistics

- Refrigeration & Freezers

- Appliances

- Automotive

- Others

By End-Use Industry

- Residential

- Commercial

- Industrial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636