Market Summary

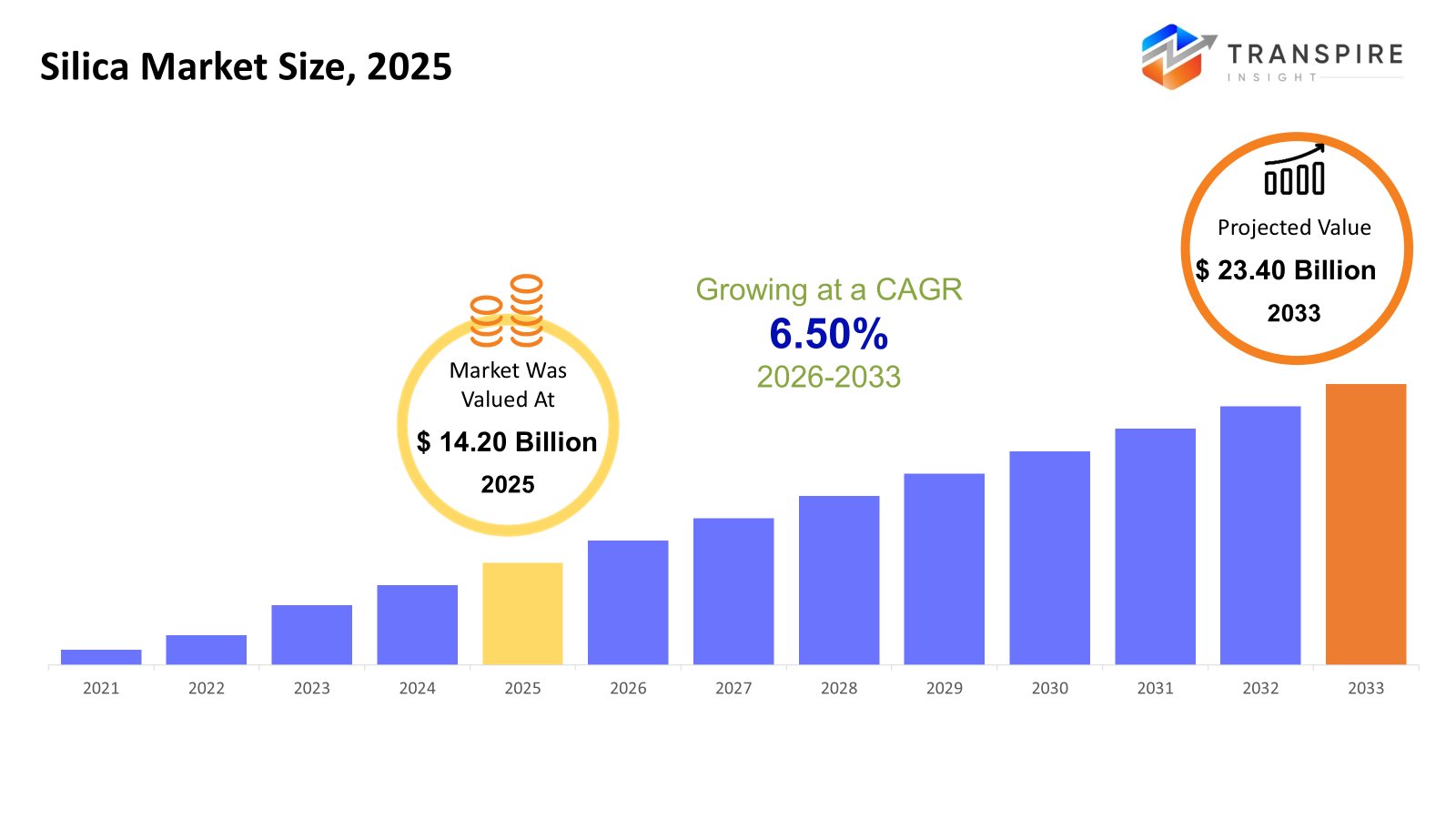

The global Silica market size was valued at USD 14.20 billion in 2025 and is projected to reach USD 23.40 billion by 2033, growing at a CAGR of 6.50% from 2026 to 2033. The Market CAGR growth is driven by the rising demand from the tire manufacturing, electronics, and construction sectors where silica improves the durability, efficiency, and performance properties. The rising use of green tires and high-performance materials is further driving the consumption growth in the industrial sector.

Market Size & Forecast

- 2025 Market Size: USD 14.20 Billion

- 2033 Projected Market Size: USD 23.40 Billion

- CAGR (2026-2033): 6.50%

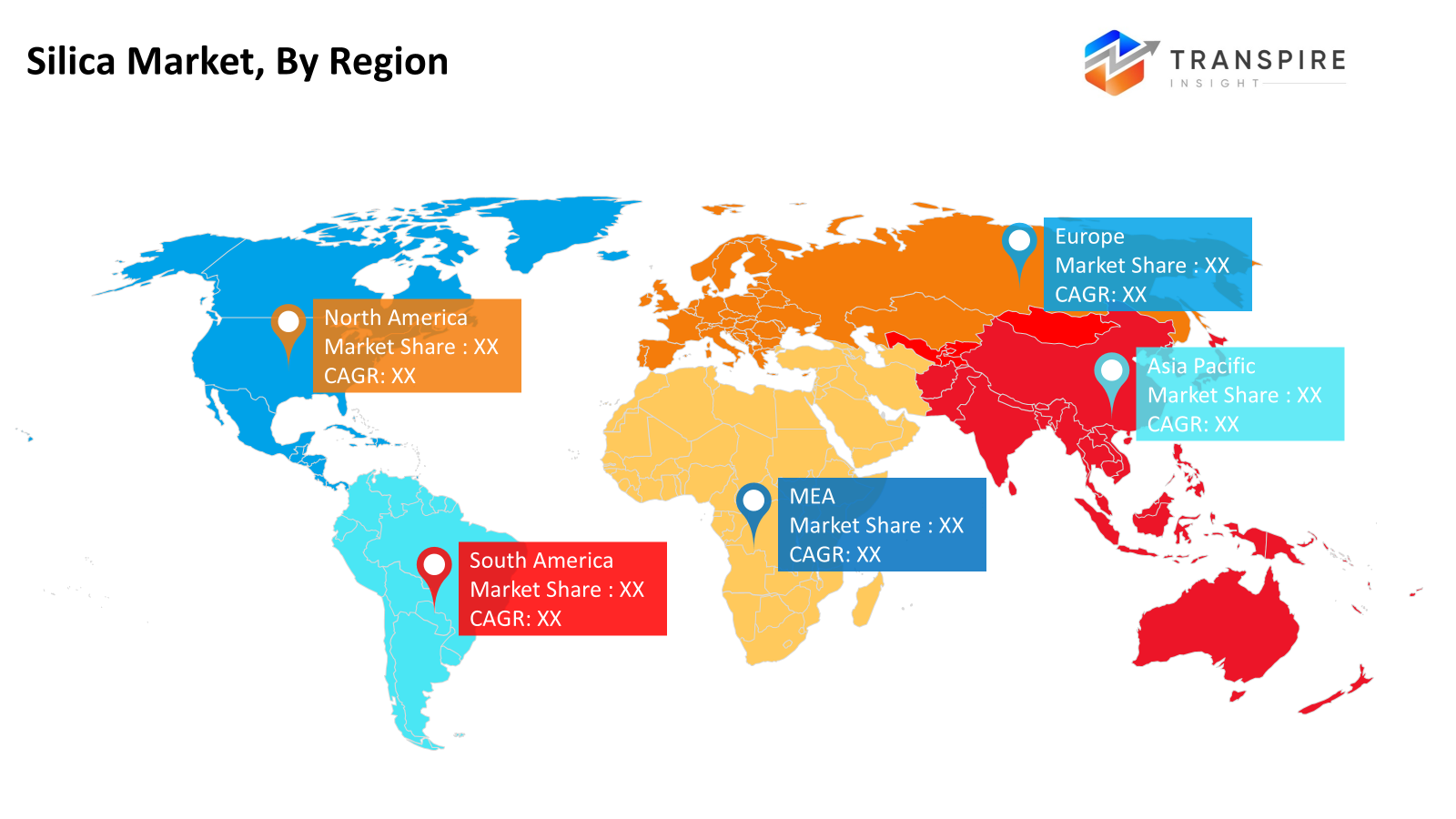

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America Reflects a healthy growth trend driven by the mature automotive and construction sectors, as well as the growing use of energy-efficient materials, and the demand for specialty silica used in coatings and electronics, where innovation and sustainable development efforts shape the future demand trajectory in various industrial segments.

- The United States remains a major growth driver due to the high demand for green tires, semiconductor manufacturing, and specialty chemicals, where R&D intensity and industrialization continue to promote the use of high-performance silica in various applications.

- The Asia Pacific market continues to drive overall market growth due to the fast-growing industrial base, with increased automotive manufacturing and a strong electronics manufacturing base, fueled by infrastructure development and the growing consumption of consumer goods, which cumulatively drive the demand for silica in the manufacturing supply chain.

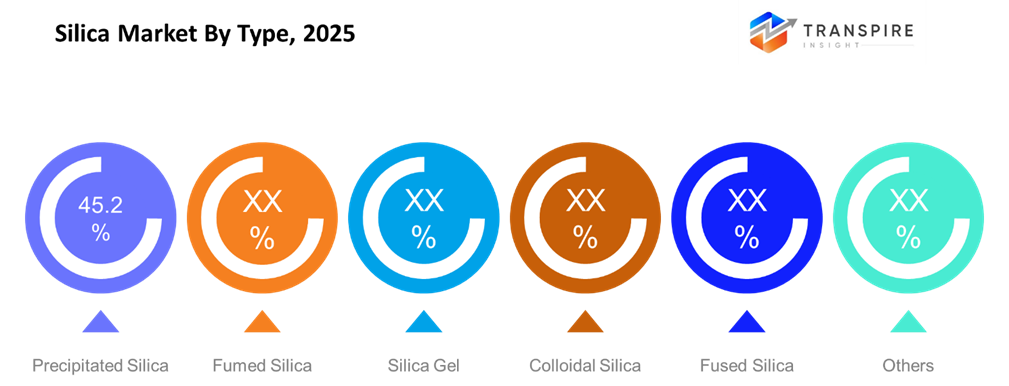

- Precipitated silica continues to be the most prominent type segment due to the growing focus of tire manufacturers on fuel efficiency, durability, and emissions reduction, and due to the increasing regulatory push for sustainable mobility solutions, which drives the adoption of performance-enhancing materials in the automotive and industrial rubber sectors worldwide.

- Powder form leads the market due to its enhanced dispersion properties, ease of processing, and adaptability with large-scale industrial processing, which facilitates efficient incorporation into rubber, plastic, and coating formulations, thereby supporting cost-effective manufacturing in high-volume production settings.

- Rubber application maintains the largest market share due to the ability of silica to enhance rolling resistance, traction, and tire life, which meets the requirements of the automotive sector for energy-efficient, safe, and sustainable material innovations in the transportation sector worldwide.

- Automotive end-use industry sustains robust growth due to the increasing adoption of silica-based materials by manufacturers to enhance tire efficiency, reduce environmental impact, and meet evolving performance standards, and due to the increasing electric vehicle production, which further drives the demand for advanced material solutions in vehicle components.

So, The silica market refers to the production and use of silicon dioxide-based materials in the rubber, plastics, coatings, electronics, food processing, and healthcare sectors. Silica is used as a reinforcing agent, anti-caking agent, thickening agent, and performance enhancer, which makes it a critical industrial material in several value chains. The market demand is primarily driven by industrial production, car manufacturing, and technological developments in material science. Market development is directly associated with the growth of green tire production, the rise in semiconductor production, and the increasing use of specialty chemicals. The ability of silica to enhance mechanical strength, thermal resistance, and surface properties makes it an ideal candidate for advanced industrial applications. The growing emphasis on sustainability and energy efficiency is promoting the use of high-performance silica grades. Moreover, the increasing trend of urbanization and infrastructure development is also supporting the use of silica in the construction and coatings sectors. The growing demand for processed foods, pharmaceuticals, and personal care products is further strengthening the demand for high-purity silica forms.

Silica Market Segmentation

By Type

- Precipitated Silica

The market share for precipitated silica is substantial owing to its widespread use in tire production and rubber industry applications. Its properties of enhancing tire rolling resistance, durability, and fuel efficiency drive market demand from the automotive and industrial segments. The rising trend of green tires further propels market adoption.

- Fumed Silica

Fumed silica is a popular thickening agent, anti-caking agent, and reinforcing agent in the coatings, adhesives, sealants, and personal care industries. Its high purity and surface area make it an ideal material for high-end applications involving rheology modification. Market development is directly associated with the specialty chemicals industry and electronics production.

- Silica Gel

Silica gel is mainly used for moisture absorption and desiccant applications in the packaging, pharmaceutical, and electronics industries. The increasing need for product preservation and shelf life extension in storage and logistics environments drives the market for silica gel. Industrial packaging applications are a major market driver.

- Colloidal Silica

Colloidal silica is finding increasing applications in precision casting, polishing, and semiconductor production on account of its stability and uniform particle size. Demand is fueled by the expansion of the electronics and advanced material processing sectors. Its application in high-performance coatings also increases market penetration.

- Fused Silica

Fused silica is preferred for its high thermal resistance, low thermal expansion, and optical clarity. It finds extensive use in semiconductor production, optical devices, and high-temperature industrial applications. Demand is fueled by the expansion of the electronics and renewable energy sectors.

- Others

Other forms of silica include crystalline and specialty silicas, which are used in specialized industrial and chemical processes. These forms of silica meet particular performance needs such as filtration, insulation, and catalyst support. Demand is application-driven and tied to industrial production volumes.

To learn more about this report, Download Free Sample Report

By Form

- Powder

The powdered form of silica is the leading type in the market due to its versatility and ability to be easily mixed with rubber, paints, and plastics. Its ability to be uniformly dispersed makes it ideal for mass production in industries. High demand from the tire and construction materials industry drives the market.

- Granules

The granular form of silica is preferred in applications where controlled flowability and low dust generation are desired. The product is largely used in agriculture, filtration, and some chemical processing industries. Ease of handling and safety benefits drive the adoption of the product in industrial settings.

- Liquid

Liquid or dispersed silica products are gaining popularity in polishing, coating, and electronics industries. The product's ability to provide precise particle distribution makes it ideal for high-precision industries. High demand from high-precision industries and semiconductor manufacturing drives the market.

By Application

- Rubber

The rubber industry is the biggest end-use segment for silica. This is due to the increasing demand from tire manufacturing. Silica helps improve the fuel efficiency, traction, and durability of tires, meeting the required regulations and sustainability standards. The rising production of automobiles continues to support the consumption levels.

- Plastics

In the plastics industry, silica acts as a reinforcing and anti-blocking agent. This is due to its ability to enhance the mechanical strength and surface properties of plastics. The increasing demand is driven by the growth of the packaging and engineering plastics industry. The trend of developing lightweight materials further supports the integration of silica into polymer materials.

- Food & Beverages

Silica is employed as an anti-caking and stabilizing agent in powdered food and beverages. The regulatory approval and increasing consumption of processed foods drive the demand for silica. The functional additives that promote shelf stability continue to be a major driving factor.

- Pharmaceuticals

In the pharmaceutical industry, silica is used as a glidant and carrier in tablet production. The rising complexity of pharmaceutical formulations and production volumes are driving the use of silica. The high purity standards required in the pharmaceutical industry guarantee a steady demand for silica.

- Paints & Coatings

Silica enhances scratch resistance, matting, and coating durability. The rising demand for construction and industrial coatings is driving the use of silica in the decorative and protective markets. Infrastructure spending is also fueling demand.

- Personal Care & Cosmetics

Silica is a common ingredient in the cosmetics industry, where it is used as an oil absorption agent, texture modifier, and formulation stabilizer. The rising demand for high-end personal care products is encouraging the use of specialty silica. Innovation in skin care and cosmetics is fueling the growth of silica.

- Agriculture

In the agriculture industry, silica is used as an active ingredient in crop protection products and as a soil conditioner. The growing need for enhanced crop output and plant protection helps the market grow. The use of sustainable agriculture practices is a major driver for adoption.

- Electronics & Semiconductors

Silica is an important material in the semiconductor industry for polishing, insulation, and manufacturing electronic components. The increasing need for electronics and digital infrastructure development fuels market demand. High-purity silica is required for high-end manufacturing.

- Others

Other markets include filtration, catalysts, and specialty industries where silica is used for its structural or functional properties. Market demand varies depending on industrial production and advancements in material science.

By End-Use Industry

- Automotive

The automotive industry continues to be a significant market for silica, mainly in the production of tires and rubber components. The growing need for fuel efficiency and lower emissions creates a positive market environment for silica. The development of electric vehicles further boosts the demand for high-performance materials.

- Construction

In the construction industry, silica is applied as an additive in cement, concrete, and coatings to enhance strength and durability. The growing need for infrastructure development and urbanization creates a positive market environment for silica. The developing countries with significant construction backlogs continue to drive demand.

- Electronics

The electronics industry applies silica in the production of semiconductors, optical fibers, and insulating materials. The growing need for consumer electronics and computing power further boosts demand. The need for high-performance materials creates a positive market environment for specialty silica.

- Healthcare

Healthcare applications of silica include the manufacture of pharmaceuticals, medical packaging, and diagnostic equipment. The stability and inert properties of silica make it an appropriate material for sensitive applications. The growth of the healthcare industry and the aging population drive the demand for silica.

- Food Processing

Silica is used in the food processing industry as an anti-caking agent and flow agent in powdered food products. The growing demand for processed and packaged food products drives the demand for silica. Compliance with regulations is a major consideration in this market.

- Chemical Manufacturing

The chemical manufacturing industry uses silica as a filler, catalyst support, and performance additive. The growth of the specialty chemical and industrial processing industries drives the demand for silica. The demand for silica is directly related to the overall industrial production trends

- Agriculture

The end-use of agriculture involves fertilizers, pesticides, and soil conditioners. The growing interest in agricultural productivity and sustainable inputs helps support slow growth. Regional agricultural practices influence adoption.

- Others

Other end-use industries involve energy, filtration, and specialty manufacturing industries. Demand is still driven by technological innovation and industrial requirements. New applications continue to provide niche growth opportunities

Regional Insights

The North America silica market, encompassing the United States, Canada, and Mexico, is driven by the presence of highly developed manufacturing infrastructure, a robust automotive market, and a rising demand for specialty silica in the electronics and coatings sectors. The European market, comprising Germany, United Kingdom, France, Spain, and Italy, is driven by robust regulatory systems that support sustainable materials and energy-efficient tire technology, as well as the manufacturing of specialty chemicals, which sustains a stable demand in the region. The Asia Pacific market, including Japan, China, Australia, New Zealand, South Korea, and India, is the fastest-growing market, fueled by a rising demand for electronics manufacturing, infrastructure development, and automotive manufacturing. The South America market, including Brazil and Argentina, is moderately growing due to agricultural and construction sector developments, while the Middle East & Africa market, including Saudi Arabia, United Arab Emirates, and South Africa, is driven by infrastructure development, diversification of industry, and a rising demand for construction and coatings applications in emerging markets.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2025, Evonik Industries AG has introduced a new business unit named Smart Effects by merging its silica and silanes business segments. This is done to enhance innovation and customer solutions in the automotive, battery, electronics, and building protection sectors. This will increase the sustainability focus and portfolio depth by leveraging the expertise of silica particle design and silane chemistry.

- In October 2024, Evonik broke ground on a major expansion of its precipitated silica production facility at Charleston, South Carolina, to raise capacity by 50% and meet the growing demand for green tires and industrial applications in North America. The project will improve supply chains in the region and reflects the company’s long-term commitment to the silica business.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 14.20 Billion |

|

Market size value in 2026 |

USD 15.00 Billion |

|

Revenue forecast in 2033 |

USD 23.40 Billion |

|

Growth rate |

CAGR of 6.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Evonik Industries AG, Cabot Corporation, Wacker Chemie AG, Solvay S.A., PPG Industries, Inc., PQ Corporation, Huber Engineered Materials, Tosoh Corporation, Akzo Nobel N.V., W. R. Grace & Co., Tokuyama Corporation, Merck KGaA, Oriental Silicas Corporation, Madhu Silica Pvt. Ltd., and Denka Company Limited |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Precipitated Silica, Fumed Silica, Silica Gel, Colloidal Silica, Fused Silica, Others), By Form (Powder, Granules, Liquid), By Application (Rubber, Plastics, Food & Beverages, Pharmaceuticals, Paints & Coatings, Personal Care & Cosmetics, Agriculture, Electronics & Semiconductors, Others) and By End-Use Industry (Automotive, Construction, Electronics, Healthcare, Food Processing, Chemical Manufacturing, Agriculture, Others) |

Key Silica Company Insights

Evonik Industries AG is a leading player in the silica industry with its expertise in precipitated and fumed silica. The company has exposure to various end-use industries and a global manufacturing base, which helps it cater to the growing demand in high-growth regions. Its AEROSIL product line and efforts to expand capacity and adopt sustainable manufacturing practices improve its competitiveness. The company’s focus on advanced materials, energy-efficient manufacturing, and application development helps it remain a leader in the specialty silica market while meeting the changing demands of the green tire, battery, and high-performance industries.

Key Silica Companies:

- Evonik Industries AG

- Cabot Corporation

- Wacker Chemie AG

- Solvay S.A.

- PPG Industries, Inc.

- PQ Corporation

- Huber Engineered Materials

- Tosoh Corporation

- Akzo Nobel N.V.

- R. Grace & Co.

- Tokuyama Corporation

- Merck KGaA

- Oriental Silicas Corporation

- Madhu Silica Pvt. Ltd.

- Denka Company Limited

Global Silica Market Report Segmentation

By Type

- Precipitated Silica

- Fumed Silica

- Silica Gel

- Colloidal Silica

- Fused Silica

- Others

By Form

- Powder

- Granules

- Liquid

By Application

- Rubber

- Plastics

- Food & Beverages

- Pharmaceuticals

- Paints & Coatings

- Personal Care & Cosmetics

- Agriculture

- Electronics & Semiconductors

- Others

By End-Use Industry

- Automotive

- Construction

- Electronics

- Healthcare

- Food Processing

- Chemical Manufacturing

- Agriculture

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636