Market Summary

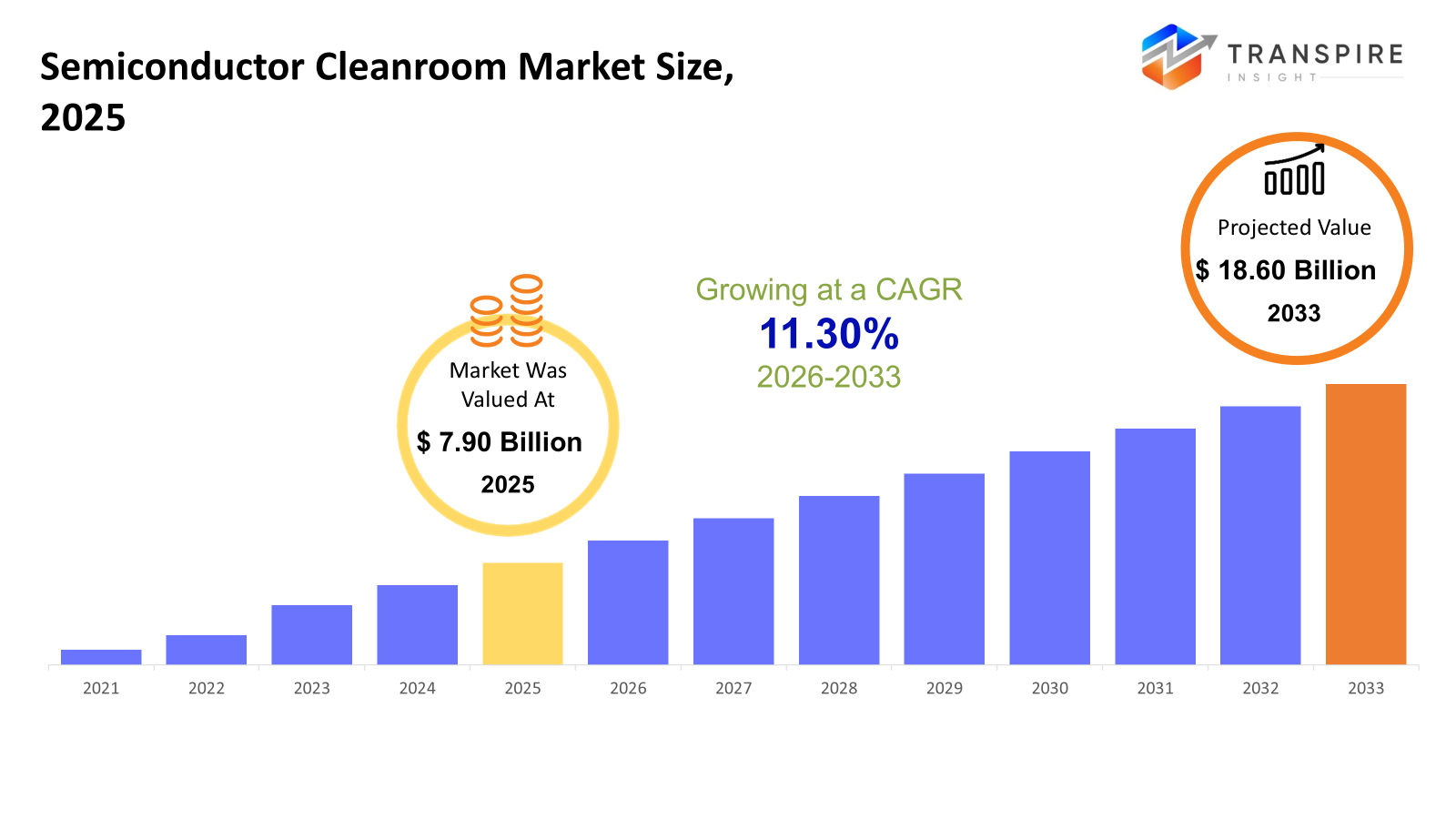

The global Semiconductor Cleanroom market size was valued at USD 7.90 billion in 2025 and is projected to reach USD 18.60 billion by 2033, growing at a CAGR of 11.30% from 2026 to 2033. The growing global semiconductor manufacturing and assembly activities, particularly in Asia Pacific and North America, are driving the semiconductor cleanroom market's strong compound annual growth rate. Investments in top-notch cleanroom facilities are driven by the growing demand for sophisticated nodes, smaller ICs, and precise packaging. Increased yields and energy efficiency are guaranteed by the use of automation, robots, and IoT-enabled monitoring, which supports market growth. Government programs that encourage domestic semiconductor production also hasten market expansion.

Market Size & Forecast

- 2025 Market Size: USD 7.90 Billion

- 2033 Projected Market Size: USD 18.60 Billion

- CAGR (2026-2033): 11.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Large-scale fab expansions, intense R&D, and policy-backed semiconductor investments have all contributed to North America's consistent growth. To support advanced-node manufacturing, the region is also seeing a rise in the use of top-notch hardwall cleanrooms, sophisticated HVAC systems, and automated contamination monitoring.

- Because of the CHIPS Act-led capacity additions, growing IDM and foundry investments, and the focus on EUV lithography, advanced packaging, and energy-efficient cleanroom infrastructure to improve yield and domestic supply resilience, the United States continues to be a focal point for cleanroom demand.

- The fastest-growing region is Asia Pacific, where demand for scalable modular and stick-built cleanrooms with high-efficiency filtration, FFUs, and real-time environmental control systems is being driven by the expansion of wafer fabrication and OSAT capacity in China, Japan, South Korea, and India.

- Because of their quick deployment, scalability, and low capital intensity, modular cleanrooms are the most popular type of cleanroom in the world. This allows manufacturers to swiftly expand or reconfigure facilities in response to changing semiconductor demand cycles and process technology advancements.

- In order to ensure process stability, yield optimization, and operational cost management, HVAC systems continue to be the most crucial component segment. This is because shrinking semiconductor nodes necessitate tighter temperature, humidity, and airflow control, which is driving the adoption of energy-efficient, digitally monitored HVAC solutions.

- Because advanced logic and memory manufacturing necessitates ultra-clean environments, precise airflow management, and automation, wafer fabrication continues to dominate application demand. Cleanroom investments are essential for preserving competitiveness in sub-5 nm and advanced packaging technologies.

- The deployment of advanced cleanroom technologies, robotics, and monitoring systems to ensure consistent quality across fabrication, assembly, and testing stages is made possible by Integrated Device Manufacturers' strong capital capacity, high production volumes, and vertically integrated operations, which enable them to lead end-user adoption.

So, The semiconductor cleanrooms market includes controlled settings intended to keep temperature, humidity, and airborne particle levels incredibly low all of which are essential for semiconductor manufacturing and research applications. For wafer fabrication, photolithography, assembly, packaging, testing, and R&D operations where even minute contamination can result in flaws and lower yield cleanrooms are crucial. In addition to HVAC systems, fan filter units, HEPA/ULPA filters, air showers, monitoring and control equipment, robotics, and other auxiliary components, the market comprises modular, stick-built, softwall, and hardwall cleanrooms.

The adoption of advanced cleanrooms is being driven, especially in Asia Pacific, North America, and Europe, by the growing worldwide semiconductor demand for high-performance computing, mobile devices, AI chips, and automotive electronics. Governments are encouraging factories to increase capacity, embrace automation, and create ultra-clean surroundings in order to boost domestic semiconductor manufacture. Rapid technological developments including robotics integration, IoT-enabled monitoring, and predictive analytics are increasing yield, decreasing human-induced contamination, and improving operating efficiency. Growing use of sophisticated packaging methods and R&D expenditures in cutting-edge semiconductor technology are additional factors driving market expansion. All things considered, the market for semiconductor cleanrooms is essential to the production of next-generation semiconductors because it offers the environmental control required for high-volume and precise manufacturing.

Semiconductor Cleanroom Market Segmentation

By Cleanroom Type

- Modular Cleanrooms

Because of its flexibility, low capital costs, and quick deployment times, modular cleanrooms are the most popular in North America and Asia Pacific. In order to expand semiconductor factories without disrupting current output, manufacturers prefer modular designs. In Japan, South Korea, and the United States, where cleanroom scalability is essential for innovation and process optimization, adoption is high in R&D and pilot manufacturing facilities.

- Stick‑Built Cleanrooms

Large-scale, long-term factories in Europe, North America, and some parts of Asia favor stick-built cleanrooms because they provide better structural integrity and customization. Significant expenditures have been made in stick-built cleanrooms for high-volume wafer production by China, the United States, and Germany. They are perfect for advanced nodes below 5 nm because they offer persistent environmental control despite their higher initial costs.

- Softwall Cleanrooms

In developing nations like Brazil, India, and the rest of South America, where inexpensive contamination control is adequate, softwall cleanrooms are being utilized more and more. For certain activities like assembly, packing, and small R&D units, they provide mobility and quick setup. Their usage in high-precision applications such as photolithography is limited by their limited scalability and reduced particle control.

- Hardwall Cleanrooms

Due to stringent contamination regulations, hardwall cleanrooms continue to rule critical fabs in the United States, Germany, Japan, and South Korea. They offer excellent structural dependability, laminar flow constancy, and air containment. In order to facilitate high-yield semiconductor production, hardwall designs are essential to photolithography, advanced packaging, and wafer fabrication.

To learn more about this report, Download Free Sample Report

By Component

- HVAC Systems

In North America and Europe, HVAC systems are essential investments that uphold stringent standards for temperature, humidity, and ventilation. Particle-free environments are guaranteed for 3 nm and below node manufacturing thanks to advanced HVAC integration in China, South Korea, and Japan. In areas with high energy prices, like Germany and the US, growth is being driven by energy-efficient technologies and ongoing monitoring.

- Fan Filter Units (FFUs)

Due to their modularity and capacity to grow with production, FFUs are extensively used throughout Asia Pacific, especially in China, Japan, and South Korea. FFUs are essential in modular and softwall cleanrooms because they offer targeted filtration. Compared to centralized systems, their installation in high-volume fabs allows more accurate airflow regulation and lowers overall energy use.

- Filtration Units (HEPA / ULPA filters)

In North America and Europe, HEPA and ULPA filters are the most used for high-purity semiconductor settings. ULPA filters are a top priority for photolithography and wafer production in nations like the US and Germany. The demand for cutting-edge filtration technologies to satisfy ISO class 1–100 criteria is driven by rising investments in upscale semiconductor factories in Asia Pacific.

- Air Showers, Laminar Flow Benches

Particularly in R&D and packing facilities, air showers and laminar flow benches are essential for contamination control at workstations and entrance points. To safeguard extremely sensitive processes, North America and Japan make significant investments in these systems. Deployment is progressively increasing throughout South America and the Middle East and Africa, mostly in the stages of assembly and inspection.

- Monitoring & Control Equipment

The expansion of modern laboratories in the United States, Germany, and South Korea is being driven by real-time particle monitoring and AMC (airborne molecular contamination) control. Process stability and yield enhancement are guaranteed by the use of IoT-enabled and AI-integrated monitoring technologies. Because of the creation of new factories, Asia Pacific is at the forefront of automated monitoring.

- Robotics / Automation

In North America, Europe, and Asia Pacific, robotics and automated cleanroom handlers are quickly being used for wafer handling and packing. Automation increases throughput for high-volume manufacturing while lowering contamination caused by humans. Growth is especially robust in South Korea, China, and Japan, which reflects the fast expansion of semiconductor manufacturing.

- Others

Consumables, pass-through chambers, and cleanroom furnishings are further components with consistent demand in every region. Due to their enormous factories and sophisticated semiconductor ecosystems, Asia Pacific and North America dominate. R&D and small-scale assembly facilities in the Middle East, Africa, and South America are gradually adopting this technology.

By Application

- Wafer Fabrication

The global cleanroom market is dominated by wafer fabrication, particularly in Asia Pacific, North America, and Europe. Sub-5 nm fabs that need ultra-clean surroundings are being heavily invested in by nations including China, Taiwan, the United States, Germany, and South Korea. The demand for sophisticated HVAC, real-time monitoring systems, and hardwall cleanrooms is driven by this market.

- Photolithography

Applications for photolithography are prevalent in North America, Europe, and Japan and need the strictest cleanroom standards. Precision airflow, filtration, and robotics integration are necessary in ISO class 1–10 environments. Due to the expansion of TSMC, Samsung, and SMIC, Asia Pacific is quickly catching up.

- Assembly & Packaging

Cleanrooms for assembly and packaging are widely used in North America and Asia Pacific (China, India, and South Korea). Automation is being incorporated more and more for die bonding and testing, and softwall and modular cleanrooms are frequently adequate. As sophisticated packaging becomes essential for AI chips and mobile processors, this market is expanding.

- Testing & Inspection

Units for testing and inspection, which are widely used in North America, Europe, and Japan, need intermediate cleanroom standards. Cleanroom deployment is being driven by the expansion of IC testing, probe cards, and metrology instruments. These cleanrooms are being progressively adopted by emerging regions, such as South America and the Middle East and Africa, for local semiconductor startups.

- Research & Development (R&D)

In North America, Europe, Japan, and South Korea, R&D cleanrooms are essential for process optimization, pilot production, and prototyping. Softwall and modular designs are favored because they are less expensive and offer greater flexibility. Government-backed semiconductor innovation projects are driving an increase in R&D cleanrooms throughout Asia Pacific.

- Others

MEMS, specialist sensors, and specialized semiconductor processes are further uses. In Europe, North America, and Asia Pacific, deployment is mostly found in sophisticated R&D facilities and small-scale factories. Because of new technologies like photonics and quantum computing, this market is still modest yet strategically important.

By End‑User

- Integrated Device Manufacturers (IDMs)

Globally, IDMs such as GlobalFoundries, Samsung, and Intel are major users of cleanroom facilities. Large IDM fabs in North America, Europe, and Asia Pacific necessitate automation, sophisticated monitoring, and full-scale hardwall cleanrooms. IDMs encourage investment in top-notch cleanrooms, particularly for cutting-edge nodes smaller than 5 nm.

- Foundries

Foundries that offer chip designers contract manufacturing services are the industry leaders in North America and Asia Pacific (TSMC, SMIC, UMC). Scalable modular and stick-built cleanrooms are in high demand due to the fabless semiconductor model's explosive growth. Maintaining yield and production efficiency requires smart investments in cleanrooms.

- OSAT / Packaging & Testing Firms

Cleanrooms are needed for packaging, assembly, and inspection by outsourced semiconductor assembly and test (OSAT) companies in China, India, the United States, and Europe. In most situations, softwall and modular cleanrooms are enough. Because of its advanced packaging trends and expanding semiconductor exports, Asia Pacific continues to be the leading market.

- R&D and Institutions

Modular and softwall cleanrooms are used mostly in North America, Europe, and Asia Pacific by universities, research labs, and pilot centers. MEMS, semiconductor prototyping, and cutting-edge technologies like AI chips and photonics are all supported by cleanrooms. Due to expanding tech ecosystems, adoption is progressively rising throughout South America and the Middle East.

Regional Insights

Hardwall and stick-built cleanrooms are widely used in wafer fabrication, research and development, and assembly facilities in North America, which is a developed market dominated by the US, Canada, and Mexico. Leading IDMs and foundries needing ultra-clean conditions are located in Tier-1 regions like the U.S., whereas Canada and Mexico provide prototype fabs and contracted packaging services.

Europe, which includes Germany, the UK, France, Spain, Italy, and the rest of Europe, places a strong emphasis on precision manufacturing and research and development. Germany and the UK are tier-1 regions with sophisticated cleanrooms for photolithography, wafer fabrication, and packaging, while southern and eastern Europe (tier-2) exhibit gradual adoption for smaller factories and R&D facilities.

Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific make up the fastest-growing area. To accommodate the demand for chips worldwide, tier-1 countries China, South Korea, and Japan are growing their cleanrooms for wafer production, assembly, and packaging. Australia and India fill tier-2 positions with an emphasis on pilot production, assembly, and research and development. The market for modular and softwall cleanrooms in South America, which includes Brazil, Argentina, and the rest of the continent, is expanding and mostly serves assembly, packaging, and small-scale R&D projects.

With a focus on adaptable modular cleanrooms for R&D and pilot facilities, Middle East & Africa which includes Saudi Arabia, the United Arab Emirates, South Africa, and the rest of the region is growing thanks to government technological development initiatives and the steady growth of the semiconductor ecosystem.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 2025, At its Rossdorf R&D facility in Germany, ZEISS SMT announced the commissioning of an extra 300 m² of cleanroom space, increasing capacity by 80%. With four more instruments for defect-free procedures, the enlarged cleanroom facilitates the development of high-precision photomask repair systems. This almost €20 million investment bolsters ZEISS's technological leadership in nanometer-range production techniques and reaffirms the company's dedication to innovative semiconductor manufacturing solutions.

- In July 2024, DuPont revealed plans to showcase advancements aimed at lowering particle generation in semiconductor equipment at SEMICON West 2024 in San Francisco by showcasing Kalrez tailored sealing solutions. The news release describes novel sealing products that enhance contamination control in plasma etch, CVD, and PVD processes, namely the Kalrez Bonded Door Seal and low-permeation seals. The business reiterated its dedication to cooperation and innovation throughout the semiconductor manufacturing ecosystem.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.90 Billion |

|

Market size value in 2026 |

USD 8.80 Billion |

|

Revenue forecast in 2033 |

USD 18.60 Billion |

|

Growth rate |

CAGR of 11.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

DuPont de Nemours, Inc., Exyte Group, Daifuku Co., Ltd., MURATA MACHINERY, LTD., Thermo Fisher Scientific Inc., Terra Universal, Inc., Clean Air Products, Kimberly‑Clark Corporation, Illinois Tool Works, Inc., Taikisha Ltd., AES Clean Technology, Camfil AB, Clean Rooms International, Inc., AAF International, Connect 2 Cleanrooms Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Cleanroom Type (Modular Cleanrooms, Stick‑Built Cleanrooms, Softwall Cleanrooms, Hardwall Cleanrooms), By Component (HVAC Systems, Fan Filter Units (FFUs), Filtration Units (HEPA / ULPA filters), Air Showers, Laminar Flow Benches, Monitoring & Control Equipment, Robotics / Automation, Others), By Application (Wafer Fabrication, Photolithography, Assembly & Packaging, Testing & Inspection, Research & Development (R&D), Others) and By End User (Integrated Device Manufacturers (IDMs), Foundries, OSAT / Packaging & Testing Firms, R&D and Institutions) |

Key Semiconductor Cleanroom Company Insights

DuPont de Nemours, Inc. is a global leader in semiconductor cleanroom solutions, with extensive offerings in advanced filtration, contamination control consumables, and cleanroom materials that meet stringent ISO class requirements. High-performance HEPA/ULPA filters, cleanroom clothing, wipes, and coatings intended to reduce particulate shedding and improve process yield are among its product offerings. Continuous innovation in contamination control technology is fueled by DuPont's strong R&D focus, which is in line with new demands for semiconductor processes like EUV lithography and 3 nm nodes. DuPont's extensive global reach throughout North America, Europe, and Asia Pacific strengthens its position in the market by allowing it to service significant foundries, IDMs, and OSAT companies.

Key Semiconductor Cleanroom Companies:

- DuPont de Nemours, Inc.

- Exyte Group

- Daifuku Co., Ltd.

- MURATA MACHINERY, LTD.

- Thermo Fisher Scientific Inc.

- Terra Universal, Inc.

- Clean Air Products

- Kimberly‑Clark Corporation

- Illinois Tool Works, Inc.

- Taikisha Ltd.

- AES Clean Technology

- Camfil AB

- Clean Rooms International, Inc.

- AAF International

- Connect 2 Cleanrooms Ltd.

Global Semiconductor Cleanroom Market Report Segmentation

By Cleanroom Type

- Modular Cleanrooms

- Stick‑Built Cleanrooms

- Softwall Cleanrooms

- Hardwall Cleanrooms

By Component

- HVAC Systems

- Fan Filter Units (FFUs)

- Filtration Units (HEPA / ULPA filters)

- Air Showers, Laminar Flow Benches

- Monitoring & Control Equipment

- Robotics / Automation

- Others

By Application

- Wafer Fabrication

- Photolithography

- Assembly & Packaging

- Testing & Inspection

- Research & Development (R&D)

- Others

By End‑User

- Integrated Device Manufacturers (IDMs)

- Foundries

- OSAT / Packaging & Testing Firms

- R&D and Institutions

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636