Market Summary

The global Renewable Natural Gas market size was valued at USD 16.37 billion in 2025 and is projected to reach USD 30.13 billion by 2033, growing at a CAGR of 7.92% from 2026 to 2033. This growth is fueled by stronger policy pushes, and cleaner fuel use is climbing fast in transport and energy production. Because financial backing for turning trash into power keeps going up, progress gets a boost. A shift toward renewable gas instead of standard natural gas also plays a big role. As more players make the switch, momentum builds on its own.

Market Size & Forecast

- 2025 Market Size: USD 16.37 Billion

- 2033 Projected Market Size: USD 30.13 Billion

- CAGR (2026-2033): 7.92%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 36% in 2026. Growth here is gaining speed, thanks to support from public policies. Rules favoring cleaner fuels play a part, too. A widespread system for capturing gas from waste sites.

- Right now, the United States tops the list in local appetite for renewable gas, as big setups pop up often. These mainly power vehicles or feed directly into major energy networks across regions.

- Waste burning for power is picking up speed across the Asia-Pacific. Momentum builds as China pushes new projects. India follows close behind with its own plans unfolding. Japan keeps steady progress through updated regulations. Growth rides on government backing more than anything else. A mix of urgency and opportunity in crowded cities.

- Landfill Gas has expected market share will be 37% in 2026. Buried trash gives off gas that powers many places. It is common because cities produce tons of waste. This method pulls methane out cheaply, making it a go-to choice across regions.

- Most renewable natural gas goes into transportation fuel. Heavy trucks and city buses now run on it more often than before. Instead of diesel, they burn cleaned biogas turned into CNG or LNG. Cleaner air comes from swapping fossil fuels for this alternative. Fleets switch because rules push lower emissions. This shift cuts carbon across long-haul routes and daily commutes alike.

- Most companies using RNG are in the utilities sector. These firms rely on it to produce electricity and feed cleaner gas into existing networks. Their aim is to cut emissions while meeting clean energy requirements set by policy or internal plans.

The Renewable Natural Gas (RNG) market involves the production, purification, and distribution of methane captured from organic waste sources such as landfills, agricultural residues, wastewater, and food waste. RNG serves as a low-carbon, sustainable alternative to conventional natural gas and is used across power generation, transportation fuel, industrial processes, and residential or commercial heating applications. Key technologies include biogas upgrading, compression, and pipeline injection, making RNG a critical component in the global shift toward cleaner energy.

From a demand perspective, the market is driven by the growing need to reduce greenhouse gas emissions and comply with renewable energy mandates. Landfill gas remains the largest feedstock due to its consistent methane output and existing infrastructure, while transportation fuel applications such as compressed natural gas (CNG) and liquefied natural gas (LNG) are gaining traction to decarbonize fleet operations. Utilities, industrial players, and commercial sectors are increasingly adopting RNG to meet sustainability targets and regulatory requirements.

In terms of regional insights, North America leads the market with strong policy support, extensive landfill gas projects, and advanced renewable fuel programs, particularly in the United States. Europe also shows significant growth, supported by carbon reduction policies, renewable energy integration, and waste-to-energy initiatives.

Technology and market trends indicate that advancements in biogas upgrading, declining costs of production, and increasing focus on carbon-neutral fuels are driving global adoption. Asia-Pacific is the fastest-growing region, with countries like China, India, and Japan investing heavily in waste-to-energy projects, renewable fuel standards, and large-scale RNG deployment, highlighting the expanding global opportunity for RNG solutions.

Renewable Natural Gas Market Segmentation

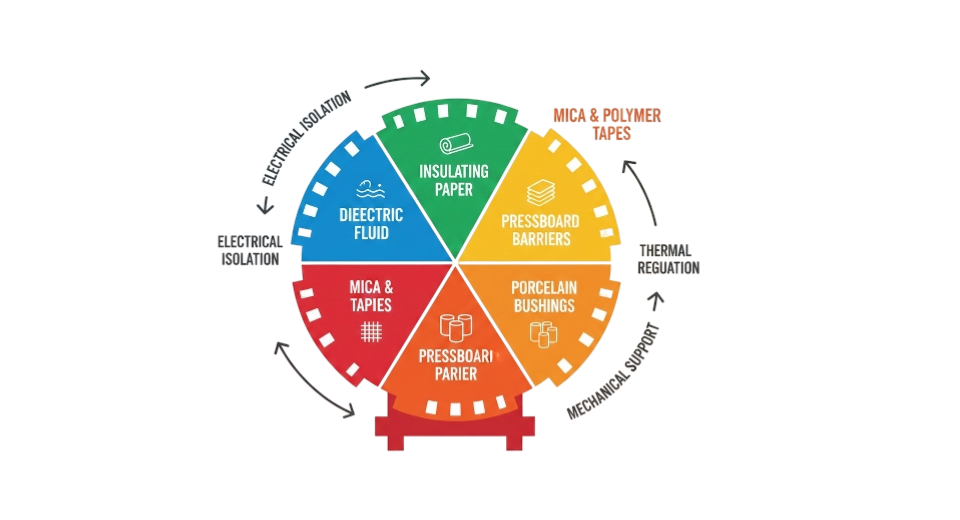

By Source

- Agricultural Waste

Farm leftovers turn into gas when waste like manure breaks down; that gas becomes fuel. From crops and animal byproducts, a usable form of energy emerges after processing. What starts in fields ends up powering vehicles or heating homes. Instead of vanishing into the air, gases get captured and repurposed through simple tech steps.

- Landfill Gas

Methane caught at city trash dumps becomes fuel. This method runs steadily without high costs. Waste sites feed the process reliably.

- Wastewater Treatment Gas

From sewage plants, gas captured during waste processing is turned into usable fuel. This biogas goes through cleaning so it can power homes and vehicles. Instead of releasing it, operators refine the gas for a cleaner energy supply. The result works much like natural gas once purified. Facilities now see value in what was once just a byproduct.

- Food & Organic Wastes

Banana peels, coffee grounds, and leftover soup scraps feed machines that make gas. Rotting carrots once dropped into city bins now power buses through hidden pipes underground.

- Others

Fuel made from factory leftovers plus plants grown just for power turns into clean gas. Waste from manufacturing, along with special crops, gets transformed on purpose.

To learn more about this report, Download Free Sample Report

By Application

- Power Generation

Electricity comes from RNG when it powers gas turbines. Heat and power together rely on this fuel source. Systems making both use RNG effectively.

- Transportation Fuel

Fuel for travel comes in forms like CNG or LNG, cutting emissions from trucks and buses. Though invisible, it flows where engines need a push. Clean burn starts underground, moves through pipes before powering wheels. Pressure turns gas compact enough to fit tanks on moving rigs. Cold keeps it liquid when distance demands more storage. Fleet shifts depend on steady supply lines behind the scenes.

- Industrial and Residential Use

Factories and homes alike run on renewable natural gas. It keeps spaces warm or cool while powering daily operations. Some businesses depend on it for manufacturing tasks. Households use it just as much for routine comfort. Not every fuel works this way across both settings.

- Injection into Gas Grids

- Starting, RNG gets cleaned up before sliding into existing gas pipes. This lets it travel through the network without hassle. Moving along, purification makes sure only the right stuff flows. After that, homes and factories can use it just like regular gas. Finally, pipeline systems carry it widely once it is ready.

By End-Users

- Utilities

Fuel providers choose RNG to feed into networks and produce electricity, one reason being the smoother adoption of green sources.

- Transportation

Fuel made from renewable sources powers buses, trucks, and delivery vehicles across cities. Some city transit systems switched to this cleaner option years ago. Companies moving goods now rely on it more each season. Big truck fleets run longer routes using this substitute. A growing number of cargo handlers choose it daily.

- Industrial

Fuel needs in factories often shift toward cleaner options when available. Plants swap coal or oil for renewable gas more every year. This change cuts emissions without slowing output. Some production sites now run mostly on recycled natural sources. Efficiency stays high even with the switch. Power from waste gases supports heavy operations daily.

- Residential and Commercial

Fuel made from waste powers everyday tasks in houses and offices. Some run their stoves on it, others heat rooms or generate power. Places of work rely on it just like living spaces do.

Regional Insights

Both North America and Europe are the most advanced markets for renewable natural gas (RNG) production, which is mainly influenced by the presence of supportive regulations, renewable fuel mandates, and well-established landfill gas infrastructure. The United States and Canada are the main Tier 1 countries in North America that lead by example with large-scale landfill gas capture, transportation fuel projects, and utility-scale RNG initiatives. Tier 2 countries, such as Mexico and other Central American nations, are slowly getting on board, primarily in transportation and municipal energy applications.

The Asia-Pacific region is the rapidly expanding RNG market. The growth is primarily due to industrialization, higher electricity demand, and renewable energy targets. Tier 1 countries such as China, India, and Japan are elevating the demand through massive landfill gas projects, agricultural waste, to RNG plants, and government-supported decarbonization initiatives. On the other hand, Tier, 2 countries like South Korea, Thailand, Indonesia, and Vietnam are experiencing the growing adoption of the public and private investments in waste, to, energy and RNG infrastructure.

Latin America and the Middle East & Africa (MEA) are two new markets with high potential. In Latin America, Tier 1 countries like Brazil and Mexico are propelling RNG utilization through projects on landfill gas and agricultural waste, whereas Tier 2 countries such as Argentina, Chile, and Colombia are slowly broadening their initiatives. In Middle East & Africa, Tier, 1 countries like the United Arab Emirates, Saudi Arabia, and South Africa are leading the way in renewable gas infrastructure and setting up large, scale projects, while Tier, 2 countries scattered across the region are gradually getting acquainted with the concept but may become new markets as waste, to, energy and renewable energy programs grow.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 30, 2025 – Viridi Energy launched the first company-operated renewable natural gas facility in Alabama.

- November 6, 2024 – Wage Energy launched its first renewable natural gas production project in Italy.

- February 21, 2023 – Shell completed the acquisition of renewable natural gas producer Nature Energy.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 16.37 Billion |

|

Market size value in 2026 |

USD 17.67 Billion |

|

Revenue forecast in 2033 |

USD 30.13 Billion |

|

Growth rate |

CAGR of 7.92% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Clean Energy Fuel Corporation, Archaea Energy Inc., Xebec Adsorption Inc., Brightmark LLC, Ameresco Inc., Montauk Renewables Inc., Waste Management Inc, Renewi PLC, Air Liquide S.A., FortisBC Energy Inc., ABB Group, Kinder Morgan, Vanguard Renewables, Ameresco, Waga Energy, Constellation, Aemetis Inc., ATCO Gas, and Others. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Source (Agricultural Waste, Landfill Gas, Wastewater Treatment Gas, Food & Organic Wastes, Other), By Application (Power Generation, Transportation Fuel, Industrial and Residential Use, Injection into Gas Grids), By End-Users (Utilities, Transportation, Industrial, Residential and Commercial) |

Key Renewable Natural Gas Company Insights

Clean Energy Fuels Corp. is a United States-based company that offers a variety of renewable natural gas solutions with a main focus on transportation fuel and infrastructure. The company actively makes RNG by capturing methane from landfills, dairies, and organic waste and hence, is supplying it to fleets, public transit, and commercial vehicles all over North America. Their innovative Clean Energy network of fueling stations and large-scale production facilities makes it possible for RNG to be widely used as a low-carbon alternative to conventional natural gas. Clean Energy Fuels Corp. has been acknowledged as a company that is at the forefront in forming strategic partnerships with utilities, municipalities, and fleet operators, thus leading the way towards the firm's major role of decarbonization in the transport sector.

Key Renewable Natural Gas Companies:

- Clean Energy Fuel Corporation

- Archaea Energy Inc.

- Xebec Adsorption Inc.

- Brightmark LLC

- Ameresco Inc.

- Montauk Renewables Inc.

- Waste Management Inc

- Renewi PLC

- Air Liquide S.A.

- FortisBC Energy Inc.

- ABB Group

- Kinder Morgan

- Vanguard Renewables

- Ameresco

- Waga Energy,

- Constellation

- Aemetis Inc.

- ATCO Gas

Global Renewable Natural Gas Market Report Segmentation

By Source

- Agricultural Waste

- Landfill Gas

- Wastewater Treatment Gas

- Food & Organic Wastes

- Other

By Application

- Power Generation

- Transportation Fuel

- Industrial and Residential Use

- Injection into Gas Grids

By End-Users

- Utilities

- Transportation

- Industrial

- Residential and Commercial

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636