Market Summary

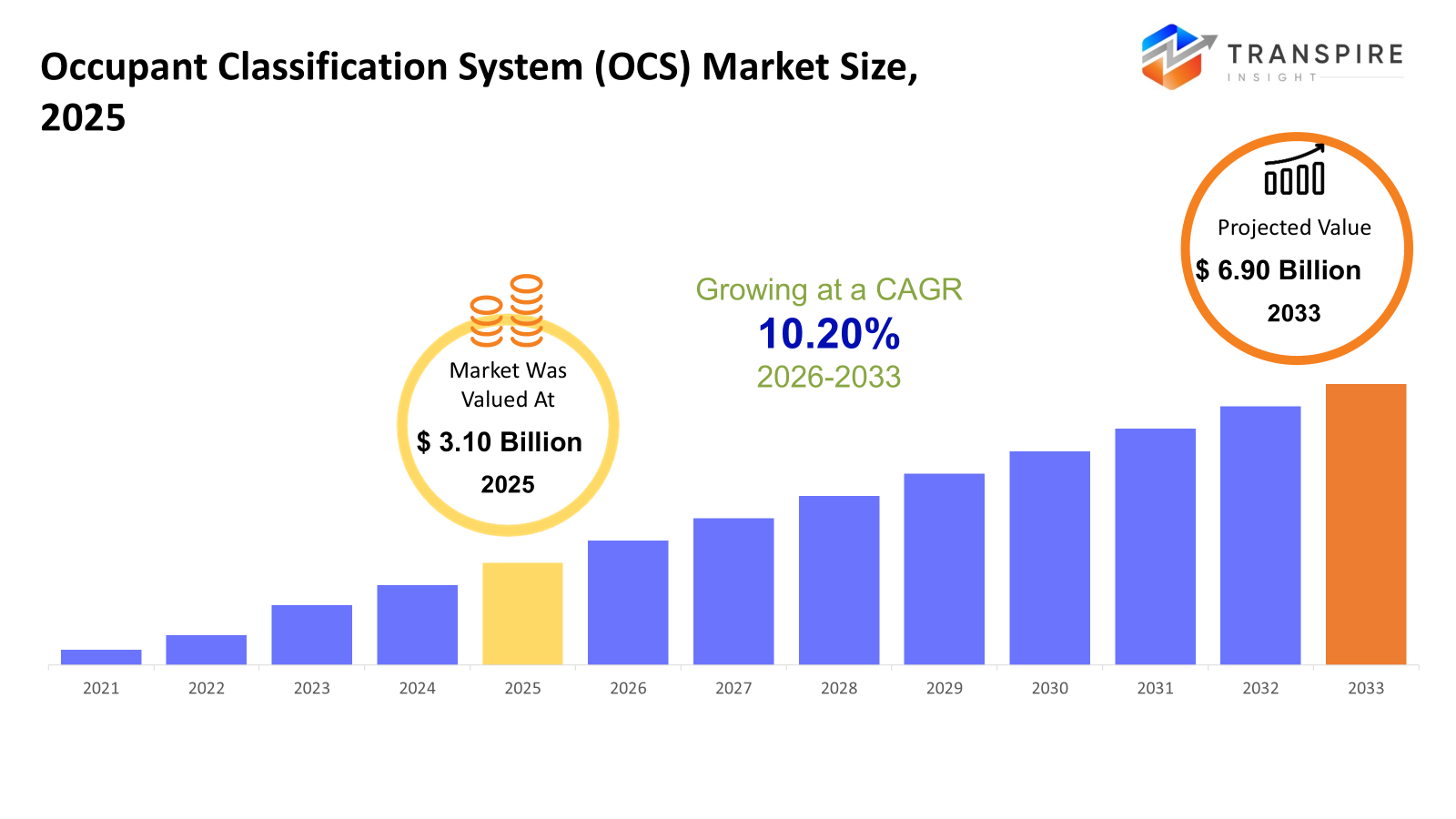

The global Occupant Classification System (OCS) market size was valued at USD 3.10 billion in 2025 and is projected to reach USD 6.90 billion by 2033, growing at a CAGR of 10.20% from 2026 to 2033. The OCS market sees a steady growth rate in CAGR, driven by increasing numbers of global automotive safety regulations that require higher specifications for occupant detection and deployment systems in airbags. Increasing integrations in ADAS, AI-based cabin monitoring, and intelligent safety features in passenger cars and electric vehicles will further accelerate adoption. Growing consumer awareness relating to vehicle safety and the protection of child occupants, along with expanding vehicle production in emerging economies, continues to underpin long-term market growth.

Market Size & Forecast

- 2025 Market Size: USD 3.10 Billion

- 2033 Projected Market Size: USD 6.90 Billion

- CAGR (2026-2033): 10.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Steady growth is being reported in the North American region due to factors like strict safety regulations and high use of advanced vehicle safety technologies, sensors account for component-type demand due to accuracy, passenger-type vehicles lead the vehicle type segment, weight-type systems are still widely employed, and airbag deployment still dominates control type applications

- The United States remains a major driver of technology adoption with regulatory requirements and end-user demand for reduced safety features, with sensors and control units remaining major components, passenger cars holding largest market share, weight-based systems holding largest share of deployed technology, and airbag deployment control maintaining highest level of applications suppliers cater to

- Asia Pacific drives growth with increasing vehicle production and implementation of safety standards while sensors hold the highest market segment, passenger vehicles lead vehicle demand, systems remain dominant due to cost efficiency, and airbag deployment control holds the highest adoption

- The reason why sensors are increasingly preferred as leading components is for the role they play in enabling the realization of precise occupant detection and system reliability, while advancements in multi-zone sensing and AI integration are improving classification accuracy and supporting wider adoption across passenger cars and electric vehicles globally.

- Whereas, passenger cars continue to represent the dominant vehicle type segment driven by large production volumes and mandatory safety feature integration, manufacturers increasingly incorporate occupant classification systems as standard equipment to meet regulatory requirements and enhance overall passenger protection.

- Weight-based systems remain the leading technology segment due to their reliability, cost-effectiveness, and ease of integration, while ongoing improvements in pressure sensing, Intelligent software analytics are improving accuracy and supporting deployment across both conventional and electric vehicle platforms.

- Airbag deployment control continues to lead application demand, and the future of adaptive airbags depends on occupant classification. Increased regulatory focus on injury reduction and passenger safety encourages automakers to give more attention to advanced occupant detection technologies across segments.

So, The Occupant Classification System (OCS) Market is comprised of technologies like detecting vehicle occupants, their size, weight, and position, thereby ensuring optimal usage of safety features like airbags, seat belts, etc. The market for OCS is fueled by stringent automobile safety norms, awareness of accident prevention, and rising usage of ADAS solutions. Some of the key components involved within the OCS include sensors, control units, software, and seat modules; nevertheless, sensors and control units have been at the forefront owing to their importance for real-time detection and response purposes. Passenger vehicles form the most dominant category within vehicles, followed by LCVs, HCVs, and EVs; however, technological advances within weight-based detectors, pressure-based detectors, ultrasonic detectors, and camera-based detectors have contributed significantly to precision and autonomous capabilities.

Applications like airbag deployment control, seat belt reminder systems, child safety detection, and passenger monitoring play an important role in achieving market growth. The growing need for vehicle safety devices in developing countries and the rising trend of electric as well as autonomous vehicles also contribute to the growth of the overall market. The inclusion of AI and learning machines in OCS leads to innovations.

Occupant Classification System (OCS) Market Segmentation

By Component

- Sensors

Sensors are the backbone of OCS, allowing users to accurately detect occupants by weight, pressure, or capacitive characteristics. The adoption of sensors in OCS technology has grown significantly due to increasing regulations and their use in high-end vehicles, especially in America and Europe.

- Control Units

Control units handle data received from sensors to deploy safety devices such as airbags. Higher reliability rates and faster operating time make them in demand for passenger cars as well as trucks in the Asia Pacific region and Europe.

- Software

Software analytics improves the accuracy of occupant classification methods and incorporates AI and predictive technologies. With growing emphasis on automated safety systems for EVs and luxury cars, the market for software solutions is expanding internationally.

- Seat Modules

Seat modules allow the integration of sensors and control units within the design of the vehicle seats, thus providing a cohesive platform for occupant detection. Seat module acceptance is encouraging, particularly in countries such as North America and Japan, which have high safety standards.

To learn more about this report, Download Free Sample Report

By Vehicle Type

- Passenger Cars

This segment is dominated by rigorous airbag deployment and seatbelt regulations. With OCS technology incorporated in sedans and SUVs, passenger safety is enhanced, thus reducing liability in accidents, especially in Europe and North America.

- Light Commercial Vehicles (LCV)

Increasing use in logistics and delivery fleet operations for driver and passenger monitoring. The market growth rate in the Asia Pacific region is driven by growing demands in urban delivery and government-mandated safety.

- Heavy Commercial Vehicles (HCVs)

Moderate adoption is seen in driver monitoring and fatigue detection. These segments are crucial in Europe and North America due to high standards of regulatory compliance.

- Electric Vehicles (EV)

Electric Vehicles are also seeing a quicker adoption pace with OCS integration into sophisticated cockpits and autonomous driving systems. North America, China, and Europe are significant markets due to expanding EV production lines and increasing safety awareness.

By Technology

- Weigh-Based Technology

Most widely used technology that takes use of seat weight for determining occupants. Strong base for cars and LCVs in North America and Europe due to the reliability and cost-effectiveness factor.

- Pressure-Based Systems

Leverage distributed pressure sensors to enhance classification accuracy. Increasingly used in high-end cars and EVs, particularly in Japan, Germany, and South Korea.

- Ultrasonic Systems

Use sound waves for occupancy detection, which can be used along with seat belt reminder and airbag systems. Gaining popularity in regions such as North America and Europe for safety and advanced applications.

- Camera-Based Systems

Use in-cabin cameras to monitor occupants in real-time and locate children in vehicles. In EVs and luxury cars, North America, Europe, and China have witnessed increased adoption of in-vehicle cameras with AI-based analytics.

By Application

- Airbag Deployment Control

This ensures the deployment of airbags as per the size and presence of occupants. In passenger cars and LCVs, OCS is the dominant usage around the world. North America and Europe have a high adoption rate, due to the strict laws on safety.

- Seatbelt Reminder Systems

These are to improve compliance and bring down injury rates. In addition, it is widely implemented in Europe, North America, and Asia Pacific regions. It is being increasingly integrated into EVs and HCVs.

- Child Safety Detection

Specialized to detect child seats and small passengers for prevention against accidental airbag deployment. Presently, the detection system finds high adoption in developed markets such as North America and Europe due to favorable regulatory frameworks.

- Passenger Monitoring Systems

These monitor the presence and activities of occupants, mainly for safety and in autonomous vehicle applications. The market has also witnessed rapid growth in North America, Europe, and Asia Pacific owing to AI integration in EVs and premium vehicles and the addition of advanced driver assistance systems.

Regional Insights

North America, which includes the United States, Canada, and Mexico, is a mature market for OCS, with strict automotive safety standards, high consumer awareness, and significant implementation of advanced airbag and passenger monitoring systems. The United States continues to be the largest contributor, buoyed by regulatory imperatives, technological development, and increasing proliferation of premium vehicles. Europe consists of Germany, the UK, France, Spain, Italy, and the Rest of Europe, where strict safety regulations and occupant protection drive market growth. Indeed, the German and UK markets are more significant for OCS adoption because of advanced automotive manufacturing, higher EV penetration, and more heightened consumer awareness for safety.

Asia Pacific includes Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific. The region is growing rapidly with increasing automobile production rates, particularly electric vehicles and commercial vehicles in China, Japan, and India. South America includes Brazil, Argentina, and the rest of South America. Moderate growth is being recorded due to passenger car and LCV demand. The Middle East & Africa region includes Saudi Arabia, UAE, South Africa, and the rest of Middle Eastern & African countries. The region is witnessing a gradual increase in demand from luxury and commercial segment with increasing emphasis on regulatory and safety initiatives.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, ZF LIFETEC launched a press announcement that presents a recent occupant classification and adaptive restraint system that was on display at InCabin 2025 in Barcelona, Spain. It combines camera and sensor information for actual-time classification and adaptive airbag and seatbelt deployment based on occupant dimensions, seating positions, and postures. It complies with growing requirements for passive safety and upcoming Euro NCAP 2026/2030 test standards and boosts improved child detection, seatbelt misuse detection, and out-of-position occupant detection capabilities.

- In January 2024, At CES 2024, Bosch stated that its solutions were enhanced in electronic vehicle technology and interior sensor modules, encompassing several aspects related to vehicle electronics. The innovation is related to improved occupant identification through better software-oriented sensing, data processing, and improved safety system responsiveness in next-generation vehicles. The development is a result of several instances where technology giants like Bosch noticed various companies focusing on intelligent cabin sensing solutions in new-age vehicular technology.

(Source:https://www.bosch-mobility.com/en/company/current-news/ces-world-premiere)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.10 Billion |

|

Market size value in 2026 |

USD 3.50 Billion |

|

Revenue forecast in 2033 |

USD 6.90 Billion |

|

Growth rate |

CAGR of 10.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Robert Bosch GmbH, Denso Corporation, ZF Friedrichshafen AG, Continental AG, IEE Smart Sensing Solutions, Aptiv PLC, AISIN Corporation, TE Connectivity Ltd., NIDEC Corporation, CTS Corporation, Joyson Safety Systems, Autoliv Inc., Flexpoint Sensor Systems, Mayser GmbH & Co. KG, and IGB Automotive Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Sensors, Control Units, Software, Seat Modules), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs)), By Technology (Weight-Based Systems, Pressure-Based Systems, Ultrasonic Systems, Camera-Based Systems) and By Application (Airbag Deployment Control, Seatbelt Reminder Systems, Child Safety Detection, Passenger Monitoring Systems) |

Key Occupant Classification System (OCS) Company Insights

Robert Bosch GmbH is a renowned global supplier of occupant classification systems. The company focuses on making use of its high levels of expertise in automotive electronics in the pursuit of great safety solutions. Their OCS systems feature pressure sensors, load cells, and smart control units that provide support for multi-zone detection and adjustable airbags. Their systems also feature cameras and radar-based occupant monitoring systems that provide better accuracy alongside child and occupant detection and global safety standards such as ISO 26262. Their systems have the ability to scale up and have been adopted on a wide range of vehicles that range from passenger cars to commercial vehicles and EVs.

Key Occupant Classification System (OCS) Companies:

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- IEE Smart Sensing Solutions

- Aptiv PLC

- AISIN Corporation

- TE Connectivity Ltd.

- NIDEC Corporation

- CTS Corporation

- Joyson Safety Systems

- Autoliv Inc.

- Flexpoint Sensor Systems

- Mayser GmbH & Co. KG

- IGB Automotive Ltd.

Global Occupant Classification System (OCS) Market Report Segmentation

By Component

- Sensors

- Control Units

- Software

- Seat Modules

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

By Technology

- Weight-Based Systems

- Pressure-Based Systems

- Ultrasonic Systems

- Camera-Based Systems

By Application

- Airbag Deployment Control

- Seatbelt Reminder Systems

- Child Safety Detection

- Passenger Monitoring Systems

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr1.png)

APAC:+91 7666513636

APAC:+91 7666513636