Market Summary

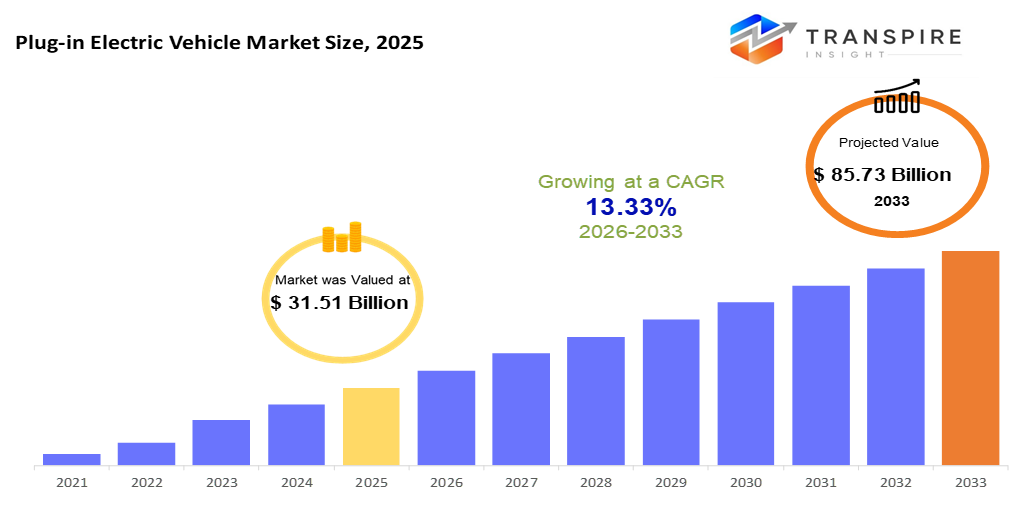

The Plug-in Electric Vehicle Market shift suggests the industry could reach roughly $85.73 billion in 2033, hinting at how central these vehicles may become in future low-emission scenarios. The global electric vehicle trend is growing fast-driven by greener consumer choices, supportive government policies, while battery tech keeps improving rapidly. Folks now lean toward EVs or plug-ins much more, boosting sales far beyond wealthy nations into emerging markets too. As charging spots spread widely and battery costs drop steadily, making the switch feels less tricky.

Market Size & Forecast

- 2025 Market Size: USD 31.51 Billion

- 2033 Projected Market Size: USD 85.73 Billion

- CAGR (2026-2033): 13.33%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America made up a big chunk of the worldwide electric car market in 2025, with 36% market share, driven by growth due to solid government support, more drivers switching to EVs, and factories getting upgrades through fresh funding.

- The U.S. plug-in car scene should increase slowly between 2026 and 2032, driven due to more buyers choosing electric rides on top of steady upgrades made by automakers.

- By battery kind, lithium-ion grabbed the biggest slice in 2025 with 78% market share, with strong power storage, lasting longer, yet costing less now. Though prices dropped, performance stayed high, making them more popular than others around that time. Their efficiency gave them an edge over alternatives despite competition from newer types emerging slowly.

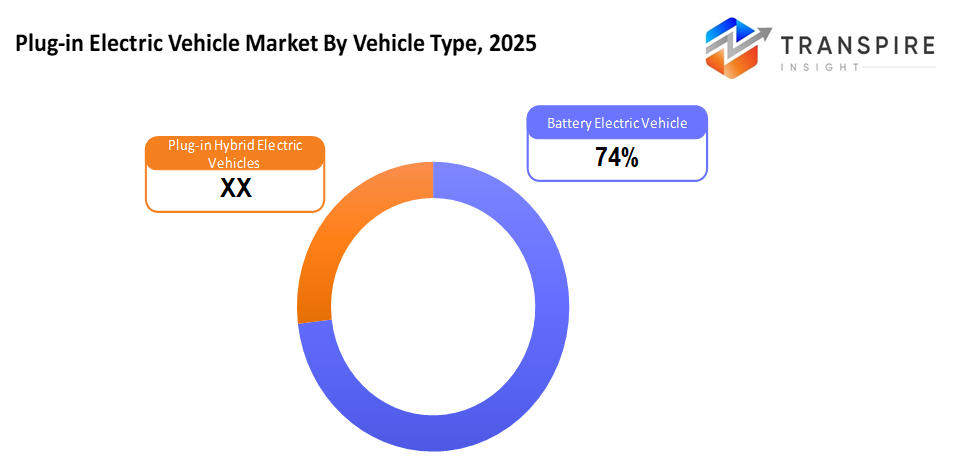

- When it comes to vehicle type, BEVs led sales in 2025. This growth came from more people wanting cars that run only on electricity and don't release exhaust fumes.

- Asia-Pacific should see the quickest rise in the coming years China, Japan, and India are driving it. Big electric vehicle output is one reason. Supportive rules from governments help too. Also, cities there are expanding fast.

The market of plug-in electric vehicles (PEV) is becoming one of the most important aspects of the developing automotive market globally, supported by the shift towards low-emission and efficient transport. Plug-in electric cars, battery electric ones, and plug-in hybrids are getting more and more popular because they are more environmentally friendly, less expensive to operate, and have better vehicle performance. The market’s shape comes from steady tech progress, while big car makers play a major role.

The push for plug-in electric cars keeps growing, since governments, buyers, and companies now focus more on cutting down CO2 output along with fossil fuel use. Shifting toward electric rides gets help from clear rules, financial perks for buying EVs, plus a stronger public sense of environmental care. On top of that, pricier gas and better city transit setups are boosting sales across personal and business vehicle sectors.

Regarding a market structure, the battery electric cars are becoming more popular than plug-in hybrid models in terms of full-electric functionality and zero tailpipe emissions. The most commonly used type of battery is the lithium-ion battery, which has continued to be supported by advancements in energy efficiency and durability. Locally, the developed markets are highly adopting because of their established infrastructure and policy backing, whereas the emerging economies are rapidly growing their electric vehicle ecosystem.

The market of plug-in electric vehicles is evolving and becoming more and more subject to investment in the electrification of vehicles, production capacity, and the environment. Automakers are expanding their electric vehicle offerings to meet the varied consumer demands as alliances in the value chain are boosting innovation. In the long run, battery, vehicle affordability, and charging accessibility will continue to enhance the spread of plug-in electric vehicles around the world.

Plug-in Electric Vehicle Market Segmentation

By Vehicle Type

- Battery Electric Vehicle

Battery Electric Vehicles (BEVs) run only on battery power. These cars are getting more popular because they do not create pollution, can go farther now, also charging spots are popping up everywhere.

- Plug-in Hybrid Electric Vehicles

PHEVs use both electricity and gasoline, giving drivers more freedom when roads get long while needing fewer plug-ins along the way.

To learn more about this report, Download Free Sample Report

By Battery Type

- Lithium-ion Batteries

Lithium-ion batteries power most electric cars. They can work for a long-time, pack plenty of energy, yet cost less now. Though once pricey, their prices have dropped fast thanks to better tech and mass production.

- Lithium Iron Phosphate

Lithium iron phosphate batteries are picking up speed, safer, last longer, also cheaper. These perks hit harder in everyday electric cars and work vehicles.

- Nickel Metal Hydride Batteries

Nickel Metal Hydride (NiMH) batteries are Common in hybrids, tough, handle heat well, though they pack less punch per size. Built to last, even when things get hot under the hood.

- Solid-State Batteries

Solid-state batteries are new tech that pack more power, charge quicker, also safer. These might hit markets in several years.

By Vehicle Class

- Passenger Cars

Passenger cars dominate electric vehicle use with rebates that help buyers, city lifestyles pushing cleaner transport, while more styles hit showrooms every year.

- Commercial Vehicles

Commercial vehicles are growing steadily, fueled by electric logistics trends, lower running costs, and stricter emissions rules.

- Two Wheelers & Three Wheelers

Motorbikes and rickshaws are spreading fast in developing countries, low prices help, so does local demand for quick city trips, and also push from national rules.

- Buses

Shifts come from city efforts to go electric, lower fuel bills, or meet green targets set by officials.

By End-Users

- Individual Consumers

Regular folks make up a big chunk of electric car buyers. More people care about the planet, want to save on gas, or get rebates when buying.

- Commercial Fleet Operators

Fleet businesses are switching to electric cars, cutting fuel bills, sticking to pollution rules, or hitting green goals.

- Government & Municipal Bodies

Public agencies want electric buses, update old vehicles, or follow rules that push greener buys - so they’re boosting the need.

Regional Insights

North America, along with Europe, stands out in the plug-in car scene, thanks to solid rules, reliable charging setups, and people who get why green transport matters. The U.S. takes the lead across North America because of national perks, local push for zero-exhaust cars, plus more companies switching their vans and trucks to electric. Meanwhile, Canada keeps things moving steadily with eco-friendly travel plans. Over in Europe, top spots like Germany, the UK, France, and Nordic nations are pushing hard on plug-ins using pollution goals, city zones that limit dirty engines, and automakers stepping up their electric game. A deep-rooted auto industry network, big-name EV brands hanging around, and ongoing cash flow into better batteries and faster chargers.

Asia Pacific stands as a top-priority area for expansion, marked by massive output, low-cost production methods, yet heavy state influence. China leads across the zone thanks to bold moves toward electric power, local battery networks, alongside broad use of plug-in cars and vans. Japan, along with South Korea, adds value using sophisticated hybrid systems instead of full EVs. Meanwhile, India, nations in Southeast Asia, plus Australia form a secondary group seeing faster uptake driven by city growth, worries over gas prices, also growing access to public charging spots. Growth here gets an extra push from shifting scooters and rickshaws to electricity, especially where economies are still developing.

South America, along with the Middle East and Africa, counts as a second-tier area, showing slow but steady uptake plus future growth chances. Brazil, Chile, and Colombia in South America are starting to shift toward electric cars, thanks mainly to greener buses, environmental pushes, or small-scale company vehicle trials. Over in MEA, nations including the UAE, Saudi Arabia, and South Africa have begun building charging setups, tied to wider efforts in clean power use or urban upgrades. Even though sales numbers aren't high yet, better rules, more stations popping up, and cheaper batteries should help markets grow slowly across both zones.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 10, 2025 – Lotus unveils plug-in hybrid Eletre after going fully electric.(Source: Auto Hindustan Times https://auto.hindustantimes.com/auto/electric-vehicles/lotus-unveils-plug-in-hybrid-eletre-after-going-fully-electric-41765337845663.html

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 31.51 Billion |

|

Market size value in 2026 |

USD 35.71 Billion |

|

Revenue forecast in 2033 |

USD 85.73 Billion |

|

Growth rate |

CAGR of 13.33% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key company profiled |

Tesla Inc., BYD Auto Co. Ltd, Volkswagen Group, Toyota Motor Corporation, Hyundai Motor Group, General Motors, BMW Group, Ford Motor Company, Mercedes-Benz Group, Samsung SDI, Renault Group, Honda Motor Co., Ltd, Others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Battery Type(Lithium-Ion Batteries, Lithium Iron Phosphates, Nickel Metal Hydride, Solid-State Batteries) By Vehicle Class (Passenger Cars, Commercial Vehicles, Two-Wheelers & Three-Wheelers, Buses), By End-Users (Individual Consumers, Commercial Fleet Operators, Government & Municipal Bodies) |

Key Plug-in Electric Vehicle Company Insights

Tesla, Inc. leads the worldwide electric car scene thanks to its edge in battery-powered models, smart drivetrain designs, while also running everything from factory to sales on its own terms. Big factories spread around the globe help back this up alongside custom batteries, unique software smarts, plus a far-reaching network of charge stations people rely on daily. Instead of just chasing trends, it pushes new tech fast, sends updates remotely like phone apps do, making high-speed EVs that grab attention in major regions such as North America or Western Europe. On top of that, ramping up output quicker than rivals, slashing storage cell expenses at the same time, gives it serious leverage against old-school car brands stuck in slower cycles.

Key Plug-in Electric Vehicle Companies:

- Tesla Inc

- BYD Auto Co. Ltd

- Volkswagen Group

- Toyota Motor Corporation

- Hyundai Motor Group

- General Motors

- BMW Group

- Ford Motor Company

- Mercedes-Benz Group

- Samsung SDI

- Renault Group

- Honda Motor Co, Ltd

- Others

Global Plug-in Electric Vehicle Market Report Segmentation

By Vehicle Type

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

By Battery Type

- Lithium-Ion Batteries

- Lithium Iron Phosphates

- Nickel Metal Hydride

- Solid-State Batteries

By Vehicle Class

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Three Wheelers

- Buses

By End-Users

- Individual Consumers

- Commercial Fleet Operators

- Government & Municipal Bodies

Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr1.png)

APAC:+91 7666513636

APAC:+91 7666513636