Market Summary

The global Living Building Materials market size was valued at USD 24.00 billion in 2025 and is projected to reach USD 48.30 billion by 2033, growing at a CAGR of 8.90% from 2026 to 2033. The Living Building Materials Market is currently growing at a steady rate, owing to the rising pressure from various regulations to decrease the carbon footprint caused by building materials currently used. The use of sustainable construction techniques and circular economy concepts is encouraging more investments in bio-based building materials. Improvements in the reliability and performance of sustainable materials are being achieved through technological advancements, which are playing a significant role in the adoption of these materials across various construction sectors.

Market Size & Forecast

- 2025 Market Size: USD 24.00 Billion

- 2033 Projected Market Size: USD 48.30 Billion

- CAGR (2026-2033): 8.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- It is expected that North America will continue to drive adoption due to robust research ecosystems, increased regulatory focus on sustainable construction, and large-scale infrastructure modernization projects that have inspired new interest by both manufacturers and developers in integrating bio-based materials into mainstream construction practices.

- The United States, backed by collaboration between biotechnology firms and construction companies, pilot-scale projects, and governmental incentives, is leading in innovation and commercialization of living building materials, thus creating a favorable environment for the adoption of bio-concrete, mycelium-based materials, and other advanced sustainable solutions.

- Asia Pacific is expected to be the high-growth region owing to rapid urbanization, smart city initiatives, and increasing investment by governments in low-carbon infrastructure. This, in turn, accelerates the adoption of sustainable construction materials, adding to technology development and market expansion for residential, commercial, and industrial projects.

- Bio-concrete remains dominant within the segment of material type, with developers increasingly biased toward durability aspects, self-healing capabilities, and lifecycle cost reduction. Besides, regulatory pressure for carbon reduction strengthens demand for biologically engineered cement alternatives in infrastructure and commercial construction.

- The main entry route for incorporating live building materials is still new construction, owing to design flexibility, consideration of green building certifications, and ease of integration. Incorporating new, innovative solutions is easier with new buildings than retrofitting existing buildings.

- The structural material segment dominates the applications segment due to its higher value in enhancing performance, minimizing maintenance, and reducing carbon content. Hence, it is the most preferred choice by construction companies for sustainable infrastructure as well as commercial infrastructure.

- In addition, residential construction fuels end-use adoption, with individuals and builders alike looking for environmentally friendly materials that provide better energy efficiency, lower operational costs, and support government incentives for sustainable construction.

So, The definition of the concept of Living Building Materials Market is the development of materials with the ability to repair themselves or interact with the environment. Here, the materials integrate with bacteria, fungus, or algae. The focus of the market is the intersection of the biotech market with buildings. The market is considered to be environmentally friendly. The materials are capable of self-repair. The market growth is closely related to the escalating environmental issues as well as the challenges of traditional building material capabilities and their contribution to carbon emissions. Living building materials are an alternative to conventional materials. They are effective in avoiding carbon emissions. The increasing research activities are hastening the transition of living building materials from experimental to practical uses. Industry players, including building companies, material manufacturers, and research organizations, are investing in the development of scalable production methods and standardization of performance. The market is impacted by factors such as green building certifications, sustainability regulation, and modernization of urban infrastructure. As the maturity level of technology increases, living materials will extend beyond niche markets to mainstream use in building construction.

Living Building Materials Market Segmentation

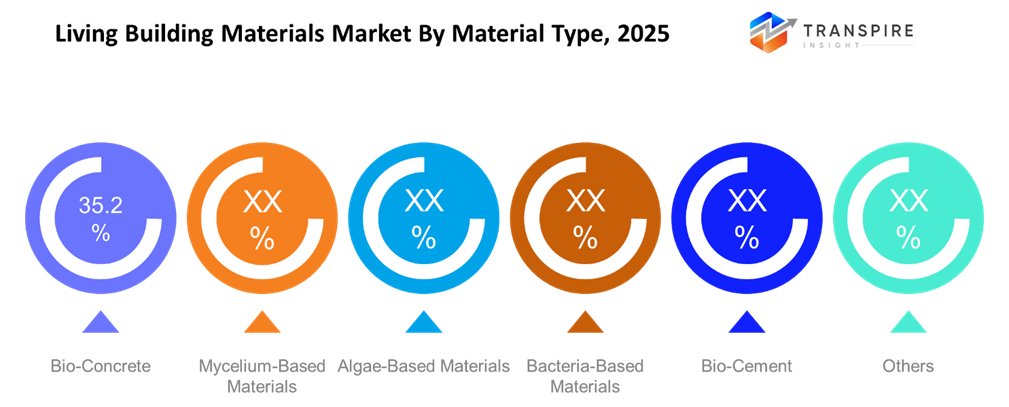

By Material Type

- Bio-Concrete

Bio-concrete adds microorganisms to repair cracks in concrete, thereby increasing durability and lowering the cost of maintenance in the long run. The segment report indicates that this segment is gaining popularity in construction industries such as infrastructure and commercial construction, particularly in developed markets.

- Mycelium-Based Materials

Mycelium-based materials are biodegradable composite materials consisting of mycelium networks, which are lightweight and friendly for insulation. Such materials are being increasingly applied for eco-friendly construction because they bear low carbon footprints. It is further fueled by green building certifications and strong demand for sustainable alternatives to other materials.

- Algae-Based Materials

Algae-based materials have been noted to offer carbon sequestering potential as well as assist in the process of "sustainable building designs." There is an exploration of the use of the product in building facades as well as "bio-reactive building elements." There have been investments in the study of the product as well as climate-related regulations

- Bacteria-Based Materials

Bacteria materials facilitate self-repairing and improve the longevity of structures through bacterial activity. These materials need these bacteria for reducing maintenance activities, especially in harsh environments. Investment in infrastructure is contributing considerably to the growth of the segment.

- Bio-Cement

Bio-cement uses biological processes for binding aggregates, which reduces the use of conventional carbon-producing processes for making cement. This segment is further helped by increasing regulations to control the emissions caused during construction. The use of bio-cements is rising for sustainable construction and experimental building sites.

- Others

Other forms of living building materials comprise hybrid bio-composites and newly developed bio-engineered materials. It is stated that these materials are mostly in the early commercialization phase but hold great promise as their long-term potential can be maximized.

To learn more about this report, Download Free Sample Report

By Construction Type

- New Construction

New construction is contributing to significant adoption due to the flexibility of incorporating green materials into the design and planning of the construction. Developers are increasingly incorporating green materials into building construction to meet regulations on sustainability. Large-scale construction projects are driving growth in this segment.

- Renovation & Retrofitting

Renovation and retrofitting are application areas, particularly in sustainability aspects, as buildings are being upgraded with newer and better sustainability features. This segment has been supported by government incentives encouraging building modernization.

By Application

- Structural Materials

Structural applications form a significant sector since living materials have the potential to improve durability and reduce lifecycle emissions. Bio-concrete and bio-cement are increasingly assessed on load-bearing structures. This demand is supported by sustainable infrastructure development and optimization of long-term costs.

- Insulation

Living materials, when used for insulation, provide both thermal regulation and certain biodegradability benefits. Insulation based on mycelium is gaining widespread attention due to its low environmental impact and efficiency in performance. The increasing standards for energy efficiency spur the adoption in various residential and commercial projects.

- Flooring

In flooring applications, living materials are being researched for resilience, sustainability, and reduced carbon footprints. Adoption continues to be in the emerging stages but is growing in eco-conscious building projects. Innovation in material durability will increase usage cases.

- Wall Panels & Bricks

Wall panels and bricks stand as an example of the prominent use, as it is relatively easy to incorporate them. Living materials help in improving building envelopes. The increasing need for prefabricated eco-friendly buildings is contributing to this segment.

- Roofing

Living material-based roofs play an important role in ensuring thermal regulations and sustainable environments. These roofs have now begun to be considered for use as part of green roofs, which are very responsive to climatic conditions. They are made possible through the initiatives of urban sustainability.

- Others

Some other applications include decorative purposes, temporary structures, and experimental works in architecture. It is noticed that these applications are limited to innovation-based projects. Further research is expected to increase the range of application.

By End Use Industry

- Residential Construction

Residential construction contributes to demand as consumers are increasingly becoming aware of eco-friendly housing options. Developers are using living materials in construction to achieve efficiency and environmental protection. Green housing projects are promoting the market.

- Commercial Construction

The commercial construction segment reflects robust adoption trends with the commitment of corporate organizations toward sustainability and ESG compliance mandates. Living materials contribute to the reduction of the carbon footprint of structures. There is robust adoption of commercial structures incorporating innovative materials.

- Industrial Construction

The use of living materials in industrial constructions is aimed at improving durability and environmental compliance. The use cases involve enhancing insulation and structural improvements in energy-intensive plants. Sustainability guidelines are promoting the use.

- Infrastructure Development

Infrastructure development is one segment which promises significant potential as construction requires effective, low-maintenance products. Bio-concrete and bacteria-based materials are especially relevant to road construction and civil engineering. Government expenditure in this segment of sustainable infrastructure is positively influencing market expansion.

Regional Insights

The North American region, dominated by the United States with support from Canada and Mexico, enjoys the advantages of well-funded research, technology uptake, and regulatory encouragement of environmentally friendly construction techniques. The United States acts as an innovation centre, while Canada focuses on green building regulations and Mexico takes a low and steady approach through modernization of infrastructure. Europe is characterized by a mature market driven by stringent environmental norms and an aggressive push towards carbon neutrality. Countries like Germany, the UK, France, Spain, and Italy have good penetration with circular economy strategies and high-end construct technology. The rest of Europe contributes to the market with pilot studies driven by research and development, and green city developments. Asia Pacific is an emerging high growth market driven by high levels of urbanization and increased construction activities in China, India, Japan, Korea, and Australia & New Zealand. Smart city projects driven by government initiatives, as well as environmental awareness, have been enabling factors, whereas the rest of Asia Pacific is witnessing rising interest in sustainable material innovation. The South American market, led by Brazil and Argentina, is slowly embracing the technology driven by urban growth and environmental factors, but the high costs are hurdles to adoption. The Middle Eastern & African region, which includes Saudi Arabia, the United Arab Emirates, and South Africa, is increasingly experimenting with using Living Materials within infrastructural and sustainable development undertakings guided by long-term environmental strategies.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 2024, Biomason has appointed Camilo Restrepo to the position of Chief Executive Officer as part of its effort to strengthen leadership and accelerate its mission on decarbonizing cement production via biotechnology-based materials. The announcement, which underlines growing commercialization efforts and strategic scaling of biocement solutions amid rising demand for low-carbon construction materials around the world, reflects industry momentum toward biologically derived alternatives for traditional methods of cement and concrete manufacture.

- In December 2023, Biomason, in partnership with GXN and other partners, today announced progress in developing BioConcrete through the use of bacterial biocement technology, which aims at carbon footprint reduction while improving material strength and performance. This initiative shows the rise in the use of living building material by architecture and industry, furthering commercialization pathways and broadening real-world uses of bio-based construction solutions within circular infrastructure projects..

(Source:https://biomason.com/wpcontent/uploads/2024/03/GXN_BioConcrete_PressRelease_231201.pdf)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 24.00 Billion |

|

Market size value in 2026 |

USD 26.50 Billion |

|

Revenue forecast in 2033 |

USD 48.30 Billion |

|

Growth rate |

CAGR of 8.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Ecovative LLC, bioMASON Inc., Prometheus Materials Inc., Green-Basilisk B.V., Ecocem Ireland Ltd., BASF SE, CEMEX S.A.B. de C.V., Heidelberg Materials AG, Holcim Ltd., CarbiCrete Inc., Blue Planet Systems Corporation, Solidia Technologies Inc., C-Crete Technologies LLC, ECOncrete Tech Ltd., and Calera Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Bio-Concrete, Mycelium-Based Materials, Algae-Based Materials, Bacteria-Based Materials, Bio-Cement, Others), By Construction Type (New Construction, Renovation & Retrofitting), By Application (Structural Materials, Insulation, Flooring, Wall Panels & Bricks, Roofing, Others) and By End Use Industry (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development) |

Key Living Building Materials Company Insights

bioMASON Inc. is an example of a leading firm in bio-based building products, as represented by its “living building materials” technology, which includes its ambient temperature cement production method, carried out using microbial-based bacteria colonization. Its product, which offers an alternative option to conventional cement production while significantly reducing greenhouse gas emissions, offers effective solutions to meeting global agendas aimed at reducing carbon footprint in construction. The involvement of bioMASON Inc. in alliances aimed at promoting low-carbon-based concretes indicates a great potential for business and meeting regulations. The firm’s ability to address key construction issues, such as durability, performance, and sustainability at once, has made it a technology-driven disruptor in bio-based construction materials, mainly due to its scalability in those construction applications needing alternative forms of conventional cements and bricks.

Key Living Building Materials Companies:

- Ecovative LLC

- bioMASON Inc.

- Prometheus Materials Inc.

- Green-Basilisk B.V.

- Ecocem Ireland Ltd.

- BASF SE

- CEMEX S.A.B. de C.V.

- Heidelberg Materials AG

- Holcim Ltd.

- CarbiCrete Inc.

- Blue Planet Systems Corporation

- Solidia Technologies Inc.

- C-Crete Technologies LLC

- ECOncrete Tech Ltd.

- Calera Corporation

Global Living Building Materials Market Report Segmentation

By Material Type

- Bio-Concrete

- Mycelium-Based Materials

- Algae-Based Materials

- Bacteria-Based Materials

- Bio-Cement

- Others

By Construction Type

- New Construction

- Renovation & Retrofitting

By Application

- Structural Materials

- Insulation

- Flooring

- Wall Panels & Bricks

- Roofing

- Others

By End Use Industry

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Development

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636