Market Summary

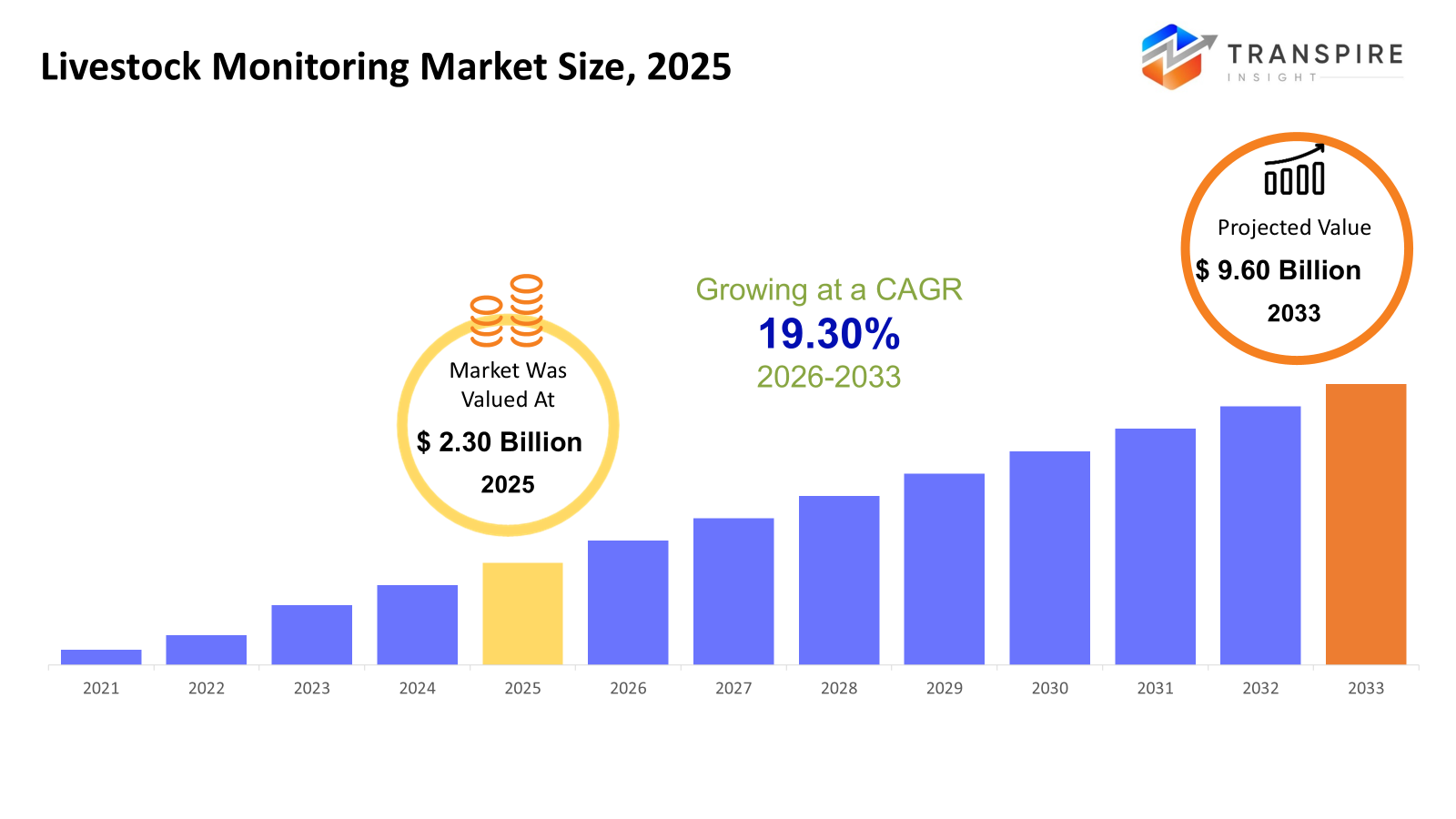

The global Livestock Monitoring market size was valued at USD 2.30 billion in 2025 and is projected to reach USD 9.60 billion by 2033, growing at a CAGR of 19.30% from 2026 to 2033. Growth in AI for factory automation spreads fast because more places adopt smart production methods along with the Industry 4.0 movement worldwide. Machines now think better thanks to artificial intelligence, helping spot breakdowns early, smooth out workflows, check product quality, improve delivery routes, cutting waste while lifting output. As robots link up with sensors and learning systems on shop floors, interest grows stronger every quarter.

Market Size & Forecast

- 2025 Market Size: USD 2.30 Billion

- 2033 Projected Market Size: USD 9.60 Billion

- CAGR (2026-2033): 19.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 30% in 2026. On top of the pack sits North America, where big farms thrive using smart animal tech. Heavy reliance on digital tools in daily operations pushes growth forward here. Vast farm sizes meet cutting-edge methods head-on. Profit-focused setups welcome automation without delay. This region moves fast because infrastructure allows it. Farming works differently now, shaped by data and sensors across fields. Progress sticks because support systems are already strong.

- From sea to shining sea, farms across the United States thrive by using smart tools that boost output while staying ahead of challenges. Government backing plays a quiet but steady role behind the scenes. Instead of tradition alone, decisions grow from data collected daily in fields stretching wide. Because systems adapt quickly, results stay consistent even when the weather shifts without warning.

- Fresh upgrades on Asian animal farms are pushing growth fast. Dairy cravings there keep climbing higher each year. Meat wants to follow close behind without slowing down. Tech tools that watch herds quietly spread across pastures now. Smart gear finds more space in daily barn routines lately.

- Hardware shares approximately 43% in 2026. Hardware takes the lead here. That happens because farms everywhere now use sensors, GPS collars, plus wearables to follow animals live. These tools show where each animal is at any moment. Their growing presence pushes hardware ahead of other parts.

- Fresh on the farm scene, RFID and GPS tagging help keep tabs on where animals go, how they move, and keep a close watch over herds. Movement checks happen fast now, thanks to signals that link tags to central logs. Where a cow roams gets recorded without delay, easing daily oversight. Herd patterns show up clearly when data flows steadily from field devices. Location details pile up quietly behind the scenes, shaping smarter routines.

- Cows top the list when it comes to farm animals, simply because so much milk and meat depend on watching their diet, wellness, and breeding closely.

- Few things matter more than catching sickness early. Most farmers focus on health because spotting problems fast saves animals. Preventing illness works better than fixing it later. This way, fewer creatures die without reason. Watching closely pays off when trouble shows up slowly.

Growth in the worldwide market for tracking farm animals comes as more growers turn to tech tools. Because people want more milk, beef, and similar goods, better ways to run farms have become essential. Devices like sensors, smart collars, radio tags, and wearables now show up across pastures. From sunrise, these gadgets follow where animals go, how they act, and their condition day by day. Losses drop when changes appear fast. Management sharpens through constant updates on each herd member. Over time, results grow clearer under open skies.

Hardware takes the lead when it comes to parts, made up of things like sensors, collars, and tracking tools that gather information nonstop. Instead of standing alone, these physical pieces work alongside software-like analysis systems and phone apps that study the gathered details to reveal useful patterns. On top of that, services such as advice, setup help, and upkeep play a quiet but steady role, helping farmers put the tech in place while keeping it running smoothly over time.

Cattle take up the biggest share when it comes to farm animals, simply because milk and meat from them are produced so widely across the globe; after that come sheep, then goats, birds like chickens, and pigs. Health care and handling sickness play a central role - keeping animals well avoids drop-offs in output while lifting overall performance. Breeding control shows up next in importance, along with fine-tuning what they eat and tracking how much energy they use each day. Watching movements and daily patterns gives clues about discomfort, changes around their surroundings, plus how suited living conditions really are, pushing farms toward longer-term balance.

North America holds the top spot, thanks to widespread use of tech-driven livestock tools, a large number of commercial farms, and rules that back such innovations. In this area, the United States stands out because it uses highly developed farming methods and pushes constant improvements in technology. Growth speeds up fast across Asia Pacific as farms shift toward modern setups, people eat more meat and dairy, while attention grows around keeping animals healthy and operations efficient. Elsewhere, Europe sees steady progress; so do parts of Latin America and regions across the Middle East and Africa - each investing more into digital tracking and smarter ways to manage herds.

Livestock Monitoring Market Segmentation

By Component

- Hardware

Fresh off the farm, gadgets like sensors tag along with animals. Wearables ride on their bodies, sending data without delay. Instead of paper trails, tiny RFID chips mark each creature’s path. Movement across fields shows up through GPS collars that stay put. Live updates flow straight from pasture to system.

- Software

A tool that handles information through digital systems appears first. Next comes a setup watching field activity closely over time instead of just once. Finally, there is an online method controlling farming tasks from far away using alerts and updates sent back and forth.

- Services

Monitoring setups get help through consulting, then follow-up care. System links are built piece by piece alongside ongoing upkeep. Support arrives when systems need tuning or fixing. Expert advice shapes each step before tools go live.

To learn more about this report, Download Free Sample Report

By Technology

- RFID & GPS Tracking

Tracking animals using RFID tags happens instantly, while GPS pinpoints their exact spot on land. Movement gets recorded moment by moment through radio signals instead of manual checks. Each animal carries a tag so its whereabouts show up live without delays. Location data flows continuously, making it easier to follow herds across wide areas.

- IoT-Enabled Monitoring System

Out in the field, sensors gather information without needing people nearby. Where machines talk to each other, tasks run more smoothly over time. With updates sent from a distance, systems adjust before problems grow. Instead of waiting, fixes happen faster through constant watch. Efficiency rises when actions follow real-time signals across locations.

- Wearable Sensors

Fresh off the wrist, sensors track heart rate, movement, and how often you stand. Sometimes they notice when routines shift, like sleeping later, walking slower. Data flows quietly through the day, spotting rhythms without questions. Little dots on a screen add up to habits over time.

- Biometric & Health Sensors

Fresh readings on body heat and pulse show hints of illness before symptoms appear. A built-in system watches changes day by day. Not just numbers, clues hidden in rhythms. Early warnings come through steady monitoring. Subtle shifts matter most when caught fast. Signs pop up quietly, this tech listens closely.

- Others

A few more tools show up smart forecasts powered by artificial intelligence, alongside sharper tracking systems that watch closely. These add depth without shouting about it.

By Livestock Type

- Cattle

From cows comes work that checks how they eat, feel, and their breeding - watching each part closely. A look into daily habits shows patterns in milk makers and meat stock alike. Not just one farm type, but both follow similar tracking steps. Health signs come first, then meals, then family growth matters too. Each animal gets attention, so nothing slips past unnoticed.

- Sheep & Goat

Health, grazing management, and disease prevention.

- Poultry

Fresh eggs come from healthy birds raised right. Watching how fast they grow tells a lot about care quality. Good food use means strong animals plus steady output.

- Swine

Pigs put on weight when fed well, their growth tracked through regular checks. Health stays strong if living spaces stay clean, and fresh air matters just as much as food quality. Temperature swings can slow progress, so stable surroundings help day by day.

- Others

Horses show up here, yet camels fit too. Specialty animals of odd kinds appear alongside.

By Application

- Health & Disease Management

Achieving better outcomes begins with spotting health issues early. Monitoring how a condition changes over time gives clearer insight into progress. Treatment works best when adjustments happen quickly, based on real observations. Staying ahead often means catching shifts before symptoms grow stronger. Care becomes more precise when guided by consistent tracking instead of guesses.

- Breeding & Reproduction Management

Starting strong with fertility, keeping track of when animals are ready helps plan. Instead of guessing, watching signs closely makes timing clearer. Planning steps come next, once patterns show up. Clear signals guide each choice forward.

- Feed & Nutrition Management

Fresh meals arrive on time, every day, thanks to smarter planning. Better ingredients mean less waste during daily routines. Careful tracking adjusts portions without guesswork. Smart choices build stronger results over weeks. Efficiency grows when habits shift slowly. Health improves because details matter most.

- Activity & Behavior Monitoring

Stress, movement patterns, and welfare tracking.

- Others

Another part covers checking environmental conditions along with streamlining how farms run day to day.

Regional Insights

Big farms in North America lead global demand for animal tracking tools because they rely heavily on tech-driven farming methods. Thanks to the fast uptake of automated systems, the United States holds the top position, boosted by active R&D, widespread supply chains, and policy backing for digital agriculture. Innovation thrives here, where modern ranchers favor data-based decisions over guesswork. Meanwhile, Canadian output grows slowly but surely, tied closely to expanding cattle herds and fresh attention toward connected devices on pastures. Dairy and meat producers alike now lean into smarter ways to manage stock, nudged forward by efficiency needs rather than trends.

Germany, France, and the UK push Europe’s lead, thanks to strict animal care rules mixed with smart farming tools. Cattle, chickens, and pigs now see more digital tracking, pulled forward by better data use on farms. As roads and networks improve, nations down south and farther east begin to follow, step by step. Growth creeps in quietly where knowledge spreads slowly but steadily.

Fastest gains now appear across Asia Pacific, Latin America, and parts of the Middle East and Africa. Driven by upgrades in farming tech, the region leads in expansion thanks to stronger appetites for milk and meat. Modern barns spread widely there, alongside deeper knowledge about keeping animals healthy. Progress moves at a steadier pace through Latin America, where vast ranches help adoption grow. Investment flows into digital tools on these large spreads, nudging efficiency higher. In arid zones and rural pockets of the Middle East and Africa, change comes slowly but steadily. Monitoring gear shows up mostly on corporate-run herds or state-backed initiatives aiming to boost output. Welfare concerns shape some of those public efforts, quietly shifting old practices.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 26, 2026 – Agriland and MSD Animal Health launched a new series ahead of breeding season.

- November 5, 2026 – RMIS launched innovative traceability platform to boost traceability platform to boost livestock tracking in South Africa.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.30 Billion |

|

Market size value in 2026 |

USD 2.80 Billion |

|

Revenue forecast in 2033 |

USD 9.60 Billion |

|

Growth rate |

CAGR of 19.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Allflex Livestock Intelligence, Zoetis, Cowlar, GEA Group, DeLaval, Nedap Livestock Management, SAS, Smartbow, SCR Dairy, Lely, AllyNav, Afimilk, BouMatic, Moocall, HerdDogg, C-Lock Inc., Sateliot, and CattleEye. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Hardware, Software, Services), By Technology (RFID & GPS Tracking, IoT-Enabled Monitoring System, Wearable Sensors, Biometric & Health Sensors, Others), By Livestock Type (Cattle, Sheep & Goat, Poultry, Swine, Others), By Application (Health & Disease Management, Breeding & Reproduction Management, Feed & Nutrition Management, Activity & Behavior Monitoring, Others) |

Key Livestock Monitoring Company Insights

A world-renowned name in tracking farm animals, Allflex Livestock Intelligence delivers tools like digital ear tags, body-worn trackers, and software for managing groups of livestock. Instead of guessing, farmers get live updates on sickness, breeding cycles, and movement patterns, helping both output and care improve. Operating widely through Canada and the United Staes plus regions in Europe and areas across Asia, the business blends smart hardware with consistent backup help. Because it leans into exact animal handling methods, connects devices through internet networks, and uses numbers pulled from daily operations, it stands out while shaping how farms monitor herds today.

Key Livestock Monitoring Companies:

- Allflex Livestock Intelligence

- Zoetis

- Cowlar

- GEA Group

- DeLaval

- Nedap Livestock Management

- SAS

- Smartbow

- SCR Dairy

- Lely

- AllyNav

- Afimilk

- BouMatic

- Moocall

- HerdDogg

- C-Lock Inc.

- Sateliot

Global Livestock Monitoring Market Report Segmentation

By Component

- Hardware

- Software

- Services

By Technology

- RFID & GPS Tracking

- IoT-Enabled Monitoring System

- Wearable Sensors

- Biometric & Health Sensors

- Others

By Livestock Type

- Cattle

- Sheep & Goat

- Poultry

- Swine

- Others

By Application

- Health & Disease Management

- Breeding & Reproduction Management

- Feed & Nutrition Management

- Activity & Behavior Monitoring

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636