Market Summary

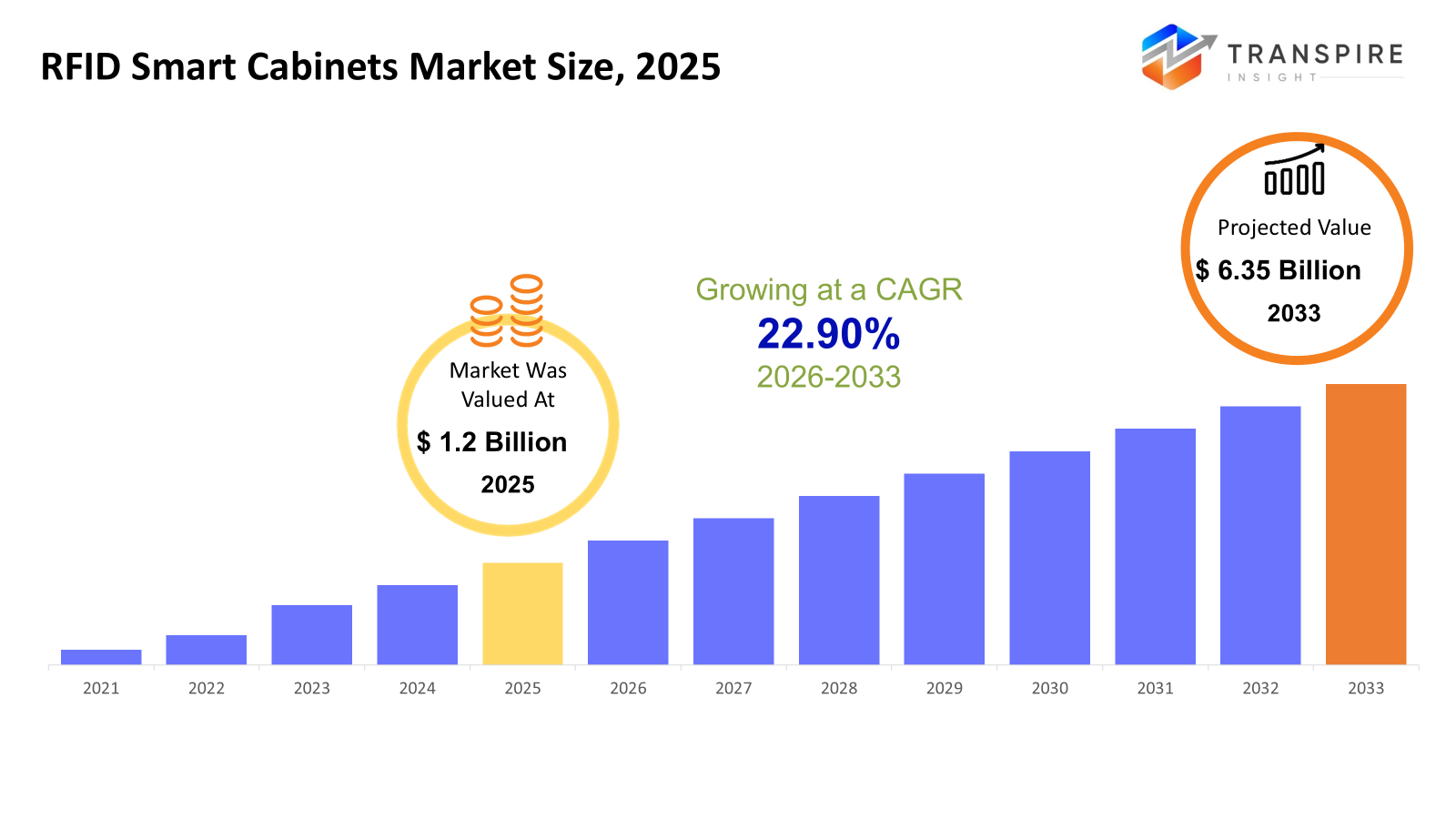

The global RFID Smart Cabinets market size was valued at USD 1.2 billion in 2025 and is projected to reach USD 6.35 billion by 2033, growing at a CAGR of 22.90% from 2026 to 2033. The market for RFID smart cabinets is expected to have a strong CAGR due to the growing need for real-time inventory management, medication safety, and loss prevention. The rising digitalization of processes, along with the reduction in the cost of RFID components, is driving the market.

The pressure for traceability continues to increase as a regulatory requirement, particularly in the pharma and hospital segments. Moreover, the integration of RFID Cabinets with analytics and cloud solutions within hospitals is also opening up new usage scenarios.

Market Size & Forecast

- 2025 Market Size: USD 1.2 Billion

- 2033 Projected Market Size: USD 6.35 Billion

- CAGR (2026-2033): 22.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is showing significant momentum, as the need for error-free medication distribution, adherence, and management of inventory costs is being increasingly met by the healthcare community, and the development of IT and the availability of RFID solutions are leading to the wider adoption of smart cabinets.

- The United States strongly drives the growth in the regional market because of a higher expenditure on healthcare, the widespread use of automated dispensing and inventory systems in the country, and the increased investments of the hospital and pharmaceutical sectors in the connected asset management solution

- The region of Asia Pacific is experiencing accelerated growth due to the sharp expansion of hospitals, production of pharmaceuticals, and the expansion of industrial facilities, and because of the, as yet, increased attention of the government regarding healthcare digitalization, cost reduction, and supply chain transparency.

- Integrated smart cabinets will be a great fit for large hospitals and big pharmaceutical firms as it provides seamless interoperability with ERP and hospital information systems, facilitating centralized data analytics, automated replenishment, and inventory optimization across the enterprise.

- RFID tags remain very important, as their falling prices and increasing robustness make item-level tagging economically viable, which in turn allows for accurate tracking of various assets, helps prevent theft, and ensures compliance with regulations in use cases related to healthcare, pharmaceuticals, and industry in general.

- Hence, the major user segment of RFID smart storage systems is created by hospitals and clinics since the pressure to minimize operational inefficiencies, as well as manage high-value medical inventory and improve care delivery outcomes, encourages sustained investments in RFID-enabled smart storage solutions.

So, The term RFID smart cabinets is defined as automated storage solutions that integrate with RFiD to track and manage resources. RFiD smart cabinets have been employed in the healthcare and pharmaceutical sectors to track drugs and materials. They have been employed in the manufacturing industry as storage solutions to manage resources such as equipment and materials. Market development is closely tied to the increasing complexity of the supply chain and the need for precise and real-time data. The smart cabinet from RFID reduces the manual process of inventory, the loss of product due to theft or expiration, and regulatory requirements, especially within the healthcare and life science markets.

Technologies like connectivity to the cloud, analytics, and compatibility with enterprise systems are increasing the application area of smart cabinets. As more focus is on efficiency, cost, and safety in organizations, RFID-enabled solutions for storage and inventory are becoming an investment, not an option.

RFID Smart Cabinets Market Segmentation

By Type

- Standalone Smart Cabinets

Self-standing cabinets work best for smaller to mid-scale operations because of their simplicity of installation and relatively lower start-up costs. They enable real-time monitoring and control of access without necessarily having to integrate thoroughly with an enterprise.

- Integrated Smart Cabinets

The integrated cabinet is meant for smooth interaction with hospital information systems, ERP systems, and warehouse management systems. These systems have been widely employed in larger hospitals and manufacturing plants trying for end-to-end visibility and auto-replenishment.

To learn more about this report, Download Free Sample Report

By Component

- RFID Tags

The root of intelligent cabinet systems is comprised of RFID tags. These tags have seen an increase in adoption due to reduced tag costs and growing demand from item level traceability.

- RFID Readers

These readers are able to extract information from tags and send it to a backend system to analyze it. When it comes to more precise readings, it plays an important part in medical and health settings of pharmacies.

- RFID Antenna

Antennas broaden the coverage area of the signal for better detection of the tags inside the cabinets. The designs of the optimized antennas help eliminate blind spots and thereby inventory inaccuracies within densely packed shelves.

- Others

This category comprises controller products, sensors, software interfaces, and connectivity modules. Such products increase the intelligence of a system, allowing analytics, notification, and seamless integration of the system.

By Cabinet Type

- Medication Cabinets

Medication cabinets have dominated because of their requirement for controlled access, says a report by Euromonitor International. They are helpful in reducing medication errors, thwarting theft, and increasing accountability.

- Supply Cabinets

Supply cabinets control the stock of consumables like syringes and disposables. This is an improvement on earlier models because it enhances visibility and prevents product expiration due to overstocked inventory.

- Equipment Cabinets

These types of cabinets are utilized for storing valuable tools and devices. They ensure the use of these devices and eliminate the possibility of losing them. The use of RFID technology for tracking enhances usage and maintenance.

- Inventory Cabinets

The inventory cabinet is largely used in industries and pharmacies to control raw and component materials. They facilitate just-in-Time inventory processes and automated reorder processes

By End User

- Hospitals and Clinics

Hospitals constitute the biggest end-use category due to the need for medication safety and efficiency. Smart cabinets allow doctors to give more focus to patients and less to inventory tasks in a hospital setting.

- Bio-Pharmaceutical Companies

Pharma companies employ the use of RFID cabinets for managing high-value pharmaceuticals, sample storage, and temperature-sensitive items. Tracking is done with a high level of accuracy, with minimal loss of products.

- Manufacturing Facilities

Smart cabinets are used by the manufacturer in the control of tools, spare parts, and consumables on the production floor. This increases the level of productivity as downtime associated with lost or misplaced items will be eliminated.

- Others

This market comprises research labs, logistics, and academic organizations. The major reason for adopting this market is the demands of accountability, secure access, and resource management efficiency.

Regional Insights

North America is a mature market, with the US leading the way in advanced healthcare infrastructure, a very high rate of technology adoption, and strict regulatory standards, which facilitates the greater use of RFID smart cabinets throughout. Canada exhibits steady uptake, while Mexico is starting to adopt automation in the healthcare and manufacturing sectors. Europe shows stable growth in all major markets: Germany, the United Kingdom, France, Italy, and Spain-supported by different healthcare modernization and industrial automation initiatives. For the Rest of Europe, tier-2 markets continue to penetrate RFID solutions to enhance efficiency and compliance. Asia Pacific represents the largest and fastest-growing region, led by Japan, China, India, South Korea, and Australia & New Zealand. The ever-increasing healthcare needs, pharmaceutical industries, and the transformation of tier-1 and tier-2 economies are fueling the growth. South America is registering competent growth, primarily driven by countries such as Brazil and Argentina because of the transformation in supply chains by organizations. The Middle East & Africa region, primarily Saudi Arabia, UAE, and South Africa, is observing slow acceptance growth because of investment in healthcare infrastructure and industrialization.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2023, Impinj, Inc., the world’s leading RAIN RFID company and IoT pioneer, today introduced the Impinj R720 RAIN RFID reader. Boasting a level of processing power and memory beyond the previous generation of RAIN RFID readers offered by Impinj, the Impinj R720 reader enables on-reader processing to handle the most demanding enterprise-class requirements.

- In February 2023, The smart package program by UPS will be implemented in the remaining network in the US, as CEO Carol Tomé said on an earnings call, after succeeding in 2022 with select locations.The project will entail using RFID tags to label packages and RFID tags worn by company human resources, to eliminate scanning and increase the flow of parcels in the delivery giant's warehouse.

(Source:https://www.supplychaindive.com/news/ups-rfid-tag-smart-package-initiative-expands-2023/642338/)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.2 Billion |

|

Market size value in 2026 |

USD 16 Billion |

|

Revenue forecast in 2033 |

USD 1.5 Billion |

|

Growth rate |

CAGR of 22.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Terso Solutions, LogiTag Systems, WaveMark (Cardinal Health), Mobile Aspects, SATO Vicinity, Invengo Technology, Palex Medical,Grifols, Impinj, Avery Dennison, Stanley Healthcare, Nexess, Alien Technology, Spacecode, Dipole RFID |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Standalone Smart Cabinets and Integrated Smart Cabinets), By Component (RFID Tags, RFID Readers, RFID Antenna, Others), By Cabinet Type (Medication Cabinets, Supply Cabinets, Equipment Cabinets, Inventory Cabinets) and By End User (Hospitals and Clinics, Bio-Pharmaceutical Companies, Manufacturing Facilities, Others) |

Key RFID Smart Cabinets Company Insights

Terso Solutions has long been identified as the market leader in terms of its provision of RFID Smart Cabinets, especially in the healthcare and life sciences industries. Its products feature the best of RFID hardware and software, allowing for real-time inventory visibility, controlled access, and seamless integration with the healthcare and enterprise environments. The company's strategy of focusing its products in terms of greater flexibility and support for organizational compliance has really paved the way for major adoption of their solutions in hospitals, med tech, and pharmaceutical companies. In their efforts to make innovation go further through API development and expansion of global distribution, Terso Solutions has really improved its market power.

Key RFID Smart Cabinets Companies:

- Terso Solutions

- LogiTag Systems

- WaveMark (Cardinal Health)

- Mobile Aspects

- SATO Vicinity

- Invengo Technology

- Palex Medical

- Grifols

- Impinj

- Avery Dennison

- Stanley Healthcare

- Nexess

- Alien Technology

- Spacecode

- Dipole RFID

Global RFID Smart Cabinets Market Report Segmentation

By Type

- Standalone Smart Cabinets

- Integrated Smart Cabinets

By Component

- RFID Tags

- RFID Readers

- RFID Antenna

- Others

By Cabinet Type

- Medication Cabinets

- Supply Cabinets

- Equipment Cabinets

- Inventory Cabinets

By End User

- Hospitals and Clinics

- Bio-Pharmaceutical Companies

- Manufacturing Facilities

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636