Market Summary

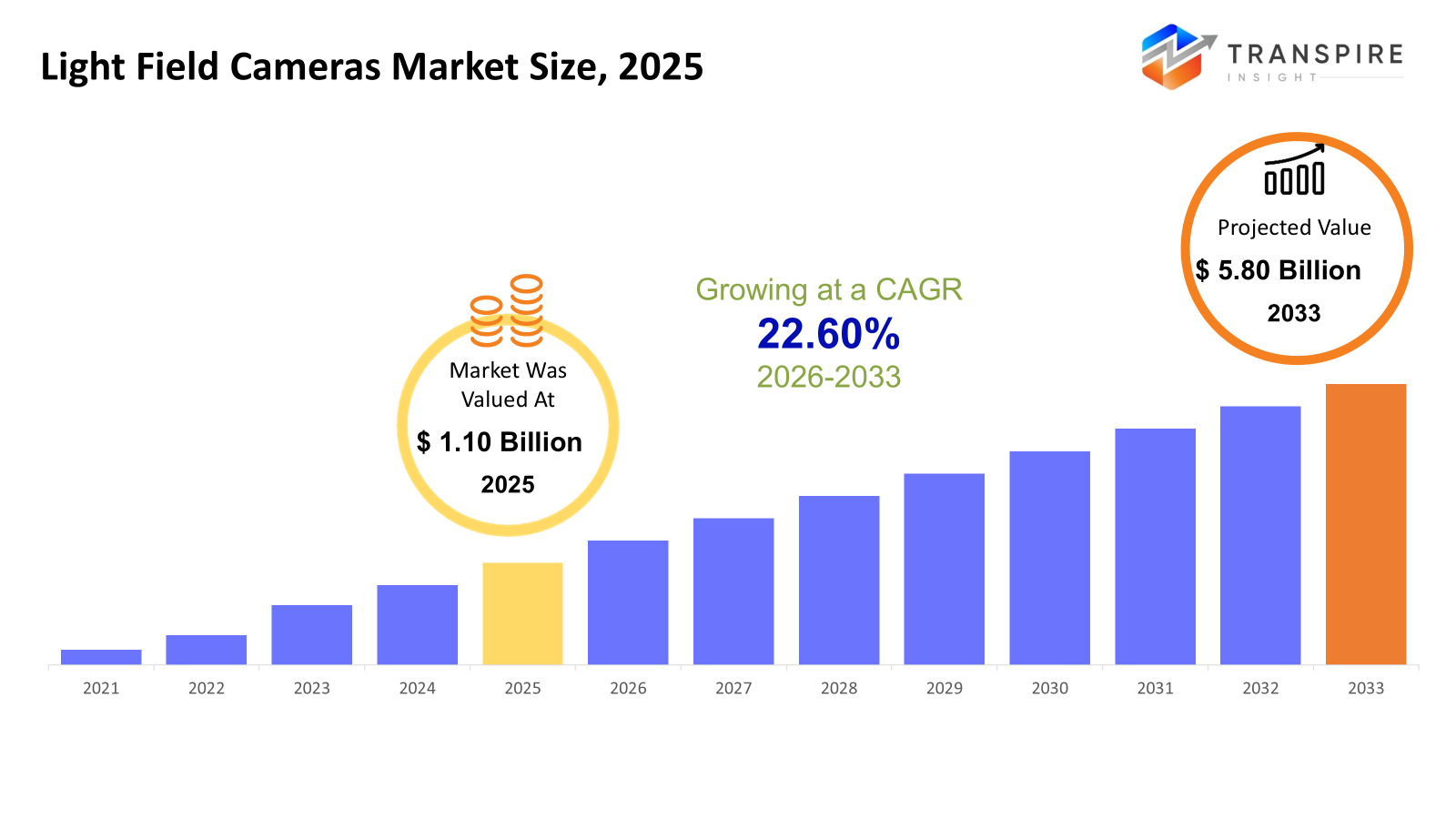

The global Light Field Cameras market size was valued at USD 1.10 billion in 2025 and is projected to reach USD 5.80 billion by 2033, growing at a CAGR of 22.60% from 2026 to 2033. Growth in AI for factory automation spreads fast because more places adopt smart production methods along with the Industry 4.0 movement worldwide. Machines now think better thanks to artificial intelligence, helping spot breakdowns early, smooth out workflows, check product quality, improve delivery routes cutting waste while lifting output. As robots link up with sensors and learning systems on shop floors, interest grows stronger every quarter.

Market Size & Forecast

- 2025 Market Size: USD 1.10 Billion

- 2033 Projected Market Size: USD 5.80 Billion

- CAGR (2026-2033): 22.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Ahead of others, North America pushes forward, fueled by active networks that spark new ideas, consistent funding funneled into research, while real-world rollouts of light field tech emerge quickly in areas like virtual experiences, film creation, and vehicle detection systems.

- Out front when it comes to crafting light field cameras, the United States pushes ahead through university labs where ideas take shape slowly, feeding a steady stream of innovation. Startups rooted in advanced engineering find space to grow here, often sprouting from breakthroughs made inside quiet workshops or backroom experiments. On one hand, smartphone makers keep asking for sharper ways to capture images using code instead of glass; on the other, government-backed groups need similar tools that see more than the eye can. Because these needs line up so tightly, progress keeps moving - quietly, without fanfare.

- Fueled by the massive production of imaging gear, the Asia Pacific region surges ahead. Consumer gadgets there now embrace new tech at lightning speed. Behind this shift, spending on virtual experiences climbs sharply - especially in China, Japan, and South Korea. Factories hum, screens evolve, and ideas take shape faster than before.

- Plenoptic Light Field Cameras share approximately 39% in 2026. Now showing up more often, plenoptic cameras offer better depth sensing while allowing tweaks after shooting - useful when building 3D images through code-driven methods. Though once rare, they fit well where detail and later adjustments matter most.

- Lenses smaller than a millimeter across still shape how light field cameras work, simply because they manage sharp images without making phones too complex. A different kind of small lens setup could change things later - maybe - but right now nothing else fits as smoothly into everyday gadgets. Their tiny size links directly to better performance, which matters when building something people actually carry around. Even new methods struggle to match that mix of clarity and practical design.

- Growing need for smarter image rebuilding, artificial intelligence that guesses distance, along with instant visual processing. Speed matters now more than ever. Tools evolve because tasks get tougher. Performance shifts when systems think faster. Demand reshapes what programs can do. New methods appear as challenges grow.

- Light field tech finds its biggest push through gadgets people carry every day. Mobile cameras now shape how images are made, thanks to built-in depth tricks. Tools for making virtual scenes borrow heavily from phone-based advances. What shows up on screens often begins inside handheld devices. New ways to capture moments spread fast when phones adopt them. Imaging shifts happen first where users touch technology the most.

Picture devices that record not only how bright light is but also the direction it travels this defines the foundation of today’s innovations driving the light field cameras market. Unlike traditional cameras that capture only intensity, these advanced systems record light paths using arrays of micro-lenses layered over image sensors, supported by sophisticated computational algorithms. Even after an image is taken, users can refocus on different points within the frame an ability once considered impossible.

Depth information is generated naturally from each capture, enabling applications in scientific imaging, industrial visualization, augmented reality, and immersive virtual experiences. By recording spatial data in unprecedented detail, light field cameras significantly expand post-processing flexibility and reshape how still images function after capture. As industries look beyond conventional photography, the light field cameras market continues to open new possibilities across research, media, healthcare, and advanced visualization technologies.

Growing curiosity around digital photo techniques, immersive visuals, and three-dimensional modeling fuels demand. Not just film or gaming firms, but medical tech, car makers, and even quality check units now test light field tools because they capture depth well. These setups rebuild surroundings in detail, giving users clearer spatial awareness. Smarter algorithms combined with powerful editing programs boost performance, letting devices adapt faster to real-world tasks.

Still, rising expenses and tricky design issues slow things down. Because these cameras capture so much detail, they need strong computers plus custom programs to make sense of it all. Even though the tech exists, most people do not know about it. Other ways to detect depth already fill the space, making entry harder. Mainstream photo users often stick with what they know.

Even with hurdles, progress in tiny design tweaks, smarter sensors, and faster on-the-fly data handling opens room for solid gains. New uses in health scans, automated machines, visual systems for computers, and lifelike chat tools push light field tricks past old-school picture taking. Work keeps piling up in labs while parts get cheaper over time - this mix hints at wider use among business teams and niche buyers alike.

Light Field Cameras Market Segmentation

By Product Type

- Standard Light Field Cameras

Light rays spread widely when shot with standard field cameras. These tools let users adjust focus after taking pictures. Depth details come out during later processing stages. General photography benefits from this flexibility.

- Focused Light Field Cameras

Light comes together just right in these cameras. Depth stays clear because space details get extra attention. Sharp images show up more true to life when focusing works this way. Accuracy improves without losing how things are spaced out. A picture that knows where everything belongs.

- Plenoptic Cameras

Through tiny lenses, plenoptic cameras capture how light moves across a scene. These setups gather detailed information needed for building three-dimensional views. Instead of just flat images, they store the depth and direction of rays. Computational methods later reshape this data into flexible photo outputs. The core idea relies on splitting incoming light finely. Each micro lens handles a small patch, adding up to a rich overall picture. This approach allows adjustments after shooting, like refocusing. Light field details make such tricks possible without extra hardware.

- Light Field Microscopy

Some microscopes capture sharp three-dimensional views using light field tech. These tools help scientists see tiny structures in detail. Built for labs, they turn complex data into clear images. Depth and clarity come through advanced optics. Research in biology often relies on precision. Each system focuses on volume imaging without extra steps.

To learn more about this report, Download Free Sample Report

By Technology

- Microlens-Based Light Field Imaging

A tiny grid sits just before the sensor, guiding how light enters. This setup tracks where rays come from, not only what they show. Rays pass through small lenses, each redirecting a piece of the scene. Information about angle and brightness gets recorded together. Direction matters as much as color here. Each micro lens handles a portion of spatial detail. The result is a layered view, built from many viewpoints at once.

- Coded Aperture-Based Imaging

A tiny hole is not used here; instead, a designed opening scatters incoming rays in unique ways so software can later sort out how far things are. Light passes through a precise stencil-like mask, creating shadows that hold distance clues within their layout. These patterns get decoded after capture, letting the system guess depth by analyzing blur variations across frames. Information once lost in traditional optics gets preserved thanks to structured masking during exposure.

- Camera Array-Based Light Field Systems

One setup uses several cameras working together to snap pictures from different angles. These shots help build a three-dimensional view of the space. Instead of one image, many come together at once. Each camera clicks at the same moment. The result is depth and detail across views. Multiple perspectives shape how objects appear in space. Timing matters because frames must line up perfectly. This method captures scenes more fully than single lenses.

- Fourier Light Field Imaging

A fresh look at light fields begins with how waves move through space. This method uses patterns of light spread out like ripples. Speed shows up when measurements skip slow steps. Precision comes alive under careful wave alignment. Movement in data appears as shifts across angles. Great detail emerges without waiting long. Clear shapes form by reading these shifts closely. The whole process leans on math that maps waves to points.

By Component

- Hardware

Inside the device, tiny sensors work together with small lenses that guide light into specialized parts. These pieces connect through optical components designed to handle image capture. A computing section takes charge of turning raw data into usable visuals. Each part plays a role in building how images are formed physically.

- Software

Running in the background, the software handles how light-field information is turned into images. What you see comes from complex steps that rebuild scenes using math rules. Instead of flat pictures, layers of depth appear through special calculations. These processes shape raw inputs into something viewable by adjusting spatial details. Behind each frame, mapping tools define how far objects seem from the viewer.

- Services

Working across setups, tailored changes, help with issues, and ongoing care of systems.

By End-Users

- Consumer Electronics

Lens systems that capture depth now appear in everyday gadgets. These let cameras record scenes more like human eyes do. Instead of flat images, they build spaces you can explore after shooting. Some headsets use similar tricks to make virtual worlds feel tangible. Depth-aware sensors help digital objects sit naturally in real environments. What used to be lab-only tech shows up in handhelds and wearables. Experiences shift when machines perceive dimensionality as people do.

- Healthcare Institutions

Light field imaging helps hospitals see inside the body more clearly. Medical centers apply this tech to study diseases in new ways. Visualization gets a boost when clinics track cell activity in real time. Research labs gain deeper views of tissues using layered image capture. Doctors explore complex anatomy without traditional limits.

- Automotive Manufacturers

Car makers use light field tech to judge distance, help drivers, while building smarter self-driving eyes. Systems track space around vehicles using layered imaging, giving machines better sight on roads. Vision tools built this way see depth as humans do, improving safety without extra gear. These setups guide automated features by capturing scenes in rich dimensions, changing how cars observe their surroundings.

- Industrial Enterprises

Factories rely on this tech to check details closely, spot flaws fast, one task after another. Machines watch every move, guiding robots through tight steps without pause. Quality stays high because errors show up early, right when they happen.

- Research & Academic Institution

Scientists at universities often test new ways to capture images using light field cameras. These tools help explore how light behaves in complex environments. Work in labs leads to a better understanding of optics through real experiments. Some teams build custom systems to push what these cameras can do. Progress shows up in peer-reviewed papers now and then.

Regional Insights

Out front, North America pulls ahead in using light field cameras because tech pioneers are concentrated there, especially across the United States and Canada, where work on augmented and virtual reality runs deep. Behind this push sits heavy backing for image processing advances, three-dimensional material design, alongside tools used in military detection and vehicle safety systems. Not far behind, Europe gains ground thanks to centers in Germany, France, and Britain focused on light-based technologies, along with wider use of these camera setups in factory checks, lab photography, and film output pipelines. What helps both areas move fast is access to mature networks for imaging gear and chip manufacturing, making it easier to turn new ideas into real products quickly.

Out here, Asia Pacific stands out as a hotspot for light field camera expansion, thanks to booming production of consumer gadgets, widespread embrace of augmented and virtual reality tools, and digital creativity across China, Japan, South Korea, and India. Push comes from state-backed programs sparking progress in advanced imaging tech, alongside deeper funding by local manufacturers focused on image processing smarts and faster hardware engines, fueling momentum. With massive demand for phones and cameras already in place, room opens wide for embedding light field systems into handheld units, clever picture-taking gear alike.

Right now, Latin America shows a steady interest in lightweight field cameras. As more media groups, schools, and creators begin using high-end imaging tools, that interest should climb slowly. Boosted by better infrastructure and moves toward digital upgrades, adoption inches forward. Over in the Middle East and Africa, only select areas show any real need, like aviation labs, military research spots, and universities. Growth there is closely tied to how much governments spend on tech and whether digital media fields keep expanding. Awareness of 360-degree visuals and robotic 3D scanning is rising, helping shape what comes next across both zones.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 23, 2025– LiteGear is acquired by Chauvet to expand leadership in the cinematic lighting industry.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.10 Billion |

|

Market size value in 2026 |

USD 1.40 Billion |

|

Revenue forecast in 2033 |

USD 5.80 Billion |

|

Growth rate |

CAGR of 22.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Lytro, Raytrix GmbH, Pelican Imaging Corporation, Stanford Computer Optics, PlenOptika, Light Field Lab, Google (Project Tango), Toshiba Corporation, Sony Group Corporation, Panasonic Corporation, GoPro Inc., Red Digital Cinema, Adobe Inc., Magic Leap, Microsoft Corporation, NVIDIA Corporation, and Qualcomm Technologies Inc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Standard Light Field Cameras, Focused Light Field Cameras, Plenoptic Cameras, Light Field Microscopy Systems), By Technology (Microlens-Based Light Field Imaging, Coded Aperture-Based Imaging, Camera Array-Based Light Field Systems, Fourier Light Field Imaging), By Component (Hardware, Software, Services), By End-Users (Consumer Electronics, Healthcare Institutions, Automotive Manufacturers, Industrial Enterprises, Research & Academic Institutions) |

Key Light Field Cameras Company Insights

A major force shaping how light field cameras evolve comes from Sony Group Corporation, thanks to cutting-edge work in image sensors and computing-driven imaging methods. High-speed CMOS sensors made by this firm find homes in pro gear, phones, car vision setups, and factory inspection tools. Progress in measuring depth, smarter photo processing using artificial intelligence, along with smaller lens parts, is fueled by steady funding from Sony. Global reach combined with deep research muscle makes it central to pushing forward smart photography tech that feels like the future.

Key Light Field Cameras Companies:

- Lytro

- Raytrix GmbH

- Pelican Imaging Corporation

- Stanford Computer Optics

- PlenOptika

- Light Field Lab

- Google (Project Tango)

- Toshiba Corporation

- Sony Group Corporation

- Panasonic Corporation

- GoPro Inc.

- Red Digital Cinema

- Adobe Inc.

- Magic Leap

- Microsoft Corporation

- NVIDIA Corporation

- Qualcomm Technologies Inc

Global Light Field Cameras Market Report Segmentation

By Product Type

- Standard Light Field Cameras

- Focused Light Field Cameras

- Plenoptic Cameras

- Light Field Microscopy Systems

By Technology

- Microlens-Based Light Field Imaging

- Coded Aperture-Based Imaging

- Camera Array-Based Light Field Systems

- Fourier Light Field Imaging

By Component

- Hardware

- Software

- Services

By End-Users

- Consumer Electronics

- Healthcare Institutions

- Automotive Manufacturers

- Industrial Enterprises

- Research & Academic Institutions

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636