Market Summary

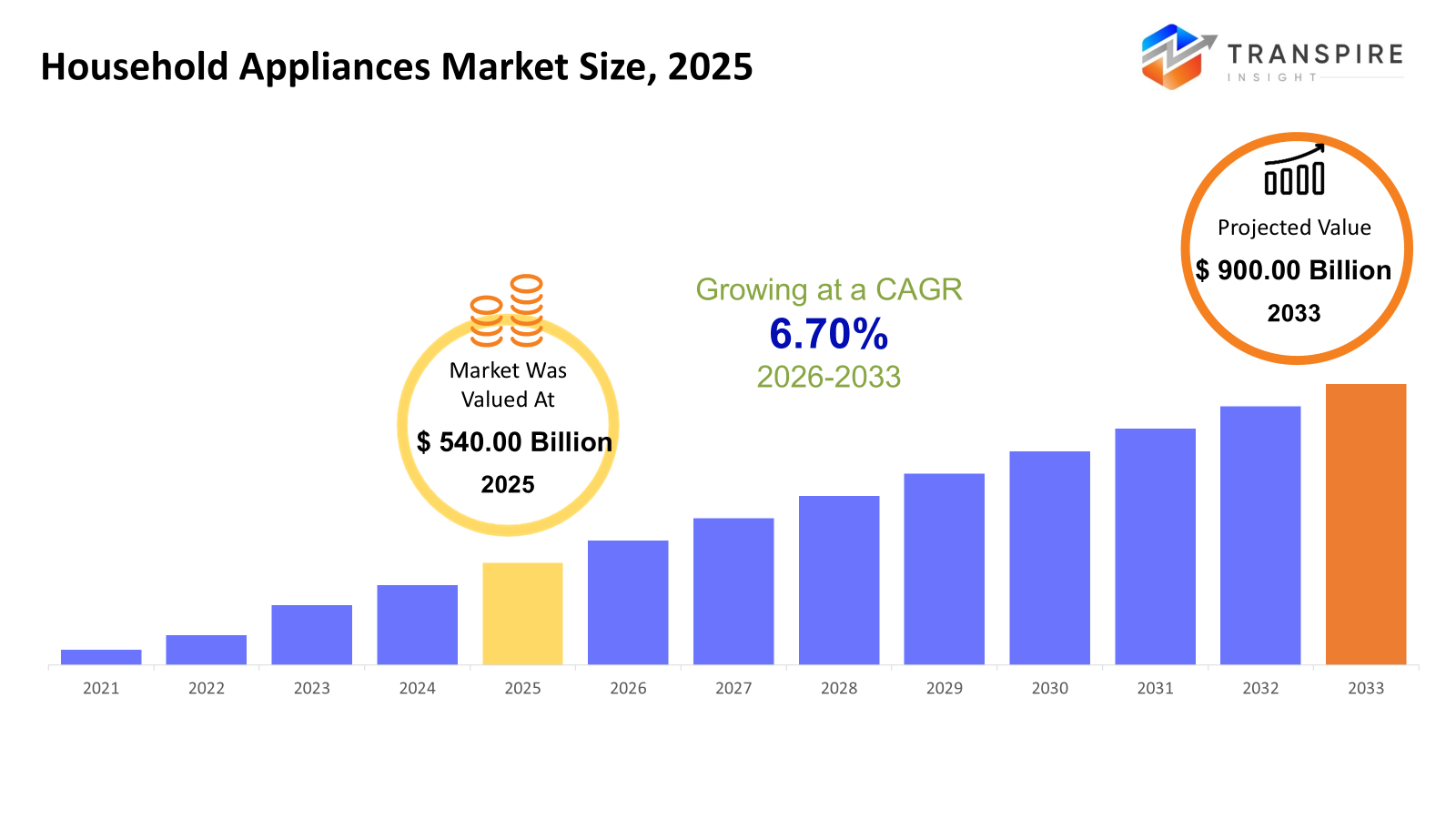

The global Household Appliances market size was valued at USD 540.00 billion in 2025 and is projected to reach USD 900.00 billion by 2033, growing at a CAGR of 6.70% from 2026 to 2033. The market for household appliances is growing at a consistent compound annual growth rate (CAGR) due to rising urbanization, rising disposable incomes, and growing middle-class populations in emerging economies. Product adoption in both major and minor appliance categories is being accelerated by consumers' growing preference for time-saving and convenience-oriented equipment.

Market Size & Forecast

- 2025 Market Size: USD 540.00 Billion

- 2033 Projected Market Size: USD 900.00 Billion

- CAGR (2026-2033): 6.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- With consumers prioritizing high-end goods and integrated home ecosystems that improve convenience, energy optimization, and connected living experiences, North America is showing steady growth bolstered by high appliance penetration, robust replacement demand, and growing adoption of smart and energy-efficient appliances.

- Due to strong replacement cycles, high adoption of smart appliances, and sophisticated consumer purchasing power, the United States leads the region in demand. Innovation in connected technologies and energy-efficient standards also continue to impact consumer behavior when making purchases of both large and small appliance categories.

- Asia Pacific continues to be the fastest-growing region due to growing middle-class populations, rising disposable incomes, and rapid urbanization. In urban and semi-urban households, there is a strong demand for both affordable technology-enabled products and necessary appliances due to increased electrification and housing development.

- Due to their essential use, ongoing replacement demand, and growing preference for energy-efficient and multi-door models, refrigerators continue to dominate the appliance market. In both developed and emerging markets, demand is consistently maintained by technological advancements and rising food storage needs.

- Growing urban lifestyles, more dual-income households, and the need for automated and water-efficient solutions are driving washing machines' market share, with consumers gravitating toward fully automatic and technologically advanced models that save time and effort.

- Consumer interest in automation, remote monitoring, and energy management features as well as growing smart home integration, are driving the adoption of smart appliances in both developed and emerging markets. Declining technology costs and better connectivity infrastructure are also contributing to this trend.

- Due to consumers' growing preference for digital platforms for convenience, competitive pricing, and product comparison, e-commerce and online retail channels are growing quickly. This allows manufacturers to improve their direct-to-consumer strategies and reach a wider audience outside of traditional retail settings.

- As a result of growing urban housing development, household formation, and consumer preference for convenience-driven appliances, the residential end-user segment dominates demand. Meanwhile, premiumization trends and replacement demand sustain revenue growth across major appliance categories.

So, The household appliances market consists of mechanical and electrical devices made to assist with household tasks like cooking, cleaning, laundry, food preservation, and personal hygiene. The market comprises both large appliances, also known as white goods, and tiny appliances that improve efficiency and ease in day-to-day household tasks. Consumer expectations and appliance functionality have changed dramatically in recent years due to increased electrification and technical innovation. Rising urban populations, shifting lifestyles, and growing customer preference for automation and energy efficiency all have a significant impact on market growth. As more homes embrace digital ecosystems, smart appliances with connectivity characteristics are becoming more and more important. In order to meet changing consumer demands across various income brackets and living conditions, manufacturers are concentrating on product innovation, energy optimization, and compact designs. Additionally, product accessibility in emerging economies has improved due to the growth of organized retail and internet distribution channels. First-time purchases in developing nations and replacement demand in developed countries both sustain market growth. Long-term market dynamics and product development strategies are also being shaped by sustainability trends and regulatory emphasis on energy-efficient appliances.

Household Appliances Market Segmentation

By Appliance Category

- Refrigerators

Due to their essential function in food preservation and ongoing replacement demand, refrigerators constitute a core sector of important household appliances. Growing urban homes, the need for energy-efficient models, and the growing use of multi-door and smart refrigeration systems all have an impact on market expansion. To satisfy changing consumer demands, manufacturers are concentrating on inverter technology and improved storage flexibility. Through first-time purchases and upgrades to high-end products, emerging economies are making a substantial contribution.

- Washing Machines

Growing urbanization, the need to save time, and increased disposable incomes all contribute to the continued high demand for washing machines. Value growth is still supported by the switch from semi-automated to fully automatic machinery, especially in emerging nations. The advantages of front-loading machines in terms of water and energy efficiency are driving their popularity. Product distinctiveness and replacement demand are being improved by technological integration, such as AI-based wash programs and connectivity features.

- Dishwashers

Dishwashers are gradually becoming more popular, especially in developed economies where labor costs and convenience are high. Growing knowledge of the water-saving potential and hygienic advantages over hand washing supports growth. In urban homes with small kitchens, compact and built-in models are becoming more and more popular. Although penetration is still relatively low in emerging nations, it is increasing due to shifting lifestyles and nuclear family patterns.

- Air Conditioners

Due to rising global temperatures, urbanization, and growing consumer attention to home comfort, air conditioners are in high demand. Due to regulatory requirements and concerns about electricity costs, inverter-based and energy-efficient systems are becoming more popular. Asia Pacific's emerging economies are propelling volume growth by expanding their middle classes and electrifying more areas. Trends toward premiumization are also influenced by intelligent and networked air conditioning systems.

- Cooking Ranges

Demand for cooking ranges is still steady, driven by modern homes and growing interest in integrated kitchen solutions. In urban home settings, built-in and multipurpose kitchen appliances are becoming more and more common. Purchase decisions are being influenced by compact designs, safety features, and energy efficiency. Steady expansion is being supported by new home developments in emerging nations and replacement demand in developed markets.

- Small Appliances

Due to their affordability, constant product innovation, and growing customer interest in convenience-focused solutions, small appliances have experienced robust growth. Higher sales volumes are a result of shorter replacement cycles as compared to big appliances. Growing urban living patterns are in line with the need for small, multipurpose appliances. Impulsive purchases and the growth of e-commerce greatly boost the segment.

- Small Kitchen Appliances

Growing interest in preparing nutritious meals, home cooking trends, and shifting food consumption patterns are the main drivers of small kitchen gadgets. Urban homes are increasingly adopting products like coffee makers, air fryers, and blenders. Customers are still drawn to innovations that emphasize automation, mobility, and energy economy. Smart-enabled and aesthetically pleasing products are clear examples of premiumization.

- Cleaning Appliances

Because working households need to save time and are becoming more conscious of hygiene, cleaning gadgets is becoming more popular. Innovation in the market is being driven by cordless and robotic vacuum cleaners. In metropolitan areas where automation and convenience are valued, demand is especially high. Adoption rates are rising as a result of technological developments including sensor-based navigation and better battery performance.

- Personal Care Appliances

Growing grooming consciousness and increased disposable incomes are driving a steady growth in personal care appliances. Both male and female consumers consistently seek products like hair dryers, trimmers, and styling equipment. Product distinctiveness is supported by innovations in cordless functionality and small design. Expanding online retail and rising brand-driven sales both contribute to growth.

By Technology

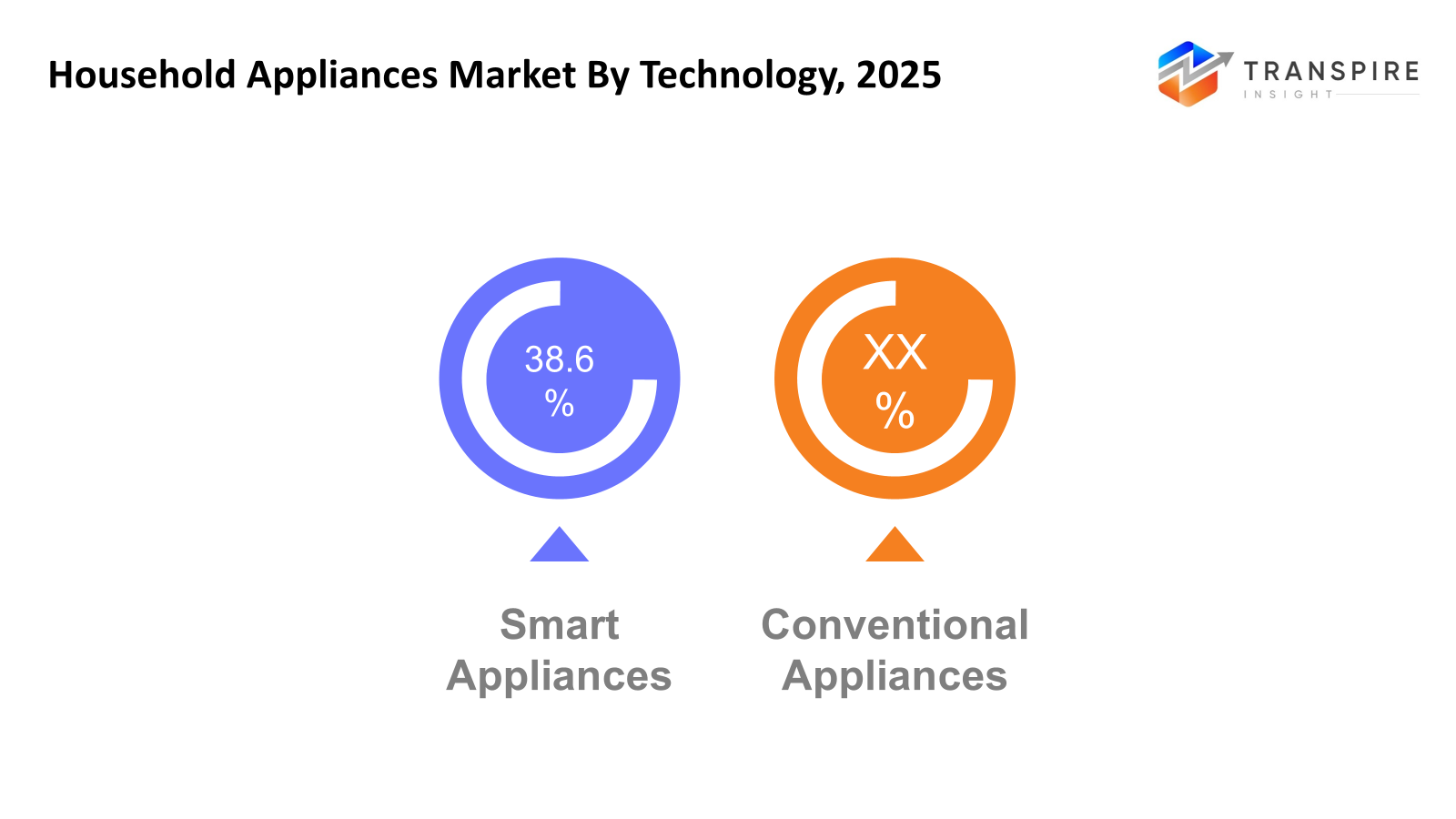

- Smart Appliances

As smart home ecosystems grow and customers place a higher value on automation and connectivity, smart appliances are becoming more and more popular. Features that improve user comfort and operational efficiency include AI-based functionality, energy optimization, and remote monitoring. Though underdeveloped economies are seeing a slow penetration because of falling technological costs, adoption is higher in developed markets. IoT capabilities are being incorporated by manufacturers more and more to improve their product value propositions.

- Conventional Appliances

Due to their affordability and widespread availability in price-sensitive areas, conventional appliances continue to command a significant market share. In undeveloped markets, where affordability is more important than sophisticated functionality, these items are still favored. Demand is maintained by gradual advancements in energy efficiency and durability. In homes with low penetration of smart infrastructure, conventional appliances also account for the majority of replacement sales.

To learn more about this report, Download Free Sample Report

By Distribution Channel

- Supermarkets & Hypermarkets

Consumers prefer to physically inspect products before making a purchase, supermarkets and hypermarkets continue to be significant distribution channels. These stores provide competitive prices through marketing efforts and encourage impulsive purchases of minor appliances. Consistent sales volumes are a result of a strong presence in urban regions. However, as internet channels increase quickly, growth is slowing down.

- Specialty Stores

Specialty shops are essential for the sale of expensive, technically complicated appliances that need to be demonstrated and consulted after purchase. Customers depend on these retailers' professional advice, installation services, and brand assurance. When it comes to product placement, premium appliance makers frequently give priority to specialty retail. Despite growing internet competition, the channel is still important for large appliances.

- E-commerce / Online Retail

The fastest-growing distribution channel is e-commerce, which is fueled by low pricing, ease of use, and digital penetration. Home delivery alternatives, user ratings, and product comparisons all help consumers. Purchases of minor appliances and replacements are especially influenced by online platforms. Direct-to-consumer tactics are being used by manufacturers more frequently in an effort to boost their internet visibility and profits.

- Others

In institutional sales settings and emerging markets, distributor networks and direct sales are still important. These channels enhance regional market penetration and support large purchases. They work especially well for accessing remote markets and distributing commercial appliances. Manufacturers can increase their reach in geographically diversified areas by forming partnerships with regional distributors.

By End User

- Residential

Increased urbanization, improving living standards, and a growing need for convenience-focused items, the residential segment currently controls the majority of the household appliances market. Sustained demand is supported by the growth of nuclear households and rising household electrification. Revenue growth is also influenced by premium product upgrades and replacement cycles. In developed nations, residential consumers are the main force behind the adoption of smart appliances.

- Commercial

The commercial sector comprises establishments that need high-capacity, long-lasting appliances, such as hotels, restaurants, and medical facilities. The expansion of the food service and hotel sectors is directly related to demand. In this market, operational dependability and energy efficiency are important purchasing considerations. The market is still growing steadily thanks to the expansion of organized food services and tourism.

Regional Insights

North America, which includes the US, Canada, and Mexico, is a developed market for home appliances with high penetration rates and robust need for replacements. Due to increased consumer spending and early adoption of smart appliances, the United States leads the area in revenue, while Canada and Mexico show consistent growth bolstered by retail expansion and housing development. Regulations pertaining to energy efficiency and technology advancements continue to impact regional shopping habits. Strict energy efficiency regulations and a strong sense of environmental responsibility have propelled steady expansion throughout Europe, including Germany, the United Kingdom, France, Spain, Italy, and the rest of the continent. Compact, built-in, and energy-efficient appliances that are appropriate for urban living are becoming more and more popular. While Eastern and Southern Europe contribute through replacement demand and upgrade of domestic infrastructure, Western Europe is the leader in the adoption of premium appliances. The fastest-growing geographical market is Asia Pacific, which includes Japan, China, Australia and New Zealand, South Korea, India, and the rest of Asia Pacific. Appliance adoption is being driven by growing middle-class populations, increasing disposable incomes, and rapid urbanization. While Japan and South Korea prioritize technological innovation and the penetration of luxury appliances, China and India dominate volume demand due to their sizable consumer bases.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, Greenheck implemented the growth of its Household Appliancess portfolio with the introduction of the RV-220 model, designed to deliver higher airflow, heating, and cooling capacities. The system improves installation economy and operational flexibility while supporting large commercial ventilation requirements with the use of R-454B refrigerant and increased cooling capacity. The development is a response to the growing need for energy-efficient ventilation systems that can handle large amounts of external air in institutional and commercial buildings.

- In October 2024, Greenheck announced enhancements to its air-source heat pump technology integrated into Household Appliancess, enabling efficient heating performance at outdoor temperatures as low as 0°F. In addition to supporting electrification and energy efficiency goals in commercial HVAC applications, the upgrade incorporates new refrigeration systems and enhanced control algorithms that enable DOAS units to function effectively throughout a wider range of climatic conditions.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 540.00 Billion |

|

Market size value in 2026 |

USD 570.00 Billion |

|

Revenue forecast in 2033 |

USD 900.00 Billion |

|

Growth rate |

CAGR of 6.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Haier Smart Home Co., Ltd., Whirlpool Corporation, LG Electronics Inc., Samsung Electronics Co., Ltd., BSH Hausgeräte GmbH, Electrolux AB, Midea Group Co., Ltd., Panasonic Holdings Corporation, Hitachi Global Life Solutions, Inc., Arçelik A.Ş., Miele & Cie. KG, GE Appliances (Haier Group), Daikin Industries, Ltd., Sharp Corporation, Godrej Appliances |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Appliance Category (Refrigerators, Washing Machines, Dishwashers, Air Conditioners, Cooking Ranges, Small Appliances, Small Kitchen Appliances, Cleaning Appliances, Personal Care Appliances), By Technology (Smart Appliances, Conventional Appliances), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, E-commerce / Online Retail, Others) and By End User (Residential, Commercial) |

Key Household Appliances Company Insights

Haier Smart Home Co., Ltd. has established a leading global position through a diversified product portfolio spanning refrigerators, washing machines, air conditioners, and smart appliances, supported by strong manufacturing capabilities and localized production strategies. By combining consumer-centric innovation and smart home connectivity, the company's ecosystem-based strategy allows for differentiation across luxury and mass-market categories. Its global distribution network has been reinforced by its acquisitions and brand expansion in North America and Europe, as well as its strong presence in Asia Pacific. Long-term competitive advantage and market leadership are supported by Haier's consistent investments in energy-efficient technologies and IoT-enabled appliances, which put the company in a favorable position amid growing demand for connected and sustainable home solutions.

Key Household Appliances Companies:

- Haier Smart Home Co., Ltd.

- Whirlpool Corporation

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- BSH Hausgeräte GmbH

- Electrolux AB

- Midea Group Co., Ltd.

- Panasonic Holdings Corporation

- Hitachi Global Life Solutions, Inc.

- Arçelik A.Ş.

- Miele & Cie. KG

- GE Appliances (Haier Group)

- Daikin Industries, Ltd.

- Sharp Corporation

- Godrej Appliances

Global Household Appliances Market Report Segmentation

By Appliance Category

- Refrigerators

- Washing Machines

- Dishwashers

- Air Conditioners

- Cooking Ranges

- Small Appliances

- Small Kitchen Appliances

- Cleaning Appliances

- Personal Care Appliances

By Technology

- Up to 20 tons

- 20-40 tons

- 40-60 tons

- Greater than 60 tons

By Distribution Channel

- Energy Recovery Ventilation (ERV) Systems

- Direct Expansion (DX) Systems

By End User

- Dairy Farms

- Swine Farms

- Poultry Farms

- Other Farm Types

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636