Market Summary

The global Green Hydrogen market size was valued at USD 2.79 billion in 2025 and is projected to reach USD 119.67 billion by 2033, growing at a CAGR of 59.97% from 2026 to 2033. The market is witnessing exponential growth due to rising global decarbonization efforts, supportive government policies, and declining renewable energy and electrolyzer costs. Additionally, increasing demand across industrial feedstock, transportation, and green fuel applications is driving large-scale adoption of green hydrogen.

Market Size & Forecast

- 2025 Market Size: USD 2.79 Billion

- 2033 Projected Market Size: USD 119.67 Billion

- CAGR (2026-2033): 59.97%

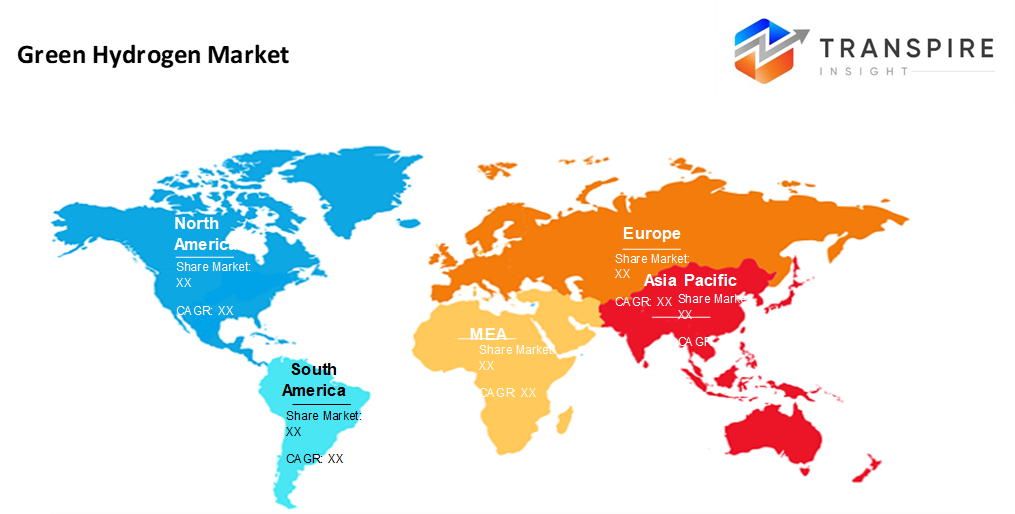

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 25% in 2026. Fueled by government support, North America is moving fast clean hydrogen clusters are popping up while cash flows into massive electrolyzer ventures. Still, it's the push behind regulations that keeps things rolling forward. Projects once on paper now take shape across open fields and industrial zones. Behind the scenes, private funds team with public goals, creating a pattern others watch closely. What stands out is not just scale, but how quickly ideas turn real.

- Fueled by federal tax breaks, new hydrogen centers backed by the Department of Energy are taking shape across the United States. Growth ticks upward as factories and plants begin shifting toward cleaner operations. Momentum builds not just from policy, but from real changes in how the industry works day-to-day. Each project adds quiet pressure to move faster, without fanfare.

- Off to a sprint, Asia Pacific leads global growth driven hard by bold moves from governments in China, Japan, South Korea, and Australia, pushing hydrogen-powered transport along with export plans.

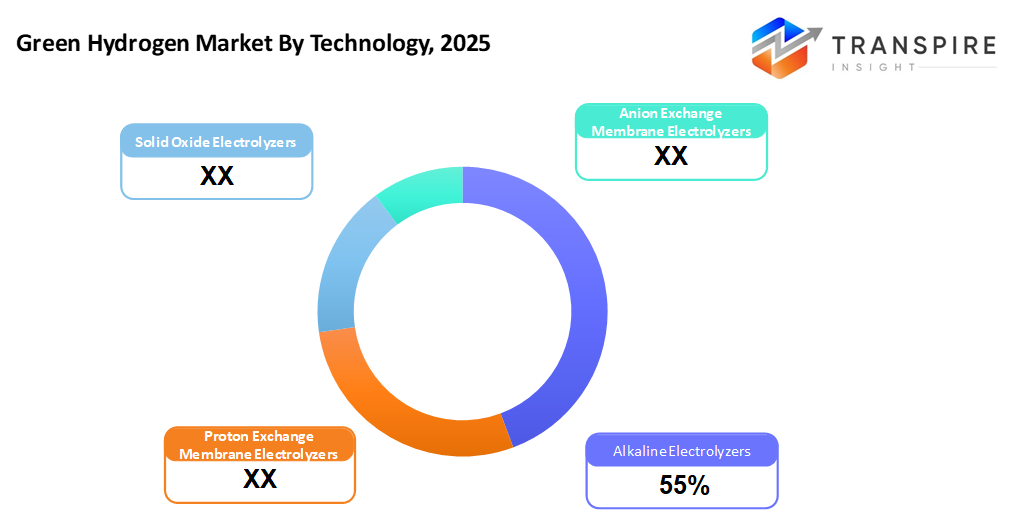

- Alkaline Electrolyzers share approximately 58% in 2026. When it comes to technology, alkaline electrolyzers take the lead. Big projects lean on them because they are reliable and cost less. Utilities and factories often pick these systems. Their track record makes a difference in real-world use.

- Fueled by breezes, wind stands out among renewables because it runs steadily and handles big output needs. Projects tied to sea-based turbines rely on this flow to produce clean hydrogen continuously.

- Fuel for farms kicks off a shift, green hydrogen now powers more ammonia plants, riding demand for cleaner fertilizers plus global energy trade.

- Heavy industries now push for greener options, shifting from gray to green hydrogen as their main raw material. This change drives up demand across production sectors, aiming at cleaner operations by the deadline years.

Right now, green hydrogen stands at the center of efforts to shift how we power the world, especially where cutting emissions feels toughest. Because it uses only water and clean electricity to split molecules, there is no CO2 released during production, unlike versions made from fossil fuels. This trait gives it an edge wherever nations aim to balance their climate goals in heavy industry, shipping, and even heating homes. Step by step, better machines that separate hydrogen from oxygen, plus cheaper wind and solar farms, are turning what once seemed too expensive into something more realistic on a large scale.

A fast climb in demand, driven by government moves and industrial shifts away from carbon-heavy fuels. Heavy sectors, such as steel, chemicals, and refineries, are out front in usage, swapping old methods for cleaner options. Buses, trucks, and even trains powered by fuel cells now see wider use, nudged forward by tighter pollution rules. Another boost comes from green ammonia and methanol, catching attention as ways to store and move energy. Downstream needs grow because of that shift.

Clear government policies help, along with financial support like grants and tax benefits, plus dedicated hydrogen plans in big industrial nations. Instead of just talking, countries now build full hydrogen zones, link up international supply routes, and connect green energy directly to production sites, turning ideas into real business. Meanwhile, better alkaline and PEM electrolyzer tech works more smoothly, handles ups and downs in wind or solar power, scales more easily, and fits tighter into larger systems. Moving the gas lacks proper networks. Yet teams from government and business are teaming up more often. Rules differ across regions, which slows things down. Even then, equipment prices keep shrinking over time. Down the road, this form of fuel could reshape how nations power themselves. Its part in cutting emissions may become essential. Security around the energy supply might lean on it heavily.

Green Hydrogen Market Segmentation

By Technology

- Alkaline Electrolyzers

Right now, alkaline electrolyzers lead in green hydrogen because they have been around longer, work without fuss, run well at big sizes, and also happen to be cheaper over time.

- Proton Exchange Membrane Electrolyzers

Their strong performance fits well in tight spaces. Power from wind or solar works just fine, even when it comes and goes. Efficiency stays high under changing conditions. Compact size helps save room without losing output. These systems handle irregular supply better than many expect.

- Solid Oxide Electrolyzers

Fueled by intense heat, Solid Oxide Electrolyzers stand out through sheer performance. Their ability to convert thermal energy into hydrogen draws strong interest across heavy industries.

- Anion Exchange Membrane Electrolyzers

Starting differently, Anion Exchange Membrane electrolyzers offer a new path using cheaper materials without sacrificing how they operate. These systems adapt easily while helping cut expenses down the line. One thing leads to another. Lower upfront spending opens doors later on.

To learn more about this report, Download Free Sample Report

By Renewable Energy Source

- Solar Energy

Sunlight powers green hydrogen a lot these days because solar panels are everywhere now and keep getting cheaper. Where sunlight hits, change follows without needing extra push.

- Wind Energy

Offshore breezes power big hydrogen efforts where turbines thrive. Where winds blow steadily, clean fuel gains ground through spinning blades. Along coastlines, gusts feed machines that remake air into usable gas. Places rich in airflow lean hard on tall towers to spark new forms of energy work.

- Hydropower

Water power keeps the lights on steady, so machines splitting water work nearly all the time.

- Others

Fueled by heat beneath Earth’s surface or organic matter, some setups make green hydrogen right where it is needed. These methods mix with solar or wind power in certain areas. Not every region uses them, yet they fit well alongside other clean options now and then.

By Application

- Ammonia Production

Fuel for fields now grows without heavy fumes, green hydrogen slips into ammonia work, quieting the old smoke of fertilizer plants.

- Methanol Production

Fuel made from methanol gets a boost when green hydrogen steps into the process. Cleaner chemicals start taking shape because of it.

- Refining Processes

Fuel plants start using clean-burning hydrogen to cut pollution during sulfur removal. Some upgrade heavy oil parts with this method instead of the old ways. Cleaner reactions happen when fossil-free gas replaces natural sources. Less planet-warming output comes out of the stack this way. Equipment runs similarly, but feeds different molecules inside.

- Energy Storage

When the sun is not shining or the wind is not blowing, green hydrogen holds onto energy for later. This form of storage works across days, weeks, and even months. It helps balance supply when renewables dip. Power gets turned into hydrogen, then saved until needed.

- Mobility and Fuel Cells

Fuel cells power vehicles using hydrogen, creating clean transport options. Movement through cities gets easier when energy comes from this source instead of fossil fuels. Infrastructure adapts slowly but steadily to support these changes. Emission levels drop because nothing pollutes except water vapor trailing behind buses and cars.

By End-Users

- Transportation

Fuel-cell buses, trucks, and trains run on green hydrogen in transport. Heavy-duty vehicles increasingly rely on this energy source across the sector.

- Power Generation & Energy Storage

Fuel made from water can hold extra power when the wind blows strongly or sunlight lasts long. When demand rises, that stored fuel helps keep electricity flowing steadily. Some companies now rely on this method to manage peaks without waste.

- Industrial Feedstock

Fuel made from water and clean power now feeds factories. Some sectors rely on it to make ammonia, metals, or cleaner fuels. What once came from oil now comes from air and electricity instead.

- Residential & Commercial Heating

Heating homes and buildings might get a cleaner twist - some trials mix green hydrogen into regular gas lines. One step at a time, the idea aims to lower carbon output from furnaces. Not every system can handle it yet, though adaptations are in motion. Fuel changes slowly, but shifts like these nudge old setups forward.

- Electronics & Specialty Chemicals

Fresh, clean hydrogen powers chip making, along with unique chemical creation. It runs quietly behind high-tech processes where purity matters most. Not flashy, just essential for precision work in electronics and complex compounds.

Regional Insights

A surge in green hydrogen activity is unfolding across North America, fueled by firm policy backing and financial support. Government-driven hubs for clean hydrogen are taking shape, helping momentum build. In both the United States and Canada, major investments are flowing into electrolyzers powered by renewables. These efforts aim to cut emissions in sectors like refining, chemical production, and long-haul transport. Parallel moves strengthen local supply networks, opening doors for future exports.

Fueled by tight emissions rules, Europe pushes ahead with green hydrogen. Clear national plans help shape its path forward. Net-zero targets are not just promises; they guide real moves. Germany steps up with big electrolyzer projects. The Netherlands links ports to clean fuel networks. France backs homegrown tech instead of imports. Spain taps sunlit plains for power-to-hydrogen hubs. Ammonia made without fossils gains ground. Cross-border pipelines spark regional cooperation. Policy and innovation walk step by step here.

Down under and across the Pacific, momentum builds fast thanks to clear plans in China, Japan, South Korea, and Australia, which focus heavily on moving people with hydrogen plus shipping it abroad. Elsewhere, Latin nations, along with parts of Africa and the Middle East, begin stepping forward, powered by wide-open sun and sweeping winds that make clean hydrogen cheap. These places see a path not just to fuel their own needs but to send supplies overseas, especially toward Europe and Asian markets.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 1, 2026 – Fusion Fuel launched a USD 35.35 million hydrogen investment platform with BrightHy Solutions.

- December 29, 2025 – KPI Green Energy wins a plasma gasification-based green hydrogen project from NTPC.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.79 Billion |

|

Market size value in 2026 |

USD 4.46 Billion |

|

Revenue forecast in 2033 |

USD 119.67 Billion |

|

Growth rate |

CAGR of 59.97% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Air Liquide, Air Products, Bloom Energy, Cummins, Engie Impact, Linde Plc., Nel ASA, Siemens Energy, Toshiba, Uniper, ITM Power, Plug Power, McPhy, Sunfire GmbH, Enapter, John Cockerill, Longi, Newtrace, and Avaada |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Alkaline Electrolyzers, Proton Exchange Membrane Electrolyzers, Solid Oxide Electrolyzers, Anion Exchange Membrane Electrolyzers) By Renewable Energy Source(Solar Energy, Wind Energy, Hydropower, Others) By Application (Ammonia Production, Methanol Production, Refining Processes, Energy Storage, Mobility & Fuel Cells) By End-Users (Transportation, Power Generation & Energy Storage, Industrial Feedstock, Residential & Commercial Heating, Electronics & Specialty Chemicals) |

Key Green Hydrogen Company Insights

A leading name in green tech, Nel ASA hails from Norway; its expertise spans alkaline and PEM electrolyzers. These tools make clean hydrogen usable across industries, power networks, and even vehicles. Pioneering methods meet real-world needs through scalable solutions built on decades of research. Their work supports shifts toward sustainable fuel without relying on fossil inputs. Back in 1927, a company started up in Oslo, now known as Nel. Over time, it placed thousands of electrolyzers in over eighty nations, quietly aiding the shift in how we power things. Factories in Norway and America are growing, aiming to make gear cheaper at huge volumes. Instead of just selling machines, they are building ties; one example is teaming up with Samsung E&A through shared ownership and joint work. These links help Nel move further into different regions without drawing attention.

Key Green Hydrogen Companies:

- Air Liquide

- Air Products

- Bloom Energy

- Cummins

- Engie Impact

- Linde Plc.

- Nel ASA

- Siemens Energy

- Toshiba

- Uniper

- ITM Power

- Plug Power

- McPhy

- Sunfire GmbH

- Enapter

- John Cockerill

- Longi

- Newtrace

- Avaada

Global Green Hydrogen Market Report Segmentation

By Technology

- Alkaline Electrolyzers

- Proton Exchange Membrane Electrolyzers

- Solid Oxide Electrolyzers

- Anion Exchange Membrane Electrolyzers

By Renewable Energy Source

- Solar Energy

- Wind Energy

- Hydropower

- Others

By Application

- Ammonia Production

- Methanol Production

- Refining Processes

- Energy Storage

- Mobility & Fuel Cells

By End-Users

- Transportation

- Power Generation & Energy Storage

- Industrial Feedstock

- Residential & Commercial Heating

- Electronics & Specialty Chemicals

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636