Market Summary

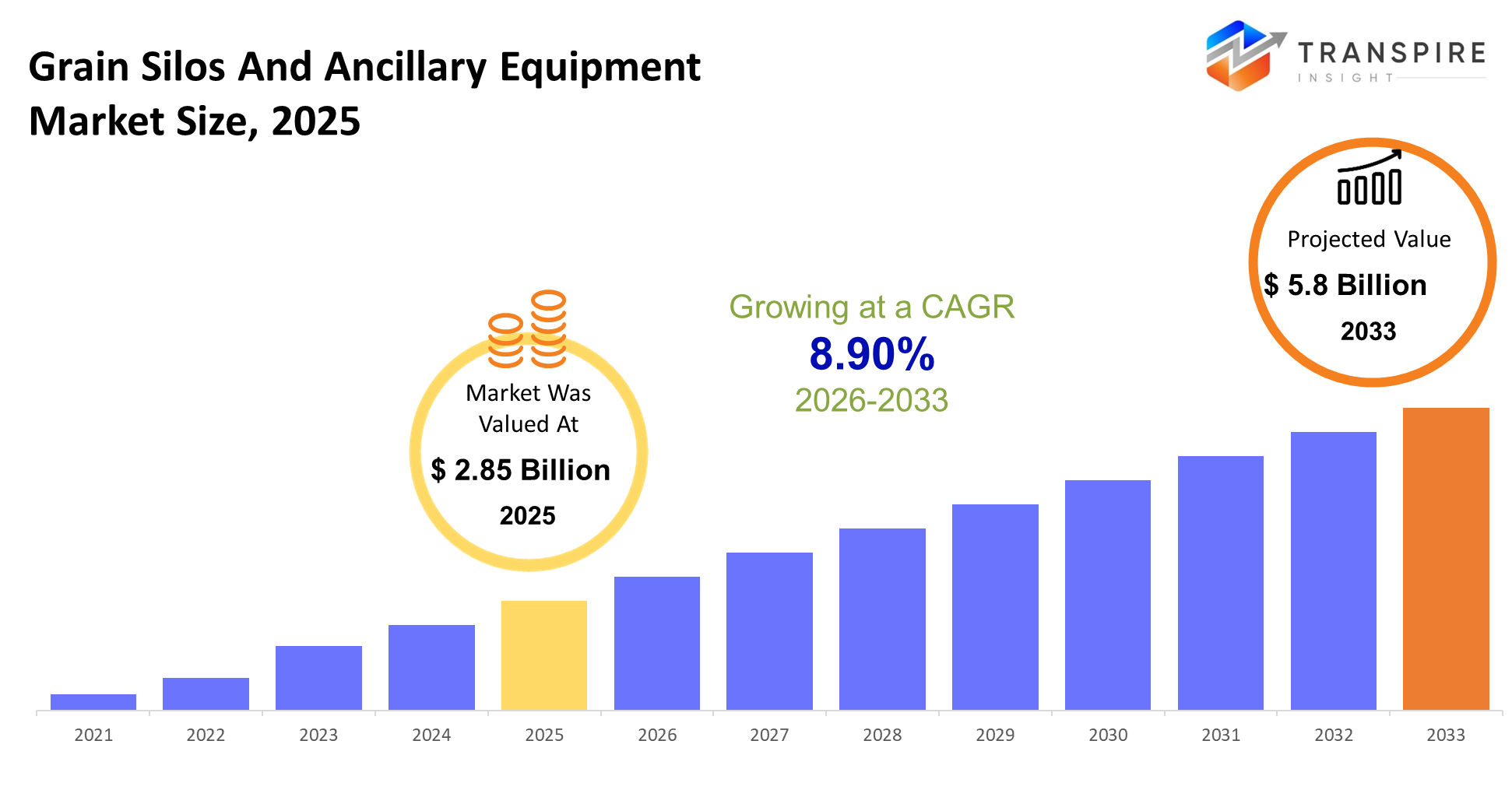

The global Grain Silos And Ancillary Equipment market size was valued at USD 2.85 billion in 2025 and is projected to reach USD 5.8 billion by 2033, growing at a CAGR of 8.90% from 2026 to 2033 The Grain Silos and Ancillary Equipment Market is growing at a steady pace of CAGR with the rising global production of grain, developing consciousness about losses after harvest, and food security initiatives globally. However, agricultural mechanization, the global trade of grain for exports, as well as storage infrastructure upgrades in the developing world, also supports the pace of growth.

Market Size & Forecast

- 2025 Market Size: USD 2.85 Billion

- 2033 Projected Market Size: USD 5.8 Billion

- CAGR (2026-2033): 8.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The level of momentum in North America remains high, driven by the replacement of aging cereal storage systems, the adoption of automated ancillary equipment, and a stable level of grain exports, which fuel the need for high-capacity and high-tech silo systems in farm operations.

- United States has leading contribution which has massive grain, or agricultural, production, along with networks for rail transportation, and rising investments in smart monitoring and drying equipment.

- Asia Pacific is characterized by high growth as the focus is on food security and minimized post-harvest losses and rural storage capacity in China and India, while in Australian and Japan, the silo automation of advanced silos is employed to enhance grain for export.

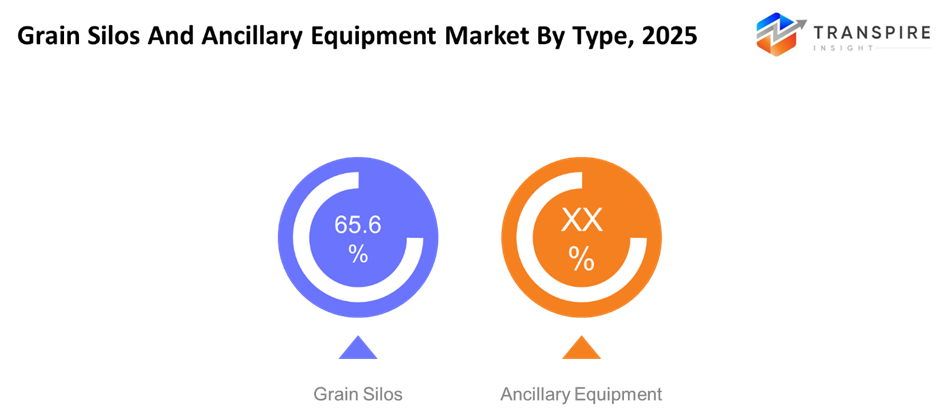

- The Grain Silos segment drives the market growth due to the demand for long-term storage silos, with a growing preference for steel silos due to their scalability, adaptability to various climatic conditions.

- Grain Storage application dominates as stakeholders increasingly focus on preserving grain quality, extending shelf life, and stabilizing supply chains amid climate variability and fluctuating global commodity prices.

So, The Grain Silos & Ancillary Equipment Market includes infrastructure and equipment that is utilized to store, safeguard, transport, and manage grains along the agricultural supply chain. This market has immense significance in fighting post-harvest losses in grains and ensuring effective functionality of the agricultural supply chain.

The grain storage silos form the primary assets, while the auxiliary equipment like elevators, conveyors, dryers, and controls for grain storage build greater efficiency. There has been an increased application of mechanized farm production, along with the escalating production rate of grain all over the world. The advanced technology applications related to controls and condition surveillance have also influenced the market conditions.

In addition, there are factors such as government-supported agricultural infrastructure development, export-oriented grain economies, and growing investments by the private sector in the development of storage facilities. Developing economies emphasize capacity development, while developed economies focus on development in the areas of efficiency and modernization.

Grain Silos And Ancillary Equipment Market Segmentation

By Type

- Grain Silos

Grain silos act as a market force that creates value for users by allowing them to store grain for a long time while preventing it from Grain silos act as a market force that creates value for users by allowing them to store grain for a long time while preventing it from being damaged by moisture, bugs, and spoilage. Increasing harvest and

- Ancillary Equipment

Ancillary equipment helps in effective grain handling, processing, and tracking within the storage facility. The growing demand for automation and optimization for labor is creating a market for coordinated handling, aeration, and drying systems for grain applications.

To learn more about this report, Download Free Sample Report

By Application

- Grain Transportation

Grain carriers see increasing adoption with the rising trade between regions. This is especially the case with the growing exports of grain. Equipment for unloading, handling of materials, and loading helps to minimize the losses during the transit process.

- Grain Storage

Storage of grains is currently the dominant use as players are keen to stabilize their inventories. Additionally, storing grains over a long period requires sophisticated grain storage facilities with temperature and moisture control.

- Others

Other use cases include the facilitation of grain processing, quality evaluation, and management of inventory. Such processes and services improve the efficiency of the value chain by increasing the traceability of activities.

Regional Insights

North America, led by the United States and Canada, embodies a mature market with vast commercial farming and sophisticated storage systems. The Tier 1 countries concentrate on automation upgrades, whereas Mexico functions as Tier 2 for market growth through agricultural modernization initiatives. Europe’s demand is stable in Tier 1 countries like Germany, France, and the United Kingdom, wherein sustainability and food safety criteria tend to drive investments in infrastructure. The Southern European nations and the Rest of Europe are classified as Tier 2 markets, wherein there is a steady growth in capacities.

The Asia Pacific market is the fastest-expanding market, with China and India being Tier 1 markets given their significant agricultural production and state-supported grain storage initiatives. Technology-based solutions are focuses of the Japanese, Australian, and South Korean markets, whereas countries in Southeast Asia are Tier 2 growth engines. South America primarily Brazil and Argentina is an enormous market for high capacity silos and export-related ancillary equipment. Rest of South America has Tier-2 growth in infrastructure development for exports. The Middle East & Africa region includes Saudi Arabia, the UAE, and South Africa as Tier 1 countries that invest in food security and import warehousing, while the remaining nations are Tier 2, concentrating on modular & adaptable warehousing.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Telangana’s government is likely to establish a modern scientific grain storage silo system in the state in order to enhance food security and minimize losses incurred due to inefficient grain storage. The project plans to develop a initial storage capacity of 20 lakh tonnes. This project is a part of overall efforts of the govt. to develop agri infrastructure.

- In October 2024, In Uzwil, Switzerland, the launch ceremony of the newest Grain Innovation Center by Bühler, a pioneering undertaking. This application center is a crucial step forward for innovation related to processing grains because the center combines high-tech with a rich history of know-how. The center has been strategically positioned to empower customers from the food as well as the animal nutrition sector so that they can differentiate themselves by adapting to the trends prevailing within the milling process environment.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.85 Billion |

|

Market size value in 2026 |

USD 3.2 Billion |

|

Revenue forecast in 2033 |

USD 5.8 Billion |

|

Growth rate |

CAGR of 8.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

AGCO Corporation, Ag Growth International Inc., Sukup Manufacturing Co., Brock Grain Systems, Symaga SA, Silos Córdoba SL, Sioux Steel Company, CST Industries Inc., Chief Industries Inc., Kepler Weber SA, Superior Grain Equipment, Bentall Rowlands Storage Systems Ltd., SCAFCO Grain Systems Co., Mysilo Grain Storage Systems, Satake Corp |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Grain Silos, Ancillary Equipment), By Application (Grain Transportation, Grain Storage, Others) |

Key Grain Silos And Ancillary Equipment Company Insights

AGCO Corporation is a strong competitor in the grain silos and related equipment industry, driving its strength through its broad-based offerings, which encompass GSI grain storage systems, drying products, as well as material handling systems designed for commercial agriculture enterprises. AGCO Corporation’s extensive global coverage also derives strength through its emphasis on R&DO investment for smart monitoring, automation, as well as sustainable designs, which boost efficiency as well as minimize losses after crop production. AGCO’s emphasis on innovative as well as sustainable practices will continue to give it a strong edge in this industry based on changing agricultural infrastructure requirements.

Key Grain Silos And Ancillary Equipment Companies:

- AGCO Corporation

- Ag Growth International Inc.

- Sukup Manufacturing Co.

- Brock Grain Systems

- Symaga SA

- Silos Córdoba SL

- Sioux Steel Company

- CST Industries Inc.

- Chief Industries Inc.

- Kepler Weber SA

- Superior Grain Equipment

- Bentall Rowlands Storage Systems Ltd.

- SCAFCO Grain Systems Co.

- Mysilo Grain Storage Systems

- Satake Corp

Global Grain Silos And Ancillary Equipment Market Report Segmentation

By Type

- Grain Silos

- Ancillary Equipment

By Application

- Grain Transportation

- Grain Storage

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636