Market Summary

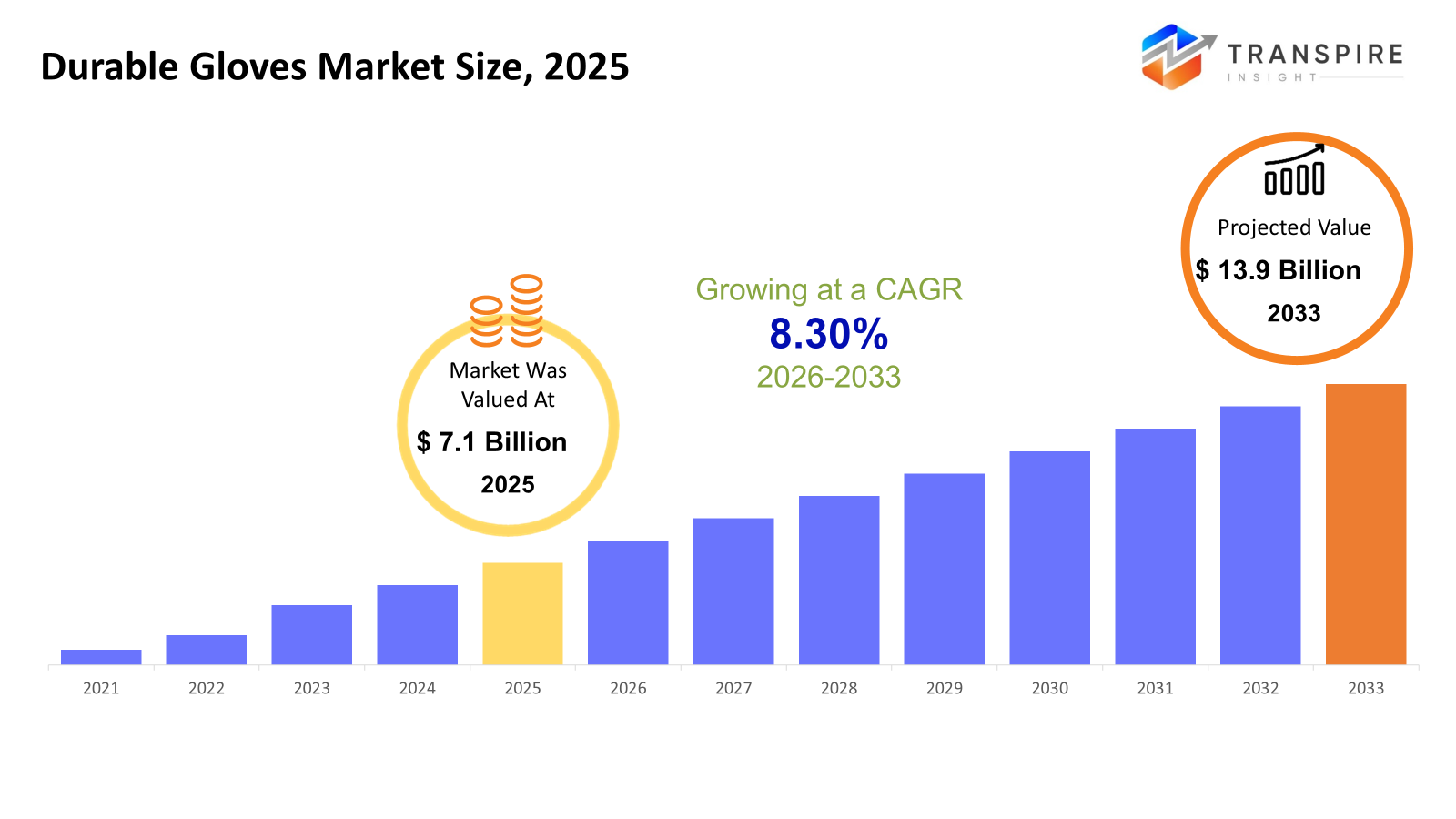

The global Durable Gloves market size was valued at USD 7.1 billion in 2025 and is projected to reach USD 13.9 billion by 2033, growing at a CAGR of 8.30% from 2026 to 2033. The market for durable gloves has an opportunity to grow solidly in light of stiffening norms around worker protection, expanding industrial employment markets, and expanding customer familiarity with reusable protecting gear. Expanding markets in industrial production, construction, and energy production are fueling replacement demand patterns for these gloves too. Improvements in glove materials extend durability and comfort too.

Market Size & Forecast

- 2025 Market Size: USD 7.1 Billion

- 2033 Projected Market Size: USD 13.9 Billion

- CAGR (2026-2033): 8.30%

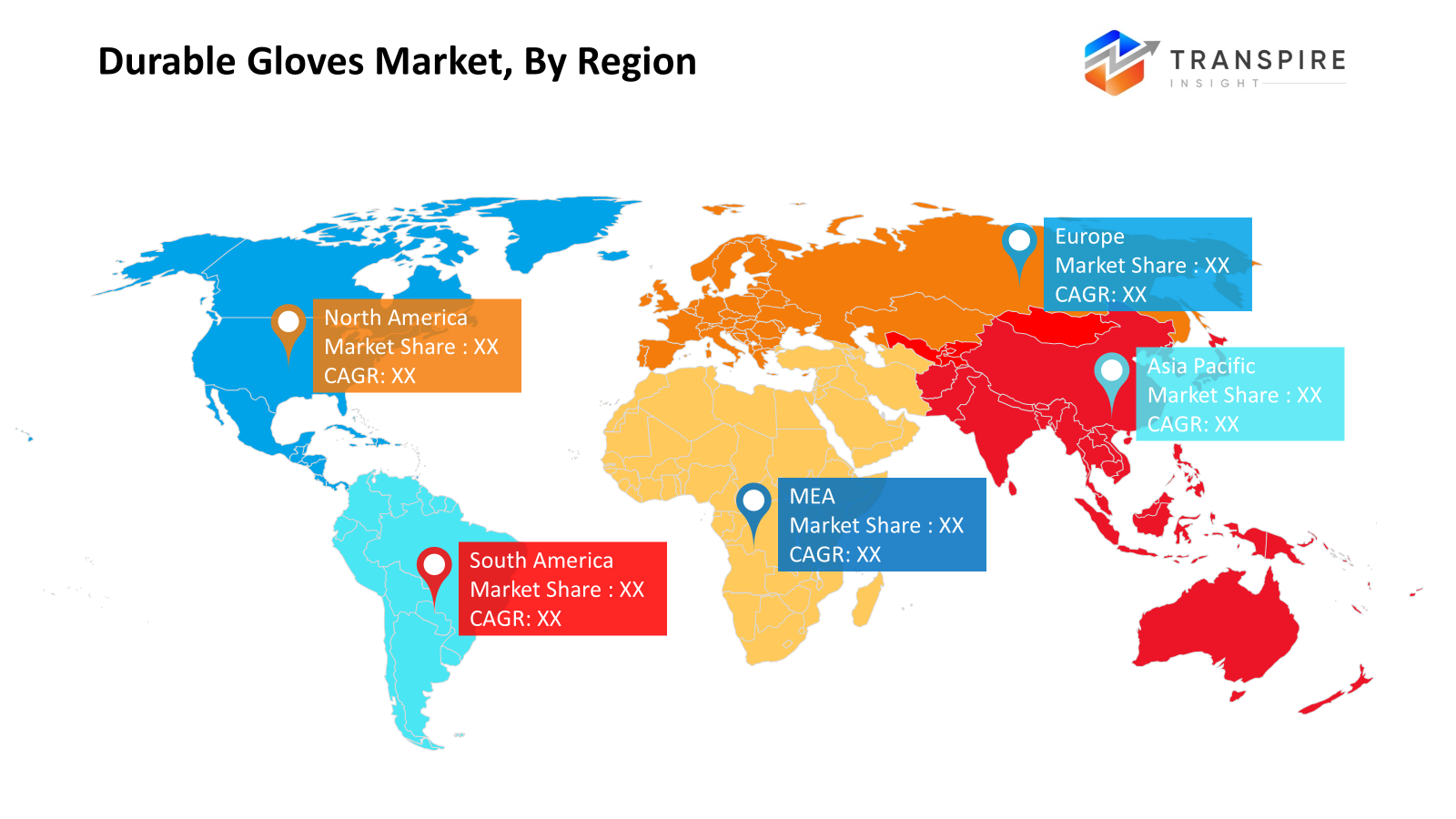

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Demand in North America reflects strong and resilient demand alongside strict enforcement of workplace safety regulations, a strong position of reusable safety gear in this region, and balanced replacement demand from industrial segments.

- The US continues its position as top contributor from North America as a result of reshoring activities in manufacturing industries, infrastructure development, and high standards set under OSHA regulations, fueling demand for high-performance durable gloves.

- Asia Pacific has been marked as a rapidly growing platform to meet the demand created by swift industrialization processes, enlarged manufacturing facilities, as well as heightened safety awareness in the workforce, through cost-effective production processes, development of facilities, as well as compliance to standards for durable gloves in emerging as well as developed countries in the APAC region itself.

- Among the growth trends, nitrile material continues to be dominant, as industries increasingly prefer latex-free, chemically resistant, and longer-lasting gloves-endorsed by regulatory compliance requirements, which have improved manufacturing processes balancing durability with comfort and tactile performance.

- The demand by the type of mechanical gloves is due to their wide application in construction, manufacturing, and logistics industries, where protection from abrasions, cuts, and impacts are imperative; these industries assure an unceasing industrial activity and, correspondingly, steady replacement and recurring procuring volumes.

- The largest end-user category is still manufacturing due to various industrial applications that need reusable protective gloves to protect hands during various industrial process requirements. This includes protection mandates for automation and labor forces in industrial facilities.

- Distributors/wholesalers will remain the major distribution route due to their reach; availability of product in stock; and the ability to provide mass reach to fragmented industrial customer bases, including small to mid-sized enterprises requiring product support in local/regional environments.

So, The market for durable gloves includes gloves that are reusable and offer protection to hands from various hazards in various industrial applications through their durability and longevity. The gloves are quite different from disposable gloves wherein protection is given to hands through durable gloves that are reusable in nature. Durable gloves serve an important function in safety management in hazardous workplaces or environments of work. Notably, there exists a strong correlation between market demand and levels of industrial activity, increase in workforce, as well as regulatory mandating in relation to ensuring worker safety. Industries like manufacturing, construction, oil and gas, as well as chemicals, play an important part in overall consumption due to continued exposure to physical/chemical threats, while innovation in materials offers benefits that promote improved durability while enhancing overall comfort.

The market also enjoys a balance between costs and performance, affecting purchases globally. While the international market focuses on legal compliance, quality, and specific safety certifications, emerging nations rely heavily on obtainable glove safety, matching the accelerating growth of industries within their boundaries. All in all, the global durable gloves market enjoys a stable nature due to the replacement needs and ever-changing safety needs in industries.

Durable Gloves Market Segmentation

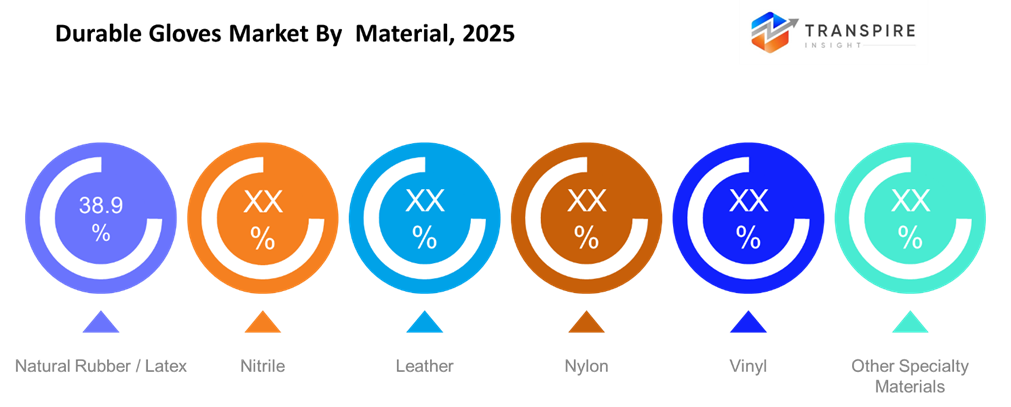

By Material

- Natural Rubber / Latex

Natural rubber gloves are appreciable in terms of their elasticity, softness, along with tactility; hence, they are best suited to precision-based industrial applications. Rubber gloves have good resistance to tears as well as scratches; however, lack of adoption is reported in terms of decreasing demand generated by concerns over latex allergies.

- Nitrile

Nitrile gloves are one among the segments that is growing the most within the materials market due to the superior resistance properties provided. It is a widely popular item within the oil & gas industry. Latex-free addition has enabled an increase in acceptance. There has been a movement towards increasing flexibility within the materials.

- Leather

Leather gloves are mostly used for strong-duty applications that require abrasion resistance, cuts, and heat. This type of glove is mostly used for construction purposes, welding, mining, and other working activities. Even though they provide good durability and grip capability, these gloves do not provide sufficient chemical resistance, making this product not applicable to many industries. Its demand is steady.

- Nylon

Furthermore, nylon gloves are lightweight as well as versatile, typically functioning as liners or coated gloves to promote dexterity in the workforce. As a result, they embody excellent characteristics as a material in assembly activities, electronic endeavors, as well as assorted industrial activities within an organization. The product’s applicability may be deemed insignificant; however, relevance can be attained through coatings. Growth can be derived from factors such as light manufacturing as well as automation.

- Vinyl

Vinyl gloves are an economic alternative for low-risk industrial and commercial applications. They provide only limited durability and chemical resistance compared to nitrile or latex. Adoption is concentrated in food handling and short-term usage scenarios. Environmental concerns and performance limitations will restrain longer-term growth.

- Other Specialty Materials

This segment includes neoprene, Kevlar, HPPE and polyurethane-coated gloves for niche and high-risk applications. These materials afford enhanced cut, heat, chemical or electrical resistance. Demand arises due to high workplace safety regulations and specialized industry processes. Higher costs are offset by critical performance benefits.

To learn more about this report, Download Free Sample Report

By Type

- Mechanical Gloves

Mechanical gloves have a larger market share because of their application and usage in various industries like construction and logistics. These provide protection against cuts, abrasions, and punctures. Increased industrial automation and manual handling needs for materials will fuel demand. Research and developments are focused on achieving comfort.

- Chemical Handling Gloves

Chemical handling gloves play an important role within industries where hazardous chemicals are used. This demand arises from stringent occupational safety requirements combined with the increased production of chemicals worldwide. Chemical handling gloves are made up mainly of nitrile and neoprene. Chemistry, oil & gas, and pharmaceuticals industries show the greatest increase.

- Thermal / Flame-Retardant Gloves

The gloves are intended to be utilized in high-temperature applications such as welding, foundry workplaces, and firefighting teams. The growth of heat resistance gloves is driven by industrial safety regulations and infrastructure investments. The use of gloves is in heavy industry and energy sectors. The gloves utilize modern technologies to increase resistance while reducing their bulk size.

- Other specialty gloves

This segment includes electrical gloves, anti-vibration gloves, and cleanroom gloves that possess specific risk profiles that cater to various requirements during specialized processes used in manufacturing industries. Even though the quantity is less, the premium paid for these gloves is high. Now that the technology has enhanced the range of applications, the future for gloves has never been brighter.

By End-Use Industry

- Construction

Construction is a major end-use segment owing to the high exposure to mechanical and physical hazards in this field. Demand in this segment can be met through infrastructure development activities as well as various activities in the development of cities across the world. The majority of glove demand in this segment constitutes abrasion- or cut-resistant gloves, and enforcement of regulations can help in increasing consumption rates.

- Manufacturing

The largest pool of demand comes from manufacturing due to varied applications and ongoing processes. Gloves provide a form of essential worker safety in various processes, which includes assembly, machining, as well as handling. It grows at a pace consistent with industrial output and trends in automation.

- Oil & Gas

Oil and gas extraction requires gloves to resist chemicals, heat, and impact forces. The tough industry environments and compliance to safety regulations create sustained demand. Offshore and oil refineries are important contributors to overall demand. "Fluctuations in energy investments affect industry demand in oil gloves."

- Chemicals

The chemicals industry heavily depends on durable gloves to provide safety against harmful substances. Government compliances and safety consciousness among workers are two significant demand drivers. Nitrile and special materials gloves are predominantly used. The market is expected to grow with an increase in production of special and industrial-grade chemicals.

- Food

Food processing and handling involve gloves that provide hygiene and moderate protection. Tough gloves are helpful for repeated work that involves reusability of gloves. The demand also comes from food handling regulations and the growth of organized food production. The demand for durability of food gloves, however, is less in comparison to other industries.

- Pharmaceuticals

The pharmaceutical industry focuses on aspects of contamination control and chemical safety. Durable gloves are used in formulation work, packaging activities, and laboratory work. Regulatory standards are important considerations in choosing materials. The industry is growing through increases in global pharmaceutical production capacities.

- Transportation

The need for durable gloves arises in transportation and logistics during loading and unloading duties or maintenance functions. The growth in warehousing and logistics indirectly serves to fuel this need. Mechanical protection and grip are important performance requirements for gloves in this industry or setting. The growth of e-commerce indirectly serves to fuel this need for gloves.

- Mining

Mining necessitates gloves with abrasion resistance, impact resistance, and cut resistance properties. The working conditions and safety regulations drive the market. It has a cyclical nature based on the price of crude materials. Specialty gloves are increasingly used to reduce injuries.

- Other Industrial & Commercial Sectors

This includes utilities, maintenance services, and infrastructure. Demand is stable and varied glove use exists for many purposes. Compliance issues revolving around safety and the need for glove use for more efficiency encourage glove use. Demand will rise gradually but surely from the need for replacements.

By Distribution Channel

- Direct Sales

Direct selling is more popular with large industrial buyers who value long-term contracts for procurement of goods. This form of selling allows for customization, bulk purchasing, as well as technical support. It is very popular in heavy industry as well as multinational operations. Well-established relations between suppliers and buyers promote more stable channels.

- Distributors / Wholesalers

In recent times, distributors have been found to be very important in meeting the demand from small to mid-scale industrial customers, as they offer a range of products along with availability. This is because this model dominates fragmented markets as well as emerging countries along with expanding industries in them.

- Online Retail / E-commerce

E-commerce adoption is on the rise, mainly for its convenience factor. There is also transparency in prices as well as access to more products. Its adoption has been higher within the business community for small and medium-sized enterprises. There are also technology-based procurement sites contributing to the advancement of these channels. There isn’t substantial adoption for specialized gloves.

- Specialty Industrial Safety Stores

These stores are for customers who are in need of certified and application-specific gloves. These stores offer technical advice and compliant-focused offerings. The demand is driven through regulated industries and professionals. This channel is still relevant despite increased internet presence.

Regional Insights

North America is a mature market with high saturation of durable gloves across construction, manufacturing, and energy sectors, due to solid regulatory frameworks. The United States captures the majority of the regional demand, while Canada and Mexico add their share through industrial manufacturing and cross-border supply chains. Europe is the second-largest region, driven by stringent worker safety directives, and includes Germany, the United Kingdom, France, Italy, and Spain as Tier 1 markets on the back of advanced manufacturing and infrastructure activities.

Asia Pacific is the fastest-growing region, powered by China, India, Japan, South Korea, and Australia & New Zealand, where industrial expansion, export-oriented manufacturing, and an increased safety awareness spur on volume demand growth. The remaining countries in the Asia Pacific region comprise the so-called Tier 2 markets, which are rapidly adopting more durable personal protective gear. The growth in South America is relatively tame, with Brazil and Argentina remaining the top demand generators based on mining, agriculture, and general industrial development.The Middle East & Africa region is growing, mainly because of oil and gas, construction, and infrastructure projects. Saudi Arabia, the United Arab Emirates, and South Africa serve as natural Tier 1 markets, with a gradual, rest-of-region uptake grounded in industrialization and improved regulatory frameworks.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, An announcement from Ansell Limited indicated that it was launching its HyFlex Precision Comfort Series of industrial gloves geared towards providing improvements in tactility along with comfort, all while maintaining resistance to cuts and abrasions for users in industry segments that require precision gloves such as in the car industry, as well as in aerospace and in metals production, which also poses uncomfortable challenges to workers in these sectors..

(Source:https://www.ansell.com/us/en/pressreleases?page=1&page_size=4&sort=Date&sort_type=desc&utm)

- In July 2024, Ansell Limited has completed the acquisition of Kimberly Clark’s Personal Protective Equipment business, KCPPE, as of July 2, 2024, further extending its footprint in the global PPE industry by entering the renowned Kimtech and KleenGuard portfolios of industrial and scientific products for PPE solutions.

(Source:https://www.ansell.com/in/en/press-releases/ansell-completes-acquisition-of-kcppe-business)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.1 Billion |

|

Market size value in 2026 |

USD 8 Billion |

|

Revenue forecast in 2033 |

USD 13.9 Billion |

|

Growth rate |

CAGR of 8.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Ansell Ltd, Superior Glove, Newell Co, Unigloves (UK) Limited, Youngstown Glove Company, Uvex Safety Group, The Glove Company, Delta Plus Group, Atlantic Safety Products, MCR Safety, NITRAS, 3M Company, PIP Global, Showa Corporation, United Glove |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material (Natural Rubber / Latex, Nitrile, Leather, Nylon, Vinyl, Other Specialty Materials), By Type (Mechanical Gloves, Chemical Handling Gloves, Thermal / Flame-Retardant Gloves, Other Specialty Gloves), By End-Use Industry (Construction, Manufacturing, Oil & Gas, Chemicals, Food, Pharmaceuticals, Transportation, Mining, Other Industrial & Commercial Sectors) and By End-Use Industry (Direct Sales, Distributors / Wholesalers, Online Retail / E-commerce, Specialty Industrial Safety Stores) |

Key Durable Gloves Company Insights

Ansell Ltd excels in providing industrial gloves worldwide while maintaining a dominant position in global industrial gloves markets through its versatile product portfolio in segments of mechanical gloves, chemical gloves, thermal gloves, and specialty gloves. The company aims to maximize product innovation in durable gloves to cope with superior technologies, particularly through utilizing Kevlar and nitrile technologies for providing increased protection and comfort to users of gloves while providing diverse protection solutions to various segments of industrial gloves markets worldwide. Its product portfolio includes glove solutions to oil & gas markets, automotive markets, chemicals markets, and life sciences markets.

Key Durable Gloves Companies:

- Ansell Ltd

- Superior Glove

- Newell Co

- Unigloves (UK) Limited

- Youngstown Glove Company

- Uvex Safety Group

- The Glove Company

- Delta Plus Group

- Atlantic Safety Products

- MCR Safety

- NITRAS

- 3M Company

- PIP Global

- Showa Corporation

- United Glove

Global Durable Gloves Market Report Segmentation

By Material

- Natural Rubber / Latex

- Nitrile

- Leather

- Nylon

- Vinyl

- Other Specialty Materials

By Type

- Mechanical Gloves

- Chemical Handling Gloves

- Thermal / Flame-Retardant Gloves

- Other Specialty Gloves

By End-Use Industry

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Other Industrial & Commercial Sectors

By Distribution Channel

- Direct Sales

- Distributors / Wholesalers

- Online Retail / E-commerce

- Specialty Industrial Safety Stores

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636