Market Summary

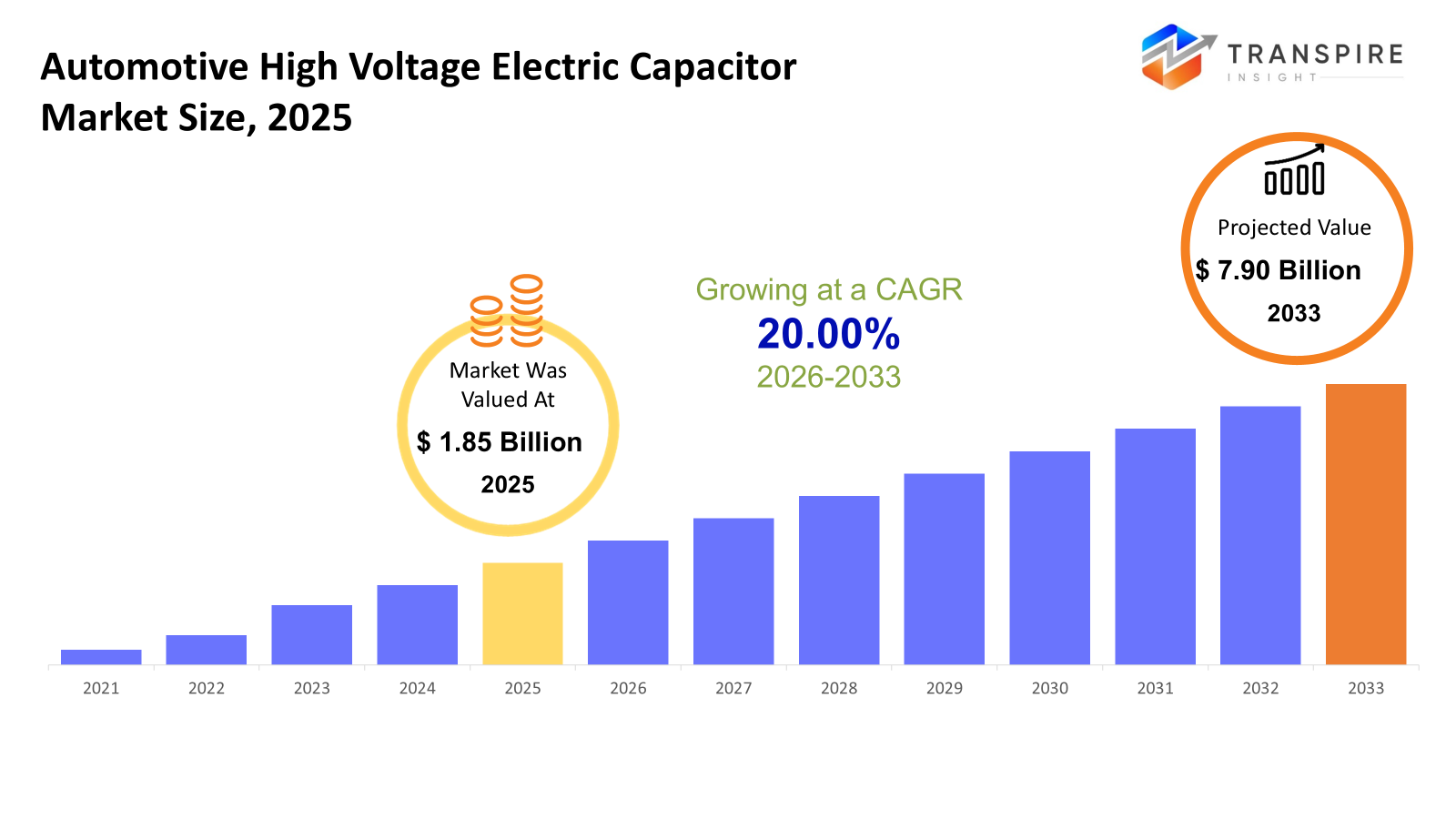

The global Automotive High Voltage Electric Capacitor market size was valued at USD 1.85 billion in 2025 and is projected to reach USD 7.90 billion by 2033, growing at a CAGR of 20.00% from 2026 to 2033. More people are choosing electric and hybrid cars those need strong electrical parts to handle power well. Power systems in EVs now get more funding, especially for things like inverters, charging units, and DC-links. This pushes up the need for better capacitors. Instead of older designs, newer models take center stage as vehicle tech moves more quickly than before.

Market Size & Forecast

- 2025 Market Size: USD 1.85 Billion

- 2033 Projected Market Size: USD 7.90 Billion

- CAGR (2026-2033): 20.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 30% in 2026. More electric cars rolling out pushes growth. Alongside, smarter tech inside vehicles helps too. Government rules favoring cleaner transport also play a role.

- High demand for high-voltage capacitors in BEVs pushes the United States ahead in the region, fueled by growth in local electric vehicle production along with spending on charging networks.

- Fueled by massive electric vehicle manufacturing in China, Japan, and South Korea, the Asia Pacific area surges ahead. Battery systems and power electronics networks here run deep, giving momentum. Growth outpaces other regions, driven not just by output but by tightly linked industrial ecosystems. Strength builds from interconnected factories turning out key components at scale.

- Film Capacitors share approximately 30% in 2026. Film capacitors stand out because they handle high voltage well. Their performance stays steady even when things heat up under the hood. When it comes to keeping electric vehicle systems running, trust leans their way. Tough conditions do not rattle them; they adapt without failing. Long-term function is built into their design, which matters where breakdowns are not an option.

- Starting at 600 volts and climbing toward 800, this range is seeing the sharpest rise lately. Car makers are shifting their electric models here, driven by a need for speedier recharging alongside better energy use. Higher voltage means less wasted power, which adds up over time.

- Electric cars run only on batteries now lead the market. Their rise comes as more countries switch to electric transport. Growth happens because engines are changing fast everywhere. Power systems in vehicles keep moving toward full electricity.

- That is where DC-link capacitors really show up. Traction setups depend on them just as much. Their job matters most when power flow gets unpredictable. You will find these components right at the heart of demanding applications. Size-wise, nothing else comes close in daily use.

Growth in the automotive high-voltage electric capacitors market is speeding up, due to more cars running on electricity instead of fuel. These components help store power smoothly while keeping electrical flow steady inside key parts like inverters and charging units. With manufacturers moving away from traditional engines, the need grows fast for durable capacitors that handle intense heat and higher voltages without failing. Performance under stress matters now more than ever across modern drivetrain designs.

When it comes to tech choices, film capacitors lead because they handle voltage better, lose less energy, stay stable when hot, last longer outperforming both electrolytic and ceramic types. In systems like DC-link and inverters, steady operation at high voltage and rapid switching make these components a top pick. As automakers move to 600V–800V or even higher setups for quicker charging and improved efficiency, newer electric vehicles lean more on film capacitors going forward.

When it comes to kinds of cars, those running only on battery power dominate the market now - growth here outpaces others because everything from movement to onboard functions depends on strong electrical setups. Even so, plug-in hybrids keep pace steadily, supported by consistent need, whereas models using hydrogen fuel cells stay rare yet complex, needing tough parts that handle high-voltage energy control. In practice, capacitors used between direct current links take up most of the space since they play a key role: smoothing voltage swings and shielding vital electronics inside motor drives and inverters. What stands out is how essential stability becomes when pushing power through these systems.

China, Japan, and South Korea push Asia Pacific ahead, thanks to massive EV output plus tightly linked local networks for power electronics and passive parts. While the United States steers North America's portion - fueled by growing vehicle output, homegrown battery and chip investments, alongside pro-electric rules the region stays firmly in play. Europe keeps pace too, pulled forward by tough pollution limits and widespread shift to electric transport, ensuring steady demand for high-voltage car capacitors until 2033.

Automotive High Voltage Electric Capacitor Market Segmentation

By Capacitor Type

- Film Capacitors

High voltage handling helps film capacitors stay ahead. Their ability to resist heat plays a role, too. Lasting years inside electric vehicle systems make them common. Long-term performance keeps engineers choosing these parts. Built tough, they handle stress without failing. Service life matters most when picking components. These traits add up over time. Reliability under pressure sets them apart.

- Ceramic Capacitors

Popping up often in tiny electronics, ceramic capacitors handle quick signals without slowing down. Their small shape fits tight spaces where speed matters most. Instead of bulkier types, these stay light and react in a flash. Built for jobs that need reliability at high rates, they rarely miss a beat.

- Electrolytic Capacitors

Priced low, electrolytic capacitors handle big energy loads while keeping voltages steady. Storing power in bulk plus smoothing out fluctuations without breaking budgets.

- Supercapacitors

A sudden surge in supercapacitor use comes from how fast they release stored power. Their ability to capture braking energy gives them an edge in transport systems. What stands out is their long life under heavy cycling. Not needing full recharges helps machines run longer without stops.

- Others

Apart from standard types, there are specialized units built to handle unique demands in vehicle electrical systems. Some blend features for better performance under stress. These support functions were regular parts that might fail. Built-in adaptability helps them manage fluctuating loads. Their role becomes critical in advanced driver assistance setups.

To learn more about this report, Download Free Sample Report

By Voltage Rating

- 400V-600V

Common in older electric cars as well as hybrids. Though newer models shift higher, many still run on these levels simply because they work.

- 600V-800V

Beyond 600 volts, things shift quickly. New electric vehicles push into the 800-volt range. Charging speeds rise as a result. Design changes in power systems make it possible. Higher voltage means less waiting at stations.

- Above 800V

Faster charging shows up past 800 volts. Efficiency climbs when systems run above that mark. Power loss drops as voltage pushes higher. This range is just starting to take shape.

By Vehicle Type

- Battery Electric Vehicles

Fueled entirely by electricity, battery electric vehicles dominate the market. Their need for robust power systems pushes demand higher. Because they run only on stored energy, advanced electronics become essential. With no backup engine, performance hinges on voltage control. This makes them heavier users of high-end components than other types.

- Plug-in Hybrid Vehicle

PHEVs are seeing more drivers choose them lately. Car makers find these models hit a sweet spot - electric power when possible, gasoline backup when needed. Range worries fade without giving up efficiency. Some like starting with electricity, switching later. Others enjoy fewer fill-ups plus lower emissions. Each year brings new versions that drive farther before burning fuel. Drivers adjust habits slightly, gain benefits steadily.

- Hybrid Electric Vehicles

Even with new tech rising, HEVs keep moving thanks to ongoing work on their engines. Production has not slowed, so interest stays put.

- Fuel Cell Electric Vehicles

Starting differently, Fuel Cell Electric Vehicles sit in a small corner of the market, yet that space is slowly growing. High-pressure power control parts become essential here. Because these cars run on hydrogen, their electrical systems demand careful handling. Growth pushes new demands. Not mainstream, though development continues. Specialized hardware keeps them running safely. Expansion means more need for precision engineering. Little by little, the role widens.

By Application

- DC-Link Capacitors

Staying steady under pressure, DC-link capacitors balance power flow inside inverters. Voltage swings get smoothed out when these components step in during converter operations. Handling rapid changes without missing a beat. Found at the heart of systems where clean energy transfer matters most. Performance stays reliable even when demands spike unexpectedly.

- Onboard Chargers

Charging units built into vehicles see a rising need as more stations pop up worldwide. Fast refill times add momentum, mainly because drivers want less waiting during daily commutes.

- Inverters

Power switches see wide use because they manage engine speed plus change the electricity flow. Motors rely on them heavily, just as grids depend on steady output.

- DC-DC Converters

Switching power units adjusts electrical levels across differing circuits. Voltage shifts happen smoothly inside these devices. From strong sources down to weaker ones, they manage flow. Not every system runs alike, so changes are needed. Matching supply to demand keeps things working right.

- Battery Management Systems

Support safe and efficient energy storage and distribution.

- Powertrain & Traction System

Electric drive systems gain ground when motors pack more punch per pound. As new designs deliver stronger performance, traction setups adapt right alongside them...

Regional Insights

Holding top spot worldwide, the Asia Pacific area shapes the auto high voltage capacitor scene because massive EV output pairs with skilled battery making plus steady upgrades in electronic controls. In places like China, Japan, and South Korea, the need runs deep since electric cars fill streets, support comes from state funding, while big car builders and parts makers set up shop nearby. With attention locked on stronger electrical systems and quicker charge networks, progress pushes film and ceramic capacitors into wider use across the zone.

A steady climb marks North America's position in the global shift toward electric transport, fueled by more factories turning out EVs and stronger local support systems for materials. Leading the charge, the United States sees higher output of battery-powered cars, backed by rules that favor clean transit at national and local levels, along with broader use of advanced electrical components across personal and work-focused electric vehicles. From up north, Canada adds momentum with assembly activity, while its southern neighbor, Mexico, strengthens shared industry pathways tied closely to vehicle making. Together, their roles shape a quiet but clear expansion underway.

Still, Europe holds ground because tough rules on emissions push cleaner driving choices. Automakers are shifting toward advanced electric vehicles, fitting more high-voltage capacitors into cars and delivery vans alike. In places like Germany, France, and the United Kingdom, this change moves fast thanks to national climate goals. Over time, countries in Latin America, along with parts of the Middle East and Africa, begin catching up too. Charging stations grow slowly, and policies start forming, helping electric models spread even if starting from far behind. While Asia Pacific and North America lead, these areas inch forward without rushing.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 18, 2025 – TDK expands B409x hybrid polymer capacitors with vibration-resistant design.

- September 1, 2024 – Samsung Electro-Mechanics expands range of multilayer ceramic capacitors for high-voltage EV applications.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.85 Billion |

|

Market size value in 2026 |

USD 2.20 Billion |

|

Revenue forecast in 2033 |

USD 7.90 Billion |

|

Growth rate |

CAGR of 20.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Terra Universal, Clean Air Products, Azbil Corporation, Getinge AB, Abtech, SKAN Group, Germfree Laboratories, Klenzaid, Bühler Group, Enbio, Heal Force, Nuaire, Air Techniques International, G-CON Manufacturing, Cleanroom Technology, AES Clean Technology, and PortaFab Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Capacitor Type (Film Capacitors, Ceramic Capacitors, Electrolytic Capacitors, Supercapacitors, Other), By Voltage Rating (400V-600V, 600V-800V, Above 800V), By Vehicle Type (Battery Electric Vehicles, Plug-In Hybrid Vehicle, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), By Application (DC-Link Capacitor, Onboard Chargers, Inverters, DC-DC Converters, Battery Management Systems, Powertrain & Traction Systems) |

Key Automotive High Voltage Electric Capacitor Company Insights

One name stands out in the world of car-based high voltage capacitors: Murata Manufacturing Co., Ltd. Its range includes film and ceramic types built to handle heavy electrical loads in modern automobiles. These components go into parts like inverters, where steady power control matters most. Instead of just making bigger units, the firm pushes for smaller designs without sacrificing endurance. Heat resistance forms another core strength, ensuring stability under tough conditions inside electric vehicles. Production sites spread across continents support consistent delivery no matter the region. Close work with vehicle makers and top suppliers keeps development tightly linked to real-world needs. Performance benchmarks often shift ahead of industry trends due to persistent engineering refinement. Growth in EV tech only strengthens their role within complex electronic networks found under the hood.

Key Automotive High Voltage Electric Capacitor Companies:

- KEMET Corporation

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- AVX Corporation

- Panasonic Corporation

- Samsung Electro-Mechanics

- Nichicon Corporation

- Vishay Intertechnology, Inc.

- Yageo Corporation

- Rubycon Corporation

- Eaton Corporation

- Kyocera AVX

- Taiyo Yuden Co., Ltd.

- Cornell Dubilier Electronics

- United Chemi-Con

- Tokin Corporation

- Hitachi Chemical Company

Global Automotive High Voltage Electric Capacitor Market Report Segmentation

By Capacitor Type

- Film Capacitors

- Ceramic Capacitors

- Electrolytic Capacitors

- Supercapacitors

- Other

By Voltage Rating

- 400V-600V

- 600V-800V

- Above 800V

By Vehicle Type

- Battery Electric Vehicles

- Plug-In Hybrid Vehicle

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

By Application

- DC-Link Capacitor

- Onboard Chargers

- Inverters

- DC-DC Converters

- Battery Management Systems

- Powertrain & Traction Systems

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636