Market Summary

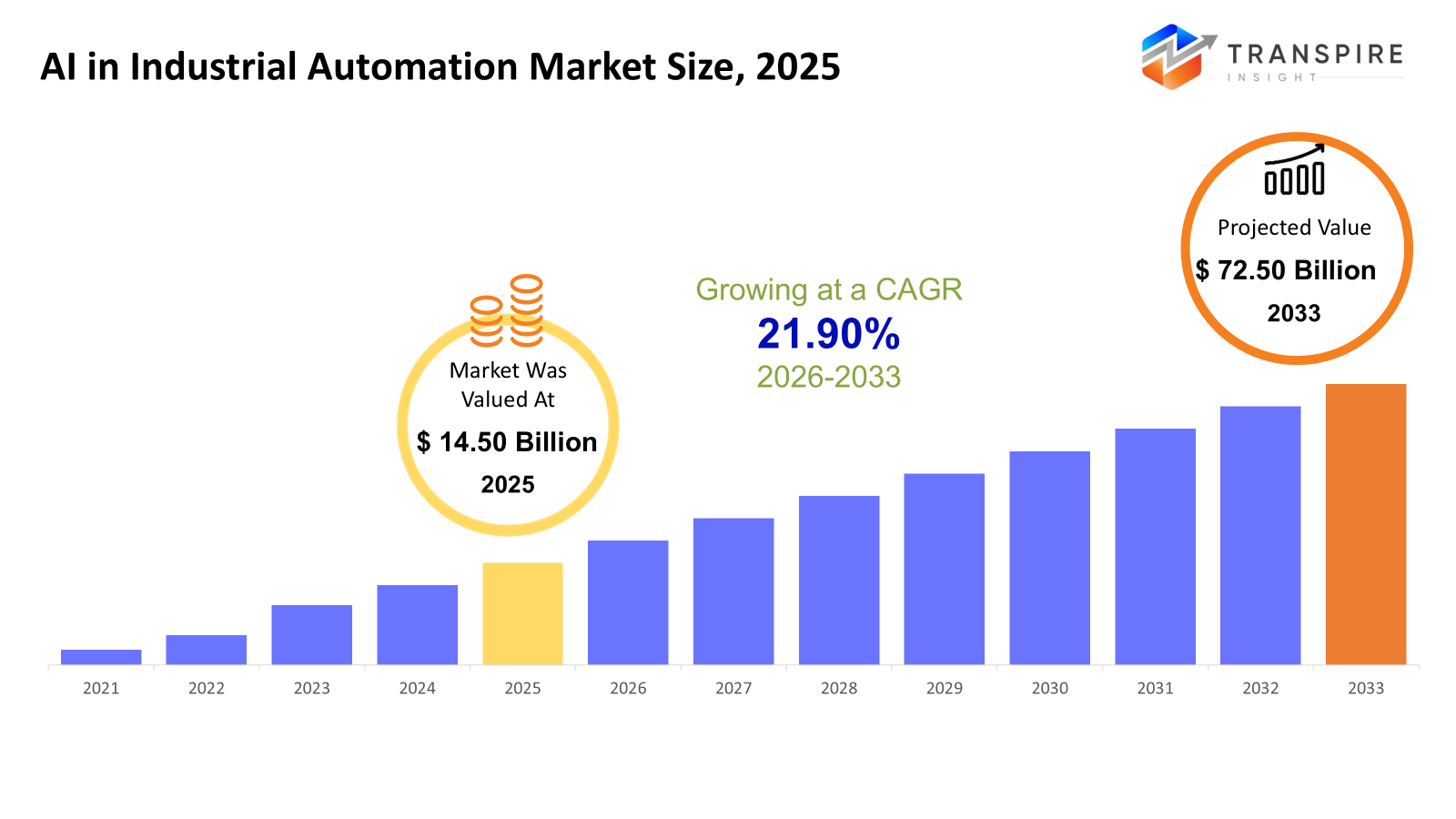

The global AI in Industrial Automation market size was valued at USD 14.50 billion in 2025 and is projected to reach USD 72.50 billion by 2033, growing at a CAGR of 21.90% from 2026 to 2033. Growth in AI for factory automation spreads fast because more places adopt smart production methods along with the Industry 4.0 movement worldwide. Machines now think better thanks to artificial intelligence, helping spot breakdowns early, smooth out workflows, check product quality, improve delivery routes, cutting waste while lifting output. As robots link up with sensors and learning systems on shop floors, interest grows stronger every quarter.

Market Size & Forecast

- 2025 Market Size: USD 14.50 Billion

- 2033 Projected Market Size: USD 72.50 Billion

- CAGR (2026-2033): 21.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Out here, factories quickly take up artificial intelligence because tech keeps moving fast. Research gets serious money, which pushes smart machines into daily work. Not waiting around, companies swap old systems for ones that learn on their own. Driven forward by innovation, tools adapt without being told every single step.

- From the United States, innovation pours into cars and planes, yet spreads strongest through tech-driven fields. Global dominance shows where the appetite for artificial intelligence runs deepest. Heavy industry here pulls more tools than anywhere else. Demand shapes progress, not just follows it. Machines learn faster because needs grow sharper.

- Down south and east, automated production floors are spreading fast. National programs there have helped speed things up. New industrial zones in China light a fire under progress. India pushes forward with fresh sites popping up. Across Southeast Asia, activity climbs without pause.

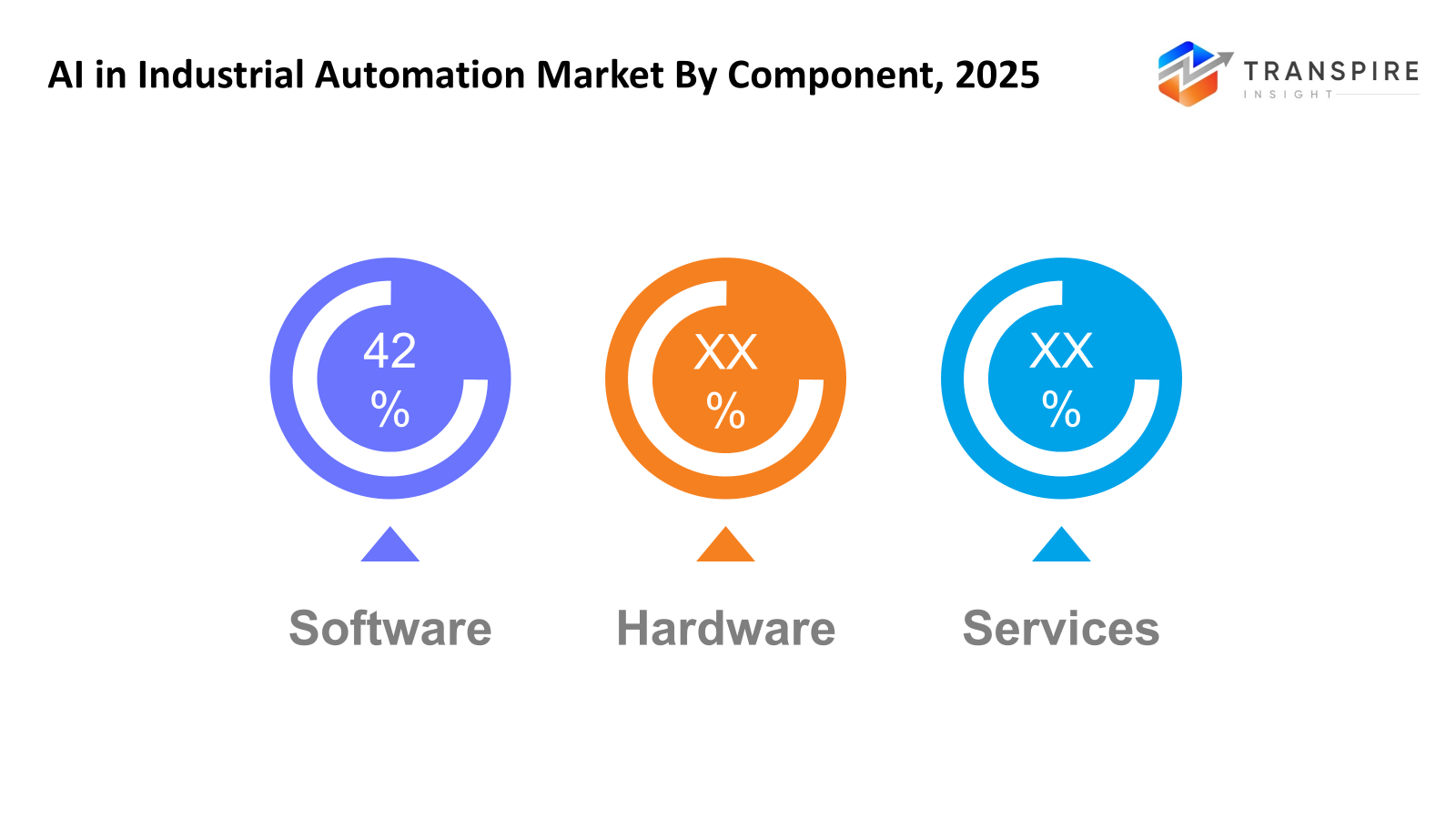

- Software shares approximately 44% in 2026. Fueled by demand for smarter workflows, software takes the lead among components. Industries turn to AI tools alongside data analysis, uncovering patterns once hidden. Automation gains depth when insight drives decisions; software makes that possible.

- Fueled by demand for smarter forecasts, Machine Learning takes the lead here. Real-time choices push it forward just as much as number-crunching predictions do. Its grip on pattern spotting keeps it ahead of alternatives. Speed meets insight, making it stick around at the top. What sets it apart is not flash, but staying power through usefulness.

- Manufacturers lean on AI, pushing predictive maintenance ahead of other uses. Downtime shrinks when smart systems spot issues early. Savings grow not just from fewer breakdowns but from smarter scheduling too.

- Fueled by spending on smart machines and self-running production lines, cars still lead the pack when it comes to AI use. They are busy building vehicles.

Outside the usual trends, machines now think smarter inside factories. Because systems learn faster, production lines move without old delays. When software watches every step, mistakes drop while output climbs. Machines talk to one another through hidden signals across floors. With live feedback, adjustments happen before problems grow. Instead of waiting, responses come mid-action. Factories once stiff now shift on their own. Intelligence built into tools reshapes how things get made.

Need for smarter upkeep, smoother workflows, and quick fault spotting drives tech use in factories. Because machines learn patterns, they now watch how gear runs, spot flaws early, and make choices on their own. These tools rely heavily on programs that run analysis systems, smart models, and virtual copies of real setups using existing gear. So it turns out software takes up much more space in today’s market.

Because machines now predict their own failures, factories keep running without surprise stops. Cars, chips, medicines, and fuel plants pour money into smart robots that handle tricky assembly lines. These systems stick around longer when software spots problems early. Watch how fewer workers get exposed to danger while power bills shrink, too.

North America holds the top spot in artificial intelligence for factory automation, thanks to its quick embrace of modern production tech, heavy spending on research, backed by big names in AI and automated systems. Leading that charge is the United States, where industries like car making, aircraft, and electronics push widespread use of intelligent machines. Not far behind, Asia Pacific gains speed faster than anywhere else, fueled by rising factories, national pushes for smarter plants, along with booming industrial zones scattered through China, India, Japan, and parts of Southeast Asia.

AI in Industrial Automation Market Segmentation

By Component

- Hardware

Fitted with robotic arms, detection units, and factory equipment that run automated tasks powered by artificial intelligence.

- Software

Running on code, these systems handle data through smart algorithms tailored to factory workflows. Machines learn patterns using programs built for heavy-duty tasks. Tools inside watch performance while adjusting outputs quietly behind the scenes.

- Services

From idea to rollout, help shapes how smart tools work in daily tasks. One step at a time, guidance fits each stage of building automated systems. When setups run into snags, fixes come through steady upkeep. Support stays close if questions pop up later on.

To learn more about this report, Download Free Sample Report

By Technology

- Machine Learning

Learning by machines helps forecast outcomes, improve workflows smart choices. What happens next gets clearer when systems adapt through experience, adjusting steps along the way. Decisions gain support from patterns found in data, quietly shaping results without fanfare.

- Computer Vision

Finding flaws becomes easier when machines see like humans do, yet through digital eyes that never blink. Quality checks happen faster since cameras spot what people might miss during long shifts. Inspection runs without pause because the software keeps working the same way every second.

- Natural Language Processing

Understanding spoken words helps machines respond as a person would. Voice controls work because computers make sense of speech patterns. Talking to devices becomes possible through smart analysis of sound. Machines learn meaning by breaking down how people express thoughts. Reading between the lines happens when systems track word choices and flow.

- Predictive & Prescriptive Analytics

With predictive and prescriptive analytics, machines learn when parts might fail. Production lines adjust before issues arise. These tools shape decisions using patterns found in daily operations. Instead of waiting, systems act ahead of time. Efficiency grows because delays shrink. Actions follow data, not guesses.

By Application

- Predictive Maintenance

Faults show up less often when machines get checked before breaking. Machines last longer if you watch how they act over time.

- Process Automation

Automates repetitive and labor-intensive manufacturing tasks.

- Quality Control & Inspection

When it comes to checking quality, spotting flaws gets easier with careful review. Standards stay consistent because each piece is looked at closely. Mistakes show up faster when attention shifts to detail. Seeing things clearly helps keep performance steady. A second look often reveals what was missed before.

- Supply Chain & Inventory Management

Stock flows improve when tracking meets smart forecasts. Moving goods gets smoother with updated routes. Making product lines up better with real demand shifts.

- Production Planning & Optimization

By using information to guide choices, production planning boosts how well things run while increasing results. Efficiency grows when decisions rely on clear insights instead of guesses. Output levels rise as systems adapt based on what the numbers show. The whole process works more smoothly once patterns emerge from solid data tracking.

By End-Users

- Automotive

Robots on factory floors learn as they go, thanks to smart software that adapts. Machines line up parts without help because systems see what needs doing. Over time, equipment warns before breaking - patterns show stress early. This keeps production moving, even when things wear down.

- Electronics & Semiconductors

AI steps in where tiny errors matter most. Manufacturing finds sharper results when machines learn patterns. Flaws show up more easily through smart systems that watch every move. Seeing is believing, especially with circuits too small for eyes. Precision gets a boost not from hands but from algorithms trained well.

- Food & Beverages

From farm to table, machines now handle tasks once done by hand. Alongside human workers, smart systems watch over freshness and consistency. Instead of guesswork, data guides decisions across distribution networks. Through sensors and algorithms, every batch gets checked without delay. Behind the scenes, patterns in delivery times get adjusted automatically. With constant feedback, adjustments happen before problems grow.

- Oil & Gas

Fuel drills run smoother when smart systems spot trouble before it happens. Safety checks stay sharp through constant digital watching. Machines work better because learning algorithms adjust on their own.

- Pharmaceutical & Chemicals

AI helps manage how drugs and chemicals are made, checks product standards, while also meeting legal rules.

- Metals & Mining

Out in mines, machines get watched by smart systems that catch problems before they grow. When tools start acting odd, alerts pop up - thanks to patterns spotted ahead of time. Efficiency climbs because workflows adapt on their own, moment to moment. Instead of waiting for breakdowns, fixes happen just in time, guided by data trails.

- Others

Textiles, packaging, or logistics each now uses AI to handle tasks faster. Machines learn routines once done by people. Efficiency shifts where humans used to decide. Workflows change without loud announcements. Small updates add up over time. Automation slips into places you might not expect first. Systems adapt quietly, step after step.

Regional Insights

It starts up north, where machines learn fast. This part of the world already runs deep with smart systems tucked into factories. Progress moves quickly here because labs keep testing new ideas. Factories in the United States stand out, using learning algorithms to spot machine failures before they happen. Think robots that adapt, lines that optimize themselves. Car makers, plane builders, tech producers, they all lean on these tools now. Digital upgrades are not rare; they are routine. When coders team up with plant managers, things shift faster. Growth feeds itself when knowledge flows like this.

Not far behind, Europe keeps pace in the AI-driven industrial shift thanks to strong factory bases in nations like Germany, the United Kingdom, France, and Italy. Thanks to pushes toward smarter factories - part of broader Industry 4.0 moves AI tools now help meet strict rules while chasing greener operations. Energy use gets sharper, inspections grow more precise, lines adapt faster, all aided by artificial intelligence stepping into older setups. Firms across the continent turn to these systems not just to keep up, but to stay ahead as automated workflows gain ground steadily.

Not far behind, the Asia Pacific races ahead factories spread wide across China, India, Japan, and Southeast nations, pulling momentum forward. Government pushes for smarter production lines add fuel, while heavy industry presence gives weight to its rise. Beyond chips and gadgets, cars and everyday items now lean on artificial intelligence more each year. New spending flows into digital tools, helping systems learn, adapt, and leave old methods behind. Farther out, Latin lands start tuning machines to think sharper, work longer without fault. Across deserts and cities in Africa and the Middle East, signals show change, too, as a slow but sure climb begins. Factories there eye better output, find help in software that predicts breakdowns before they happen. Rising funds go toward tech upgrades, not just for status, but survival amid global shifts.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 6, 2026 – Siemens unveiled technologies to accelerate the industrial AI revolution at CES 2026.

- January 6, 2026 – Siemens and NVIDIA expand partnership to build the industrial AI building system.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 14.50 Billion |

|

Market size value in 2026 |

USD 18.00 Billion |

|

Revenue forecast in 2033 |

USD 72.50 Billion |

|

Growth rate |

CAGR of 21.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Siemens AG, ABB Ltd., Rockwell Automation, Schneider Electric SE, Honeywell International Inc., General Electric Company, Mitsubishi Electric Corporation, Bosch Rexroth AG, KUKA AG, Yaskawa Electric Corporation, FANUC Corporation, Omron Corporation, IBM Corporation, Intel Corporation, SAP SE, Universal Robots A/S, and Emerson Electric Co |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Hardware, Software, Services), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Predictive & Prescriptive Analytics), By Application (Predictive Maintenance, Process Automation, Quality Control & Inspection, Supply Chain & Inventory Management, Production Planning & Optimization), By End-Users (Automotive, Electronics & Semiconductors, Food & Beverages, Oil & Gas, Pharmaceuticals & Chemicals, Metal & Mining, Others), |

Key AI in Industrial Automation Company Insights

A powerhouse in tech, Siemens AG shapes how machines think and act across factories everywhere. Its toolkit covers everything from automated controls to digital support services that keep industries running smoothly. Through MindSphere, an online network for devices, plus clever data analysis powered by artificial intelligence, it spots issues before they grow. Smarter upkeep routines emerge, alongside better output on assembly lines. Merging intelligent robots with live feedback loops and machine brains makes modern plants more responsive. Such setups thrive in car manufacturing, power systems, and electronic goods production. Across continents, fresh ideas take form thanks to collaborations and relentless upgrades behind the scenes. Progress rolls forward because of steady groundwork, not flash or noise.

Key AI in Industrial Automation Companies:

- Siemens AG

- ABB Ltd.

- Rockwell Automation

- Schneider Electric SE

- Honeywell International Inc.

- General Electric Company

- Mitsubishi Electric Corporation

- Bosch Rexroth AG

- KUKA AG

- Yaskawa Electric Corporation

- FANUC Corporation

- Omron Corporation

- IBM Corporation

- Intel Corporation

- SAP SE

- Universal Robots

- Emerson Electric Co

Global AI in Industrial Automation Market Report Segmentation

By Component

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing

- Predictive & Prescriptive Analytics

By Application

- Predictive Maintenance

- Process Automation

- Quality Control & Inspection

- Supply Chain & Inventory Management

- Production Planning & Optimization

By End-Users

- Automotive

- Electronics & Semiconductors

- Food & Beverages

- Oil & Gas

- Pharmaceuticals & Chemicals

- Metal & Mining

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636