Market Summary

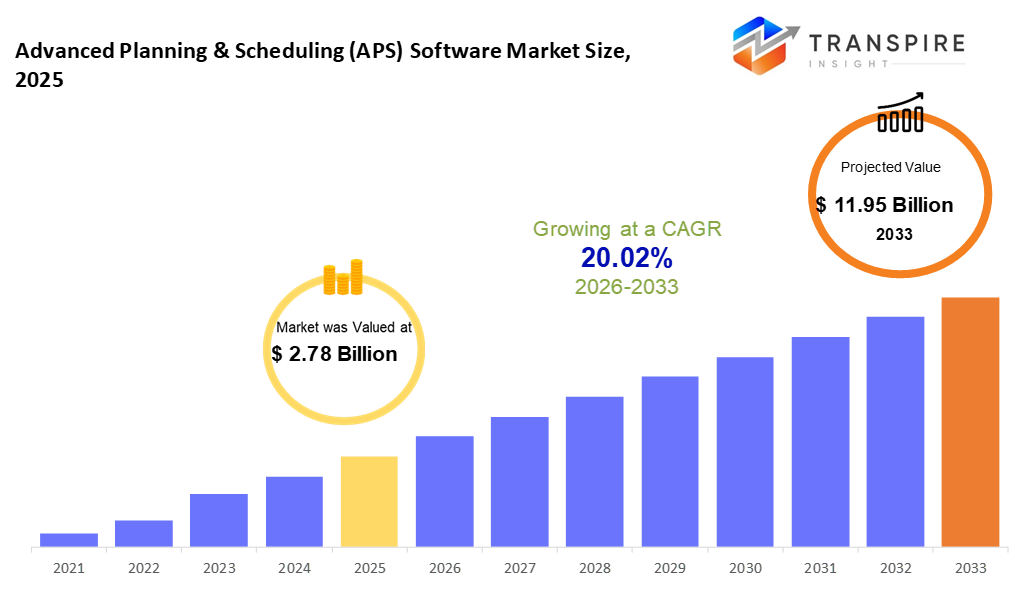

The global Advanced Planning and Scheduling (APS) Software market size was valued at USD 2.78 billion in 2025 and is projected to reach USD 11.05 billion by 2033, growing at a CAGR of 20.02% from 2026 to 2033. The strong growth of the Advanced Planning and Scheduling (APS) Software market is driven by increasing supply chain complexity and the need for real-time, data-driven production and demand planning. Rapid adoption of cloud-based platforms, AI-enabled analytics, and Industry 4.0 initiatives is accelerating enterprise investment in advanced planning and scheduling solutions.

Market Size & Forecast

- 2025 Market Size: USD 2.78 Billion

- 2033 Projected Market Size: USD 11.05 Billion

- CAGR (2026-2033): 20.02%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 36% in 2026. Fueled by the broad use of modern planning systems, North America dominates the APS landscape. Digital shifts in various sectors push progress here more than elsewhere. Industry-wide upgrades help keep this region ahead. Momentum builds as companies embrace new methods. Tools evolve alongside changing needs. Growth follows where technology takes root first.

- Still on top, the United States holds its place as the biggest market nationwide. Strong activity in making goods helps fuel adoption across stores and tech firms. Cloud-powered planning tools are seeing steady uptake thanks to consistent spending. Growth continues, driven largely by companies upgrading how they manage supply chains.

- Fueled by swift factory growth, the Asia Pacific surges ahead. Manufacturing centers are spread widely across its landscape. Technology reshapes how goods move here faster, smarter. Growth does not slow; it builds momentum from within.

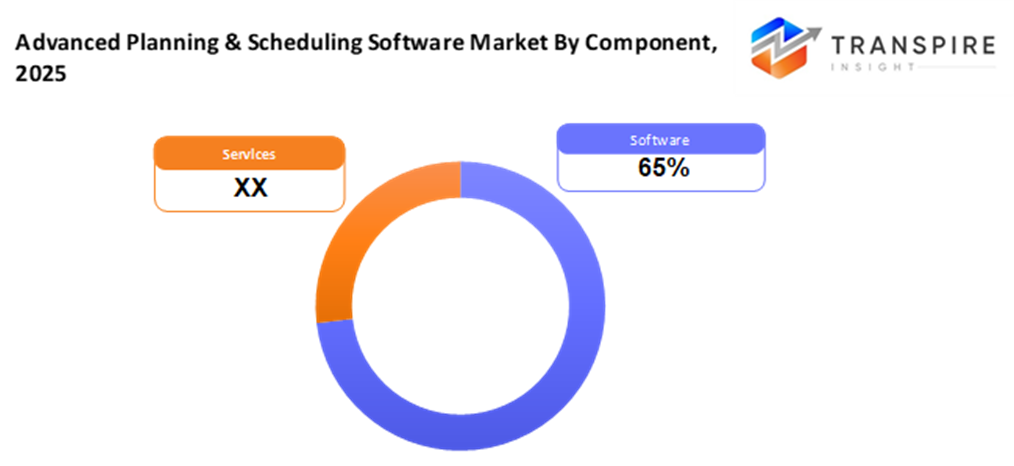

- Software shares approximately 68% in 2026. Software takes the lead, thanks to companies adopting smarter APS systems that boost how they see and manage supply chains on the fly.

- Now showing up more often, cloud-based setups offer room to grow without big initial spending. Access from different locations adds to their appeal. What stands out is how easily they adjust as needs change.

- Faster than others, Demand Planning leads because businesses want better predictions when shortages hit. Staying ahead of delays that shake up deliveries.

- Fueled by demands in production planning, factories lead the way in uptake. Their push comes from tighter control over materials and timing.

Now shaping up fast, the Advanced Planning and Scheduling (APS) Software market meets growing demands for smoother production flow, clearer supply tracking, while boosting responsiveness across operations. With pressure rising, companies turn to APS tools that map out workflows, factoring in limits like workforce size, raw material access, machine output, and shifts in customer needs. Once seen as just another backend helper, these systems now take center stage when disruptions strike unpredictable notes into logistics networks worldwide.

Pressure to deliver faster, hold less stock, and cut expenses. Shifting customer needs and shaky supply chains play a big role, too. These challenges make guessing demand the right way harder than before. Better coordination between making goods and actual orders matters now more than ever. With APS, decisions rely on facts pulled from live information. This helps teams adjust quickly when markets shift or buyers change their minds.

Out in today's scene, tools like cloud-powered APS setups, smart number-crunching through artificial intelligence, alongside live data syncing are quietly redefining what stands out. Instead of working solo, current APS tools now link tightly with ERP, factory-level tracking systems, and logistics networks, stretching planning across entire operations. Moving things online via cloud models opens doors wider: handling growth gets easier, reaching the system feels smoother, spending less becomes possible, and pulling interest from big corporations down to smaller teams alike.

Change sweeps through the APS software world as old-school planning tools give way to smarter, self-learning systems. Instead of just basic functions, today’s versions predict outcomes and adapt automatically. Companies building these tools now prioritize clean designs, faster problem-solving math, and tailored fits for specific industries. Because factories, food makers, drug producers, and stores push harder into digital upgrades, demand grows for planning tech that responds quickly. Resilience strengthens, operations run smoother, and competition shifts when such software takes root in worldwide supply networks.

Advanced Planning and Scheduling (APS) Software Market Segmentation

By Component

- Software

Running behind the scenes, these systems handle live updates to production plans while balancing what’s needed with available supplies. Instead of guessing, they adjust forecasts as conditions shift throughout the network. By linking orders to materials, timing gets sharper without constant manual input. Efficiency rises when machines, people, and timelines align automatically through shared data flows.

- Services

Starting, there is setup help to get systems running smoothly. Moving on, pieces are connected so they work together without hiccups. Experts give advice tailored to specific needs along the way. Learning sessions build confidence in using the tools properly. Lastly, assistance continues after launch to keep things on track.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- On-Premises

Some companies stick to on-premises setups when they want a tighter grip on their data. Internal control matters most for these teams. Custom workflows fit better here than elsewhere. Security needs often drive this choice. Planning stays within company walls with this approach.

- Cloud-Based

Working online means systems can grow easily, adapt quickly, allow access from anywhere, cost less at the start, so many groups are shifting their tech now, and choosing it.

By Planning Type

- Production Planning

Starting with how things get made, production planning lines up when stuff gets built. It moves materials where they need to go just before they are needed. This keeps machines running instead of waiting around. Smooth movement on the floor means fewer holdups during work hours. The goal shows up in steady output without hiccups along the way.

- Demand Planning

Starting with past numbers, this process guesses what buyers will want next. It shapes how much gets made, based on patterns found in old records. Production levels shift when predictions change. Looking ahead begins by studying what already happened. Decisions rely heavily on trends pulled from earlier sales.

- Supply Planning

Fresh stock shows up when needed because someone lines up suppliers, storage, and transport. Timing stays on track through careful coordination of movement and resources. Materials arrive where they should just before they are used. Movement from factory to shelf follows a quiet rhythm most never notice.

- Capacity Planning

Ahead of busy seasons, teams check how much work they can handle. Matching people, machines, and tools to what needs making keeps things steady. When demand shifts, adjusting schedules avoids delays. Too few staff cause bottlenecks; too many idle hands waste time. Predicting output means fewer surprises later on.

By End-Users

- Manufacturing

Manufacturing firms rely on APS systems to handle intricate workflows. Efficiency gets a boost when production timelines shrink. Smarter planning often follows from better tools. Complex tasks become easier to track over time.

- Food & Beverages

That system handles timing, freshness tracking, plus how much to make based on what people actually order. Freshness matters when supply meets appetite.

- Pharmaceutical & Life Sciences

Starting strong with drug makers who need tight control, APS steps in to handle batch schedules that meet rules. Tracking every piece from start to finish becomes doable when systems link up early. Production runs smoother once timing gets fine-tuned behind the scenes.

- Retail & Consumer Goods

Shoppers and stores rely on APS to guess what will sell better. Getting stock levels right happens more often because of smarter number crunching. Delivery routes adjust smoothly when needs shift across regions.

- Others

Some sectors, like chemical production, power supply, and freight movement, are aiming for sharper scheduling and better use of available assets.

Regional Insights

Over here in North America, you see the biggest chunk of the APS software scene take shape. That comes down to how fast companies in manufacturing, retail, and processing are jumping on digital upgrades and smart factory tools. The United States leads that push, no surprise, with big-name APS providers setting up shop, solid tech networks already running, and plenty of large firms pouring money into smoother operations and better output tracking. A clear move toward cloud-powered APS systems, thanks to their ability to grow with demand and keep teams synced live.

A big push for better factories drives APS use across Europe. Tough rules on making things keep pressure high in industries like food and drink. Germany, the United Kingdom, and France stand out they already have strong industry networks. These places lean into digital upgrades that link planning tools with existing software. Efficiency matters more now, so plants connect systems to save time. Compliance becomes easier when data flows without delays. Machines, schedules, and orders work together through smarter setups. Old ways give way where precision counts most. Progress shows up in how fast teams respond to changes. Smooth operations come from linking what happens on floors with back-end plans. Factories stay sharp by reducing waste bit by bit. New methods replace outdated routines step by step.

Growth surges across the Asia Pacific thanks to fast-moving factories and tech uptake in nations such as China, India, Japan, and South Korea. Driven by a need to stay ahead, smaller businesses there now lean more on APS tools. Moving beyond that area, Latin America sees slow but sure gains as companies begin using APS systems. In the Middle East and Africa, similar patterns emerge - firms adjust their output plans while managing shifting customer needs. Supply networks get smarter as software helps fine-tune operations. New doors open for providers willing to step into these evolving landscapes.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 20, 2025 – Strangeworks acquired Quantagonia to create a global leader in applied AI, optimization, and quantum computing

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.78 Billion |

|

Market size value in 2026 |

USD 3.09 Billion |

|

Revenue forecast in 2033 |

USD 20.02 Billion |

|

Growth rate |

CAGR of 20.02% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

SAP SE, Acumatica, Oracle Corporation, Infor, Microsoft Corporation, Kinaxis Inc., Blue Yonder, Dassault Systèmes, IFS AB, QAD, Epicor, Syncron Tech, Siemens, OptiProERP, Asprova, ORSOFT, and Nexelem. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Software, Services) By Deployment Mode(On-Premises, Cloud-Based) By Planning Type (Production Planning, Demand Planning, Supply Planning, Capacity Planning) By End-Users (Manufacturing, Food & Beverages, Pharmaceutical & Life Sciences, Retail & Consumer Goods, Others) |

Key Advanced Planning and Scheduling (APS) Software Company Insights

Big companies turn to SAP SE when they need powerful software for managing business operations around the world. Instead of just linking tools together, SAP builds them into one system - seen in SCM and S/4HANA that handles complex planning tasks. These tools adjust factory timetables on the fly, balance what customers want with what factories can deliver, while squeezing more value out of available resources through live data views. With offices everywhere, hands-on knowledge across sectors, and a wide web of collaborators, SAP fits well within big industrial, retail, and production firms. New upgrades using smart algorithms, pattern recognition, and online-hosted systems keep its forecasting sharp, giving full sight across every stage of moving goods from start to finish.

Key Advanced Planning and Scheduling (APS) Software Companies:

- SAP SE

- Acumatica

- Oracle Corporation

- Infor

- Microsoft Corporation

- Kinaxis Inc.

- Blue Yonder

- Dassault Systèmes

- IFS AB

- QAD

- Epicor

- Syncron Tech

- Siemens

- OptiProERP

- Asprova

- ORSOFT

Global Advanced Planning and Scheduling (APS) Software Market Report Segmentation

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Planning Type

- Production Planning

- Demand Planning

- Supply Planning

- Capacity Planning

By End-Users

- Manufacturing

- Food & Beverages

- Pharmaceutical & Life Sciences

- Retail & Consumer Goods

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Software_Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636