Market Summary

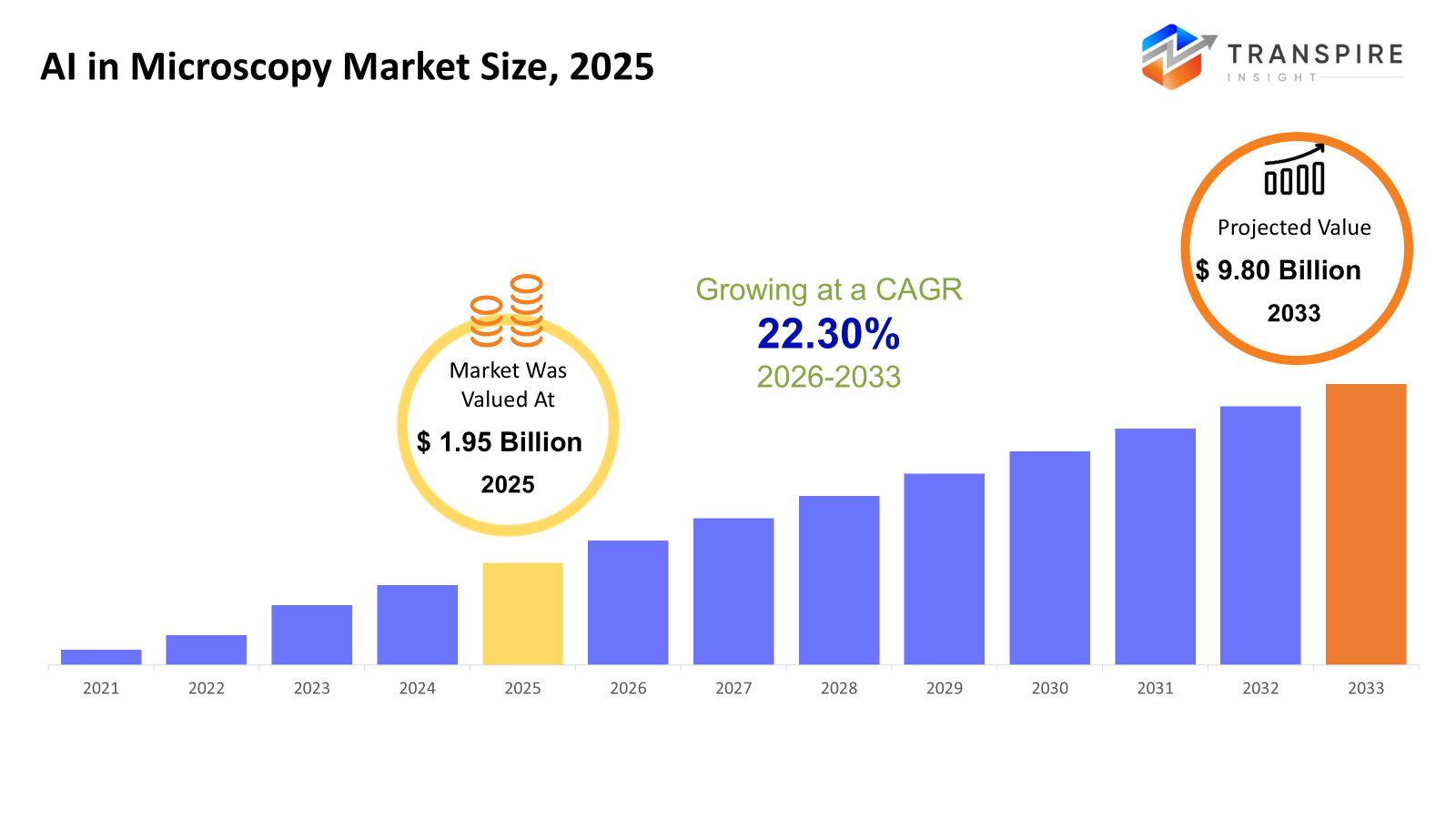

The global AI in Microscopy market size was valued at USD 1.95 billion in 2025 and is projected to reach USD 9.80 billion by 2033, growing at a CAGR of 22.30% from 2026 to 2033. Speedy expansion in the worldwide AI-driven microscopy sector comes from a stronger need for sharp imaging along with automatic evaluation across biology, materials study, and medical labs. With artificial intelligence built in, pictures get analyzed quicker, mistakes drop, results grow more reliable, making studies move faster. More funding flowing into health-related investigations, medicine development, plus cutting-edge detection methods pushes more labs to take up smart microscope tools.

Market Size & Forecast

- 2025 Market Size: USD 1.95 Billion

- 2033 Projected Market Size: USD 9.80 Billion

- CAGR (2026-2033): 22.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 45% in 2026. Fueled by cutting-edge labs and solid financial backing, North America keeps a leading position. Early embrace of artificial intelligence in lab settings pushes its edge further. What stands out is how quickly new tools get put to work there. Progress thrives where support meets innovation. That mix shapes much of today’s landscape.

- First out front, the United States holds the top position here because research gets serious funding. Big names in artificial intelligence and microscope tech call this place home. Close ties between labs and learning centers make progress move faster.

- A burst of growth lights up Asia Pacific, where labs push forward, and chip production climbs. New imaging tools powered by artificial intelligence find their way into daily use across China, Japan, and South Korea. Research gains momentum here, feeding progress in tech and industry alike. Momentum builds quietly but steadily through investment and innovation side by side.

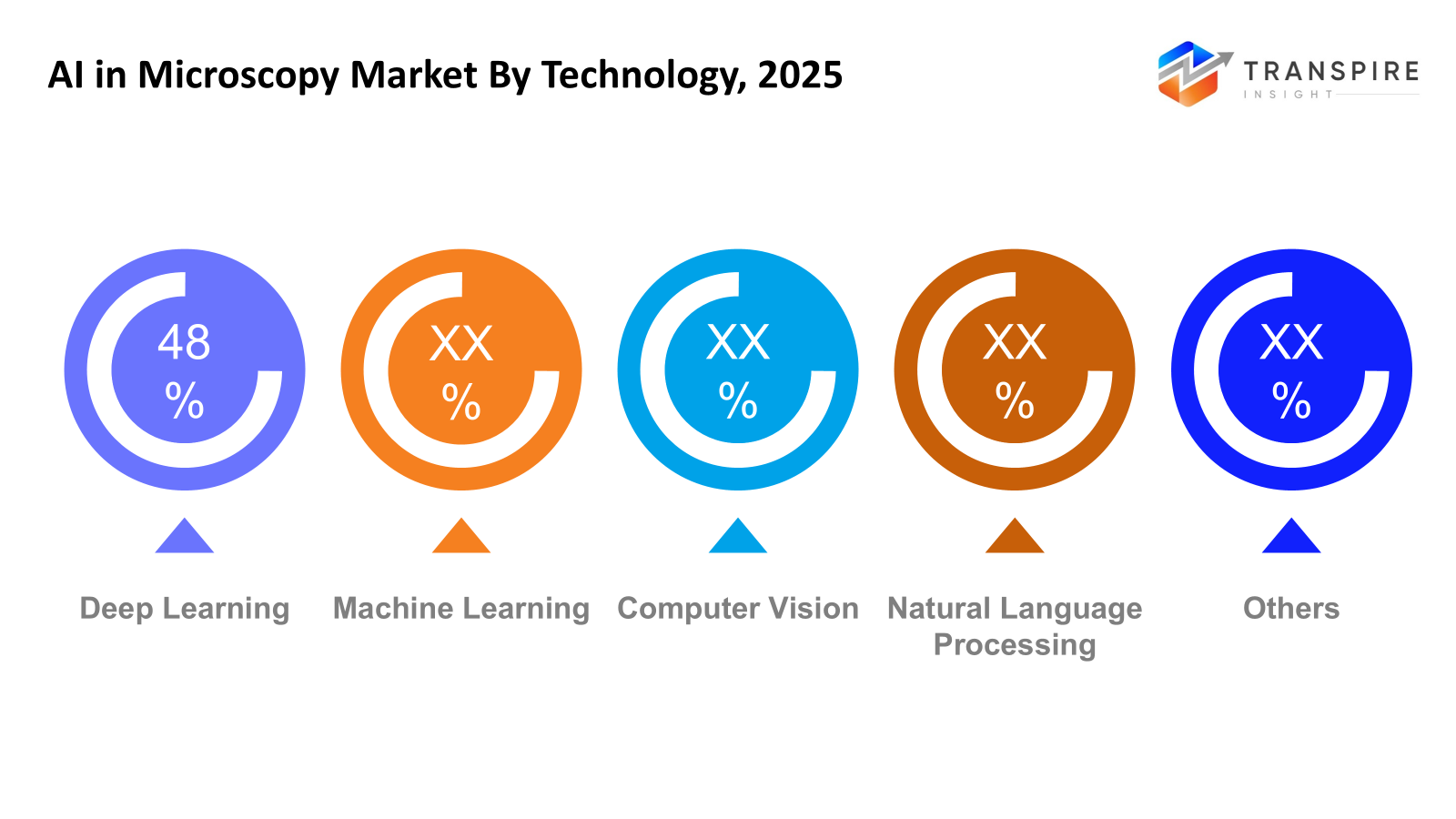

- Deep Learning shares approximately 52% in 2026. Deep learning takes the lead; its strength shows when spotting patterns, sorting out pixel details, or making sense of messy microscope outputs. What pushes it ahead is how precisely it handles visuals and intricate datasets that others struggle with. Performance like that keeps it at the front, especially where fine distinctions matter most.

- A single method stands out when you look at tools under the lens; optical microscopy takes the lead. Thanks to AI weaving into everyday lab tasks, it shows up heavily in studies of living cells. Work in medical labs leans on it too, making it a go-to choice across biology. Smarter software now works hand-in-hand with standard scopes.

- Most of the value sits in software, because smart functions like spotting patterns in images come alive inside complex programs that handle information. Tools that read visuals deeply while managing loads of data push software ahead of everything else.

- Holding top spot, academic and research institutes drive demand because artificial intelligence in microscopes supports work across biology, materials study, and foundational experiments

A wave of change sweeps through microscope labs now that smart software steps in where humans once spent hours staring at slides. Instead of relying only on tired eyes, machines scan images faster, spotting shapes and shifts with steady precision. Outcomes grow more reliable when algorithms handle repetitive tasks, leaving researchers free to explore deeper questions. Speed climbs while mistakes drop across biology labs, factories checking materials, and even university experiments everywhere microscopes work, results come quicker.

Picture clarity, sorting parts, pulling out details, deep learning, plus eyesight tech tackle tough microscope shots. Machines now run programs that manage tons of visuals spat out by today’s microscopes. Not just one method thrives; optical scopes and electron types both gain sharpness through smart code. Precision work leans on these tools where tiny structures demand exact reading.

More colleges and labs now use AI-powered microscopes to dig into living cells, tiny materials, or new tech at the nano level. Big pharma outfits tap these tools too - peeking into how drugs behave, checking harmful effects, studying cell reactions. Hospitals and testing centers are bringing them into daily work, using smart scopes to spot illnesses, guide treatments, and examine tissue signs. Growing trust in such systems keeps their presence rising across medical practice.

Nowhere is progress faster than in wealthy nations, where labs run on deep science networks, steady money flows, plus a head start with smart machines watching through microscopes. Elsewhere, new players catch up fast, cash pours into lab work, chip plants, and health systems, pulling them closer. Step by step, sharper code, better cameras, smoother programs link together, pushing artificial brains deeper into tiny worlds. Each leap opens another door.

AI in Microscopy Market Segmentation

By Technology

- Machine Learning

From spotting patterns to sorting images, machines learn tasks once done by hand. Microscopes now pair with smart systems that recognize details without constant guidance. These tools adapt, improving each time they examine a new sample. Instead of fixed rules, they build understanding through repeated exposure. What once took hours can happen in moments, quietly, behind screens.

- Deep Learning

Starting with deep learning, computers can spot tiny details in microscope images more accurately. Instead of guessing, they learn patterns through repeated examples. These systems break down complicated visuals into clear parts. Because of this training, identifying shapes becomes far easier. They pull out key pieces without needing step-by-step rules.

- Computer Vision

Picture analysis runs live on tiny visuals, spotting items while sharpening clarity. A steady flow handles detail work without delay, linking detection to improved output. Sharpness grows as parts emerge clearly, frame by frame. Systems track small forms the moment they appear, boosting precision through constant updates. Clarity shifts happen alongside recognition, layer after layer.

- Natural Language Processing

From understanding text to sorting lab findings, it links microscope outputs directly into study records through smart reading tools.

- Others

Hybrid methods pop up here, mixing new AI tricks made just for tough imaging jobs. These approaches adapt on the fly, fitting into complex microscope routines without fuss. Some blend old logic with fresh learning models, others shift shape depending on data flow. Each one adjusts itself quietly behind the scenes during analysis.

To learn more about this report, Download Free Sample Report

By Microscopy Type

- Optical Microscopy

Picture-taking through lenses often pairs with smart software to study living cells up close during everyday lab work. Sometimes it tracks movement in real time instead of just snapping stills.

- Electron Microscopy

A fresh look at tiny details comes through electron microscopy, where smart software digs into sharp pictures. This mix helps spot patterns in materials, plus life forms, down to the smallest piece. Machines learn what to see, making sense of complex shapes in samples. Work like this pushes how deeply we can explore matter and living cells alike.

- Scanning Probe Microscopy

Fine details on tiny surfaces come clearer when smart software steps in. Hidden flaws pop into view through pattern-learning tricks instead of manual checks. Machines now spot what once required sharp eyes and hours of work.

- Super-Resolution Microscopy

A fresh look at tiny details emerges when smart algorithms step in. Picture clarity jumps past old barriers once thought fixed. Machines learn patterns, then sharpen what eyes cannot see. Fine structures appear clearer, thanks to computed guesswork trained on data. Old microscope rules fade a bit more each day.

By Component

- Software

Most artificial intelligence runs on software that breaks down visuals and handles information. It’s everywhere now, quietly shaping how systems see and sort things. Think of it like a brain inside machines, learning patterns without needing words. This kind of tech is not flashy, yet it powers everything from scans to smart decisions behind screens.

- Hardware

Cameras that use artificial intelligence work alongside sensors, linking up with microscopes. These tools connect through computing parts built right into the system. Intelligence inside the hardware helps capture details during imaging tasks. Processing units handle data while the microscope operates. Sensors respond to changes, feeding information back instantly. Each piece fits together so the whole setup functions smoothly.

- Services

Support rolls out across four areas systems get tied together smoothly. Training walks new users through each step without rushing. Maintenance keeps everything running on schedule, no surprises. Data analysis offers clear help when numbers need sense made of them.

By End-Users

- Academic Research Institutes

From labs tucked inside universities to quiet research centers, work in biology, chemistry, and materials takes shape. Where experiments unfold slowly, these places form the backbone of long-term study. Though often overlooked, their role shapes how science moves forward. Each discovery begins with a question raised in such settings. Progress here does not shout; instead, it builds, step by unnoticed step.

- Pharmaceutical & Biotechnology Companies

Some labs in pharma and biotech now rely on AI-powered microscopes to spot how drugs behave inside cells. Instead of just watching cell reactions by eye, machines help track changes faster. These tools map out toxic effects early, which shifts how teams decide what compounds to keep. Image-based data guides decisions about which molecules move forward. Scientists gain clearer views into biological responses without waiting weeks for results.

- Hospital & Diagnostic Laboratories

Microscopy gets a boost in hospitals when smart systems step in. Labs spot illnesses faster once artificial intelligence joins the view. Clearer images emerge where digital eyes support human ones. Detection sharpens, not because of machines alone, but through careful pairing of tech and expertise. Pathology evolves quietly when tools learn patterns beyond sight.

- Semiconductor & Electronics Manufacturer

Microscopes powered by artificial intelligence help chip makers spot tiny flaws. Quality checks become faster when machines learn what errors look like. Tiny details at microscopic levels get reviewed with precision tools. Instead of manual scans, smart systems highlight irregularities early. Production lines run more smoothly because problems show up sooner.

Regional Insights

Home to top-tier labs and deep investment in both biology and materials studies, North America holds the edge in AI-driven microscopy. Because universities team up with tech firms and hospitals, progress moves fast here. New tools powered by machine learning spread quickly across labs focused on medicine, finding new drugs, or checking tiny circuits. Early trust in smart software gives the area a steady push forward. Demand grows steadily as more fields rely on sharp, automated imaging.

Steady progress marks Europe's market, fueled by deep roots in academic exploration, solid health networks, and one step at a time embracing automated lab processes. Quality in study outcomes matters greatly here; precision in findings stands out, and following rules closely opens doors to using smart imaging tools in medicine and materials. Into sharper views, nations lean toward artificial intelligence, boosting super-detailed and electron-based scopes. Momentum builds quietly, guided by curiosity paired with practical needs across labs on the continent.

Out here, the Asia Pacific leads in growth pace. Rising R&D spending lights a spark. Semiconductor production spreads wider there, too. On top of that, AI finds more uses in health and factory settings every month. Take China, Japan, or South Korea; these places now link AI tightly with microscope tools. Clearer images come out. Work moves faster. Down south, Latin America inches forward. So do parts of Africa and the Middle East. Better labs help. Curiosity about smart analysis grows slowly. All these shifts add up across continents.

To learn more about this report, Download Free Sample Report

Recent Development News

- February 27, 2025 – Honeywell unveiled new technology using artificial intelligence to speed up and simplify healthcare testing.

- July 5, 2024 – Medprime Technologies launched AI-Integrated digital microscopy platform Micalys.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.95 Billion |

|

Market size value in 2026 |

USD 2.40 Billion |

|

Revenue forecast in 2033 |

USD 9.80 Billion |

|

Growth rate |

CAGR of 22.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Terra Universal, Clean Air Products, Azbil Corporation, Getinge AB, Abtech, SKAN Group, Germfree Laboratories, Klenzaid, Bühler Group, Enbio, Heal Force, Nuaire, Air Techniques International, G-CON Manufacturing, Cleanroom Technology, AES Clean Technology, and PortaFab Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Machine Learning, Deep Learning, Computer Vision, Natural Language Processing, Other), By Microscopy Type(Optical Microscopy, Electron Microscopy, Scanning Probe Microscopy, Super-Resolution Microscopy), By Component (Software, Hardware, Services), By End-Users (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Semiconductor & Electronics Manufacturers) |

Key AI in Microscopy Company Insights

One name stands out when it comes to artificial intelligence meeting microscope tech: Thermo Fisher Scientific. Their tools blend high-end microscopes with smart software that learns from images. Because of deep investments in R&D, their devices adapt quickly to complex tasks in real labs. Not limited to one field, these systems serve biologists, materials experts, and manufacturing teams alike. What sets them apart is not just hardware, but how seamlessly machines interpret what they see. Labs using their platforms often report sharper results in less time. Across universities, hospitals, and factories worldwide, demand stays steady for their intelligent imaging setups. Innovation drives every update, making old methods feel slow by comparison. Global reach helps them stay close to users needing precision at scale. In the evolving space where algorithms meet microscopic detail, they remain hard to ignore.

Key AI in Microscopy Companies:

- Thermo Fisher Scientific

- Carl Zeiss AG

- Leica Microsystems

- Olympus Corporation

- Bruker Corporation

- Oxford Instruments

- JEOL Ltd.

- Hitachi High-Tech Corporation

- Nikon Corporation

- FEI Company

- Andor Technology

- Hamamatsu Photonics

- TESCAN ORSAY HOLDING

- Gatan Inc.

- Digital Surf

- NanoFocus AG

- Intel Corporation

Global AI in Microscopy Market Report Segmentation

By Technology

- Machine Learning

- Deep Learning

- Computer Vision

- Natural Language Processing

- Other

By Microscopy Type

- Optical Microscopy

- Electron Microscopy

- Scanning Probe Microscopy

- Super-Resolution Microscopy

By Component

- Software

- Hardware

- Services

By End-Users

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Semiconductor & Electronics Manufacturers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636