Market Summary

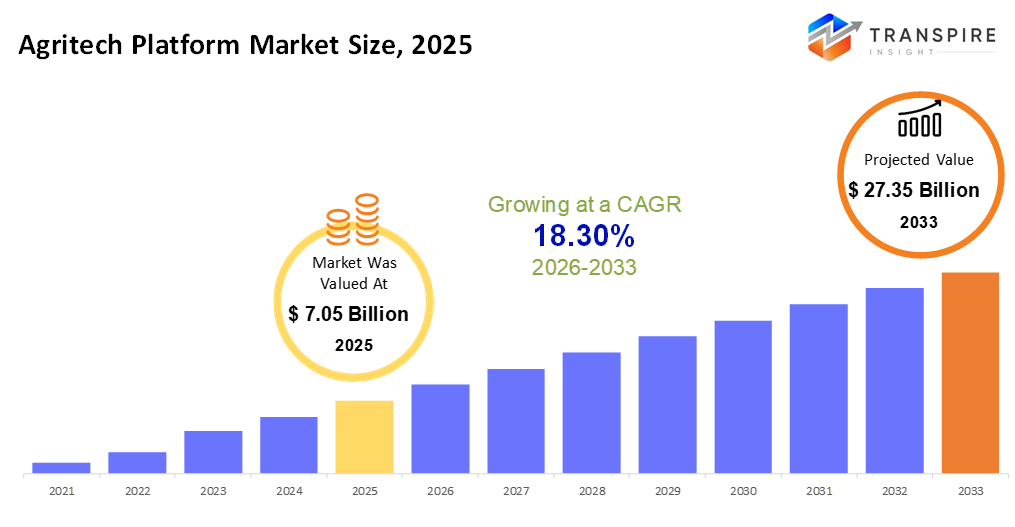

The global Agritech Platform market size was valued at USD 7.05 billion in 2025 and is projected to reach USD 27.35 billion by 2033, growing at a CAGR of 18.30% from 2026 to 2033. Farmers now lean more on digital tools because they help crops grow better and save time. As choices based on numbers become common, many turn to smart farming systems that track fields nonstop. Some governments back these changes with funding or programs worth pursuing. New tech keeps arriving, pushing how we check food origins and move it from soil to shelf. Growth follows where machines talk to each other, and records stay clear.

Market Size & Forecast

- 2025 Market Size: USD 7.05 Billion

- 2033 Projected Market Size: USD 27.35 Billion

- CAGR (2026-2033): 18.30%

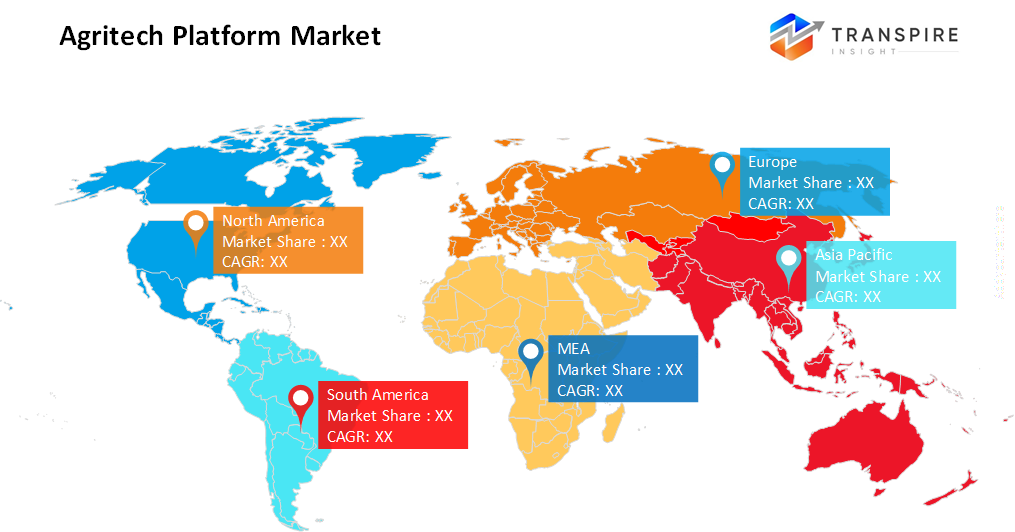

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 45% in 2026. Agritech platforms grow fastest across North America because farmers there rely heavily on precise farming methods. Digital networks cover most rural areas here, allowing smooth operations. Data tools work closely alongside internet-connected devices on many farms. This mix helps the region stay ahead in using new farm tech.

- Farm tech spreads fast in the United States, due to big agribusinesses adopting digital tools that streamline how crops and animals are managed. While data systems reshape daily operations, change moves quickly through key farming areas, and efficiency grows without slowing work. Not every method shifts at once, yet patterns emerge where numbers guide decisions more than before.

- Fueled by national tech pushes, parts of Asia and the Pacific are advancing more quickly than elsewhere. New tools find their way into big farms as well as tiny plots tended by families. Alongside this shift, concern grows about feeding people without harming nature.

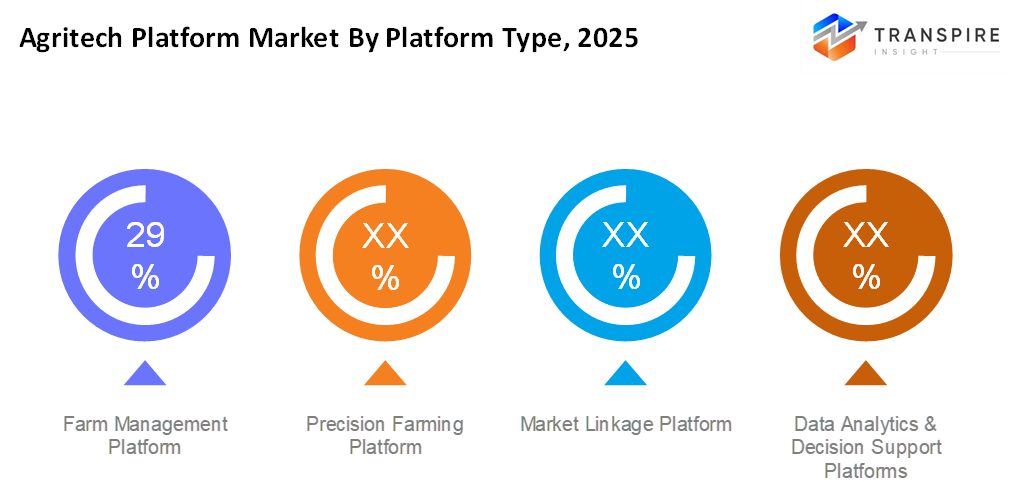

- Farm Management Platform shares approximately 30% in 2026. Farmers now lean toward management platforms because they help streamline daily tasks while sharpening choices in the field. These systems stand out by combining functions that lift overall output without extra effort.

- Software tools are leading the way. Real-time insights push adoption forward. Access through phones matters more every season. Decisions shaped by information define modern farming. Features that track, predict, and guide steer progress behind the scenes.

- Farm tracking grows quickest, powered by sky pictures from satellites plus smart number-crunching that shows exactly how crops are doing. Remote eyes in orbit feed data, helping spot issues early through pattern forecasts instead of guesses.

- Farms that are big or run for profit spend the most on tech tools simply because they operate at a size where high-end systems make sense. What pushes their buying is not just budget - it’s necessity shaped by vast acreage and tight margins.

Farms everywhere now tap into digital tools, reshaping how agriculture works from top to bottom. Instead of guesswork, real-time inputs guide planting, watering, and harvesting - thanks to smart gadgets in soil and sky. Data flows from drones circling above, sensors buried below, and satellites tracking change over time. One dashboard pulls it all together: moisture levels, weather shifts, and growth patterns appear clearly. With facts at hand, choices become sharper, less waste shows up, and more crop comes out. Even small plots gain precision once reserved for large estates. Outcomes shift quietly but surely toward better results with fewer missteps.

Precision farming tools let growers watch plant growth, ground quality, and weather shifts as they happen. Because of that, actions can be taken early, supplies go exactly where needed, and schedules improve yield climbs without wasting materials. On animal fronts, digital systems keep tabs on herd wellness, mating cycles, and milk output, so every part of the land works more smoothly than before.

Farmers find it easier to reach markets when tech platforms link them straight to buyers, cutting out middle steps. Moving goods becomes smoother because shipping companies join the same networks, too. Prices show up clearly, so deals feel more honest for everyone involved. When money tools like loans or coverage are built into these systems, handling daily work gets less risky. Stability grows quietly behind the scenes, simply by having everything connected.

Fueled by a push for farming that lasts, demand keeps rising. With support from governments and science teams, new tech moves into fields helping meet rules while protecting nature and feeding people better. When digital systems spread, they stick; today’s farms, big or small, rely on them to run smoothly, track what grows where, then link pieces of the food chain into something tougher, leaner, greener.

Agritech Platform Market Segmentation

By Platform Type

- Farm Management Platform

Farmers can map out tasks using digital tools made for managing their land. These systems help track what happens each day across fields. One after another, actions get reviewed to boost efficiency over time. Instead of guessing, decisions rely on updates collected regularly. Efficiency grows when routines adjust based on real input. Step by step, small changes add up through consistent oversight.

- Precision Farming Platforms

Farming tools that track soil and weather help adjust planting on specific land patches. These systems rely on location data plus internet-connected devices to monitor crops day by day. Outcomes often show better yields through smarter decisions tied to real-time updates across fields.

- Market Linkage Platform

Farmers meet buyers face to face through digital hubs that also link them to supply sources. These platforms open doors to wider trading spaces. Getting inputs becomes easier when connections form online. Direct contact reduces middlemen in transactions. Trade flows more smoothly once networks are built. Access grows stronger with each new relationship formed.

- Data Analytics & Decision Support Platforms

A fresh look at farm choices begins with smart tools that learn from patterns in soil, weather, and market shifts. These systems guide planting schedules by studying past yields alongside current conditions. Instead of guessing, farmers see likely outcomes when storms loom or prices shift. Daily routines gain clarity through alerts tied to real-time field data. Choices around equipment use stem from trends spotted over seasons. Outcomes improve not by chance, but by feedback loops built into each cycle.

To learn more about this report, Download Free Sample Report

By Component

- Hardware

Flying machines, smart gadgets, location trackers, plus tools that sense surroundings, make up the gear. Machines gather details automatically while moving through space. Each piece feeds information into larger systems without delay.

- Software

From tracking crops to organizing schedules, digital tools help manage daily tasks. These programs offer insights through data views on screens. Phones carry some of these functions into the field. Planning gets easier when information updates in real time.

- Services

Help is available through setup guidance, expert advice, learning sessions, and ongoing tech assistance. Getting it running well means having backup at every stage, from first steps to daily use. Support spans onboarding, planning help, skill building, and troubleshooting when needed.

By Application

- Crop Monitoring & Management

From above, the fields show how plants are doing over time. Growth gets checked by spotting changes week after week. Predictions come alive through data that shifts with seasons. One sign of progress might be color, another could be height or spread. Health is not guessed; it shows up in the details seen daily.

- Soil & Water Management

A healthy Earth holds water better. That means crops drink when they need to. Fertilizer goes further, lands stay rich. Roots dig deep where care happens.

- Livestock & Dairy Manageme

Cows stay checked on every day, watching how they grow and act. Health signs get written down each week without fail. Breeding plans follow careful timing throughout seasons. Milk output moves up when diets improve slowly.

- Supply Chain & Market Access

Fresh produce moves faster from fields to stores when routes are smarter. Getting goods where they need to go becomes easier with better planning. Farmers reach more buyers without delays piling up. Delivery paths shaped by real needs cut down wasted time. Markets fill reliably when transport works smoothly behind the scenes.

- Financial & Insurance Services

Farmers get access to online loans, coverage options, and life planning resources through tech-based platforms. What shows up is support that fits how they work every day.

By End-Users

- Small Holder Farmers

A single person or a close-knit family runs these plots of land. Technology helps them grow more with less effort. What they do matters just as much as big operations do.

- Commercial & Large Farms

Farms big enough to need machines often turn to digital tools just to keep up. What changes is how fast they grow when software handles the details. Size matters less once systems do the work of dozens.

- Agricultural Cooperatives

Farmers team up through cooperatives, relying on common tools and group choices. These setups let them pool what they have, shaping outcomes together instead of working alone.

- Government & Research Institutions.

- From town halls to field labs, decisions take shape using these tools. Watching crops grow helps shape smarter rules over time. Data flows where answers are needed most. Studies gain ground when access spreads widely.

Regional Insights

In North America, smart tech in farming spreads fast because internet systems work well there. Big farm companies operate across the United States and Canada, using digital tools that help manage fields more exactly. Instead of guessing, growers now rely on data dashboards that track soil needs or weather shifts. Governments back these changes through funding and rules that encourage innovation. Equipment connected to sensors feeds information into software programs daily. Progress happens quickly since research teams build new features regularly. Outcomes show up clearly in how crops grow, and resources get saved.

A quiet shift spreads across European farms, shaped by rules that demand cleaner practices, clearer origins, visible footprints. In places like Germany, France, and the United Kingdom, digital tools slip into daily work measuring soil health, tracking emissions, and meeting tight benchmarks. Not just lone developers pushing code: universities, tech firms, public efforts link up, sharing insights, testing new methods. Big growers, farm collectives, they are leaning in, drawn less by hype than measurable gains.

Down south, farms are starting to tap into tech tools, yet progress moves slowly when set beside places like Europe or the United States. Countries across Asia see sharp jumps in using smart farming systems, pushed by hunger for stable food supplies and fresh policies backing digital fields. In China, India, Australia, plus pockets of Southeast Asia, pressure builds fast to update how crops are grown. Crowds grow larger, governments act more boldly this mix pulls new platforms into daily use. Even so, parts of Africa, Latin America, and desert zones trail behind, aiming mostly to fix delivery routes, boost harvests, and link farmers better to buyers.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 7, 2026 – Auri Grow India Ltd launched an AI-powered carbon credit agritech platform.

- September 22, 2025 – ICAR launched Maitri 2.0 to boost bilateral collaboration in agritech with Brazil.

(Source: Generic and Agritech Platform initiatives https://www.gabionline.net/pharma-news/new-denosumab-and-ustekinumab-Agritech Platform-launches-in-us-canada-and-japan

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.05 Billion |

|

Market size value in 2026 |

USD 8.50 Billion |

|

Revenue forecast in 2033 |

USD 27.35 Billion |

|

Growth rate |

CAGR of 18.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Corteva, Bayer, Syngenta, Trimble, Deere & Company, Raven Industries, Taranis, Farmers Edge, Tevel Tech, Phytech, Hortau, CropX, Cropin, Intello Labs, Arable, Gamaya, Semios, and Phytech |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Platform Type (Farm Management Platforms, Precision Farming Platforms, Market Linkage Platform, Data Analytics & Decision Support Platform), By Component(Hardware, Software, Services), By Application (Crop Monitoring & Management, Soil & Water Management, Livestock & Dairy Management, Supply Chain & Market Access, Financial & Insurance Services), By End-Users (Smallholder Farmers, Commercial & Large Farms, Agricultural Cooperatives, Government & Research Institutions) |

Key Agritech Platform Company Insights

A leading name stands out when looking at major players. Deere & Company fits that role well. This firm builds heavy equipment used on farms and construction sites across the world. Machines roll off production lines with durable designs meant to last seasons. Ownership often stays loyal once they start using these tools daily. Few rivals match its deep presence in rural economies. Starting strong in fields worldwide, Deere builds smart machines that talk to software. Machines roll through soil while feeding live updates into systems that farmers watch daily. Instead of guessing, choices come from signals sent by sensors stuck in the earth or mounted on steel frames. From tiny plots to vast stretches, insights shape planting, watering, and harvesting. Tools track fuel, tire wear, and even carbon footprints over seasons. Behind every alert is a mix of motors, code, and satellites working quiet hours. Farms stay sharp without wasting seed or spray. Decisions grow clearer when numbers replace hunches. What runs in cabs links up with cloud logs seen on tablets at home. Efficiency shows not just in yields but in saved time and cleaner records. This blend of dirt and data keeps operations moving, season after season.

Key Agritech Platform Companies:

- Corteva

- Bayer

- Syngenta

- Trimble

- Deere & Company

- Raven Industries

- Taranis

- Farmers Edge

- Tevel Tech

- Phytech

- Hortau

- CropX

- Cropin

- Intello Labs

- Arable

- Gamaya

- Semios

- Phytech

Global Agritech Platform Market Report Segmentation

By Platform Type

- Farm Management Platforms

- Precision Farming Platforms

- Market Linkage Platform

- Data Analytics & Decision Support Platform

By Component

- Hardware

- Software

- Services

By Application

- Crop Monitoring & Management

- Soil & Water Management

- Livestock & Dairy Management

- Supply Chain & Market Access

- Financial & Insurance Services

By End-Users

- Smallholder Farmers

- Commercial & Large Farms

- Agricultural Cooperatives

- Government & Research Institutions

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr1.png)

APAC:+91 7666513636

APAC:+91 7666513636