Jan 07, 2026

The report “Vertical Farming Market By Growth Mechanism (Hydroponics, Aeroponics, Aquaponics), By Crop Type(Leafy Greens, Herbs, Microgreens, Fruits & Vegetables, Flowers & Ornamentals, Others), By Farming Environment (Indoor Vertical Farming, Hybrid), By End-Users (Commercial Vertical Farms, Retail & Supermarket-Based Farms, Small-Scale Vertical Farms, Research & Educational Institutes)” is expected to reach USD 30.27 billion by 2033, registering a CAGR of 21.92% from 2026 to 2033, according to a new report by Transpire Insight.

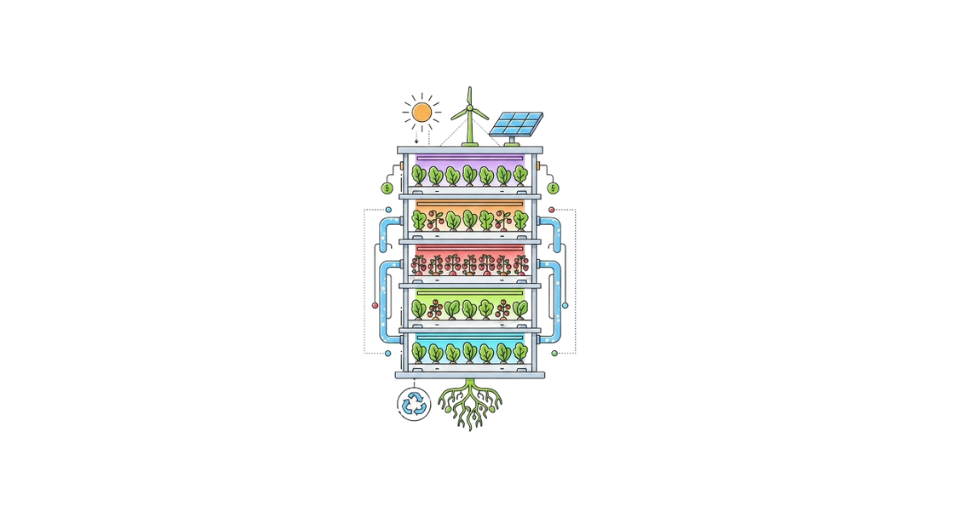

Fresh vegetables sprouting under artificial light, cities grow more of their own food this way now. Because farmland shrinks, these stacked farms fit into tight spaces where soil will not cooperate. Rain or drought outside makes little difference; inside, conditions stay steady through every season. Water gets recycled instead of wasted, flowing just enough to feed roots without overflow. Rarely needed when bugs can’t easily reach elevated trays. People want to know where dinner comes from, so labels showing farm-to-table paths gain trust. Skyscrapers host greens above ground-floor shops, shortening delivery routes by miles. Growth continues quietly, tucked behind glass and steel, feeding neighborhoods one level at a time.

Hydroponics runs the show because it saves money, scales well, and works reliably at a large size. Momentum shifts toward aeroponics when top quality or heavy output matters more than ease. Aquaponics stays small; tricky setups slow things down. Look closely: leafy greens pop up everywhere, as well as herbs, tiny nutrient-packed sprouts. Quick harvest times help. So does steady appetite from stores and restaurants. Farms stacked indoors. Bright lights that mimic the sun, smart machines doing routine tasks, and software guiding decisions, these push progress forward.

Heavy spending, solid tech foundations, and a growing number of soil-free indoor farms, especially across the United States. On the opposite end, Asia Pacific races forward fastest - crowded cities, worries over stable food access, and policy backing for city-based farming push momentum there. With prices for gear dropping and daily operations running smoother, stacked-layer crop systems now shift into wider business use. This path cements their role in how humans will grow meals down the line.

The Hydroponics segment is projected to witness the highest CAGR in the Vertical Farming market during the forecast period.

According to Transpire Insight, hydroponics is growing within vertical farming, expected to lead to gains through the coming years. Because it uses resources more smartly and scales more easily, many see it as a top choice now. Instead of guesswork, growers get exact nutrient delivery plus steady water management. This means crops grow quicker and yield more. Water use drops sharply when compared to old-style field agriculture. For businesses running big indoor setups, especially those selling greens, herbs, or tiny young plants, consistency matters most. Year after year, demand stays strong for clean, reliable harvests without seasonal breaks. It is what pulls interest toward hydroponic models first.

Now cities see more indoor farms popping up, pushing a bigger need for hydroponics since these setups work smoothly with automated controls, smart sensors, and also pair well with low-energy lights. Equipment getting cheaper helps too, while better daily operations draw steady funding from farm-tech firms along with major financial backers. With global worries about fresh food access and environmental impact growing sharper, hydroponic methods stay ahead, holding firm as the leading force driving expansion in vertical farming spaces.

The Leafy Green segment is projected to witness the highest CAGR in the Vertical Farming market during the forecast period.

Growth in the vertical farming sector points toward leafy greens leading the rise over the coming years. Short growing times give them an edge, along with more harvest per space used indoors. People keep buying these vegetables throughout the year without slowing down. Lettuce, spinach, kale, and arugula thrive under stable indoor conditions. Unlike tomatoes or peppers, they need less complex care when it comes to nutrients and lighting. Farms built for profit often pick them first because money comes back quicker. Efficiency runs more smoothly when systems do not face heavy demands. That balance pulls operators toward green leaves again and again.

Freshness matters more now, so stores and eateries look closer to home for clean leafy greens. Because city crowds grow, indoor farms gain ground without relying on distant suppliers. Quality stays steady week after week when growing conditions stay under control. Shelf life stretches out when harvests happen nearby instead of far away. Health-focused buyers prefer food with no chemical sprays, nudging growers toward stacked systems. Tighter safety rules push the shift quietly but steadily forward. This kind of farming fits tight spaces where traditional fields cannot go. Leafy crops lead simply because they adapt fast indoors.

The Indoor Vertical Farming segment is projected to witness the highest CAGR in the Vertical Farming market during the forecast period.

According to Transpire Insight, Fresh produce needs keep growing, so big indoor farms are expected to grow faster than others in the coming years. Because they run all year without fail, stores and restaurants turn to them for steady deliveries. High-tech tools like water-based growing methods, robots, and smart monitoring help these operations get more crops with less waste. Machines take care of tasks while numbers guide decisions behind the scenes. Supply never dips, which puts money into the system reliably. That steady flow keeps them ahead when it comes to earning.

Fueled by fresh backing from agriculture companies, investors, and public green programs, big indoor farms are spreading fast. With food networks leaning into homegrown options and weather-proof methods, these large operations edge out smaller ones. Rising demand puts them ahead as the most rapidly adopted users, shaping how widely this kind of farming can grow.

The Commercial Vertical Farms segment is projected to witness the highest CAGR in the Vertical Farming market during the forecast period.

Growth in commercial vertical farms should outpace other areas of the sector over the coming years. Fresh food needs that are steady, big-volume, and available every season push this trend forward. Technology like automated nutrient flows, robotic handling, machine oversight, and real-time crop tracking helps these setups run smoothly while boosting output. Supply chains value steady delivery schedules. Stores, kitchens, and cafeterias rely on it daily. Because they move significant quantities reliably, their earnings shape much of what drives the business overall.

With more cash flowing in from farm companies, investors, tough questions about fresh produce lead some growers to try indoor crops under lights. These controlled environments grow vegetables using stacked layers inside buildings instead of open fields. Farmers can harvest year-round regardless of weather thanks to precise control over light and nutrients. Some cities now host large warehouses filled with leafy greens growing vertically. Technology helps reduce water use compared to traditional farming methods. Indoor yields per square foot often exceed those outdoors by wide margins. Energy demands remain high due to constant lighting needs across multiple levels. Not every crop adapts well to tower-style growth systems. Lettuce and herbs thrive while root vegetables struggle in vertical plots. Advances in LED efficiency help cut long-term power costs significantly. Urban locations allow faster delivery to nearby grocery shelves. Fewer transport miles mean less spoilage before reaching consumers. Climate concerns push interest in low-carbon ways to raise food locally. Drought-prone areas find soil-free techniques especially useful during dry spells.

The North America region is projected to witness the highest CAGR in the Vertical Farming market during the forecast period.

Ahead of many regions, North America stands to grow fast in vertical farming due to a steady push in tech uptake and heavy backing for indoor growing methods. Fueled by modern facilities, frequent use of water-based crop techniques, and an eagerness to apply smart automation tools, operations are scaling up across major hubs in both the United States and Canada. What sets it apart is not just access to gear, but how quickly farms there turn new ideas into working models.

People want vegetables that are local, free of chemicals, and picked fresh. Backing from governments for eco-friendly growing methods adds momentum. On top of that, worries about unstable weather and broken supply chains make these high-tech farms more appealing. Innovation thrives here. North America stays ahead by turning ideas into real business at scale. That energy keeps the region central to how this kind of farming spreads worldwide.

Key Players

Top companies include AeroFarms, Plenty, Bowery Farming, BrightFarms, Gotham Greens, Kalera, Infarm, Signify (Philips Lighting), Osram, Heliospectra, Spread Co., Sky Greens, Mirai, Vertical Harvest, AppHarvest, and Lufa Farms.

Drop us an email at:

Call us on:

+91 7666513636