Market Summary

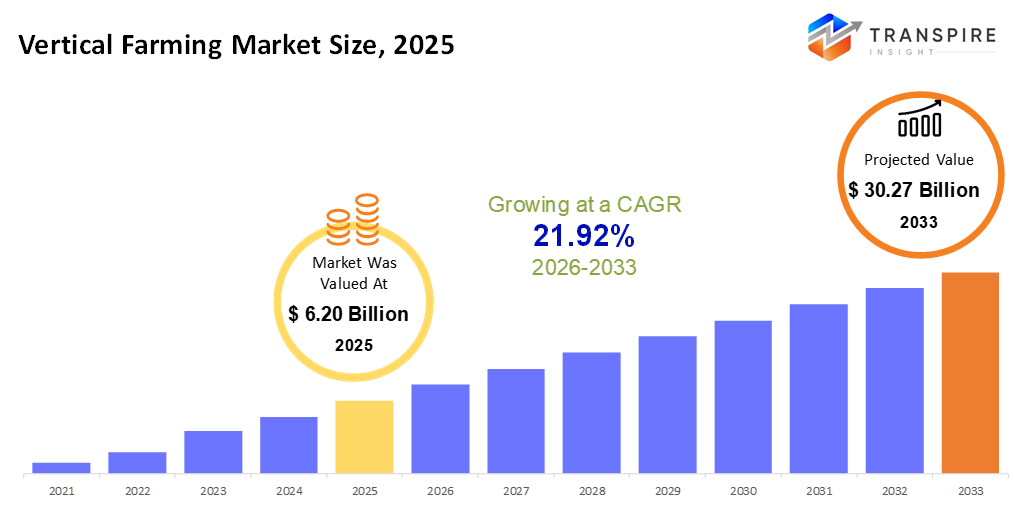

The global Vertical Farming market size was valued at USD 6.20 billion in 2025 and is projected to reach USD 30.27 billion by 2033, growing at a CAGR of 21.92% from 2026 to 2033. Rising hunger for clean food mixes with tighter space for traditional crops, pushing this method forward. Hydroponics and aeroponics keep evolving automation tags along, plus smarter LED systems chip in too. Yields climb. Costs dip. Cities grow taller, and so do farms tucked inside them. Commercial setups now pop up more often than before. Money flows in not just from investors but also from policy-driven backing. Growth is not slowing; it is finding a new footing instead.

Market Size & Forecast

- 2025 Market Size: USD 6.20 Billion

- 2033 Projected Market Size: USD 30.27 Billion

- CAGR (2026-2033): 21.92%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 41% in 2026. Fresh greens grow inside big rooms across North America, where water farming spreads fast. These setups work at high volume, built for a steady supply. Most plants raised this way never touch soil. Instead, nutrients flow straight to roots through the liquid. Operations here set the pace for others to follow.

- Fresh produce grows inside tall shelves under soft lights across United States cities. These indoor farms supply grocery stores through steady partnerships nationwide. Money flows into climate-controlled rooms where vegetables thrive without soil. Lights hum above rows of greens in warehouses near highways and suburbs alike.

- Fueled by city expansion, hunger for stable food sources pops up across the region small-scale indoor farms begin filling gaps. Space-saving setups gain ground where land runs tight. Growth surges, not from tradition, but necessity meeting innovation head-on.

- Hydroponics share approximately 70% in 2026. Even though hydroponics leads worldwide because it works well at a large scale, aeroponics finds its place in city-based farms focused on premium crops.

- Fresh salad crops dominate sales because they produce more per square foot. Meanwhile, tiny greens and culinary herbs are expanding more quickly than any others.

- Farming indoors takes the lead because it works every time. Still, mix-style setups grow more common where money matters most.

- Farms built for business rake in most of the money. Yet those tied to shops grow faster every year.

Food growers around the world now lean more toward vertical farms, tight spaces stacked high with crops, safe from weather swings. Inside these setups, lights tuned to plant needs shine down while sensors track growth minute by minute. Cities grow faster, farmland fades, yet people want clean vegetables without chemicals. That mix pushes both rich and developing nations to explore this method. Season after season, harvests rise regardless of storms outside.

Hydroponic setups lead the tech side of things, favored for packing more produce per square foot, using less water, and shrinking utility demands. What also stands out is how these systems adapt easily to big growing spaces without losing performance. On another note, aeroponic methods are gaining ground quickly, especially where top-tier plants matter most, growth speeds up, and resources shrink even more than before. Though not as common, aquaponics sticks around in smaller pockets, limited mainly by tricky setup needs and maintenance hurdles. New tools keep arriving, smart controls, automated tracking, and smarter lights that chip away at daily effort while trimming electricity bills slowly over time.

Fresh lettuce, basil, and radishes grow fast indoors, so farms make more of them than anything else. Because shops want a steady supply, these plants win every time. As tech gets better, strawberries and tomatoes now appear on indoor shelves too. Rooms stacked with crops under lights still lead the way everywhere. They give exact results, day after day. Some places mix greenhouses with towers, though, trying to save power when possible.

Right now, North America sits ahead in vertical farming thanks to heavy funding, solid tech networks, and widespread use of indoor hydroponics, especially across United States cities. Meanwhile, growth surges fastest in the Asia Pacific, where crowded cities, worries about stable food supply, and state-backed urban farms push progress forward in places like Japan, China, and Singapore. Step back, and the bigger picture shows a shift underway: small test setups are giving way to full-sized operations, quietly weaving vertical farms into tomorrow’s worldwide food chains.

Vertical Farming Market Segmentation

By Growth Mechanism

- Hydroponics

Floating on water, plants grow fast. This method spreads easily across farms. Efficiency rules how nutrients move through the setup. Big harvests come without soil, just careful feeding.

- Aeroponics

Mist-fed roots push plants ahead, no soil needed. Speed climbs when nutrients float in the air instead of soaking through the dirt. Top-tier produce leans on this method most often.

- Aquaponics

Fish live where plants grow, one system feeding both. Water flows differently here, cycling through roots then tanks. This method saves resources, though it demands careful balance. Mistakes spread fast when life depends on flow.

To learn more about this report, Download Free Sample Report

By Crop Type

- Leaft Greens

Bursting up fast, leafy greens sell quickly. This speed matches well with tight market needs. Their brief life from seed to shelf fits perfectly inside stacked farm systems. Because people want fresh greens every day, these plants earn steady returns. Quick harvests mean more rounds each year, boosting output without extra space.

- Herbs

Their compact growth means more profit in less space. Retail shops want them. So do restaurants. This steady need pushes more growers to plant them. Space efficiency meets market pull.

- Microgreens

Tiny greens pop up quickly, landing on city plates more each season. These young plants fetch good value where tastes lean fresh and local. Harvests come fast, meeting steady interest without long waits in the soil.

- Fruits & Vegetables

Fresh produce stands out where precise management matters most. As tools evolve, smarter setups take hold slowly. Not every farm jumps in right away -some wait, others adapt step by step.

- Flowers & Ornamentals

Pretty plants take center stage here, grown mostly for how they look. These blooms thrive where conditions are tightly managed. Beauty drives demand, not function. Indoor setups often support their development. Careful attention shapes each petal's form. Growing them needs precision, not chance.

- Others

A few types of plants fit outside usual categories, tucked into studies or made for specific jobs. Some exist just to test ideas in labs or serve unusual purposes beyond food. These do not follow regular farming patterns, showing up where they are needed most. A handful help scientists explore new methods, while others deliver targeted results in niche areas.

By Farming Environment

- Indoor Vertical Farming

Crops grow tall inside buildings where lights stay on through winter. Machines watch every leaf while seasons change outside.

- Hybrid

Out in the fields, sunlight works alongside smart setups that manage growing conditions. This mix cuts down on how much power is needed. Efficiency comes from blending old-style farming with modern tech.

By End-Users

- Commercial Vertical Farms

A few big players pull most of the income in commercial vertical farming. Their setups run on automation, built for volume. Efficiency drives output in these sprawling indoor operations.

- Retail & Supermarket-Based Farms

Right inside stores, small farms grow food fresh each day. These spots make produce taste better by cutting travel time. Shoppers see plants growing, which builds trust in the brand. Less moving around means fewer delays and waste. Some supermarkets even label items with harvest timestamps.

- Small Scale Vertical Farms

Fresh greens rise in city corners where compact vertical plots feed nearby homes using movable structures that adapt easily. These neighborhood hubs grow food close by, swapping long hauls for short trips from soil to table.

- Research & Educational Institutes

From test fields come new ways to grow food better. Labs tucked inside universities shape smarter crops over time. Trial plots teach what works, season after season. Scientists adjust methods when results surprise them. Growing techniques evolve where learning meets soil.

Regional Insights

Standing tall in the world of vertical farming, North America and Europe lead as top players. Led by the United States, then Canada close behind, one side thrives on steady funding from private sources alongside well-built systems for climate-controlled crops. Hydroponic setups fill city spaces here, feeding stores and restaurants alike. On another front, Germany, the Netherlands, and the UK take point across Europe, with France, Italy, and Spain not far off. Rules favoring green practices shape growth there, where new tech meets a rising taste for fresh, chemical-free produce near cities.

Nowhere else are city rooftops turning into farms as fast as across the Asia Pacific, where crowded cities push innovation in growing food close to home. Driven by tight spaces and a need for reliable crops, governments are backing indoor farming like never before. In places such as Japan, China, and Singapore, high-tech setups dominate, automated, precise, yet born out of having almost no farmland left. Meanwhile, countries including South Korea, Australia, and India are stepping up spending on large-scale vertical growing operations. What stands out is how quickly enclosed farm systems spread here, mainly raising greens and herbs right inside or near big towns.

Starting differently each time differently, progress creeps forward across regions outside major markets. Cities in Brazil and Mexico pull interest through everyday shopping patterns, plus pressure from shifting weather. Over in the Middle East and parts of Africa, nations like the United Arab Emirates and Saudi Arabia move ahead because fresh water runs low and meals often come from abroad. Meanwhile, efforts grow quietly in South Africa and Egypt, and small tests turn real thanks to backing from officials. Each place moves at its own pace, shaped by local realities rather than broad trends.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 15, 2025 – Newly launched humanoid robot to work in Malaysian vertical farms

- September 19, 2024 – Urban Crop Solution & Inagro unveiled a vertical farming tower in Agrotopia.

(Source: https://igrownews.com/urban-crop-solutions-latest-news/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.20 Billion |

|

Market size value in 2026 |

USD 7.56 Billion |

|

Revenue forecast in 2033 |

USD 30.27 Billion |

|

Growth rate |

CAGR of 21.92% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

AeroFarms, Plenty, Bowery Farming, BrightFarms, Gotham Greens, Kalera, Infarm, Signify (Philips Lighting), Osram, Heliospectra, Spread Co., Sky Greens, Mirai, Vertical Harvest, AppHarvest, and Lufa Farms |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Growth Mechanism (Hydroponics, Aeroponics, Aquaponics) By Crop Type(Leafy Greens, Herbs, Microgreens, Fruits & Vegetables, Flowers & Ornamentals, Others) By Farming Environment (Indoor Vertical Farming, Hybrid) By End-Users (Commercial Vertical Farms, Retail & Supermarket-Based Farms, Small-Scale Vertical Farms, Research & Educational Institutes) |

Key Vertical Farming Company Insights

AeroFarms runs vast indoor spaces where plants grow without soil. Instead of traditional fields, mist delivers nutrients through air-based systems that use little water. Data guides every stage; sensors track growth patterns so adjustments happen before problems appear. Machines handle planting and harvesting, reducing human error while keeping pace steadily. Leafy vegetables like kale and arugula thrive under carefully tuned LED lights night and day. These crops reach stores fast, staying crisp thanks to short travel distances. Major grocery chains stock them across the United States and nearby regions. Each decision leans toward lower environmental impact from energy choices to packaging materials. New methods emerge regularly, tested quietly before going live at full scale. Trust builds slowly among buyers who value consistent quality and clean labels. Not everyone knows how food gets made indoors, but results speak louder than explanations ever could.

Key Vertical Farming Companies:

- AeroFarms

- Plenty

- Bowery Farming

- BrightFarms

- Gotham Greens

- Kalera

- Infarm

- Signify (Philips Lighting)

- Osram

- Heliospectra

- Spread Co.

- Sky Greens

- Mirai

- Vertical Harvest

- AppHarvest

- Lufa Farms

Global Vertical Farming Market Report Segmentation

By Growth Mechanism

- Hydroponics

- Aeroponics

- Aquaponics

By Crop Type

- Leafy Greens

- Herbs

- Microgreens

- Fruits & Vegetables

- Flowers & Ornamentals

- Others

By Farming Environment

- Indoor Vertical Farming

- Hybrid

By End-Users

- Commercial Vertical Farms

- Retail & Supermarket-Based Farms

- Small-Scale Vertical Farms

- Research & Educational Institutes

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636