Market Summary

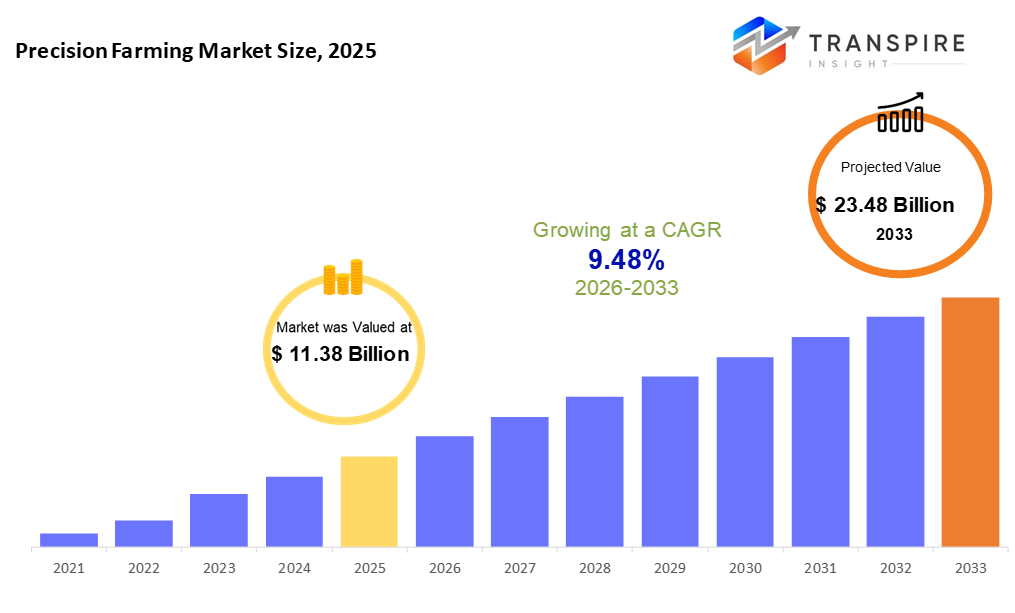

The global Precision Farming market size was valued at USD 11.38 billion in 2025 and is projected to reach USD 23.48 billion by 2033, growing at a CAGR of 9.48% from 2026 to 2033. The market of Precision Farming is showing good CAGR growth as a result of the growing popularity of sustainable and data-oriented agriculture. Fortune in the field of AI, IoT, and automation is changing the conventional farming methods. Increasing food demand and climate issues also further contribute to an increase in adoption. Digital agriculture, with government assistance, is still fueling market development.

Market Size & Forecast

- 2025 Market Size: USD 11.38 Billion

- 2033 Projected Market Size: USD 23.48 Billion

- CAGR (2026-2033): 9.48%

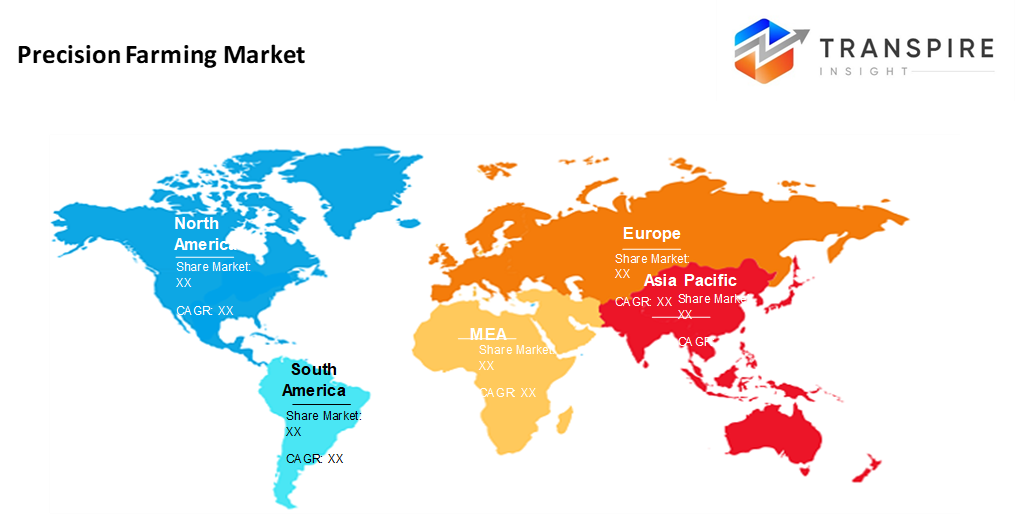

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market share is estimated to be approximately 40% in 2026. North America: The adoption is high due to the developed agri-tech infrastructure.

- In the United States, vigorous adoption of GPS, AI, and computer-controlled farm machines.

- Asia Pacific is a region that is rapidly expanding thanks to the increasing demand for food supply and digital farming programs.

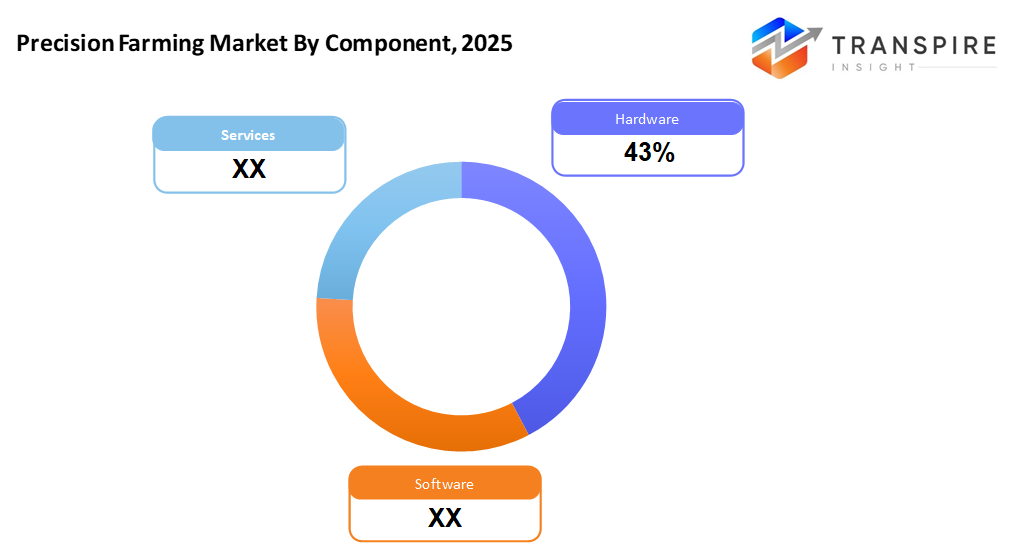

- Hardware shares approximately 45% in 2026. The leader adopts hardware because of the sensors, drones, and automated machinery demands.

- AI and ML are the booming technologies in predictive and data-driven agriculture.

- Large farms are used extensively because of their large investment capacity of investment.

- Yield Monitoring is essential use in optimization of productivity.

The Precision Farming market includes medicines made from living cells, closely matching existing biologic drugs in how safe, effective, and reliable they are, yet usually cheaper. Because these treatments come from biological sources, their production is complicated, needing strict oversight so there’s no real difference in performance versus the original. They are commonly prescribed for illnesses like cancer, rheumatoid arthritis, diabetes, or clotting problems, helping patients access care without high costs. As key biologic drug patents run out across countries, more companies jump in, pushing steady growth in this sector.

Demand for Precision Farming is going up because medical expenses keep climbing, serious illnesses are spreading, yet cheaper treatments are needed now more than ever. Since biological drugs usually cost a lot and must be taken for years, hospitals, along with insurers, are pushing similar medicines to save money without losing effectiveness. In cancer care or managing immune system disorders, areas where such advanced meds matter most, the push grows even stronger.

Patent expirations on major biologic meds have opened doors for cheaper copies, giving Precision Farming makers a clear shot at the market. On top of that, clearer rules in places like Europe and the United States help doctors and patients trust these options more. Because medical staff are getting more familiar with them, acceptance is growing, especially where insurance covers the cost easily.

The market’s getting a boost from better biomanufacturing tools, smarter testing ways, while drug makers team up more often - fueling longer Precision Farming lineups. In developing regions, strong potential is opening up as state leaders push cheaper options to get biologics into more hands. Step by step, copycat versions that can swap freely plus steady rule-maker backing should heat up rivalry, widen reach, and keep the Precision Farming sector growing down the road.

Precision Farming Market Segmentation

By Component

- Hardware

This consists of GPS, sensors, drones, and automated farm machines.

- Software

Software farm management, analytics, and decision support digital platforms.

- Services

Management services, integration services, maintenance services, and managed agricultural services.

To learn more about this report, Download Free Sample Report

By Technology

- GPS/GNSS

GPS/GNSS: Allows proper positioning, navigation, and mapping of the field.

- Remote Sensing

It involves the use of satellites and drones to scan the crop and soil status.

- Variable rate technology (VRT)

This maximizes the use of inputs, e.g., seeds and fertilizers

- Internet of Things (IoT)

Resorts to the connection of farm equipment and sensors to real-time data

- AI & Machine Learning

Enables predictive analytics and optimization of yield.

By Farm Type

- Large Farms

Large-scale farms that have adopted high technology.

- Medium Farms

Semi-commercial farms that have embraced the selective precision tools.

- Small Farms

Smallholder farms are progressively transforming into cost-effective practices.

By Application

- Yield Monitoring

Monitors the crop performance and the productivity.

- Field Mapping

Soil and Field Analysis.

- Crop Scouting

Pests, diseases, and nutrient deficiencies.

- Irrigation Management

Water optimization and management.

- Weather Tracking and Forecasting

Aids in making climate-related choices in farming.

Regional Insights

Farming tech thrives across the United States, and Canada's strong equipment networks give these countries an edge worldwide. Out here, machines guided by satellites work alongside smart data tools that help grow more with less waste. Drones scan fields while computers spot patterns humans might miss. Support from national programs nudges bigger operations to upgrade faster than before. What stands out is how quickly new methods take root when resources align.

Farmers across Germany, as well as in France, the United Kingdom, and the Netherlands, find new ways to grow more with less. These nations see steady uptake of precise farming tools thanks to tighter green rules plus national digital farm programs. Out in the fields, sensors talk to satellites while data flows into systems that track plant health, soil needs, and even water use. Machines learn patterns; decisions shift before problems spread. Efficiency rises just as pressure on nature eases. Quiet changes add up where tractors roll through morning mist guided by invisible signals.

Food needs keep climbing across parts of Asia, where nations such as China, India, Japan, and Australia are seeing strong momentum. Government efforts there now support high-tech farming methods more than before. Farmers in these places also feel more at ease using digital tools every season. Moving west, Brazil and Argentina begin shaping smarter ways to grow crops on vast fields. In South Africa and the UAE, similar shifts quietly take root amid wide-open farmland. Efficiency matters more each year when managing water, soil, and seed inputs. New chances emerge steadily for tech firms aiming beyond familiar borders. Growth pulses strongest where change moves fast.

To learn more about this report, Download Free Sample Report

Recent Development News

- February 27, 2025 – Yamaha Motor expands into precision agriculture with the launch of Yamaha Agriculture Inc.

- July 31, 2024 – New FieldSense Precision Farming Service launched by ProCam.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 11.38 Billion |

|

Market size value in 2026 |

USD 12.46 Billion |

|

Revenue forecast in 2033 |

USD 23.48 Billion |

|

Growth rate |

CAGR of 9.48% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

John Deere, Trimble Inc., AGCO Corporation, CNH Industrial, Raven Industries, Topcon Positioning System, Bayer CropScience, BASF, Corteva Agriscience, Kubota Global Site, DJI Enterprises, Farmers Edge Laboratories, Yara International, and Climate Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Hardware, Software, Services), By Technology(GPS/GNSS, Remote Sensing, Variable Rate Technology, Internet of Things, Artificial Intelligence & Machine Learning), By Farm Type (Large Farms, Medium Farms, Small Farms), By Application (Yield Monitoring, Field Mapping, Crop Scouting, Irrigation Management, Weather Tracking & Forecasting) |

Key Precision Farming Company Insights

John Deere is a multinational company that provides the world with innovative farming technologies, such as high-technology GPS-controlled machines, automation, and computer-controlled farm management systems. The company unites AI, sensors, and data analytics in its machines to enhance productivity and efficiency. It is highly concerned with smart farming and automation, which makes it one of the most important innovators of the precision farming market.

Key Precision Farming Companies:

- John Deere

- Trimble Inc.

- AGCO Corporation

- CNH Industrial

- Raven Industries

- Topcon Positioning System

- Bayer CropScience

- BASF

- Corteva Agriscience

- Kubota

- DJI Enterprises

- Farmers Edge Laboratories

- Yara International

- Climate Corporation

Global Precision Farming Market Report Segmentation

By Component

- Hardware

- Software

- Services

By Technology

- GPS/GNSS

- Remote Sensing

- Variable Rate Technology

- Internet of Things

- Artificial Intelligence & Machine Learning

By Farm Type

- Large Farms

- Medium Farms

- Small Farms

By Application

- Yield Monitoring

- Field Mapping

- Crop Scouting

- Irrigation Management

- Weather Tracking & Forecasting

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636