Jan 22, 2026

The report “LNG Terminals Market By Technology (Liquefaction, Regasification), By Function (Import, Export, Bifunctional), By Terminal Type (Onshore, Floating) and By Capacity (Small-scale, Medium-scale, Large-scale Terminals)” is expected to reach USD 96.8 billion by 2033, registering a CAGR of 8.40% from 2026 to 2033, according to a new report by Transpire Insight.

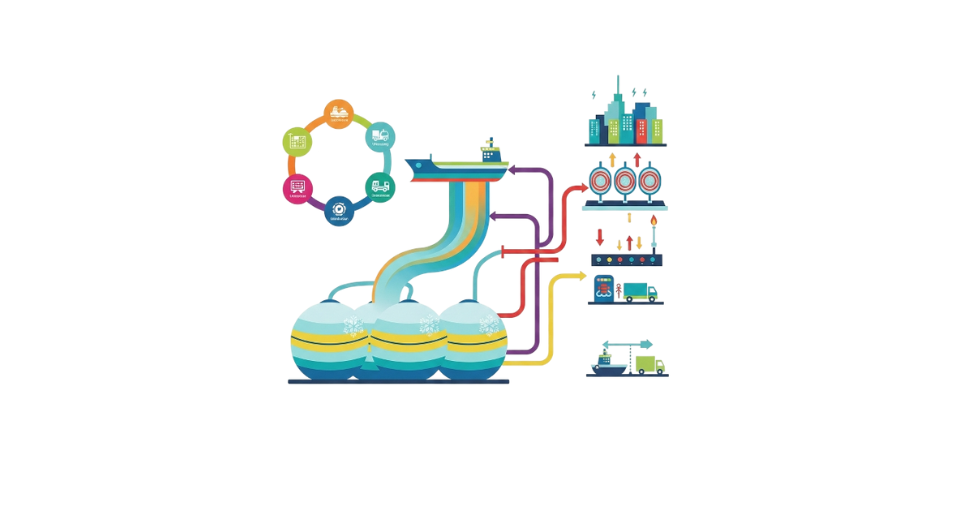

The LNG Terminals Market is an important factor in facilitating the global trade of natural gas. This is mainly because of the fact that LNG terminals provide vital links between the gas-producing area and consuming centers, especially in places where the gas pipeline infrastructure does not exist or is geopolitically restricted. Although market demand is expected to be driven by energy security concerns, a steadily rising level of global energy consumption, and a shift towards low carbon fuels, the growing consideration of the role of LNG as a bridging fuel is offering momentum towards the conversion of coal-fired energy production to the use of gas. A large number of countries that are energy-importing rely on LNG terminals. Advances in technology with regards to efficiency in liquefaction, optimizing storage capacity, as well as technological innovations in floating terminals, have boosted the economics of such projects. In addition, Floating Storage & Re-gasification Units have gained popularity as they offer quick entry to markets, mostly in emerging nations.

Moreover, the increasing number of LNG supply contracts with long terms, the development of global trade routes, and the strategic investment of governments are contributing to the growth of the market. Even though the capex of the market is a challenge, the development of infrastructure and the increasing volume of global gas trade are anticipated to drive the growth of the LNG terminals market.

The Liquefaction segment is projected to witness the highest CAGR in the LNG Terminals during the forecast period.

According to Transpire Insight, Liquefaction marks the most prominent technological area in the LNG terminals industry, as the technological helps in the conversion of gas to its liquid form, thereby enabling long-distance transportation. This area helps in the growth of LNG exports, as gas-exporting nations get the opportunity to reach distant markets easily. Large-scale plants help in the achievement of economies of scale, making the transportation of LNG more economical.

Research and development in high-efficiency liquefaction trains, modularization, and emission-reduction solutions are making this market sub-sector more commercially viable. The export hubs consider liquefaction capacity crucial for tapping gas reserves, besides entering into long-term offtake contracts. The growth in international LNG trading is expected to keep the liquefaction terminal infrastructure remains the backbone for the growth of the market.

The Import segment is projected to witness the highest CAGR in the LNG Terminals during the forecast period.

A major share of the market is held by the import function of the LNG terminals, owing to the rising dependence on LNG amongst the gas deficit economies. These import terminals assist in the diversification of sources, lesser dependence on a single source, resulting in enhanced energy security. They assist in the power, industrial, and domestic sectors.

Import terminals will get growth support from policy-driven efforts to reduce CO2 emissions, as LNG will be replacing coal and oil in the energy mix. With the flexibility in terms of procurement strategies and the ability to easily access spot shipments, the import countries will easily be able to cope with fluctuations in the pattern of demands. Since the growth of demands will continue to be in the Asia Pacific and Europe, the import terminals will continue to move ahead with good growth dynamics.

The Onshore segment is projected to witness the highest CAGR in the LNG Terminals during the forecast period.

According to Transpire Insight, Onshore terminals are the most established and widely accepted terminal types because of their large throughput handling capacities over prolonged operational cycles. These terminals are seamlessly connected to large pipelines and storage networks to provide efficient distribution to the next consumers. These onshore terminals are usually adopted when markets are already established with predictable demand patterns to meet. Their high handling capacities make them suitable for large imports as well as exports and thus strengthen their market presence.

Although the time and initial investment required in onshore terminals are longer compared to the other type of solution, they entail lower operational costs and more reliability in the end. This is due to their advanced security measures being more adaptable to engineering and government regulations. Onshore terminals, in turn, have a more adaptable nature with respect to capacity expansion and changes in technology in the future, an aspect that will be valuable in the face of growing global and basin-center market demand for gas supply commitment and security in the coming years.

The Large-scale Terminals segment is projected to witness the highest CAGR in the LNG Terminals during the forecast period.

Large-scale LNG terminals currently handle the majority of LNG trade. They serve as hubs in the global LNG market and allow for the large-scale reception and dispatch of LNG. This helps in realizing cost savings. It is important for large-scale LNG terminals to cater to the demand of large-scale importers of LNG in order for the LNG market to maintain a stable supply chain. Some countries and energy companies view large-scale terminals as important for their energy strategies.

In terms of investments, large-scale terminals are attractive for large energy companies because the revenue streams are less dependent on market volatility, primarily due to assured offtake contracts for a long period of time. Although these investments require a lot of capital, the economies of scale, market strength, and the ability to shape market pricing in a particular way in the locale drive these investments. With the growing demand for gas worldwide, the importance of large-scale LNG terminals will continue to shape the gas LNG market structure.

The North America region is projected to witness the highest CAGR in the LNG Terminals during the forecast period.

One of the most prominent global LNG terminals markets is offered by the region of North America, backed by significant natural gas reserves, a strong infrastructure base, and a robust export strategy. The United States is at the forefront of the market within the region, thanks to the commissioning of massive-scale liquefaction terminals located on the Gulf Coast, which provide an opportunity for low-cost export of LNG volumes primarily destined for deliveries within Europe, Asia-Pacific, and Central and South Americas. Canada is steadily moving towards the development of export terminals on its west coast, catering to the Asian market, while Mexico is expanding its regasification infrastructure in a bid to fuel the country’s industrial sector through the availability of pipeline-borne gas. A favorable government framework, established pipeline network, and the availability of low-cost shale gas make the region a solid LNG supply base.

Apart from export capacity, the other benefit for the North American market is the steady investment in the expansion of terminals, efficiency enhancement, and greenhouse gas emission cuts. The increasing focus of geopolitics on energy security makes the demand for the North American market’s natural gas stronger, especially from European customers, making the market even more important globally. Even the challenges posed due to its capital efficiency and the long permitting process do not seem to hamper the development of the market, as the market growth fundamentals are excellent globally.

Key Players

The top 15 players in the LNG Terminals market include ExxonMobil Corporation, QatarEnergy, Shell plc, Chevron Corporation, TotalEnergies SE, BP plc, ConocoPhillips Company, Equinor ASA, ENI S.p.A., Cheniere Energy, Inc., Woodside Energy Group Ltd., Sempra Infrastructure, CNPC (China National Petroleum Corporation), PetroChina Company Limited, and Petronet LNG Ltd.

Drop us an email at:

Call us on:

+91 7666513636