Market Summary

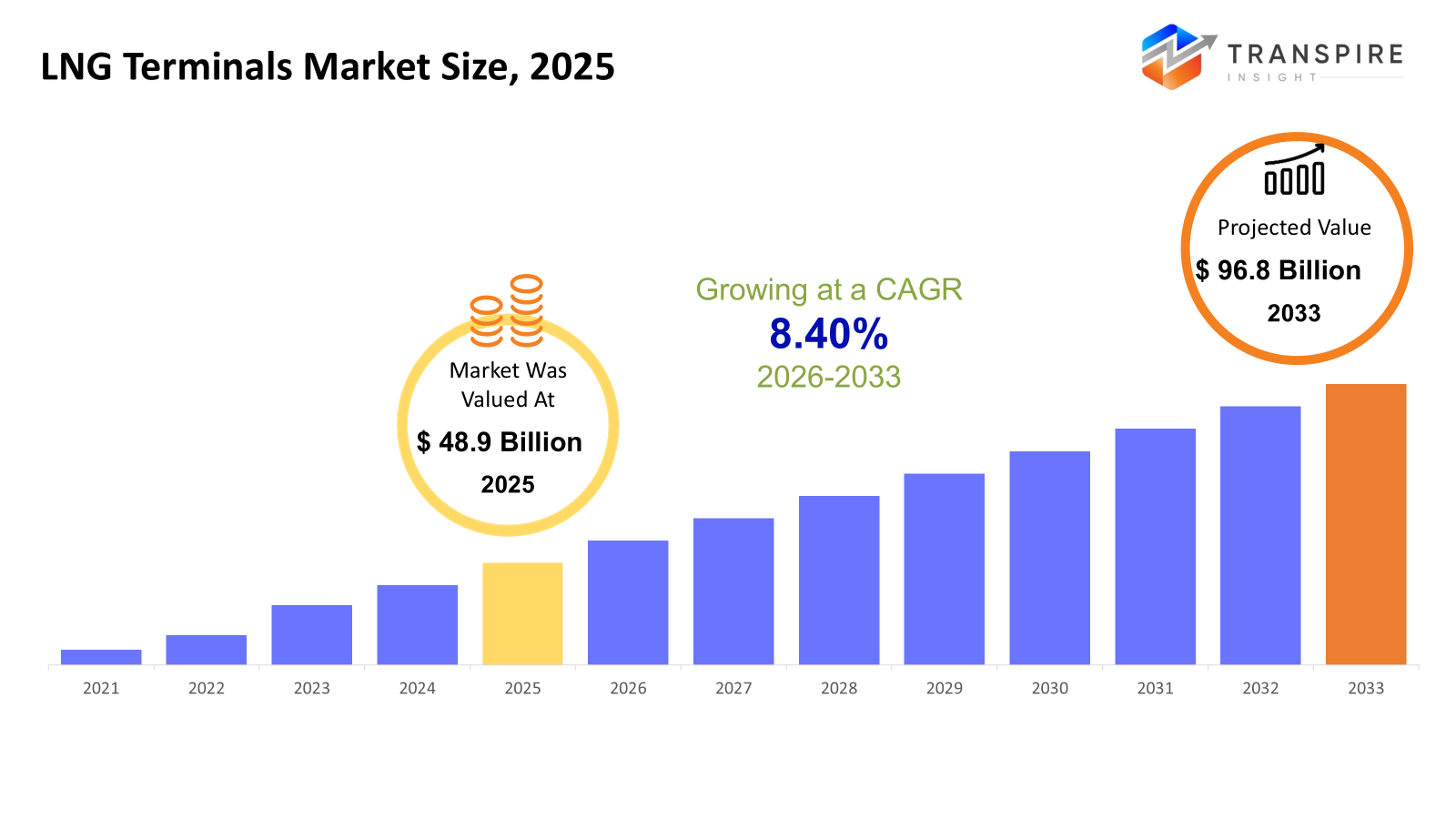

The global LNG Terminals market size was valued at USD 48.9 billion in 2025 and is projected to reach USD 96.8 billion by 2033, growing at a CAGR of 8.40% from 2026 to 2033. The LNG terminals market is growing at a steady state, driven by increasing demand for natural gas worldwide, including energy security priorities and diversification away from pipeline gas. This increasingly flexible LNG trade, along with rapid FSRU deployment, supports LNG's status as a transition fuel toward decarbonization goals and collectively ensures long-term CAGR.

Market Size & Forecast

- 2025 Market Size: USD 48.9 Billion

- 2033 Projected Market Size: USD 96.8 Billion

- CAGR (2026-2033): 8.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- A major modification in this scenario is the fact that today North America is a firm pillar in the trade of natural gas in the form of LNG. This is in view of the region’s ample gas supply in shale formations as well as favorable liquefaction economics for exports.

- The United States leads the pacing through export terminal expansion, cost-competitive feedstock, and flexible contract terms that allow for easy adjustment according to demand trends in the international market, thus enhancing its political strength in the energy market.

- Asia Pacific remains the strongest market, due to demographic, industrial, and fuel-switching dynamics in Japan, China, India, and the Korean Peninsula, where governments focus on the import of LNG to secure their energy and pollution mitigation strategies.

- Technology advances in liquefaction spur the overall market, as exporters keep investing in large-scale, efficient facilities that can be used to realize the value within their gas reserves, thereby lowering the cost of gas through economies of scale.

- Import-oriented terminal functions are well represented because of the growing LNG dependence of gas-deficit countries. This is because balancing risk and simplifying resource sourcing through diversification become important in mitigating demand risks.

- The onshore terminal remains the preferred alternative for a large volume of business, enjoying the benefits of economies of scale, arterial connections, and familiarity with the authorities, especially in the established market.

- Large-scale terminals have the largest share in terms of capacity, as they serve as the foundation of the country’s energy strategy and have the ability to influence the world LNG market in terms of price.

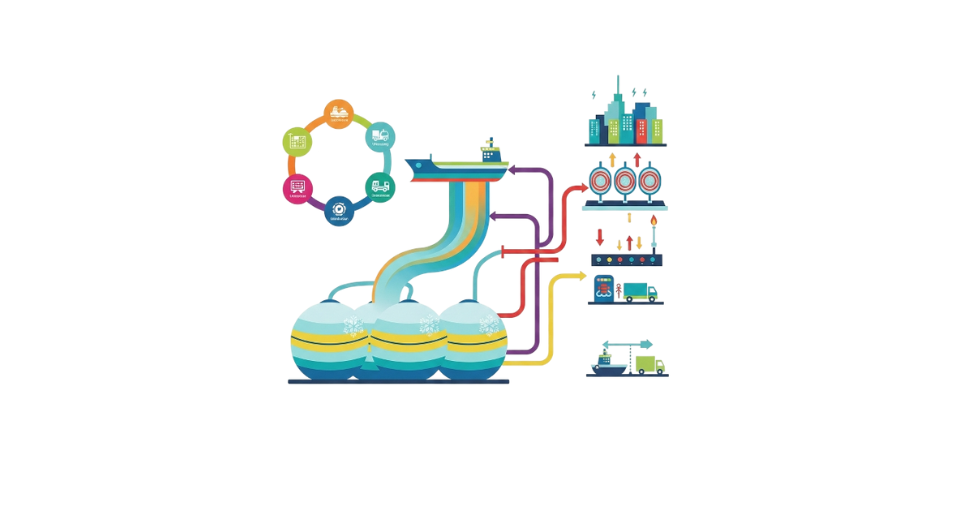

So, the market for LNG terminals pertains to the infrastructure that might be involved in the liquefaction of natural gas for exporting, regasification of LNG for local use, or a combination of both. Such terminals are the backbone of the LNG trade chain, which makes it possible to transport natural gas over a vast distance in regions where the laying of a pipeline might not be feasible due to geological or political reasons. Demand is driven by energy security, diversification, and clean-burning fuel requirements versus coal and oil. LNG terminals enable flexible sourcing, where the importing country can source fuel from different terminals and simultaneously enable countries with LNG to commercially exploit their natural gas reserves. The floating concept has even expedited this process with reduced development time and costs. Advances in technology regarding efficiency improvements, subsequent storage, and regasification technology have been improving project economics. Even though the dominant type of terminal that has existed in the initially established markets is the larger onshore terminal, the emergence of newer economies is tending to pioneer modular and floating terminals. Overall, the importance of LNG terminals cannot be overemphasized.

LNG Terminals Market Segmentation

By Technology

- Liquefaction

Liquefaction is the process of converting natural gas to LNG. The key in the exporting front is the use of liquefaction, where producers target the global need for gas. The revenue base, despite high capital expenditure, is boosted by long-term contracts.

- Regasification

This process regenerates gas from imported LNG for subsequent use in the domestic market. This plays a crucial role in meeting overall gas imports and serves as a vital element in meeting overall energy transition demands.

To learn more about this report, Download Free Sample Report

By Function

- Import

Import terminals provide countries with limited domestic production the ability to diversify, increase security of supply, and improve market pricing. Import terminals play a crucial role in the energy transition as countries move from the use of coal, oil, to more environmentally friendly liquefied natural gas.

- Export

The existence of export infrastructure enables the producer to access the more lucrative market, exploit the surplus gas, or hedge the domestic market variability. The infrastructure is the fuel behind the geopolitics.

- Bifunctional

Bifunctional terminals facilitate the execution of both import and export operations, ensuring the optimization of resources. These terminals are gaining popularity in areas with changing trade flows.

By Terminal Type

- Onshore

Onshore terminals have been traditional, large-volume terminals that provide strong safety standards, offering a long life span. These terminals can be suitable in stable demand areas or export/import terminals that have availability of land.

- Floating

- Floating Terminals (FSRUs/FLNGs): These have the advantage of fast deployment, relatively lower upfront costs, and the ability to move from place to place. They may be attractive to new markets and to locations with limited access to land

By Capacity

- Small Scale

Small scale LNG cater to specialized sectors (remote, industrial, bunkering). Smallscale LNG promotes localized decarbonization in regions where main infrastructure investments are unreasonable.

- Medium-scale

Medium Scale term terminals target capacity and investments in a proportional manner. These terminals serve as a precursor to major expansions. These terminals complement the pipelines.

- Large Scale

Mega facilities are responsible for major trade volume in the bulk market and provide the framework upon which country energy policies rely. Mega facilities rely on economies of scale to reduce costs and enable big trade volumes to be imported and exported to influence global LNG prices.

Regional Insights

The North American region, comprising the United States, Canada, and Mexico, is a mature market for gas liquefaction terminals, focusing on export-oriented terminal business. The United States is a prime sourcing destination for gas globally, having Canada announce its export projects targeting the Asian market, besides Mexico emphasizing the regasification business for its power industry. The main importers of gas are the European countries of Germany, the United Kingdom, France, Spain, Italy, and the remaining European countries. Due to the changes in the global political arena, the process of regasification and the construction of FSRUs has been accelerated. Asia Pacific, which extends to Japan, China, Australia, & New Zealand, South Korea, India, and the other Asia Pacific region, is the biggest consumer of LNG. Japan and South Korea have attained market maturity, while China and India are the current driving forces, while Australia is a major export hub. In South America, primarily in Brazil and Argentina, there is a trend of LNG importation to cater to the demand and irregularities in domestic production. It is relatively stable, though not at a rapid pace. The Middle East and Africa mainly comprises export-driven Gulf states like Saudi Arabia and the UAE, and also includes emerging import-driven markets like South Africa and the rest of Africa. The region is characterized by significant liquefaction capacity and emerging regasification demand.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Shell and its partner, Mitsubishi, are reportedly contemplating the divestment of some equity interests in the C$40 billion LNG Canada, while Phase 1 is already under construction, and an expansion related to Phase 2 is planned. This is strategic rebalancing, given the global capacity additions in the LNG market.

- January 2026, Saudi Aramco and US Commonwealth LNG have reached a deal on a long-term contract to provide a supply of maximum annual volumes of liquefied natural gas of as much as 1 million tons per annum, with the goal of increasing the volumes to 2 mtpa. Commonwealth LNG aims to achieve the Final Investment Decision on the US 9.5 million tons per annum export project in Louisiana, marking a further endorsement of cooperation in US and Middle East liquefied natural gas.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 48.9 Billion |

|

Market size value in 2026 |

USD 55 Billion |

|

Revenue forecast in 2033 |

USD 96.8 Billion |

|

Growth rate |

CAGR of 8.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ExxonMobil Corporation, QatarEnergy, Chevron Corporation, Shell plc, CNPC (China National Petroleum Corporation), PetroChina Company Limited,TotalEnergies SE, ConocoPhillips Company, BP plc, Equinor ASA, Cheniere Energy, Inc., ENI S.p.A., Woodside Energy Group Ltd., Petronet LNG Ltd., Sempra Infrastructure |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Liquefaction, Regasification), By Function (Import, Export, Bifunctional), By Terminal Type (Onshore, Floating) and By Capacity (Small-scale, Medium-scale, Large-scale Terminals) |

Key LNG Terminals Company Insights

Cheniere Energy, Inc. is one of the main players within the United States’ LNG industry, which exerts strong global LNG export influences due to their historical innovation and contributions to the US liquefied gas export infrastructure as the number one LNG exporter within the United States. They handle main infrastructural projects such as Sabine Pass and Corpus Christi with overall global export capabilities ensuring US dominance as far as global gas exports are concerned. This crucial actor within the global gas trade sustains global energy security and diversification patterns.

Key LNG Terminals Companies:

- ExxonMobil Corporation

- QatarEnergy

- Chevron Corporation

- Shell plc

- CNPC (China National Petroleum Corporation)

- PetroChina Company Limited

- TotalEnergies SE

- ConocoPhillips Company

- BP plc

- Equinor ASA

- Cheniere Energy, Inc.

- ENI S.p.A.

- Woodside Energy Group Ltd.

- Petronet LNG Ltd.

- Sempra Infrastructure

Global LNG Terminals Market Report Segmentation

By Technology

- Liquefaction

- Regasification

By Function

- Import

- Export

- Bifunctional

By Terminal Type

- Onshore

- Floating

By Capacity

- Small-scale

- Medium-scale

- Large-scale Terminals

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636