Market Summary

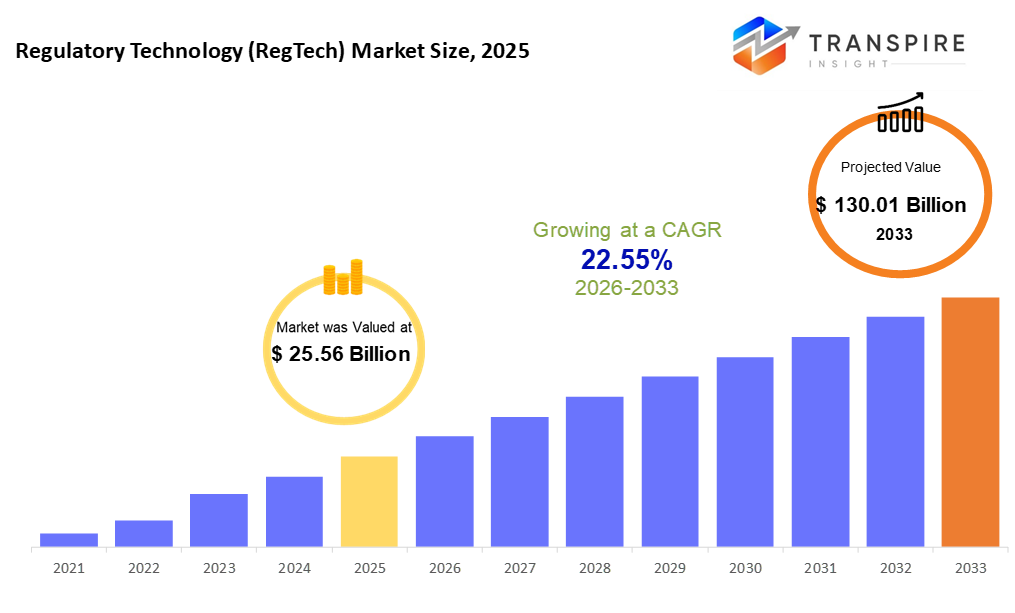

The global Regulatory Technology (RegTech) market size was valued at USD 25.56 billion in 2025 and is projected to reach USD 130.01 billion by 2033, growing at a CAGR of 22.55% from 2026 to 2033. The strong growth of the Regulatory Technology (RegTech) market is driven by increasing regulatory complexity across financial services, rising compliance costs, and the need for real-time risk monitoring and reporting. Additionally, the rapid adoption of AI, cloud, and automation technologies by banks and financial institutions is accelerating demand for efficient, scalable RegTech solutions globally.

Market Size & Forecast

- 2025 Market Size: USD 25.56 Billion

- 2033 Projected Market Size: USD 130.01 Billion

- CAGR (2026-2033): 22.55%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market share is estimated to be approximately 40% in 2026. Fueled by tough rules, the region stays ahead because new tech fits right in. Its financial networks grow faster since startups find room to move. What stands out is how quickly tools get used once they arrive.

- United States leads regional expansion because strict rules push demand, while heavy spending on AI-powered regulatory tech fuels progress. Complexity pulls innovation forward here.

- Fueled by wider access to online finance tools, the Asia Pacific surges ahead. New rules reshape how institutions operate across the area. Efforts to block money-related misconduct gain ground steadily here. Growth outpaces every other part of the world because of these shifts.

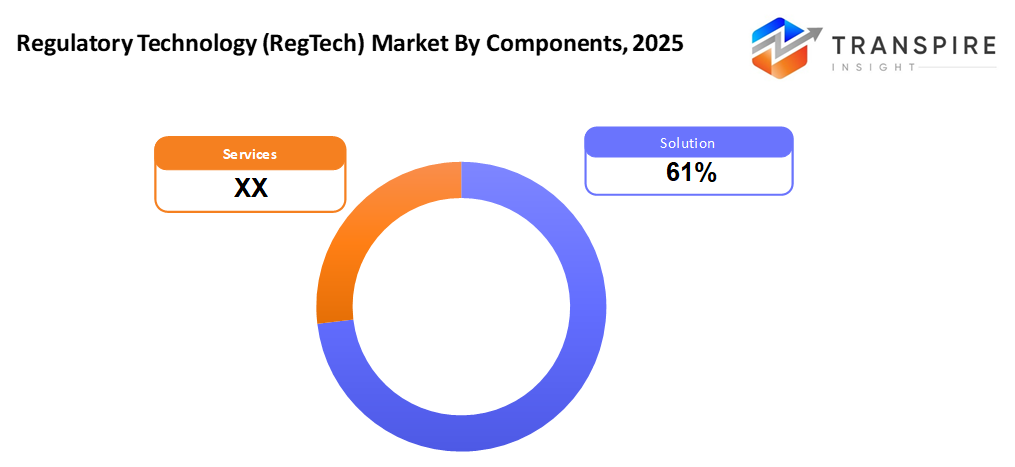

- Solution share approximately 63% in 2026. Solutions take the lead because organizations now want full-package systems instead of separate tools. What matters most is how everything connects from start to finish.

- Growth comes from easier scaling. Updates meet regulations more quickly. Less money goes into physical systems.

- Artificial intelligence plus machine learning. These tools spot risks as they happen. Prediction becomes part of staying compliant. Smarter oversight emerges from instant analysis. Patterns surface before problems grow. Speed changes how rules are followed.

- Transaction monitoring and anti-money laundering see fastest gains, as pressure mounts on banks worldwide. Rules tighten everywhere, pushing demand higher. Risks rise, responses follow. Growth spikes where threats grow quickest.

The Regulatory Technology (Reg Tech) market is enjoying a healthy growth owing to the growing regulatory complexity and compliance costs, as well as the risk of committing financial crimes among financial institutions. RegTech solutions are based on the power of advanced technologies, including artificial intelligence, machine learning, robotic process automation, big data analytics, and blockchain, to assist a bank, insurance company, or fintech company in automating compliance processes, mitigating operational risk, and ensuring compliance with new regulations. The fast digitalization of financial services, coupled with the increasing necessity to provide real-time reporting and monitoring are contributing to the use of RegTech solutions around the world.

RegTech platforms are being implemented by financial institutions in a wide variety of use case scenarios, such as compliance management, risk assessment, KYC and identity verification, transaction monitoring, AML, regulatory reporting, and fraud detection. Predictive risk intelligence, anomaly detection, and automated decision-making are becoming a reality with AI and ML-powered tools that help organizations to stay ahead of regulatory challenges. There is also the adoption of cloud-based solutions to be scalable, fast to deploy, and update smoothly to meet the changing regulatory requirements.

The market is also undergoing great acceptance in large organizations, especially banks and financial institutions, with huge volumes of transactions and complicated regulatory requirements. The models of cloud deployment take over because of their flexibility and affordability, whereas on-premise solutions are still applicable in cases where the organization would need strict data security and control. The growth of partnerships between fintech companies, RegTech solutions, and regulating bodies is also promoting innovation further, as this allows for monitoring compliance in real-time and streamlining the reporting processes.

The North American market dominates the RegTech market, which is a result of established financial systems, stringent regulatory regulations, and early adoption of technologies. Close behind Europe is a huge investment in digital compliance platforms and regulatory reporting tools. Asia Pacific is turning out to be the fastest-growing market, driven by the increasing digital banking, regulatory reforms by the government, and increasing awareness of fraud prevention in financial crime. All these trends make the RegTech market a promising growth and innovation in the forecast period.

Regulatory Technology (RegTech) Market Segmentation

By Component

- Solution

Automated tools handle rules, checks, updates, and data tracking. These systems manage oversight tasks while processing legal requirements across daily operations.

- Services

Helping teams adopt RegTech tools through guidance, setup, learning programs, and ongoing oversight. Expertise spans planning, connecting systems, skill building, plus day-to-day management. Support begins at design, continues through launch, and extends into refinement. Each phase is shaped by real needs, live data, and practical goals. Custom approaches fit specific workflows, compliance demands, and team size.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- Cloud-Based

Cloud-based setups let firms scale RegTech easily, watching compliance as it happens while cutting update costs through shared infrastructure models that adjust on demand.

- On-Premises

Firmly rooted on local servers, these setups appeal to organizations guarding sensitive information tightly. Sometimes compliance rules make off-site storage a nonstarter. For them, control means everything - especially when laws demand it.

By Technology

- Artificial Intelligence & Machine Learning

Using smart systems that learn over time helps spot risks before they grow. These tools guess where problems might show up in rules checks. Odd patterns get flagged fast without waiting. Machines notice what humans could miss.

- Big Data Analytics

Out in the open, massive piles of rules and deal records get broken down fast, suddenly patterns show up, clear reports follow close behind. Sometimes it is slow at first, yet detail floods in before anyone expects.

- Blockchain

A digital trail that stays unchanged once written. Records appear clear to those who need them. Changes cannot happen without leaving a mark behind.

- Robotic Process Automation (RPA)

Automates repetitive compliance workflows and reporting tasks.

- Natural Language Processing

Reading between the lines of rules, documents, and messy compliance info, this tool makes sense of it all. By piecing together jumbled text, it spots what matters without needing perfect formatting. Understanding human language in reports becomes possible, even when details are scattered. Hidden patterns emerge from policy wording that others might overlook. Meaning rises from chaos, quietly.

By Application

- Compliance Management

For handling rules, there is software that brings everything together. One system keeps tabs on what needs doing. Staying up to date becomes easier when oversight happens in a single place. Following laws is not left to chance; it gets built into daily operations. Tasks like reporting or audits fit within structured workflows. Oversight does not rely on scattered spreadsheets anymore. Requirements are visible at every step.

- Risk Management

Staying ahead means spotting problems before they grow. One step at a time, weak spots get fixed. Watch closely, rules change fast. Mistakes slow things down. Every detail matters when avoiding trouble. Small fixes today prevent big issues tomorrow.

- Identify Management & KYC

Starting off, digital checks help confirm who people really are when they sign up online. These steps make sure banks follow rules about knowing their customers. One way this works is by using secure identity proofs during registration. Following laws against money laundering also depends on solid ID tracking. Verification happens early, so everything stays compliant later down the line.

- Transaction Monitoring & AML

Fresh alerts pop up when odd transactions appear. Risky patterns get flagged fast during checks. Suspicious behavior shows on screen before harm spreads. Money trails that twist too much draw immediate attention. Systems watch every move without slowing things down.

- Regulatory Reporting

Reports go out on time, filled without manual entry. Systems handle filings the moment they are due. Accuracy improves when software takes over updates. Rules are followed because checks run automatically. Submission deadlines pass smoothly, no last-minute fixes needed.

- Fraud Management

Fighting money tricks using smart machines that learn. Spotting shady moves before they cause harm, thanks to pattern reading. Stopping fake transactions by watching behavior clues. Learning from past slips to block future sneaky acts.

Regional Insights

The market of RegTech is dominated by North America (Tier 1: United States, Canada; Tier 2: Mexico) because of the developed financial environment, high regulatory standards, and the willingness to utilize new technologies at the earliest to adhere to AI, machine learning, and cloud-based technologies. The region is dominated by the United States, and banks and financial institutions invest a lot in automated compliance monitoring platforms and risk management platforms. Canada experiences gradual purchasing in digital banking and digital insurance, and Mexico, as a Tier 2 destination, is slowly initiating RegTech to increase regulatory compliance and financial transparency.

The region of Europe (Tier 1: United Kingdom, Germany, France; Tier 2: Italy, Spain, Nordics, Eastern Europe) has been identified as a huge market of RegTech because of strict regulatory frameworks such as MiFID II, GDPR, and AML regulations. The UK is first in terms of the implementation of AI-based compliance and reporting systems, followed by Germany and France, which specialize in risk management, fraud detection, and KYC automation. There is an increasing usage of tier 2 European markets, especially in digital banking and fintech ecosystems, as companies aim to address regional regulatory requirements in an effective manner.

The region with the most active growth in the RegTech market is Asia Pacific (Tier 1: China, India, Japan, Australia; Tier 2: Southeast Asia including Singapore, Indonesia, Thailand, Vietnam), as the fast pace of the shift to digital banking and the introduction of government-driven regulatory changes, as well as the increased awareness of financial crime prevention, drive its growth. China and India are the Tier 1 adopters with massive deployments in banking, payments, and AML compliance, and Japan and Australia concern regulators' reporting and risk management. The Tier 2 markets in Southeast Asia are gaining prominence as the new areas of growth, and fintech startups and banks are beginning to apply RegTech solutions to KYC, transaction monitoring, and fraud prevention.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 24, 2022 – Fidelity Investments launched an innovative new regulatory technology business to help financial institutions create compliant public communication.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 22.56 Billion |

|

Market size value in 2026 |

USD 31.33 Billion |

|

Revenue forecast in 2033 |

USD 130.01 Billion |

|

Growth rate |

CAGR of 22.55% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ACTICO, Thomson Reuters, PWC, Accenture, IBM Corporation, Oracle Corporation, Wolter Kluwer, FIS Global, Finastra, MetricStream Inc., Nice Actimize, ComplyAdvantage, Actico, Regology, Seon Technologies, and ComplyCube |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Solution, Services) By Deployment Mode(Cloud-Based, On-Premises) By Technology (Artificial Intelligence & Machine Learning, Big Data Analytics, Blockchain, Robotic Process Automation, Natural Language Processing) By Application (Compliance Management, Risk Management, Identity Management & KYC, Transaction Monitoring & AML, Regulatory Reporting, Fraud Management) |

Key Regulatory Technology (RegTech) Company Insights

Thomson Reuters is a global leader in Regulatory Technology (RegTech), providing comprehensive solutions for compliance, risk management, and regulatory reporting. Its platforms integrate real-time regulatory intelligence with advanced analytics, helping banks, insurance firms, and fintechs stay compliant with evolving regulations efficiently. The company offers tools for KYC/AML, transaction monitoring, and audit-ready reporting, reducing operational risk and manual workloads. With a strong global presence, deep expertise in financial regulations, and robust partnerships with financial institutions, Thomson Reuters remains one of the most influential players in the RegTech market.

Key Regulatory Technology (RegTech) Companies:

- ACTICO

- Thomson Reuters

- PWC

- Accenture

- IBM Corporation

- Oracle Corporation

- Wolter Kluwer

- FIS Global

- Finastra

- MetricStream Inc

- Nice Actimize

- ComplyAdvantage

- Regology

- Seon Technologies

- ComplyCube

Global Regulatory Technology (RegTech) Market Report Segmentation

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Technology

- Artificial Intelligence & Machine Learning

- Big Data Analytics

- Blockchain

- Robotic Process Automation

- Natural Language Processing

By Application

- Compliance Management

- Risk Management

- Identify Management & KYC

- Transaction Monitoring & AML

- Regulatory Reporting

- Fraud Management

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

APAC:+91 7666513636

APAC:+91 7666513636