Jan 24, 2026

The report “Immunotherapy Drugs Market By Type of Immunotherapy (Monoclonal Antibodies, Checkpoint Inhibitors, CAR-T Cell Therapy, Cytokines, Cancer Vaccines, Others), By Route of Administration (Intravenous, Subcutaneous, Oral, Others), By Application (Oncology, Autoimmune Diseases, Infectious Diseases, Others), By End-Users (Hospitals & Clinics, Ambulatory Care Centers, Research and Academic Institutes, Home Healthcare)” is expected to reach USD 395.00 billion by 2033, registering a CAGR of 8.00% from 2026 to 2033, according to a new report by Transpire Insight.

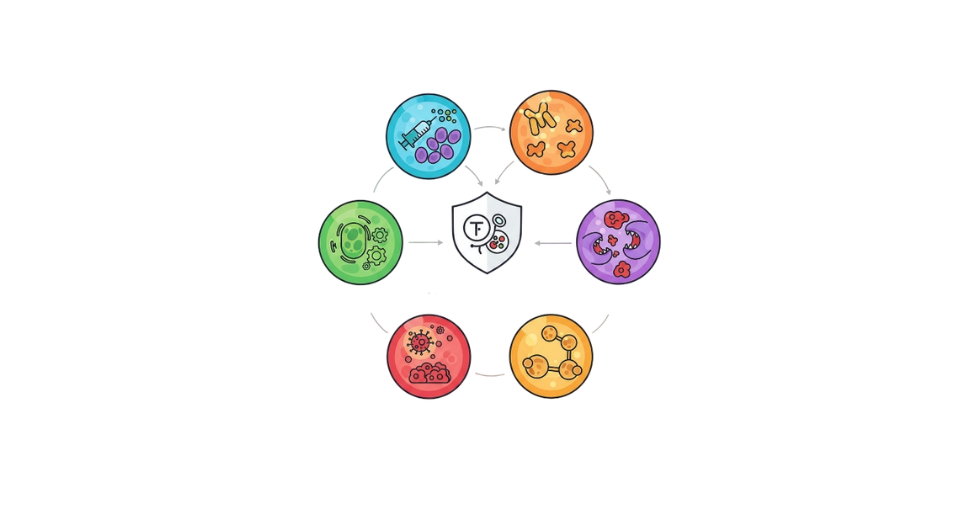

Fighting illness by tuning the body's own defenses shapes much of today’s work in immunotherapy medicines. Instead of wiping out cells, some treatments push the immune system into sharper focus, especially against cancer, overactive immunity, or infections. Monoclonal antibodies lead because doctors rely on them often, particularly when handling tumors or long-term health issues. Other paths, like checkpoint blockers, engineered T-cells, signaling proteins, and vaccines, train the body to strike precisely. These options tend to cause less collateral damage than older methods did. Precision plays a bigger role now, nudging response rather than forcing it. Though varied, each method shares the aim: better results without wearing patients down.

More people facing cancer and immune disorders are pushing market expansion, along with better health knowledge, plus wider availability of modern medical care. Leading the way, North America thrives on deep research efforts, quick uptake of new treatment methods, and a well-built medical framework. Over in Europe, steady health networks and clear regulations help sustain progress. Growth surges quickest across the Asia Pacific, where medical services are reaching more individuals, backed by national programs and a stronger need for high-level treatments, especially seen in nations such as China and India.

Out in labs and hospitals, new ways to deliver treatments like IVs, under-the-skin shots, pills, and targeted techniques are reshaping how care moves through the system. From medical centers to private homes, places giving care now adapt fast, showing shifts in how patients get help during stays or after discharge. Driven by tools that tailor therapy, connect data, or track progress without constant human input, results improve while workflows simplify, pushing immune-based drugs into sharper focus across worldwide drug markets.

The Monoclonal Antibodies segment is projected to witness the highest CAGR in the Immunotherapy Drugs market during the forecast period.

According to Transpire Insight, expect steady growth ahead for monoclonal antibodies in the immunotherapy drug space - their broad use in cancer, autoimmune conditions, and long-term illnesses gives them an edge. Because they zero in on harmful antigens, treatments become more accurate, often sparing patients harsher reactions seen with older methods. Progress doesn’t stop there; better designs like dual-targeting versions and linked drug forms keep emerging. On top of that, fresh approvals for different health issues help spread their reach through medical centers globally. What you see now is momentum built on science that keeps evolving quietly but firmly.

Personalized treatments are getting attention, pushing these drugs forward. Healthcare knowledge spreads wider now; because of that, cancer studies get extra money, especially where clinics and hospitals grow fast in developing nations. North America uses them a lot already same goes for Europe, but places like Asia see quicker jumps lately. Because progress moves so fast there, these antibodies likely stay top priority worldwide when it comes to immune-based medicines over the next few years.

The Intravenous segment is projected to witness the highest CAGR in the Immunotherapy Drugs market during the forecast period.

Most cutting-edge immunotherapy treatments enter the body through the veins. Because these include complex agents like monoclonal antibodies, checkpoint blockers, and signaling proteins, they rely on drip systems for accurate delivery. Hospitals favor this path since it ensures steady dosage control alongside immediate spread across the bloodstream. Patient responses can be watched carefully during treatment sessions. Given the intricate nature of such therapies, careful regulation matters so IV stays ahead. Specialized clinics stick with infusions due to safety demands and consistency needs.

Fueled partly by larger hospitals and more clinics, the IV sector keeps expanding. Patient numbers climb - especially those needing care for cancer or immune disorders - not slowing down anytime soon. Improved tools for infusions now make procedures safer and feel less invasive, too. In North America and parts of Europe, strong health systems plus well-trained staff push usage higher. Meanwhile, across the Asia Pacific, new infusion centers pop up as therapies become reachable. Medical need pairs with real-world readiness. That bond locks intravenous delivery into place as a central force in worldwide treatment efforts.

The Oncology segment is projected to witness the highest CAGR in the Immunotherapy Drugs market during the forecast period.

According to Transpire Insight, Nowhere is immunotherapy expanding faster than in cancer care, since tumors still claim countless lives worldwide. Because they zero in on malignant cells, treatments like monoclonal antibodies, checkpoint blockers, CAR-T approaches, and tumor vaccines gain favor spare healthy tissue when possible. More diagnoses happening sooner, a growing number of patients, plus pressure to find better outcomes, keep pushing usage up across clinics focused on malignancies.

More spending on research helps this area grow, along with fresh green lights for cancer treatments that train the body’s defenses. Hospitals and clinics focused on cancer are using these therapies more often now. Leading the pack, North America benefits from high-end medical systems and busy testing grounds for new drugs; doctors there know a lot about them. Europe and parts of Asia are catching up fast because care reaches more people, patients recognize options better, plus backing from officials adds momentum. All together, these pieces make cancer treatment the biggest piece of the immune-based drug world, growing quicker than any other part.

The Hospitals & Clinics segment is projected to witness the highest CAGR in the Immunotherapy Drugs market during the forecast period.

With their ready access to advanced care setups, hospitals and treatment centers are seeing stronger demand for immunotherapy drugs than other user groups. Because they house skilled teams and tools needed to handle intricate treatments - like monoclonal antibodies or CAR-T cells these places form the backbone of delivery. Treatment unfolds under watchful eyes, whether patients stay overnight or visit briefly during the day. Safety checks, correct doses, and quick response to reactions happen most reliably here. Growth in drug use ties closely to how these settings manage real-time care needs.

More hospital beds help this area grow, along with new cancer and immune disorder clinics popping up across regions because better infusion tech draws investment. Leading the way, North America stays ahead thanks to strong medical systems that quickly bring in cutting-edge treatments. In contrast, places like the Asia Pacific are speeding up upgrades, giving more people access to newer forms of therapy such as immunotherapy. Hospitals there modernize fast since funding flows into diagnosis tools and care spaces. Across Europe, progress moves at a reliable pace, given that both state-run and private health providers prioritize novel options for patients needing long-term solutions.

The North America region is projected to witness the highest CAGR in the Immunotherapy Drugs market during the forecast period.

Home to cutting-edge medical systems, North America leads global demand for immunotherapy treatments. Thanks to deep research roots, fresh therapies like checkpoint blockers arrive here first. The United States, standing ahead within the region, shapes much of this space, and spending on health care runs high. Trials unfold at scale across cities and labs. Specialized clinics and hospital hubs make delivery of intricate options like CAR-T possible. New antibody-based methods took hold early in these networks.

North America sees stronger market expansion as more people face cancer diagnoses, while attention grows around autoimmune conditions. Faster therapy approvals happen because rules support innovation. Personalized treatments get more funding now, alongside improvements in hospital facilities. New methods for delivering infusions also help patients respond better. Working together, university hospitals team up with private clinics and drug developers. These partnerships spread new approaches quickly. Leadership in immunotherapy stays centered here for now.

Key Players

Top companies include Roche, Bristol-Myers Squibb, Merck & Co., Novartis, Johnson & Johnson, AstraZeneca, Amgen, Gilead Sciences, Pfizer, Eli Lilly and Company, AbbVie, Regeneron Pharmaceuticals, Takeda Pharmaceutical, Celgene, Biogen, Sanofi, Seattle Genetics, Kite Pharma, Moderna, and Moderna Therapeutics.

Drop us an email at:

Call us on:

+91 7666513636