Market Summary

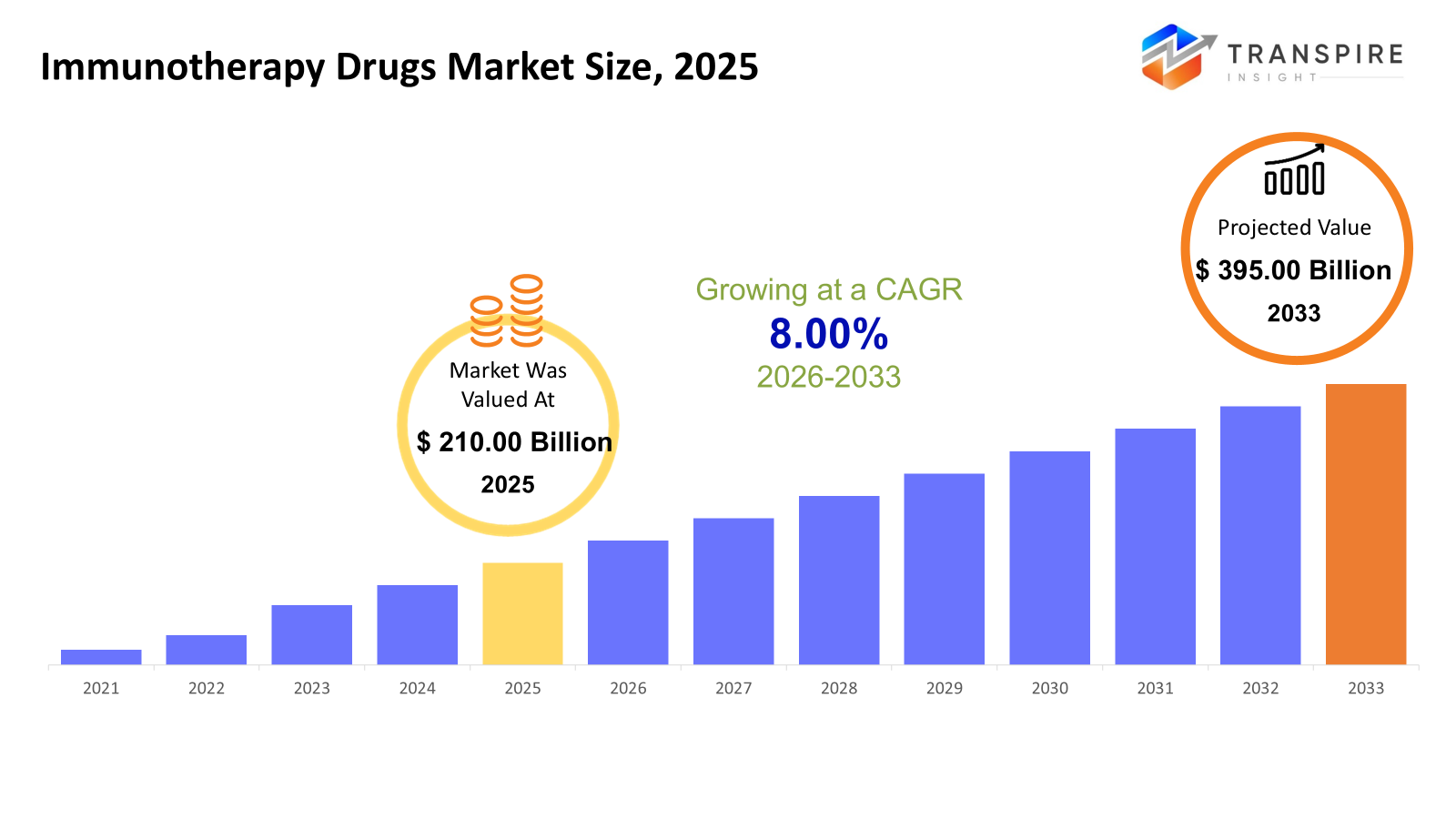

The global Immunotherapy Drugs market size was valued at USD 210.00 billion in 2025 and is projected to reach USD 395.00 billion by 2033, growing at a CAGR of 8.00% from 2026 to 2033. The growth of the global immunotherapy drugs market is driven by the increasing prevalence of cancer, autoimmune disorders, and other chronic diseases that require advanced treatment options. Rising investment in research and development has led to the introduction of novel immunotherapy treatments, including checkpoint inhibitors, CAR-T therapies, and monoclonal antibodies, which are improving patient outcomes and expanding treatment options.

Market Size & Forecast

- 2025 Market Size: USD 210.00 Billion

- 2033 Projected Market Size: USD 395.00 Billion

- CAGR (2026-2033): 8.00%

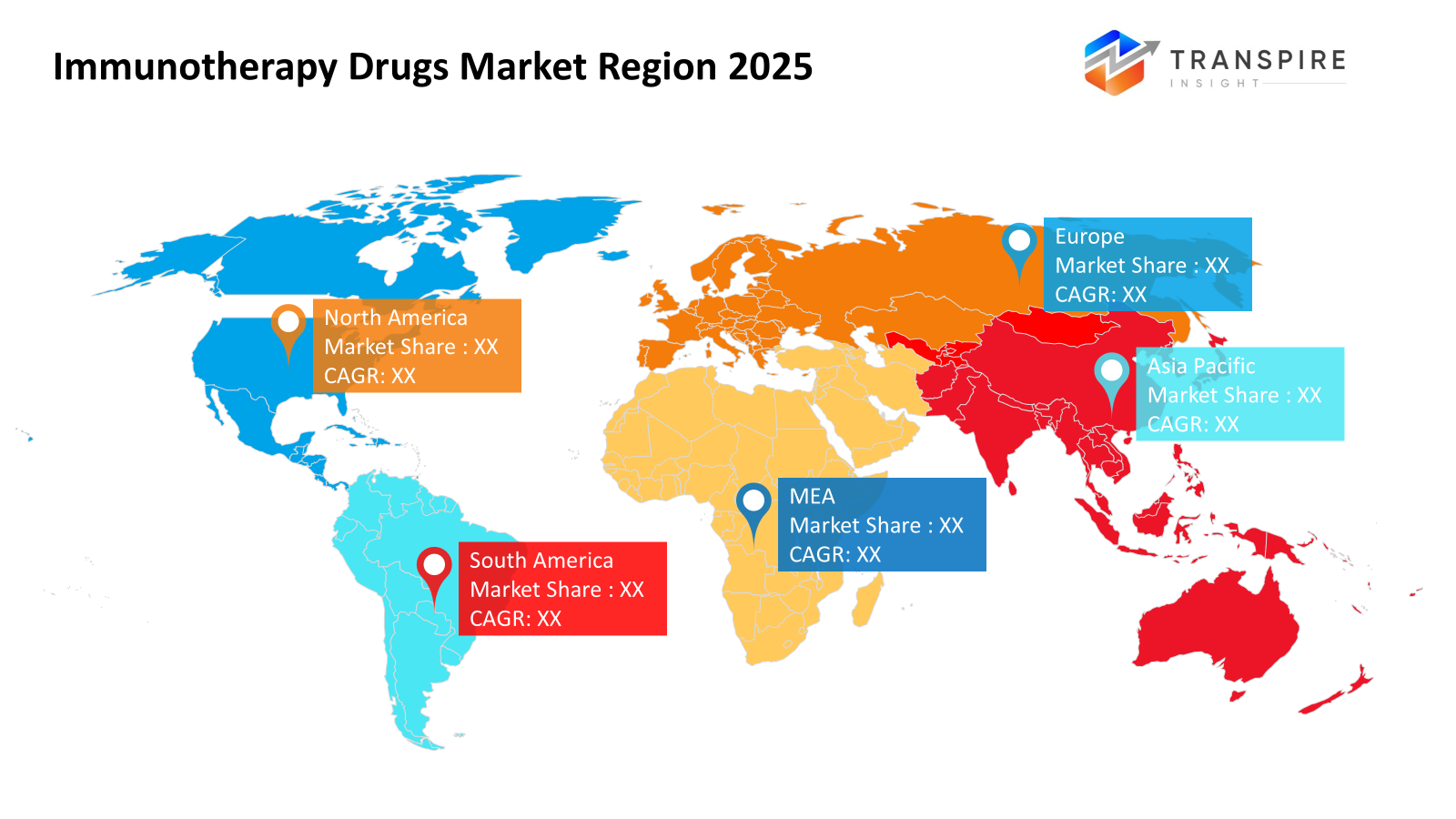

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 46% in 2026. Top spot worldwide when it comes to using cutting-edge immune treatments. Research efforts run deep here, fueling progress. Approvals from oversight bodies come through steadily. Medical systems are built to handle these therapies smoothly. Progress thrives where support is already in place.

- The United States Home to countless studies testing new treatments, this nation leads across the continent. New medical approaches often appear here first, shaping what comes next. Spending on health services runs deep, fueling progress in unpredictable ways.

- In the Asia Pacific, health needs grow faster than anywhere else. Cancer shows up more often now. Care reaches further into communities. Money flows in from officials and businesses alike, building new capabilities for immune-based treatments.

- Monoclonal Antibodies share approximately 77% in 2026. Common in clinics, always evolving. Their reach grows through steady updates in precision treatments. Real-world use keeps expanding.

- Through veins it flows the go-to path for powerful immune treatments needing steady, body-wide reach. Most cutting-edge therapies enter here first.

- Cancer treatments push the sector forward. Immunotherapies dominate here, expanding more quickly than anything else. Mostly new drugs targeting tumors through immune activation.

- Most treatments still happen where doctors can watch closely. These places handle tough cases because they have the space and tools ready. Equipment lines up just right when therapy needs careful steps. Watching patients closely matters most during stronger doses. Staff stay nearby whenever new rounds begin.

Around the world, medicines that work by adjusting how the body's defense system acts make up a growing part of health care, especially for illnesses like cancer, autoimmune problems, and infections. Instead of just one method, these include things like lab-made proteins, molecules that release immune brakes, altered T cells, signaling proteins, along with vaccines meant to fight existing cancers. Because they aim at specific disease pathways, patients often face fewer unwanted reactions than what happens with older methods, such as chemo or strong immune blockers.

Even though monoclonal antibodies lead today's market, their main role comes from frequent use against cancer and long-term illnesses. Instead of older methods, newer options like CAR-T cell therapy are spreading fast because they work where others failed. Checkpoint inhibitors join them, rising in use thanks to real results seen in tough cases. Behind the scenes, ongoing studies keep feeding a growing list of fresh immune-based treatments. Approvals by health authorities add momentum, just as positive trial outcomes boost trust across global markets.

Fueled by more cases of cancer, autoimmune disorders, and infections worldwide, demand keeps climbing. Healthcare knowledge spreads, care becomes easier to reach, and on top of public programs upgrading medical systems, this mix lifts usage across North America and Europe. Elsewhere, places like Asia Pacific and Latin America accelerate fast, not because of old trends but fresh gains in hospital quality and larger numbers needing care.

Fresh waves of tech progress reshape how immune treatments reach patients through IV drips, under-the-skin shots, pills, or tailored methods. From hospital wards to doctor offices, labs to living rooms, care now spreads across many settings, matching shifts in where healing happens. Digital tools, smart machines, and custom therapies quietly boost results while smoothing workflows behind the scenes. This field pulses at the core of change in drug science worldwide, not loud, just vital.

Immunotherapy Drugs Market Segmentation

By Type of Immunotherapy

- Monoclonal Antibodies

Fresh from the lab, these tailored antibodies hunt down precise markers linked to cancers or immune disorders. One by one, they are built to recognize trouble spots that cells can not hide. Not random helpers, each locks onto a single distinct signal. Made on demand, they mirror natural defenders yet aim sharper. Precision matters when tagging disease triggers others miss.

- Checkpoint Inhibitor

Stopping certain brakes on immune cells lets them fight tumors better. These medicines take the lid off natural defenses so they can target rogue cells. Some treatments work by interrupting signals that hold back white blood cells. Freeing up the immune system helps it recognize and destroy abnormal growths more effectively. Blocking checkpoint pathways turns up the body’s own surveillance against cancer.

- CAR-T Cell Therapy

Imagine your immune system getting a high-tech upgrade, engineered T-cells hunt down tumors like guided missiles. Each treatment is built from the patient's own cells, trained to recognize dangerous invaders. Instead of one-size-fits-all drugs, this method tailors the attack precisely. Modified defenders multiply inside the body, staying alert long after therapy ends. Cancer cells that once hid now face a custom-made threat designed just for them.

- Cytokines

Certain proteins guide how the body fights illness, interleukins and interferons, among them. These molecules shape immunity, nudging cells into action when threats appear. To switch on defenses, adjust intensity, and keep balance. Without such signals, response systems stumble. Each type plays a distinct role in coordination.

- Cancer Vaccines

A shot that teaches the body to spot cancer cells. These vaccines push the immune system into action when tumors appear. Instead of preventing illness, they step in after the disease shows up. The goal is recognition, making sure rogue cells get noticed. Immune activity turns targeted, focusing only on what harms. Treatment shifts toward precision rather than broad strikes.

- Others

A few newer treatments are showing up, like engineered viruses that attack cancer cells or drugs adjusting how immunity works across different illnesses.

To learn more about this report, Download Free Sample Report

By Route of Administration

- Intravenous

Floating straight into the blood, IV sends medicine fast where it needs to go. Speed meets precision without detours through digestion.

- Subcutaneous

Beneath the surface, medicine slips just under the skin. This route simplifies delivery while helping patients stick to treatment. A small needle is placed into fatty tissue below. Comfort matters here, so ease of use becomes key. Fewer steps mean less hassle each day.

- Oral

Popping a pill is how some get their immune system treatments at home. These small containers hold medicine meant to fight illness without needles. Swallowing them kicks off the body's defense training. Capsules travel down, opening where they are needed most. No clinics required, just steady doses over time.

- Others

Some treatments reach the body through skin applications, breathing in vapors, or targeted shots placed directly where needed. Delivery shifts depending on the therapy’s goal, using paths beyond standard pills or drips. Routes such as these allow medicine to act in precise areas instead of spreading throughout the system.

By Application

- Oncology

From inside the body, cancer fights back when immunity shifts. Tumors, both hard masses and rogue cells in circulation, respond as defenses recalibrate. Change happens not by attack but by balance. Shifts in response alter disease paths. Healing hides in adjustment, not force.

- Autoimmune Diseases

Management of conditions such as rheumatoid arthritis, lupus, and multiple sclerosis.

- Infectious Diseases

When germs attack, some treatments help the body fight back stronger. These methods boost how well immunity works during illness caused by viruses or bacteria.

- Others

Some treatments using the immune system help with allergic reactions. Besides allergies, these methods assist people in managing metabolism issues. Immune-based therapies also play a role when someone receives a new organ. Support for transplants sometimes involves adjusting how the body responds internally.

By End-Users

- Hospitals & Clinics

Hospitals and clinics handle most advanced immunotherapies; these places have the tools needed. Where care gets intense, that is where these therapies usually start.

- Ambulatory Care Centers

Some clinics offer cancer treatment without overnight stays. These spots give infusions during daytime visits. Patients go home after sessions. Treatment happens outside hospitals. Care continues regularly but not indoors.

- Research and Academic Institutes

Some labs test new treatments through hands-on studies. Where science meets real-world patient care in structured experiments. These hubs push medical knowledge by running controlled trials. Work here often shapes how diseases are tackled tomorrow. Teams explore fresh therapies under strict observation rules. Progress happens where research blends with practical healing methods.

- Home Healthcare

Home care for immune therapies, handle yourself, or have doctors watch from a distance.

Regional Insights

The United States leads the world in immunotherapy drug use, thanks to its robust medical system and fast uptake of new treatments like monoclonal antibodies, CAR-T, and checkpoint inhibitors. Because research thrives there, progress moves quickly, fuelled by heavy spending on health and a steady flow of clinical trials. Rules that back innovation help, too, keeping North America ahead. While smaller in scale, Canada adds consistent momentum through public healthcare support and growing use of high-tech biologic medicines. This mix keeps the region at the front, unmatched in reach and development depth.

Nowhere is medical progress more visible than across Europe, where stable systems keep care within reach for most people. Because public coverage exists almost everywhere, new treatments spread steadily through populations. Germany, along with the United Kingdom and France, moves faster in using immune-based therapies; patients there know more, and doctors respond quicker. Safety matters deeply here, shaped by strict rules that shape how medicines enter clinics. Research thrives thanks to long-standing academic ties between institutions. Over time, nations in the east begin catching up, fueled by fresh funding and better hospitals rising year after year.

Fast growth is showing up across parts of Asia Pacific, Latin America, and the Middle East & Africa. Driven by countries like China, India, and Japan, the Asia Pacific moves quickly thanks to more cancer cases, better health services, and funding from both public and private sources. In Latin America, progress creeps forward as knowledge spreads and money spent on care rises slowly. The Middle East and Africa find openings because of upgrades in medical systems, plus collaborations with international drug makers, yet their share today still trails behind that of North America and Europe.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 5, 2025 – Intas Pharmaceutical launched HETRONIFLY™, India’s first novel immunotherapy for advanced small-cell lung cancer.

- July 16, 2025 – First dog received combination immunotherapy new cancer trial.

(Source:https://www.dvm360.com/view/first-dog-receives-combination-immunotherapy-in-new-cancer-trial

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 210.00 Billion |

|

Market size value in 2026 |

USD 230.00 Billion |

|

Revenue forecast in 2033 |

USD 395.00 Billion |

|

Growth rate |

CAGR of 8.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Roche, Bristol-Myers Squibb, Merck & Co., Novartis, Johnson & Johnson, AstraZeneca, Amgen, Gilead Sciences, Pfizer, Eli Lilly and Company, AbbVie, Regeneron Pharmaceuticals, Takeda Pharmaceutical, Celgene, Biogen, Sanofi, Seattle Genetics, Kite Pharma, Moderna, and Moderna Therapeutics |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type of Immunotherapy (Monoclonal Antibodies, Checkpoint Inhibitors, CAR-T Cell Therapy, Cytokines, Cancer Vaccines, Others), By Route of Administration (Intravenous, Subcutaneous, Oral, Others), By Application (Oncology, Autoimmune Diseases, Infectious Diseases, Others), By End-Users (Hospitals & Clinics, Ambulatory Care Centers, Research and Academic Institutes, Home Healthcare) |

Key Immunotherapy Drugs Company Insights

A giant in biotech and pharma, Roche zeroes in on cancer and immune system medicines. Built on breakthroughs like monoclonal antibodies, their work shapes how tumors are targeted today, think precision drugs that block key signals plus smart combos. Pushing science forward means pouring resources into labs where new forms of tailored treatment take shape. Across continents, from clinics in Chicago to research hubs in Shanghai, they team up with universities, medical centers, and startup innovators. Outcomes shift when discoveries move beyond test tubes into real lives, one therapy at a time.

Key Immunotherapy Drugs Companies:

- Roche

- Bristol-Myers Squibb

- Merck & Co.

- Novartis

- Johnson & Johnson

- AstraZeneca

- Amgen

- Gilead Sciences

- Pfizer

- Eli Lilly and Company

- AbbVie

- Regeneron Pharmaceuticals

- Takeda Pharmaceutical

- Celgene

- Biogen

- Sanofi

- Seattle Genetics

- Kite Pharma

- Moderna Therapeutics

Global Immunotherapy Drugs Market Report Segmentation

By Type of Immunotherapy

- Monoclonal Antibodies

- Checkpoint Inhibitors

- CAR-T Cell Therapy

- Cytokine

- Cancer Vaccines

- Others

By Route of Administration

- Intravenous

- Subcutaneous

- Oral

- Others

By Application

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Others

By End-Users

- Hospitals & Clinics

- Ambulatory Care Centers

- Research and Academic Institutes

- Home Healthcare

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636