Dec 26, 2025

The report Gastrointestinal Endoscopy Market By Type (Rigid Gastrointestinal Endoscope, Flexible Gastrointestinal Endoscopes, Disposable Gastrointestinal Endoscope), By Procedure Type(Colonoscopy, Gastroscopy, Duodenoscopy, Enteroscopy, Flexible Sigmoidoscopy, Others), By Application (Diagnosis, Treatment), By End-Users (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Laboratories, Others), By Industry Analysis, Size, Share, Growth, Trends, Region and Forecasts 2021-2033 “The global Gastrointestinal Endoscopy market is expected to reach USD 19.86 billion by 2033 from USD 12.75 billion in 2025, at a CAGR of 5.70% from 2026 to 2033.

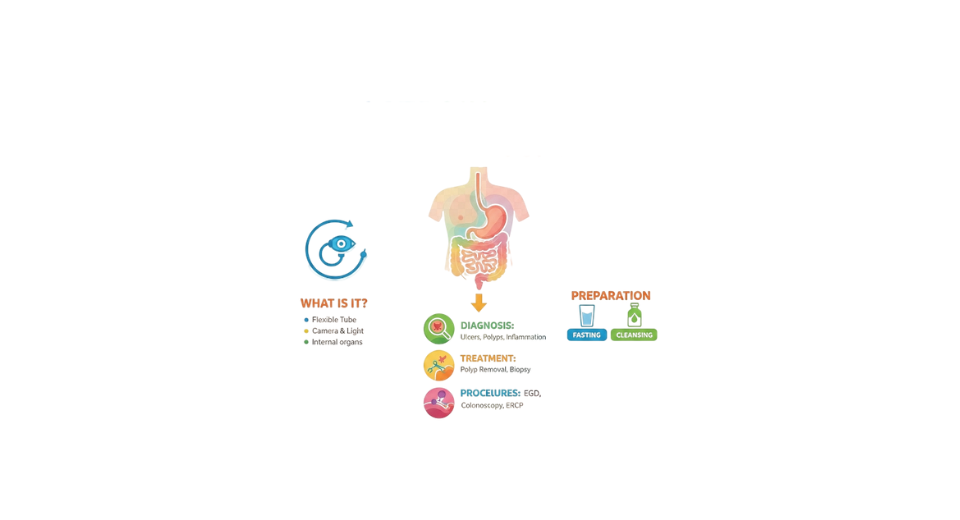

The worldwide gut scope scene plays a key role in today’s medical checkups and treatments, fueled by more people facing issues like colon cancer, swollen bowels, stomach bleeds, or acid reflux. Because these scans skip big cuts, give clear results, yet fix problems at the same time, doctors often choose them first. Newer tools - like sharp video modes, special light filters, smart software that spots odd tissue, even tiny pill-sized cameras are boosting success rates while spreading use from rich countries into growing health networks.

More people getting checked for health issues, especially colon problems, is helping drive demand, since older folks face higher risks of gut troubles. Big medical centers still lead the field, handling tough cases thanks to better tools and larger teams, whereas smaller surgery hubs and focused clinics are becoming popular due to lower costs and quicker recovery times. There's also a move toward cleaner practices and smoother operations, sparking more use of one-time scopes, mainly where infections could spread easily, or patients don't stay overnight.

North America stays ahead because it’s got solid screening rules, good insurance coverage, plus quick use of modern scopes. Still, Europe isn’t far behind due to robust government health networks and widespread knowledge about catching illnesses early. Meanwhile, the Asia-Pacific region is gaining speed faster than others, fueled by huge numbers of patients, better medical setups, and rising funds poured into testing centers in places like China, India, or Japan. All things considered, this worldwide gut-scope scene keeps growing slowly, sees constant upgrades, while more people everywhere gain access to less-invasive digestive treatments.

The Disposable Endoscope Vehicle segment is projected to witness the highest CAGR in the Gastrointestinal Endoscopy market during the forecast period.

The disposable endoscope part is expected to grow fastest in the gut scope market over the coming years. This jump comes as more people worry about infections and keeping patients safe. Since reusable scopes need tough cleaning steps, any mistake can lead to spreading germs; that’s where disposables step in. These one-time tools skip the whole cleanup issue, cutting down contamination chances completely. Because of this, they’re a strong fit for risky treatments, weak immune system cases, or busy clinics seeing lots of people. On top of that, tighter health rules, efforts to stop hospital bugs, and higher cleanliness demands are pushing more places to switch to throwaway scopes.

In fact, single-use scopes bring practical and financial perks that push more clinics and surgery centers to switch fast. Since they don’t require expensive cleaning setups, these tools cut down on upkeep bills while speeding up room turnover thanks to ready-to-go access. Better tech now means clearer pictures, smoother movement, and stronger results during procedures, making them much closer to traditional models in function. With medical teams focusing harder on speed, safety, and clear costs, throwaway scopes are set to grow quickly and reshape how gut exams happen going forward.

The Treatment Application segment is projected to witness the highest CAGR in the Gastrointestinal Endoscopy market during the forecast period.

The treatment side of GI endoscopy is likely to grow fast, since more procedures now focus on fixing issues, not just finding them. Instead of cutting open patients, doctors use scopes to remove polyps, put in stents, stop bleeding, widen narrow passages, or take out abnormal tissue from the gut lining. Because these methods usually mean less time in the hospital, fewer problems after the procedure, and quicker healing, hospitals are choosing them more often than traditional surgeries.

Fresh upgrades in scopes, camera tools, and gear accuracy keep opening doors for more issues handled through endoscopy. Since gut cancers, bleeding problems, and liver-pancreas illnesses show up more often, doctors now lean harder on endoscopic fixes right from the start. Clinics and outpatient surgery spots are putting cash into high-end endo systems not just to get better results but also to run more smoothly day-to-day. With medical teams focusing on affordable, people-first treatment paths, this therapy area should grow fast - fueling broader gains across the GI scope market.

The Duodenoscopy segment is projected to witness the highest CAGR in the Gastrointestinal Endoscopy market during the forecast period.

The duodenoscopy part of gut scanning tools should grow a lot in the coming years, as more people face liver and pancreas issues, while interest in tests like ERCP climbs. New features such as sharper visuals, smart software help, and better hand control boost success rates, plus open up tougher treatments. With stronger medical systems worldwide and more procedures happening, reuse-friendly and high-end scopes keep gaining ground steadily.

A growing move in the duodenoscopy field leans into one-time use scopes. These throwaway versions are catching on fast because reusing old types brings bigger infection risks, especially since cleaning them well is tough. Because they’re tossed after each patient, contamination chances drop sharply, so busy clinics or places where germs matter most now pick these more often, pushing their growth rate way above older reusable kinds. Rules focused on keeping patients safe back this change, nudging companies to build better disposable tools, helping this part of the market expand quickly ahead.

The Ambulatory Surgical Centers segment is projected to witness the highest CAGR in the Gastrointestinal Endoscopy market during the forecast period.

The ambulatory surgical centers (ASCs) are part of the market expected to grow fast, thanks to more focus on outpatient and one-visit treatments worldwide. Because they cut expenses and speed things up, these clinics are becoming go-to spots instead of hospitals, especially for common gut checks like colonoscopies or stomach viewings. Faster appointments, less waiting, plus cheaper bills make them appealing not just for doctors but also for patients looking into GI scopes.

Fresh tech upgrades in scopes plus safer methods now let clinics do more types of checkups without hospital stays. Some surgery hubs are swapping old tools for sharp, single-use cameras, which cuts down germs and speeds up room turnover. At the same time, better insurance payouts across certain areas help keep patient numbers rising. With hospitals aiming to save costs and boost outcomes, these walk-in centers should handle a bigger share of gut screenings soon, giving the industry a solid push forward.

The North America region is projected to witness the highest CAGR in the Gastrointestinal Endoscopy market during the forecast period.

The North American ambulatory surgical centers (ASCs) are seeing steady gains in the gastrointestinal endoscopy space - this jump comes as more patients move to outpatient settings where care fits better into daily life while easing financial pressure on health networks. Instead of hospitals, folks in the U.S. and Canada now go to ASCs for standard gut checks like colonoscopies or upper scopes since it’s cheaper, takes less time sitting around, plus appointments open up quicker. Because insurers back these office-based screenings with reliable pay structures, clinics perform them more often without delays piling up.

On top of that, clinics across North America are quickly bringing in better scopes - like HD cameras and throwaway tubes to keep patients safer while running more smoothly. Because rules around cleanliness are tight, one-time tools are catching on fast to lower the chance of spreading germs. With doctors pushing for smarter care, quicker visits, and less hassle, outpatient surgery spots up north should keep fueling demand for gut-check tech.

Key Players

Top companies include Olympus Corporation, Boston Scientific Corporation, Medtronic, Johnson & Johnson, Fujifilm, Stryker, Hoya Corporation, Smith + Nephew, Cook, Conmed Corporation, Ambu, Richard Wolf GmbH, Steris Plc, Medorah Meditek Pvt Ltd, Cliniva Healthcare, Micro-Tech Co. Ltd, and Shailli Endoscopy.

Drop us an email at:

Call us on:

+91 7666513636