Market Summary

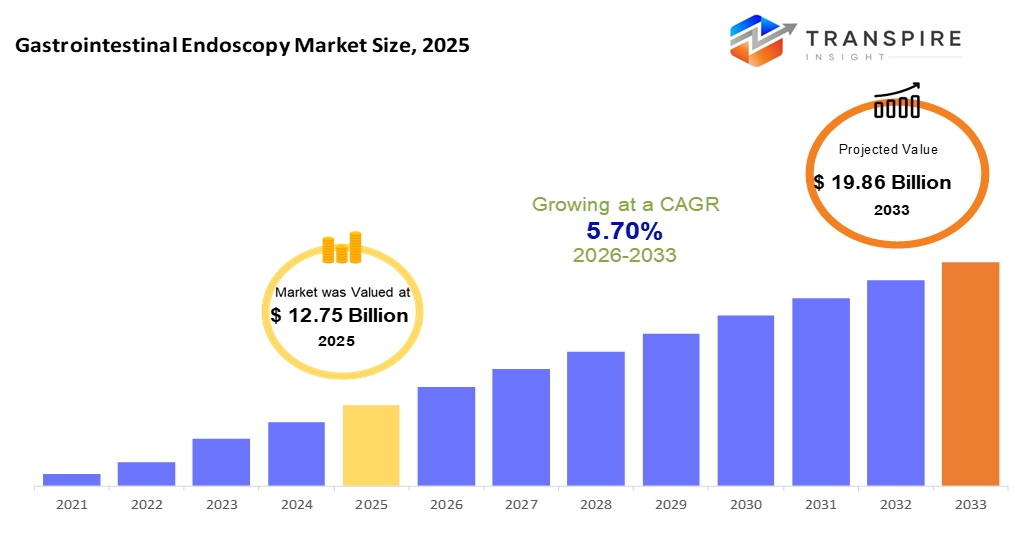

The Gastrointestinal Endoscopy Market shift suggests the industry could reach roughly $19.86 billion in 2033. More people getting checked for health issues, especially colon problems, is helping drive demand, since older folks face higher risks of gut troubles. Big medical centers still lead the field, handling tough cases thanks to better tools and larger teams, whereas smaller surgery hubs and focused clinics are becoming popular due to lower costs and quicker recovery times. There's also a move toward cleaner practices and smoother operations, sparking more use of one-time scopes, mainly where infections could spread easily, or patients don't stay overnight.

Market Size & Forecast

- 2025 Market Size: USD 12.75 Billion

- 2033 Projected Market Size: USD 19.86 Billion

- CAGR (2026-2033): 5.70%

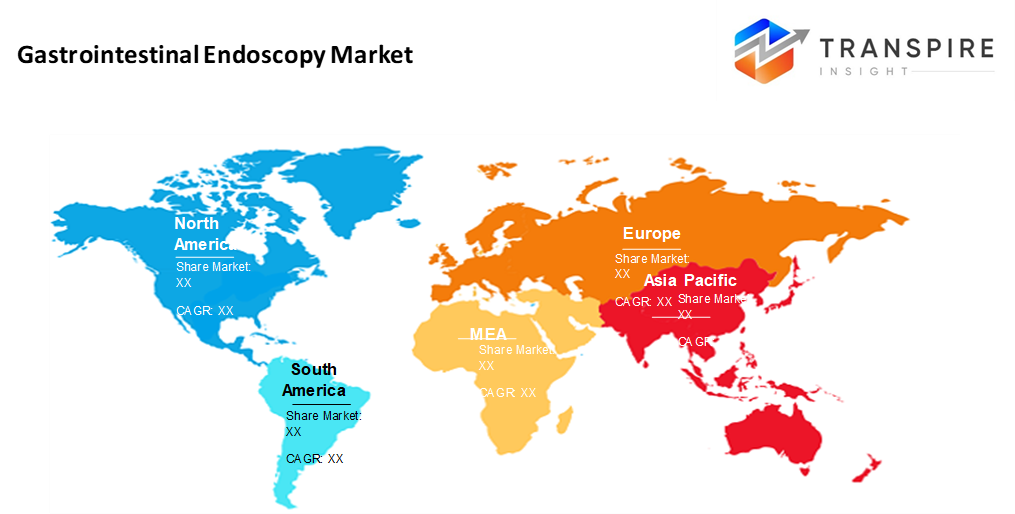

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has an approximate market share will be 42% in 2026. North America still leads in gut scope use, due to strong medical systems that quickly embrace new tech tools while staying well-equipped overall.

- In North America, the U.S. drives expansion because of high rates of long-term gut issues such as colon cancer and similar conditions alongside heavy health care costs, while prioritizing timely detection via routine check-ups.

- Asia Pacific’s health sector is growing quickly due to more cash flowing into care systems, clinics popping up everywhere, plus a bigger load of illness hitting huge communities like China, India, or Japan.

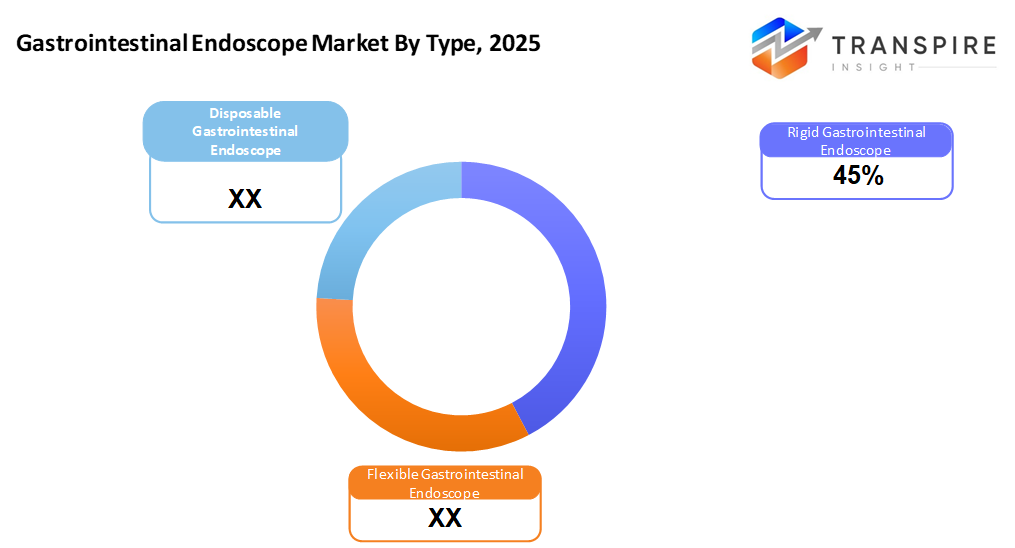

- Disposable Gastrointestinal Endoscope has market share will be 47% in 2026. Disposable (Single-Use) Gastrointestinal Endoscopes are expected to grow more quickly than others in GI scopes. Rising demand stems from a focus on preventing infections, reducing cleaning expenses, and preferring easier processes in clinics and surgery centers.

- Endoscopy's set to expand quickest. That rise ties to more frequent use in high-level checks and treatments, say, ERCP for issues in the bile ducts or pancreas.

- Treatment uses like therapeutic endoscopies are rising faster now. That’s because more people get small procedures instead of big surgeries -things like removing polyps, putting in stents, stopping bleeding, or similar fixes that skip the operating room.

- Ambulatory Surgical Centers (ASCs) While hospitals have the biggest piece, ambulatory surgery centers are expanding quicker - driven by shifts in care delivery.

The worldwide gut scope scene covers tools and tech that help doctors see, spot issues, or fix problems in parts like the food pipe, belly, gut tube, large bowel, and back passage. Tools here range from bendy and stiff scopes to imaging setups, pill-sized cameras, along with gear like tissue grabbers, support tubes, stretchers, and bleed-stoppers. These gut checks come into play during testing or treatment - offering a less intrusive way to look inside or step in quickly, cutting healing periods plus easing pressure on health services.

Demand for gut scans goes up because more people get sick from issues like colon cancer, stomach tumors, or inflamed bowels. Spotting problems early matters now, so check-ups using scopes happen way more often around the world. Older folks, poor eating patterns, plus less movement, lead to more illness, which pushes clinics and surgery hubs to do these tests nonstop.

The market keeps evolving with new tech like sharp 3D visuals and smarter image processing. Alongside this, better ways to spot tissue changes pop up thanks to smart algorithms. Minimally invasive treatment gadgets are also becoming more common. Tiny pill-sized cameras now help check gut health deep inside. These tools, together with upgraded ultrasound scopes, reach parts that were tough before. Because infections remain a worry, one-time use scopes are gaining traction. Especially in clinics handling many patients daily.

Hospitals still lead as the main users due to trained staff and solid equipment, but outpatient clinics are using more GI scopes because they save money and handle patients more quickly. In rich regions, steady health networks and routine check-ups help growth; meanwhile, poorer areas are catching up fast as hospitals improve and funding rises. All in all, gut scope tech keeps changing - aiming at safer, smoother care that reaches more people without major surgery.

Gastrointestinal Endoscopy MarketSegmentation

By Type

- Rigid Gastrointestinal Endoscope

Rigid gut scope is mostly for tough surgeries where clear vision matters most; built to last through heavy use.

- Flexible Gastrointestinal Endoscopes

They’re popular doctors use them a lot since they bend easily, plus patients don’t feel much discomfort during checkups or treatments.

- Disposable Gastrointestinal Endoscopes

A disposable gastrointestinal endoscope is gaining ground quickly due to better safety from infections, ease of one-time use, and smoother daily operations.

To learn more about this report, Download Free Sample Report

By Procedure Type

- Colonoscopy

Colonoscopy is the biggest type of procedure key for checking colon cancer or spotting gut issues early because it helps catch problems before they get worse.

- Gastroscopy

Gastroscopy helps spot issues like stomach sores or acid reflux also useful when checking for growths. It’s a go-to tool if something feels off up high in the gut.

- Duodenoscopy

Duodenoscopy is on the rise, mostly used for ERCP or tricky bile duct procedures.

- Enteroscopy

Enteroscopy is reaching deeper into the small intestine due to smarter tools that help spot issues or deliver treatments on the go. Devices now twist less, glide easier, yet pack more control for doctors at the helm.

- Flexible Sigmoidoscopy

Flexible sigmoidoscopy checks part of the colon; good for focused exams because it’s cheaper and easier on patients. Some choose it over pricier options since recovery is quick, and discomfort stays low.

- Others

Other stuff covers ERCP, EUS, alongside niche techniques gaining traction in treatment roles.

By Application

- Diagnosis

Core application for early detection of GI diseases, supported by advanced imaging and AI-assisted systems.

- Treatment

Fastest-growing application, encompassing therapeutic interventions like polypectomy, stent placement, and hemostasis

By End-Users

- Hospitals

Hospitals dominate as the top users due to solid facilities and trained experts, while handling lots of procedures.

- Ambulatory Surgical Centers

Ambulatory surgical centers are expanding more quickly than any other user group. Doctors choose them because they handle day surgeries well while saving money through simpler operations.

- Specialty Clinics

Specialty clinics are slowly using endoscopy more, especially for regular check-ups or tracking progress after treatment.

- Laboratories

Labs handle combined testing steps plus studies on gut health.

- Others

mobile clinics, community efforts, or labs - each adds a little boost now and then.

Regional Insights

North America still leads the worldwide gut scope market, mainly because of the U.S., where top-tier medical setups, lots of procedures, early detection efforts, and solid insurance payouts keep things moving. Its portion stays large thanks to the broad use of new tools like smart imaging powered by AI and less invasive gear. In this area, top spots go to the U.S. and Canada, though places like Mexico are picking up speed as hospitals spread out and more people can get check-up tests. Much alike, Europe takes a big slice too; countries such as Germany, the U.K., and France push usage ahead, while others, including Italy and Spain, add momentum via heavier health spending and better screening drives.

The Asia Pacific area is seeing the quickest rise worldwide, driven by large populations that are getting older, more digestive health issues, and better medical facilities. Countries like Japan, China, and South Korea set the pace not just in using new tech but also performing more procedures - thanks to public health programs and stronger funding from private players. Places such as India and parts of Southeast Asia are catching up fast because clinics are easier to reach now, people pay more attention to staying healthy, and besides wanting cheaper treatments that require smaller cuts. Growth here gets an extra push from factories producing at home and offering budget-friendly options, turning this part of the world into a major hub for what's coming next.

Latin America, along with parts of the Middle East and Africa, make up modest chunks of the GI endoscopy scene, yet both are growing bit by bit. Take Brazil or Mexico - they’re ahead in Latin America thanks to updated clinics and better health policies, whereas nations across Central and South America inch forward with more procedures becoming available. Over in the Middle East, places like Saudi Arabia and the UAE expand fast due to high-end hospitals plus a push for medical travel; at the same time, African countries outside major hubs grow slowly as roads, power, and trained staff get stronger. All told, higher medical budgets coupled with greater knowledge about internal scans help drive use in these areas.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 7, 2025 – Fujifilm Revolutionizes Endoscopy with the launch of ELUXEO® 8000 Endoscopy System and 800 Series ELUXEO® Endoscopes at RCST 2025.

(Source: Fujifilm https://www.fujifilm.com/th/en/news/fujifilm-revolutionizes-endoscopy-with-launch-of-eluxeo-8000-endoscopy-system

- January 11, 2024 – Docrate launched gastrointestinal endoscopy services.

(Source: Decrates https://docrates.mehilainen.fi/en/press-releases/docrates-launches-gastrointestinal-endoscopy-services/

- November 29, 2022 – Boston Scientific announced an agreement to acquire Apollo Endosurgery Inc.

(Source: Boston Scientific https://news.bostonscientific.com/2022-11-29-Boston-Scientific-Announces-Agreement-to-Acquire-Apollo-Endosurgery,-Inc

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 12.75 Billion |

|

Market size value in 2026 |

USD 13.47 Billion |

|

Revenue forecast in 2033 |

USD 19.86 Billion |

|

Growth rate |

CAGR of 5.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key company profiled |

Olympus Corporation, Boston Scientific Corporation, Medtronic, Johnson & Johnson, Fujifilm, Stryker, Hoya Corporation, Smith + Nephew, Cook, Conmed Corporation, Ambu, Richard Wolf GmbH, Steris Plc, Medorah Meditek Pvt Ltd, Cliniva Healthcare, Micro-Tech Co. Ltd, and Shailli Endoscopy. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Rigid Gastrointestinal Endoscopes, Flexible Gastrointestinal Endoscopes, Disposable Gastrointestinal Endoscopes) By Procedure Type (Colonoscopy, Gastroscopy, Duodenoscopy, Enteroscopy, Flexible Sigmoidoscopy, Others) By Application (Diagnosis, Treatment), By End-Users (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Laboratories, Others), |

Key Gastrointestinal Endoscopy Company Insights

Olympus Corporation is not just an early mover but is still ahead of the pack due to wide options like bendable and fixed scopes, sharp imaging tools, and treatment-focused add-ons. What sets them apart isn’t flash, it’s constant upgrades, such as smart-image helpers, clearer visuals, along with newer scope methods that stick in major medical spots: hospitals, outpatient surgery hubs, niche care centers. Their edge comes from a solid research drive, far-reaching supply chains, yet a clear eye on safer treatments plus smoother procedures, which keeps them on top when it comes to digestive tract viewing gear.

Key Gastrointestinal Endoscopy Companies:

- Olympus Corporation

- Boston Scientific Corporation

- Medtronic

- Johnson & Johnson

- Fujifilm

- Stryker

- Hoya Corporation

- Smith + Nephew

- Cook

- Conmed Corporation

- Ambu

- Richard Wolf GmbH

- Steris Plc

- Medorah Meditek Pvt Ltd

- Cliniva Healthcare

- Micro-Tech Co. Ltd

- Shailli Endoscopy.

Global Gastrointestinal Endoscopy Market Report Segmentation

By Type

- Rigid Gastrointestinal Endoscopes

- Flexible Gastrointestinal Endoscopes

- Disposable Gastrointestinal Endoscopes

By Procedure Type

- Colonoscopy

- Gastroscopy

- Duodenoscopy

- Enteroscopy

- Flexible Sigmoidoscopy

- Others

By Application

- Diagnosis

- Treatment

By End-Users

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Laboratories

- Others

Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636