Feb 12, 2026

The report “Bifocal Prescription Lens Market By Material Type (Glass, Plastic (CR-39),Polycarbonate, High-Index Plastic), By Lens Type (Flat-Top (D-Segment) Bifocal, Round Segment Bifocal, Executive (Franklin) Bifocal, Blended Bifocal), By Coating Type (Anti-Reflective Coating, Scratch-Resistant Coating, UV Protection Coating, Blue Light Blocking Coating, Anti-Fog Coating),By Application(Presbyopia, Myopia with Presbyopia, Hyperopia with Presbyopia, Astigmatism with Presbyopia) and By Distribution Channel (Optical Retail Stores, Hospitals & Eye Clinics, Online Retail, Optical Chains)” is expected to reach USD 12.60 billion by 2033, registering a CAGR of 6.80% from 2026 to 2033, according to a new report by Transpire Insight.

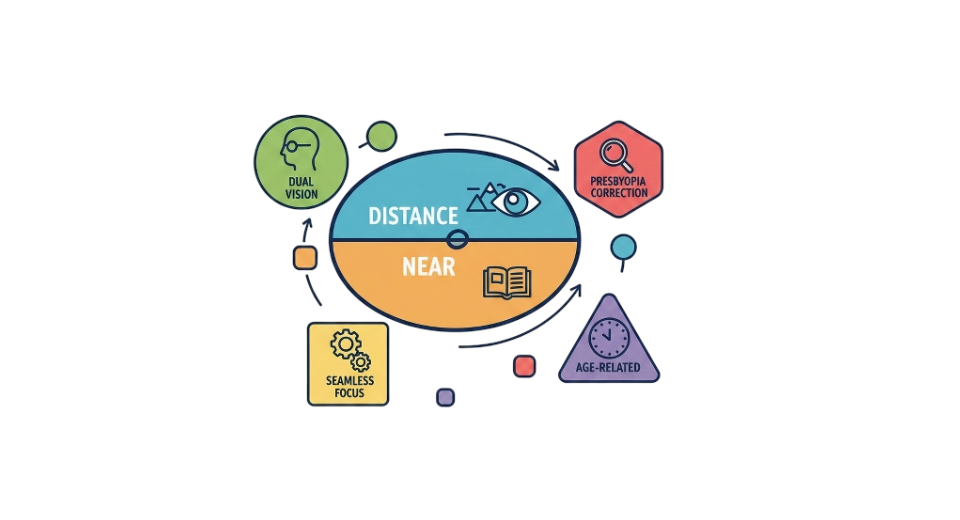

Overall, the market revolves around the significant scope of the bifocal prescription lens segment in terms of its contribution to the global market for ophthalmic lenses, which attempts to meet the rising requirements of individuals suffering from presbyopia, thereby covering all the demands encompassed by bifocal lenses. The bifocal prescription lens enables users to have different viewing zones, thus proving advantageous to the overall growth of the market, which remains backed by the awareness of individuals regarding overall vision care, eye checks, and retail optical service availability. The demand growth would depend on demographic factors and the increasing number of people over the age of 40 years and the impairment of their vision. Increased lifespan and lifestyles of consumers, such as an increased amount of time spent using digital media, have further fueled the demand for corrective eyewear solutions. Moreover, the development of better lens materials has enabled consumers to enjoy the benefits of using such products due to their ability to last longer.

Technological advancements in the construction of materials that are light in weight, such as high-index plastic materials, and polycarbonate materials in lens construction are making the products more comfortable for the end users. They also allow for the aesthetic requirements of making the lens thinner. Coating technology, including anti-reflective coatings and blue light filtering agents, is also becoming more embedded in the products. Furthermore, the increasing number of organized optical retail chains and online eyewear storefronts is expected to enhance the accessibility of products, as the growth of emerging markets can be seen due to the increasing disposable income and awareness of eye health. Keeping in view the significant factors of product availability and financial expenditure, bifocal prescription lenses will continue to hold their place in the market along with other advanced lenses.

The Plastic (CR-39) segment is projected to witness the highest CAGR in the Bifocal Prescription Lens during the forecast period.

According to Transpire Insight, The plastic lenses, also known as CR-39 product lenses, have shown that they will maintain their position as a market leader for bifocal lenses for prescription use due to their price efficiency and characteristics regarding optical qualities as well as lightweight properties. The product is easily affordable and is therefore widely accepted, especially in emerging markets, where price is a fundamental factor for consumers. Optical consultants commonly recommend plastic lenses for routine prescriptions, which is also a driving factor for product demand for bifocal lenses for prescription use.

The segment also gets augmented by the increasing demand for accessible vision correction products, particularly because of the aging population. As the rate of presbyopia increases worldwide, the consumer base is looking to purchase affordable yet comfortable lenses. CR-39 lenses, while not as strong as the others, offer enough durability for everyday function, making it the preferred option for new bifocal wearers. The continued demand from opticians and hospital clinics will also sustain the position of the segment.

The Flat-Top (D-Segment) Bifocal segment is projected to witness the highest CAGR in the Bifocal Prescription Lens during the forecast period.

Flat top bifocals continue to hold their position in the market due to their effectiveness and ease in moving from one zone of vision to another. The clear distinction between the two portions makes it easier for people to adjust to the change in bifoci vision, which might have caused difficulties in adapting to these lenses in earlier days. These lenses are widely recommended by optical service providers, which explains their continued popularity in both developed and developing countries.

Another important aspect that indicates increased growth prospects for bifocal segments is their acceptance by existing bifocal wearers and users who are likely to demand bifocals due to their practicality rather than their appearance. The increased near vision area that bifocals provide as opposed to other types of lenses makes them practical for reading and office work. Flat-top bifocals are important because, even after the development of progressive lenses, these bifocals are still relevant due to their lower price.

The Anti-Reflective Coating segment is projected to witness the highest CAGR in the Bifocal Prescription Lens during the forecast period.

According to Transpire Insight, Anti-reflective coatings stand as the most popular form of coatings. This is due to their ability to provide significant improvements in visual comfort through the reduction of glare and transmittance of light. Increased exposure to the screen, as well as nighttime driving and artificial lighting, has encouraged consumer demand for lenses with low reflection characteristics. As such, anti-reflective coatings define standard bifocal lenses as opposed to an upgraded offering.

This segment also enjoys the added advantage of increasing awareness about viewers' visual fatigue. Retailers in the optical business segment encourage anti-reflective coatings as a result of their effectiveness, in addition to their lower incremental cost relative to total lens price. Combination with such added features as scratch resistant properties and UV protection also helps this particular segment to remain in a strong position.

The Presbyopia segment is projected to witness the highest CAGR in the Bifocal Prescription Lens during the forecast period.

However, presbyopia again is the largest market for the bifocal prescription lens industry in application terms, owing to the effect of the normal aging process on vision capabilities for near vision. The number of people in the world older than 40 has increased the market size for bifocal lenses in the category substantially. Bifocal lenses are the most cost-effective and easiest corrective option for people requiring corrections for both distance and near vision.

Further, the growth in the segment is also accounted for by the increased awareness of the benefits associated with early vision correction. In addition to this, there is an increase in the accessibility of eye care services. With the growth in the number of people seeking early vision correction services, bifocal lenses have continued to remain a popular choice as compared to progressive lenses based on the convenience factor in emerging nations.

The Optical Retail Stores is projected to witness the highest CAGR in the Bifocal Prescription Lens during the forecast period.

According to Transpire Insight, Optical retail stores still play a significant role in distribution due to their capability to offer professional consultation services and immediate customer support. In many cases, especially where the use of prescription lenses is concerned, consumers have a preference for shopping from stores because of the need for accurate measurements. Having such opticians builds increased consumer confidence, resulting in higher conversion rates compared to online shopping.

Additionally, the increase in the number of organized optical retail outlets has enhanced product accessibility and increased availability. Bundling eye tests with eye products encourages repeat business and fosters brand loyalty. The ability to offer consumers numerous options from multiple manufacturers at multiple price points within a given outlet enhances this channel’s power, guaranteeing dominance in bifocal prescription lens distribution.

The North America region is projected to witness the highest CAGR in the Bifocal Prescription Lens during the forecast period.

North America leads the bifocal prescription lens market, and this is because of the higher awareness of vision care coupled with the well-developed optical healthcare infrastructure. The region enjoys an aging population with access to higher ophthalmic examinations. It is a region with higher insurance coverage as well as the willingness to spend on lens materials, mainly in the United States and Canada.

The presence of key players in the production of ophthalmic lens products and well-organized structures for the operation of optical shops around the regions also bolster the strength of the market. The willingness to spend on comfort-enhancing features, especially in the North American market, also adds impetus to the market. Ongoing innovation in products and technological improvements in the production of lens products also ensure the continuous growth of the market.

Key Players

The top 15 players in the Bifocal Prescription Lens market include EssilorLuxottica SA, Carl Zeiss AG, HOYA Corporation, Rodenstock GmbH, Seiko Optical Products Co., Ltd., Shamir Optical Industry Ltd., Nikon Corporation, Tokai Optical Co., Ltd., Vision Ease (Younger Optics), Fielmann Group AG, Kering Eyewear, Mitsui Chemicals Inc., Johnson & Johnson Vision, Menicon Co., Ltd., and Safilo Group S.p.A.

Drop us an email at:

Call us on:

+91 7666513636