Market Summary

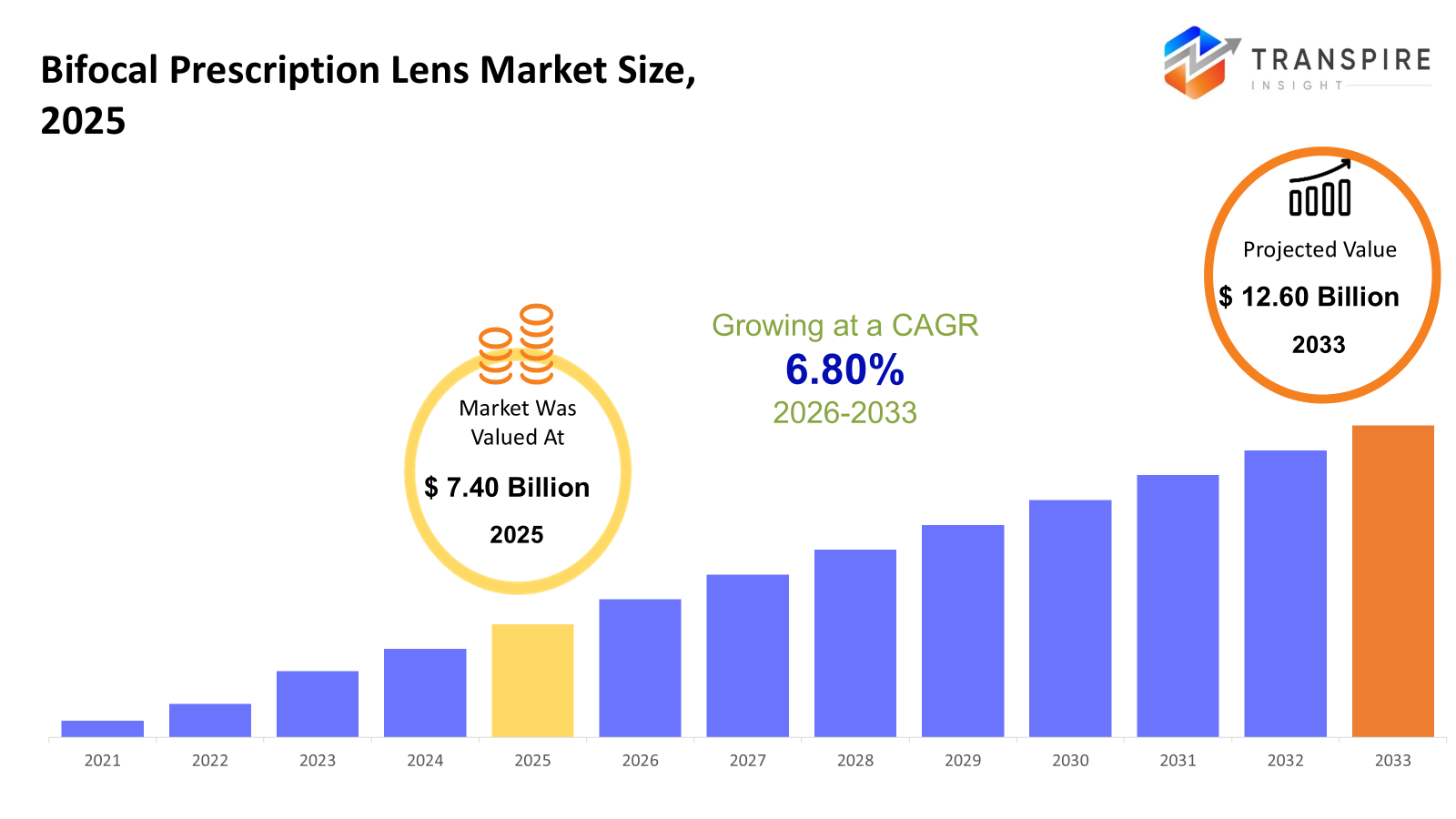

The global Bifocal Prescription Lens market size was valued at USD 7.40 billion in 2025 and is projected to reach USD 12.60 billion by 2033, growing at a CAGR of 6.80% from 2026 to 2033. The market is recording steady growth due to the increasing global prevalence of presbyopia from aging populations and increased life expectancy. Increasingly growing awareness of corrective eyewear coupled with regular eye check-ups supports consistent demand across both developed and emerging economies.

Market Size & Forecast

- 2025 Market Size: USD 7.40 Billion

- 2033 Projected Market Size: USD 12.60 Billion

- CAGR (2026-2033): 6.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America shows a strong demand model with stable growth driven by demographic shifts, a high optical retail penetration rate, and high awareness of vision correction products, while rising acceptability of feature-rich coating and material technologies helps ensure consistent replacement volumes for a healthy market growth rate.

- The largest contributing country is still the United States, given easy access to eye care services, insurance-aided optical material purchases, and high exposure to digital screen displays that make bifocal lenses with anti-reflective coatings and blue blocking in addition to lightweight high-index materials popular.

- Asia Pacific continues to show strong growth rates driven by large populations, rising prevalence of presbyopia, increasing levels of middle-class incomes, and build-out of optical retail infrastructure, with the demand for cost-effective plastic materials and flat top bifocal designs growing in the emerging regions.

- The popular plastic material CR-39 dominates, given its cost-effectiveness and lightweight specifications; moreover, such a material is ready for large-scale implementation. On the other hand, high-index material usage is noted for urban markets.

- Flat-top bifocal lenses still dominate the demand aspect of lens types due to easy adaptation and visual segmentation; however, blended bifocals are exhibiting an increase in demand among consumers who prefer better aesthetic advantages without switching to progressive lenses.

- Anti-reflective coating coatings contribute to the adoption of lead coatings due to the improvement in the appearance of the coatings and the reduction of glare, while blue light blocking coatings result from the use of digital devices aimed at reducing the health consequences of the long-term use of such products by consumers.

- Another application that presbyopia continues to drive is the largest segment, with the added vision conditions such as myopia with presbyopia increasing in popularity due to the rising digital lifestyle and the onset of refractive errors in young consumers in the market.

- Optical stores continue to dominate retail channel sales because of eye examinations and individualized service, while online retail is increasing its presence due to its competitiveness, digital prescription technology, and the rising comfort of customers in buying eye-wear items online.

So, The bifocal prescription lens market segment of the ophthalmic lens market entails a segment of the lenses that focus on the correction of both distance vision and near vision with a single lens. These lenses are usually prescribed for patients with a condition affecting vision after the age of 40 years, commonly referred to as presbyopia. Presbyopia is a common age-related condition that affects the eye's capability to focus on objects that are near. These lenses offer a cost-effective solution as opposed to progressive lenses, particularly for patients who seek a separate zone of clear vision.

Market demand for the product will be driven by demographic factors, mainly the improvement in the percentage of an aging population worldwide and a rise in lifespan. With more and more people becoming aware of the importance of eye health, as well as regular testing and an increase in optical stores, this bodes well for product adoption. Moreover, technologically advanced materials have contributed significantly to longer-lasting comfort, thus making bifocal lenses a more desirable option for the market populace. Lifestyle changes also lead to an increase in the incidence of eye problems due to prolonged use of digital devices and more screen exposure. Companies are emphasizing light weighting and value-added coatings as a way to further differentiate their products. The market is still developing, particularly in emerging economies where, despite all the advances in technology, affordability and accessibility remain major purchase drivers.

Bifocal Prescription Lens Market Segmentation

By Material Type

- Glass

Glass bifocal lenses provide superior optical clarity while being scratch-resistant. Although they are preferred by many who require precise lens clarity, there are disadvantages to the increased weight of the lenses and the ability to break easily. Overall, the demand for bifocal lenses remains relatively low, since most are used to traditional lenses.

- Plastic (CR-39)

CR-39 plastic lenses are dominating the market because of their light weight, lower cost, and satisfactory optical properties. CR-39 plastic is often used in entry and mid-range bifocal lenses. Rising demand in cost-conscious markets also supports the demand for these lenses.

- Polycarbonate

Polycarbonate lenses are showing increased demand due to their impact resistance and inherent ultraviolet protection. The product is more popular for active users and is being used for safety-oriented prescription use. There is increased awareness regarding eye safety and durability among young presbyopic users.

- High-Index Plastic

The high-index plastic lenses would address the needs of those with higher prescriptions, making thinner and lighter lenses. Premium positioning and added comfort propel the demand in urban and developed markets. The increasing consumer preference towards aesthetics and comfort presents a boost to segment growth.

To learn more about this report, Download Free Sample Report

By Lens Type

- Flat-Top (D-Segment) Bifocal

The flat top bifocials are the most popular ones because they provide a clear demarcation between the areas of distant and near vision, thus providing ease of adaptation as well as cost advantage.

- Round Segment Bifocal

Where the segment of bifocal eyeglasses is round in shape, the result is more stylish with a smoother change of vision contrasted with the flat-top design. Still, the small near vision zone might not allow for the full use of the eyeglasses.

- Executive (Franklin) Bifocal

Executive bifocals are available with a full width reading segment, thus accommodating wider near vision fields. They are applicable for users with an extensive reading or desk requirement. Although there are some functional benefits, there are some limitations to the executive bifocal, which lower its popularity.

- Blended Bifocal

Blended bifocals make for a more desirable product due to a minimized demarcation line between lenses. The product will be attractive to consumers concerned about a beautiful look. The increasing demand for a more attractive lens further suggests that bifocals will continue to grow gradually.

By Coating Type

- Anti-Reflective Coating

Anti-reflective coatings improve image clarity for better visualization. There is a rising demand for anti-reflective coatings due to increased usage of digital devices and the need to drive at night. It is becoming a standard feature in the best bifocal eyeglasses.

- Scratch-Resistant Coating

Scratch-resistant coatings enhance lens durability and are useful for extending product lifespan, especially for plastic lenses. Increased consumer interest in product durability and ease of maintenance bodes well for demand. The coatings are highly consumed by all price segments

- UV Protection

Coating UV protection coatings help guard against dangerous ultraviolet radiation, thereby ensuring eye health. Today, awareness has grown concerning the hazards of exposure to UV radiation, leading to an increased adoption rate in the world. The coating is increasingly being used in standard lens options.

- Blue Light Blocking Coating

The coatings which filter blue light are witnessing growth, as people are spending more time in front of digital screens. The demand for these coatings is mainly for people who are working and are looking for a comfortable experience.

- Anti-Fog Coating

Anti-fog coatings for increased usability in humid conditions or while using a mask/change in temperature: Its usage is on the rise for those living in places with varying climatic conditions. It is a small segment with increased relevance for functional lens upgrades.

By Application

- Presbyopia

Presbyopia is the largest application segment, riding on the aging demographics across the world. Increased life expectancy and better awareness levels of vision correction options support the demand for corrective lenses. Bifocal lenses remain an economical option compared to progressive lenses.

- Myopia with Presbyopia

This segment is growing because of the rise in myopia among older populations. The user needs correction for both distance and near vision. It is also caused by urban lifestyles and increased screen exposure.

- Hyperopia with Presbyopia

It is taken together with presbyopia, for which one requires precise lens correction, hence supporting demand in custom-made bifocal lenses. The Segment also has improved diagnostic capabilities in ophthalmological clinics. In mature optical markets, growth remains steady.

- Astigmatism with Presbyopia

This segment requires specialized design of lenses, as this kind of eye defect needs accurate visual correction. Growing detection rate of astigmatism is therefore supporting the market demand. Product availability and comfort are also improving due to continuous technological development in manufacturing lenses.

By Distribution Channel

- Optical Retail Stores

In the field of distribution, optical retail outlets have a dominant share owing to personalized fits and consultation services provided in these outlets. Also, consumers prefer to try out glasses and get eye exams before purchasing optical lenses. A strong presence in offline media also favours this segment's leadership position.

- Hospitals & Eye Clinics

This business also contributes significantly through prescription-based sales as well as consulting. Growing awareness about eye health, along with regular eye checks, also supports this channel. Segment that contributes through trust and consulting.

- Online Retail

There is a rapid expansion seen in online retailing due to convenience, competitive costs, and uploading prescriptions. The limitations for fitting and customization are an issue, though there is increasing digital and online commerce penetration.

- Optical Chains

Optical chains are also witnessing expansion in terms of standardized services and brand-based offerings. Price competitiveness, coupled with the availability of service bundling and the offering of diverse products, increasingly attracts customers to optical chains. Expansions in the optical chain retail outlets also help in the growth of the market

Regional Insights

A mature market exists in North America, which includes countries such as the U.S., Canada, and Mexico. The market is characterized by a high level of awareness concerning eye correction and well-established retail infrastructures. The U.S. is a dominant market in this particular region with regard to eye care services and increased demand for high-end lens materials and coatings. Mexico and Canada are also steady markets with increasing healthcare availability.

Europe, which comprises countries such as Germany, the UK, France, Spain, Italy, and Rest of Europe, shows steady performance of markets, driven by aging populations and stringent regulations for optical products; Western European countries are strong adopters of premium lenses, followed by moderate growth in optical retail outlets in the rest of Europe. The fast-growing region is represented by the Asia Pacific, including Japan, China, Australia & New Zealand, South Korea, India, and the Rest of Asia Pacific, because of huge population bases and increasing prevalence of refractive disorders. Strong demand growth is supported by rapid urbanization, rising disposable incomes, and expanding eye care awareness across developed and emerging economies.

South America, dominated by Brazil and Argentina, is characterized by gradual expansion, supported by improving access to vision care and growing urban populations. The growth in the Middle East & Africa, containing Saudi Arabia, the United Arab Emirates, South Africa, and the Rest of the Middle East & Africa, is moderate, driven by healthcare infrastructure development and a rise in awareness about eye health solutions.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 2025, ZEISS Vision Care announced its participation in the Collaborative Community of Ophthalmic Innovation to further the development of innovative ophthalmic technology and enhanced long-term visual health outcomes through collaboration and innovation..

(Source:https://www.zeiss.com/vision-care/en/newsroom/news/2025/press-release-zeiss-joines-ccoi.html)

- In November 2025, EssilorLuxottica’s announcement about enhancement in their collection of spectacle lenses through innovative work in lens technologies and vision solutions reflects positively on their current position in ophthalmic lens development, especially in response to the rising need for prescription lens solutions.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.40 Billion |

|

Market size value in 2026 |

USD 7.90 Billion |

|

Revenue forecast in 2033 |

USD 12.60 Billion |

|

Growth rate |

CAGR of 6.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

EssilorLuxottica SA, Carl Zeiss AG, HOYA Corporation, Rodenstock GmbH, Seiko Optical Products Co., Ltd., Shamir Optical Industry Ltd., Nikon Corporation, Tokai Optical Co., Ltd., Vision Ease (Younger Optics), Fielmann Group AG, Kering Eyewear, Mitsui Chemicals Inc., Johnson & Johnson Vision, Menicon Co., Ltd., and Safilo Group S.p.A. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Glass, Plastic (CR-39),Polycarbonate, High-Index Plastic), By Lens Type (Flat-Top (D-Segment) Bifocal, Round Segment Bifocal, Executive (Franklin) Bifocal, Blended Bifocal), By Coating Type (Anti-Reflective Coating, Scratch-Resistant Coating, UV Protection Coating, Blue Light Blocking Coating, Anti-Fog Coating),By Application(Presbyopia, Myopia with Presbyopia, Hyperopia with Presbyopia, Astigmatism with Presbyopia) and By Distribution Channel (Optical Retail Stores, Hospitals & Eye Clinics, Online Retail, Optical Chains) |

Key Bifocal Prescription Lens Company Insights

EssilorLuxottica SA holds a dominant position in the market for bifocal prescription lens products by virtue of its vertically integrated business model that includes lens manufacturing, coating, distribution, and retail. The company's significant investment in research and development activities ensures further improvement in lens materials, coatings, and lens technology, which in turn supports the market share by virtue of the growing demand for bifocal lens products in the aging global populace and the presbyopia segment. The company's presence in the global market, coupled with a strong portfolio of eyewear brands, ensures effective market penetration in both developed and emerging markets. The company's continuous innovation in products, coupled with the development of more lens materials and ophthalmic lens technologies, further improves the company’s competitive advantage.

Key Bifocal Prescription Lens Companies:

- EssilorLuxottica SA

- Carl Zeiss AG

- HOYA Corporation

- Rodenstock GmbH

- Seiko Optical Products Co., Ltd.

- Shamir Optical Industry Ltd.

- Nikon Corporation

- Tokai Optical Co., Ltd.

- Vision Ease (Younger Optics)

- Fielmann Group AG

- Kering Eyewear

- Mitsui Chemicals Inc.

- Johnson & Johnson Vision

- Menicon Co., Ltd.

- Safilo Group S.p.A.

Global Bifocal Prescription Lens Market Report Segmentation

By Material Type

- Glass

- Plastic (CR-39)

- Polycarbonate

- High-Index Plastic

By Lens Type

- Flat-Top (D-Segment) Bifocal

- Round Segment Bifocal

- Executive (Franklin) Bifocal

- Blended Bifocal

By Coating Type

- Anti-Reflective Coating

- Scratch-Resistant Coating

- UV Protection Coating

- Blue Light Blocking Coating

- Anti-Fog Coating

By Application

- Presbyopia

- Myopia with Presbyopia

- Hyperopia with Presbyopia

- Astigmatism with Presbyopia

By Distribution Channel

- Optical Retail Stores

- Hospitals & Eye Clinics

- Online Retail

- Optical Chains

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636