Market Summary

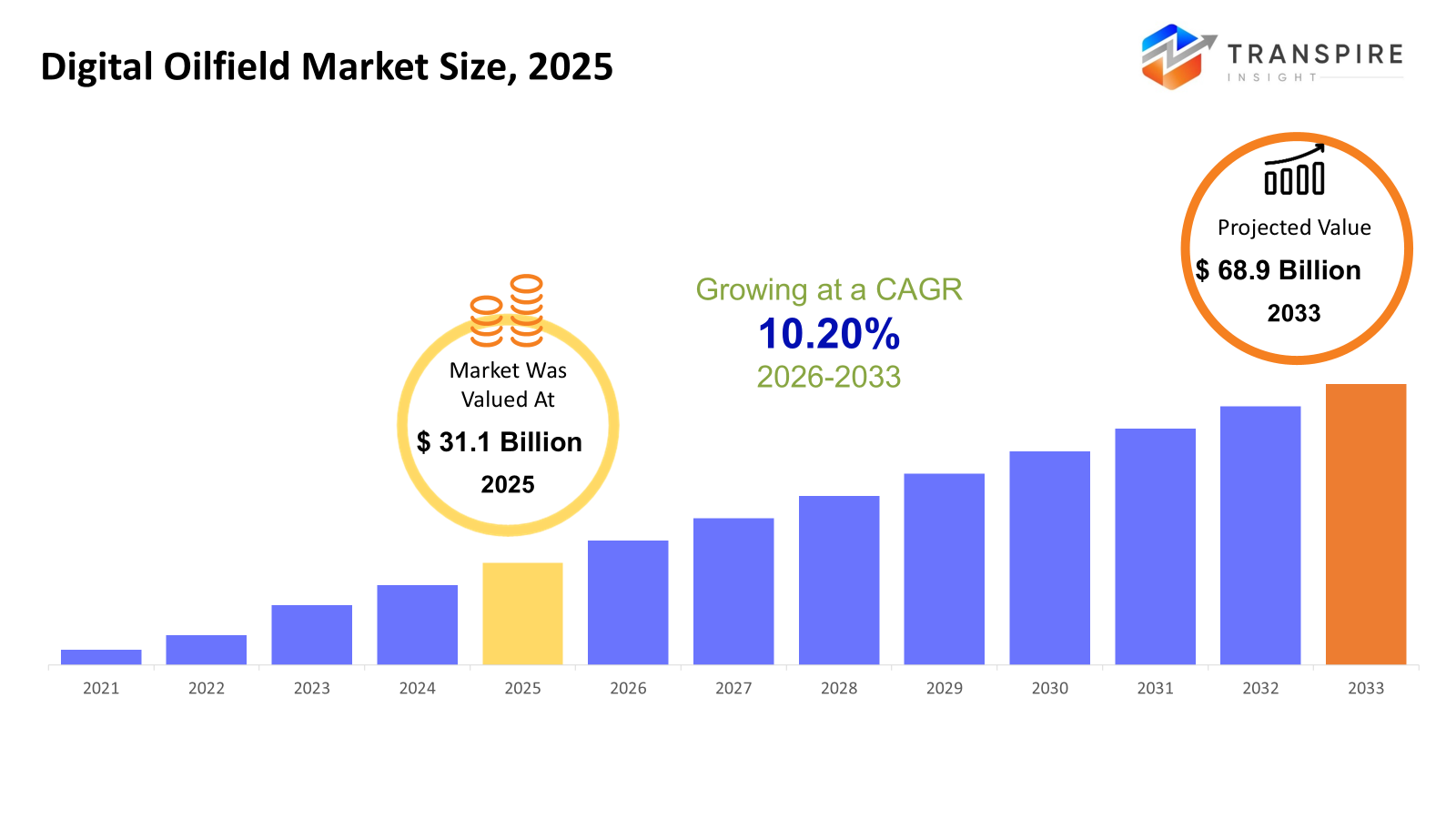

The global Digital Oilfield market size was valued at USD 31.1 billion in 2025 and is projected to reach USD 68.9 billion by 2033, growing at a CAGR of 10.20% from 2026 to 2033. The international digital oilfield market is growing with significant CAGR due to the rise in the adoption of advanced analytics tools, Internet of Things, and artificial intelligence technologies designed for improving efficiencies in production. The rise in energy consumption and complicated exploration conditions are some of the factors that boost the development of optimized drilling and management of the reservoir. The inclusion of technologies such as real-time monitoring and automation ensures cost savings and sustainability.

Market Size & Forecast

- 2025 Market Size: USD 31.1 Billion

- 2033 Projected Market Size: USD 68.9 Billion

- CAGR (2026-2033): 10.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America oil and gas industry has adopted advanced technology solutions for upstream oil and gas operations. There is growing adoption of solutions for drilling and gas management in this region due to technological advancements and innovative solutions.

- The United States is at the forefront of adopting digital oilfields due to significant investment in smart oilfield solutions. The companies are concentrating their efforts and strategies on product optimization and software solutions related to predictive maintenance and operational efficiencies and are streamlining their approach to drilling optimization.

- The Asia Pacific market is observing fast growth because of increasing offshore and onshore explorations. The operators of the oil fields are embracing reservoir and drilling optimization solutions, as well as hardware and software solutions, to increase efficiency and mitigate risks associated with operations.

- Product optimization is also gaining traction internationally with operators adopting predictive analytics tools and IoT sensors integrated with AI monitoring solutions to ensure maximal efficiency and reduce downtime and wastage to increase overall oil yields and benefits from oilfield production.

- The software and service offerings are growing worldwide with the escalating use of cloud analytics and process automation and management solutions that serve as the means of deriving insight for real-time decision-making on drilling and production activities.

- Offshore applications are driven by ease of use of sensors, IoT, and analytics solutions onshore, which offer an effective and scalable digital solution set to the operator to enable easy management of operations and optimal production with minimal disruption on the rigs and platforms.

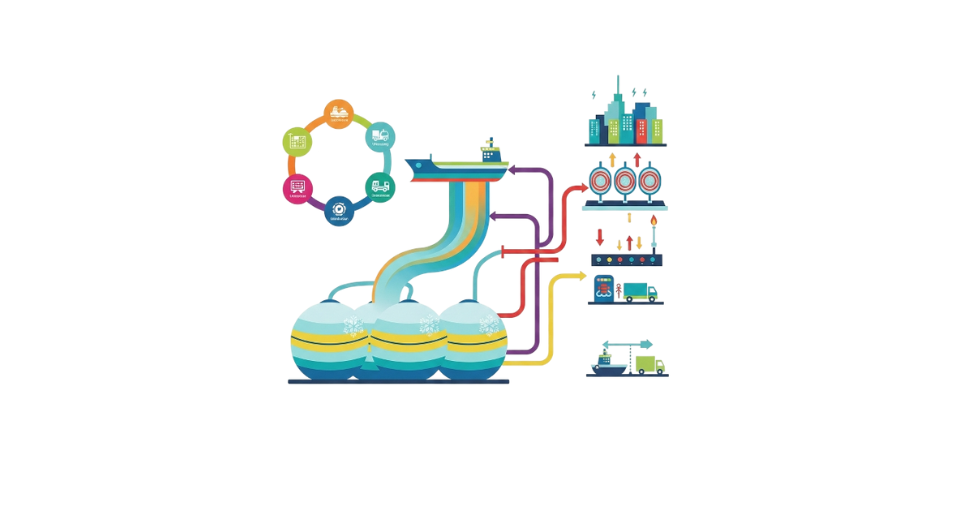

So, the digital oilfield market includes integrated solutions and technologies for the optimization of exploration, drilling, production, and operational efficiency of the oil and gas fields. The solutions and technologies involve hardware as well as software and data analytics for the monitoring and optimization of processes, which helps in saving operational and downtime costs. The increasing energy requirements and the need for higher operational efficiency of production are driving the market at a fast pace. This has been due to the complexity of oilfield operations and increasing demands for enhanced oil recovery. The solutions provided by drilling optimization, reservoir modeling, safety solutions, and asset management help operators make informed decisions. Cloud technology, IoT and AI-driven analytics are transforming oilfield data collection, storage, and analysis. The blended knowledge of advanced software solutions and oilfield hardware ensures effective operating procedures, enhanced asset life and improved safety compliance procedures. Besides this, regulatory pressures and sustainability initiatives encourage the implementation of digital technologies to monitor environmental performance and reduce operational risks. The market is seeing more investments from major oil and gas companies in key regions where the infrastructure is technologically rich, such as North America and Europe, while emerging markets are adopting solutions in Asia Pacific, Middle East, and South America to achieve optimization in production efficiency and reduction in costs.

Digital Oilfield Market Segmentation

By Process

- Product Optimization

It mainly deals with enhancing the performance of oilfield products and equipment by using predictive analytical solutions for real time monitoring. It is done to ensure proper production output for the company based on efficient oilfield operations.

- Drilling Optimization

Advanced digital solutions improve drilling parameter optimization, non-productive time and the accuracy of well placement. It assists the operator in making decisions through data in drilling activities.

- Reservoir Optimization

Integration of subsurface information and analytics improves recovery and reservoir management. Operators can forecast reservoir behavior, plan and execute interventions and extract resources with optimal efficiency.

- Safety Management

The digital oilfield solution also improves safety and ensures compliance with regulations. Real time monitoring of people and equipment prevents accidents and ensures positive risk management practices are followed.

- Asset Management

The Digitized asset management practices its devices or equipment to analyze their status regarding maintenance needs and increases their lifespan. This reduces costly breaks or unforeseen maintenance stoppages.

To learn more about this report, Download Free Sample Report

By Solution

- Hardware Solutions

This includes sensors, IoT, and monitoring instruments used in the field. They improve operational visibility and are used in real-time data acquisition.

- Software & Service Solutions

Includes predictive analytics and cloud monitoring solutions as well as field management software. It also equips decision-makers with intelligence and optimizes operations performance.

- Data Storage Solutions

The storage and handling of large operational data need to be secure. Scalable storage techniques facilitate easy accessibility and preservation of data as well as its analysis by artificial intelligence systems.

By Application

- Onshore

The advantages include ease in adopting digital technology onshore. This is because cost-efficient monitoring, prediction, and automation are achieved by enhancing productivity and efficiency.

- Offshore

The offshore oil fields tend to work in more challenging environments. The more efficient digital solutions provide safety standards as well as remote monitoring opportunities.

Regional Insights

The region which has adopted digital oilfield solutions at a large scale is North America, led by the United States, owing to its well-developed technology infrastructure and a well-established oilfield industry. Canada and Mexico also observe a growing adoption of digital solutions in upstream operations. The European market is witnessing constant growth as countries such as Germany, United Kingdom, France, Spain, and Italy are adopting digital technologies for managing their aging oilfields and maintaining government regulations. The remaining countries in Europe are slowly starting to adopt digital oilfield solutions as a form of modernization. Asia Pacific is emerging as a lucrative market, and countries like Japan, China, Australia, New Zealand, Korea, and India are focusing on offshore exploration and efforts to improve efficiencies. The other countries of Asia Pacific are adopting solutions like Predictive Maintenance, Reservoir Optimization, and Real-time Monitoring solutions to lower their operational risk.

South America, including Brazil and Argentina, is adapting digital oilfield technology in order to increase efficiencies in oilfield production and minimize non-productive time in new oilfields. The remaining countries in South America are starting to invest in automation and analytics solutions for both onshore and offshore assets. The Middle East and Africa region, specifically Saudi Arabia, UAE, and South Africa, is adopting digital solutions for the oil fields for optimizing valuable offshore projects. The remaining regions are relying on safety, expenses, and extraction of maximum value using IoT and Predictive Analytic solutions.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, SLB, or Schlumberger, brought to the market a highly advanced AI tool that could automate various processes and workflows within energy companies.

- In July 2025, The energy player Santos collaborated with Xecta to successfully model and extend the use of the Integrated Production System Model (IPSM) on a large-scale digital oilfield at a point considered to be one of the first in Australia and PNG.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 31.1 Billion |

|

Market size value in 2026 |

USD 35 Billion |

|

Revenue forecast in 2033 |

USD 68.9 Billion |

|

Growth rate |

CAGR of 10.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Siemens AG, Schneider Electric SE, ABB Ltd., Rockwell Automation, Inc., Honeywell International Inc., Emerson Electric Co., National Oilwell Varco, Inc., Kongsberg Gruppen ASA, Pason Systems Inc., CGG SA, Infosys Limited |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Product Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, Asset Management), By Solution (Hardware Solutions, Software & Service Solutions, Data Storage Solutions), By Process (Onshore, Offshore) |

Key Digital Oilfield Company Insights

Schlumberger Limited is at the forefront of the digital oilfield industry due to its broad offering of artificial intelligence-driven solutions and digital twins, ensuring increased drilling and production and reservoir optimization worldwide through its DELFI Cognitive E&P environment, which combines physics-based simulation and machine learning algorithms for better insight into upstream operations, driving reduced non-productive time and operational costs. Schlumberger Limited's extensive presence in North America, the Middle East, and the Asia-Pacific region enables large-scale operations and strategic collaborations with national oil companies, while innovation in the use of cloud technology, predictive maintenance, and autonomous operations cements Schlumberger as leaders in the industry for the transformation of conventional oilfield operations into smarter, more efficient, and safe ones.

Key Digital Oilfield Companies:

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Rockwell Automation, Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- National Oilwell Varco, Inc.

- Kongsberg Gruppen ASA

- Pason Systems Inc.

- CGG SA

- Infosys Limited

Global Digital Oilfield Market Report Segmentation

By Process

- Product Optimization

- Drilling Optimization

- Reservoir Optimization

- Safety Management

- Asset Management

By Solution

- Hardware Solutions

- Software & Service Solutions

- Data Storage Solutions

By Application

- Onshore

- Offshore

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636