Market Summary

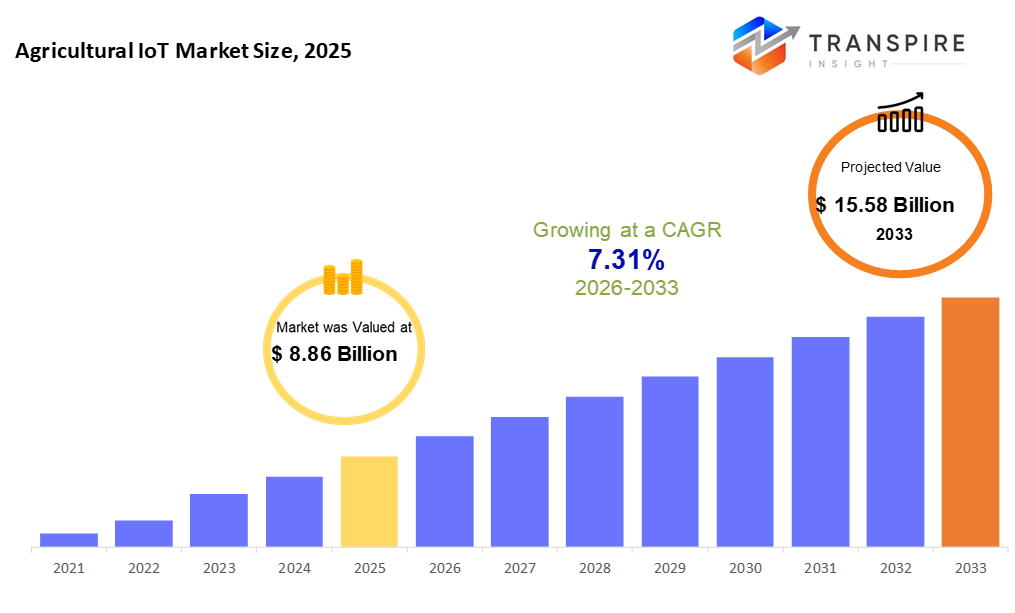

The global Agriculture IoT market size was valued at USD 8.86 billion in 2025 and is projected to reach USD 15.58 billion by 2033, growing at a CAGR of 7.31% from 2026 to 2033. Farms now use more tech gadgets that talk to each other, helping grow better crops while saving money on supplies and handling weather surprises. Money flowing into exact farming methods grows fast, especially where officials back digital tools for growers.

Market Size & Forecast

- 2025 Market Size: USD 8.86 Billion

- 2033 Projected Market Size: USD 15.58 Billion

- CAGR (2026-2033): 7.31%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Fueled by high-tech farming setups, North America sits ahead. Early jumps into connected devices pushed its edge forward.

- Farms spread wide across the United States soil, pushing output higher. Technology steps into fields where tractors once ruled alone. Big operations lead the shift, pulling gains from scale. Investment flows into tools that track, measure, and feed. Growth holds steady, rooted in acres and innovation alike.

- Fueled by growing appetites for food, the Asia Pacific races ahead. The government pushes for smarter farming methods add momentum here.

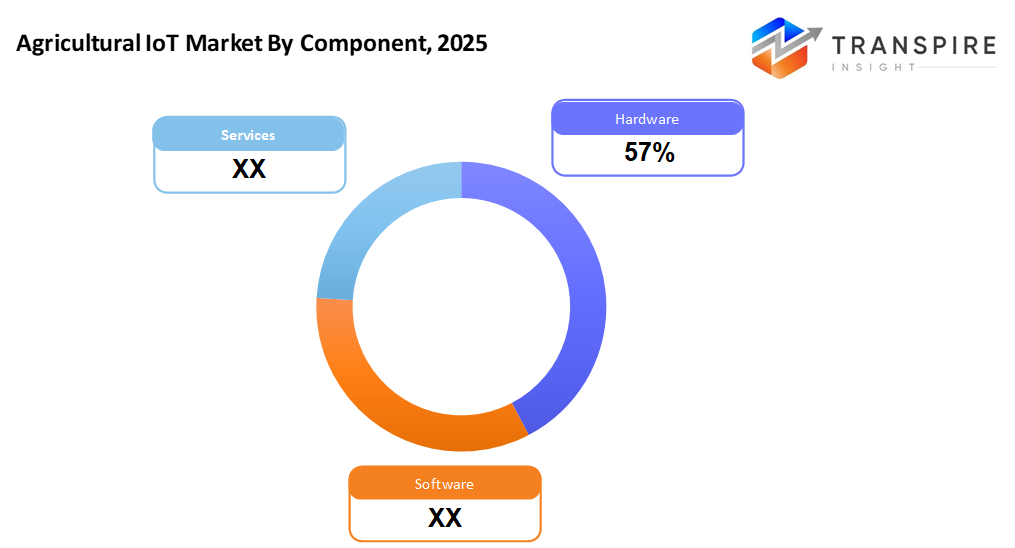

- Hardware shares approximately 59% in 2026. Hardware takes off fast when more sensors get installed everywhere. Devices that link up push their growth forward. Equipment rolls out quicker because systems talk to each other now. New tools spread widely since monitoring parts have shown up in daily objects.

- Farming choices now shape up quicker thanks to sharp forecasts. Smarter moves come from data patterns spotted early. Speed in decision-making climbs where machines learn from what fields reveal. Insight grows not by chance but through steady number crunching. Progress hides in daily updates, quiet yet constant.

- Farming now runs smarter, thanks to precise methods cutting waste while boosting harvests. Efficiency shapes choices here, where every drop and seed gets tracked carefully. Yield goals push innovation forward, guiding how tools are used across fields.

- Big farms tend to adopt more often because they can afford it. Their size helps them make better use of resources. Money is less of a barrier when customers operate at that level. Being large means lower costs per unit produced. Financial flexibility opens doors to new methods quickly.

Out in the fields, technology is changing how crops are grown. IoT gear tracks everything from dirt moisture to plant growth. Devices like sensors and drones send updates straight to a screen, helping spot issues before they spread. Instead of guessing, growers adjust watering or fertilizing based on live feedback from their land. Machines equipped with GPS move precisely across plots, reducing waste and overlap. Data piles up fast, yet simple dashboards turn it into usable insights. This is not just about gadgets; it reshapes daily decisions using facts pulled directly from the environment.

Farmers face growing pressure as hunger spreads and seasons shift unpredictably. Still, many see clearer paths forward through smarter tools in the fields. With every drop counting, choices matter more than ever when watering crops. Some now rely on live soil updates instead of guesswork for feeding plants. Outcomes change fast once alerts warn of bugs creeping in overnight. Machines quietly track growth while storms loom miles away. Decisions tighten, waste slips down, harvests hold stronger. Land breathes easier under lighter chemical loads. Yields rise without extra effort simply because timing improves. Hidden details become visible, then actionable. Progress hides in small adjustments most never notice.

Farms once cut off now hum with quiet signals under open skies. Tools that learn from patterns help growers pick better days to plant or water. Not long ago, too pricey; they dot fields where budgets matter most. Decisions shaped by real numbers replace guesses at dawn. As links between devices grow stronger, even distant plots feel close to control. Clever models chew through weather and soil trends without fanfare. What used to crawl now moves fast across dirt and data both.

Farmers see change happening because officials back tech projects that connect machines, offer help with funding, and then link businesses together on shared goals. Tech firms now work more closely with farm supply giants, building tools that grow with operations while fitting different land types and crops. Machines talking to each other out in fields might sound odd, yet this shift could hold answers when it comes to feeding people, protecting nature, and keeping harvests steady no matter what hits next.

Agriculture IoT Market Segmentation

By Component

- Hardware

Out in the fields, sensors track conditions while GPS units map locations. Drones take flight to scan large areas from above. Farm machines with built-in connections share information as they work. Each tool feeds real-time details into the system simply by doing its job.

- Software

Tools that watch fields closely. These run on smart systems made for connected devices. Decisions come easier when data flows fast. Because insights show what crops need right now. Running well means knowing soil, weather, and growth all together without delay.

- Services

Setting up devices comes first, followed by linking them smoothly into existing setups. Tracking performance happens continuously once live. Fixing issues pops up whenever needed to keep everything running.

To learn more about this report, Download Free Sample Report

By Technology

- Sensing Devices

Out in the fields, tools track how wet the ground is. Temperature shifts get recorded every few hours. Air dampness levels show up on screens daily. Plants’ conditions are checked by sensors overhead. One after another, these gadgets send updates without stopping.

- Connectivity Technologies

Signals fly using cell systems, or stretch far via low-power wide-area links, sometimes bouncing off satellites high above. Networks hum differently depending on distance needs, terrain shape, and weather patterns nearby. Each path handles information flow in its own quiet way.

- Cloud Computing

Out there, information lives on remote servers instead of local machines. These systems handle heavy lifting when it comes to crunching numbers or saving files. That’s part of the deal, too.

- AI & Analytics

Farming gets smarter when machines learn patterns. Insights appear before problems do. Automation handles tasks once done by hand. Predictions shape daily choices in fields. Technology shifts how work moves across seasons.

- Blockchain

From deep within digital systems, trust grows when records stay unchangeable. One step at a time, transparency follows every move goods make across borders.

By Farm Type

- Large Farms

Farms spread wide, where tech flows through fields like water. Machines talk to sensors buried in soil. Crops get attention down to each root. Data moves without wires, shaping how tractors turn. These places grow food with silent networks humming under the sun.

- Medium Farms

Semi-commercial farms adopting selective IoT technologies.

- Small Farms

Smallholder farms using cost-effective IoT tools.

By Application

- Precision Farming

Farming smarter by reading the land's signals yields climbs while waste drops. Numbers guide every seed, every drop of water. Outcomes shift when soil talks and farmers listen. Less guesswork, more response. Decisions grow sharper through patterns found in everyday field details.

- Livestock Monitoring

A single collar checks how each cow feels, where it moves. Health signs appear through tiny sensors inside. Motion patterns tell if something seems off. Location updates happen every few minutes. Behavior shifts get logged automatically.

- Smart Irrigation

A system thinks ahead about watering needs, adjusting itself without help. It learns patterns over time instead of following fixed rules. Water moves through pipes only when the soil really asks for it. This method keeps plants healthy while using fewer resources overall.

- Greenhouse Monitoring

Controls climate conditions for protected farming.

- Supply Chain & Traceability

- Fresh produce gets followed closely, moving straight from fields into stores. Each step is recorded starting at harvest, ending on the shelves.

Regional Insights

Out here in North America, farming meets advanced tech through widespread use of IoT tools on fields already packed with machinery. Farms across the United States and Canada's top-tier areas are quick to install sensor networks, drone flights, and artificial intelligence systems that track soil and crops. Meanwhile, down in Mexico, a step behind but catching up, new interest grows in smarter watering setups and digital crop tracking thanks to fresh funding and updated methods. Progress moves at different speeds, yet each country leans into connected devices more every year.

Not far behind, Spain, Italy, and nations across Eastern Europe are turning more toward digital tools not just for better harvests but also to meet tighter ecological rules. Driven partly by grants from Brussels, these regions slowly weave tech into daily farm work. Leading the pack, Germany, France, the United Kingdom, and the Netherlands push ahead using smart sensors and automated systems in fields and barns alike. Their edge comes not only from wealth but also from consistent backing through laws that favor green and connected agriculture.

Food needs grow fast here, so farms in the Asia Pacific now use more digital tools than anywhere else. Across China, Japan, and Australia, places with deep pockets, IoT gear, robots, and data systems shape how crops rise from the soil. Smaller operators in India, Southeast nations, plus South Korea find simpler tech that fits tight budgets yet lifts output on modest plots of land. Down south, Brazil and Argentina begin weaving sensors into fields as interest builds slowly but surely. In arid zones like the United Arab Emirates or the farmlands of South Africa, tracking every drop matters more each season, nudging farmers toward connected devices despite early steps.

To learn more about this report, Download Free Sample Report

Recent Development News

- March 24, 2025 – ThingLog unveiled IoT-Based smart agriculture solutions for distributed field management

(Source: https://igrownews.com/thingslog-latest-news/

- March 31, 2025 – ARB IoT Launched an AI-Powered fertilizer system for precision ag.

(Source: https://igrownews.com/arb-iot-latest-news/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 8.86 Billion |

|

Market size value in 2026 |

USD 9.51 Billion |

|

Revenue forecast in 2033 |

USD 15.58 Billion |

|

Growth rate |

CAGR of 7.31% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Trimble Inc., Deere & Company, AGCO Corporation, Topcon Positioning Systems, PrecisionHawk, Raven Industries, Bosch, Hexagon, Santera LLC, Farmers Edge, Teralytic, Arable Labs, CropX Technologies, AG Leader Technology, Prospera Technologies, and CropMetrix. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Hardware, Software, Services), By Technology(Sensing Devices, Connectivity Technologies, Cloud Computing, Artificial Intelligence & Analytics, Blockchain), By Farm Type (Large Farms, Medium Farms, Small Farms), By Application (Precision Farming, Livestock Monitoring, Smart Irrigation, Greenhouse Monitoring, Supply Chain & Traceability) |

Key Agriculture IoT Company Insights

Out on the fields, Trimble Inc. delivers tools that make farming more accurate and efficient. Instead of guessing, growers use GPS-guided systems built by the company to track every row and resource. From sensors in the soil to digital maps in cabs, each piece collects information during daily work. These tools give live updates so decisions happen faster, right where they matter. Whether it's guiding tractors or adjusting water flow, automation plays a quiet but steady role. Across continents, big farms rely on these setups while smaller ones begin adopting them too. Behind progress in modern cultivation, there’s often a network shaped by Trimble’s design.

Key Agriculture IoT Companies:

- Trimble Inc.

- Deere & Company

- AGCO Corporation

- Topcon Positioning Systems,

- PrecisionHawk

- Raven Industries

- Bosch

- Hexagon

- Santera LLC

- Farmers Edge

- Teralytic

- Arable Labs

- CropX Technologies

- AG Leader Technology

- Prospera Technologies

- CropMetrix

Global Agriculture IoT Market Report Segmentation

By Component

- Hardware

- Software

- Services

By Technology

- Sensing Devices

- Connectivity Technologies

- Cloud Computing

- Artificial Intelligence & Analytics

- Blockchain

By Farm Type

- Large Farms

- Medium Farms

- Small Farms

By Application

- Precision Farming

- Livestock Monitoring

- Smart Irrigation

- Greenhouse Monitoring

- Supply Chain & Traceability

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636