Feb 17, 2026

The report “Breast Ultrasound Market By Product Type (Handheld Ultrasound Systems, Automated Breast Ultrasound Systems, 3D/4D Ultrasound Systems), By Technology (2D Ultrasound, 3D Ultrasound, Doppler Ultrasound, Elastography), By Application (Breast Cancer Screening, Diagnostic Imaging, Treatment Monitoring, Biopsy Guidance), By End-Users (Hospitals, Diagnostic Imaging Centers, Specialty Clinics, Ambulatory Surgical Centers)” is expected to reach USD 5.80 billion by 2033, registering a CAGR of 9.30% from 2026 to 2033, according to a new report by Transpire Insight.

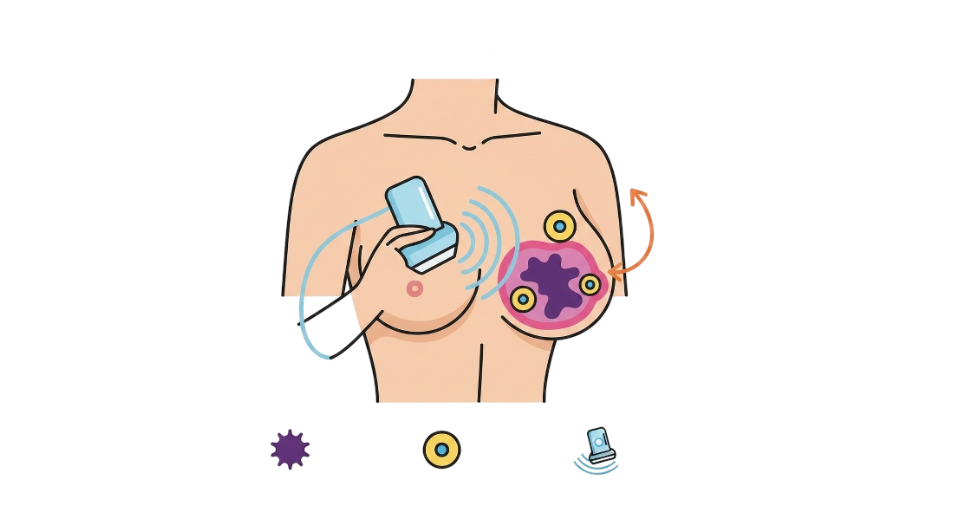

Healthcare workers now lean more toward tools that catch breast cancer earlier, especially when dealing with dense tissue. Not like regular hand-scanned ultrasounds, machines built for full-breast scans follow set patterns every time. Because of this, results stay steady no matter who runs the device. Fewer differences between operators mean clinics can rely on them during large-scale checks. Places doing many exams daily find these systems fit well into their flow.

Faster computers now help doctors see breast tissue more clearly. Because of sharper 3D pictures, scans show small changes better than before. Machines that rebuild images faster cut down wait times during exams. When smart software spots odd patterns, it gives radiologists another set of eyes. With these upgrades, reading scans feels smoother and takes less effort. Confidence grows when findings match what the system highlights. Time once lost to delays gets returned to the day. Mammograms still lead, yet this tool fits right beside them.

Even when setup expenses and staff learning curves slow things down somewhere, fresh attention to extra checks and tailored results keeps pulling interest along. Since more providers now see how tissue thickness matters, plus the value in scans that skip radiation, they are weaving ABUS into standard exams, slowly making it central to today’s breast care tools.

The Automated Breast Ultrasound Systems segment is projected to witness the highest CAGR in the Breast Ultrasound market during the forecast period.

According to Transpire Insight, one reason the Automated Breast Ultrasound Systems part of the market may grow fastest is that it handles dense breast tissue better than older methods. Unlike traditional handheld tools, these machines capture full-breast images the same way every time. That means results stay steady regardless of who operates the device. Consistency improves when human variation fades out. Big screening efforts benefit, as do organized medical routines. Growth seems likely where precision matters most.

One way to look at it: more people learning about extra screening options helps push ABUS forward. With tools like three-dimensional scans and smart software lending a hand, results get sharper while saving time on analysis. It just flows better now that doctors lean into tech-based diagnosis, so systems that fit smoothly tend to spread faster. Growth seems likely simply because it fits how things are moving.

The 3D Ultrasound segment is projected to witness the highest CAGR in the Breast Ultrasound market during the forecast period.

With clearer views of breast tissue through three-dimensional visuals, the 3D Ultrasound sector should see solid gains in the Breast Ultrasound arena. Because it shows structure with more depth compared to standard 2D scans, doctors can better detect irregularities. Details become easier to spot, helping physicians assess suspicious areas with increased certainty. Fewer issues slip past notice when images reveal what older methods might overlook.

Better 3D pictures now show finer details, thanks to sharper scans and instant image building. Because clinics want accurate results without surgery, they are turning more to 3D ultrasounds. These tools are spreading fast in expert diagnostics spots, especially where breast checks need high clarity. Realistic visuals help doctors see clearly, so adoption grows where precision matters most.

The Breast Cancer Screening segment is projected to witness the highest CAGR in the Breast Ultrasound market during the forecast period.

According to Transpire Insight, a heavy focus on catching problems early pushes ultrasound use higher in breast checks. Awareness efforts are spreading wider now, which helps more people learn about screening benefits. Because doctors often suggest regular scans, patients look for extra options beyond standard tests. Dense tissue concerns grow slowly into bigger conversations among health providers. Mammograms stay common, yet ultrasounds step in where they fall short. New patterns in care shape how tools get used across clinics today.

Folks are turning more to breast ultrasound during checkups since it does not invade the body, skips radiation, yet still spots tiny or buried abnormalities. With medical care moving faster toward catching issues early, helping people live longer, and lowering therapy expenses, the need for this kind of scanning tool grows bit by bit.

The Hospitals segment is projected to witness the highest CAGR in the Breast Ultrasound market during the forecast period.

Fueled by modern imaging tools plus well-trained radiologists, hospitals are seeing rising demand in breast ultrasound services. Because these facilities manage countless screenings and diagnostics each day, they have become central hubs where early cancer signs often show up first.

Few places adapt as fast as hospitals, where new tools like 3D ultrasound quietly reshape how checks are done, raising precision one scan at a time. Because they handle everything - spotting concerns, confirming them, guiding biopsies, tracking therapy, they stay ahead, not by claim but by scope.

The North America region is projected to witness the highest CAGR in the Breast Ultrasound market during the forecast period.

Ahead of most others, North America sees rising demand in breast ultrasound tools because people pay close attention to spotting cancer sooner, backed by clear check-up rules. Strong hospital systems help here, supported by deep funding and a habit of quickly using new types of scanning gear.

On top of that, big names in medical tech keep pushing growth by rolling out new tools like smart ultrasounds and 3D imaging. Because more attention is now going toward extra checks for women with dense breasts, better ultrasound options are seeing higher demand across the area.

Key Players

Top companies include GE Healthcare, Siemens Healthineers, Canon Medical Systems, Hitachi Ltd., Hologic Inc., Koninklijke Philips N.V., Samsung Medison, Mindray Medical, Fujifilm Holdings, Delphinus Medical Technologies, SonoCiné Inc., QT Ultrasound (QT Imaging), SuperSonic Imagine, Esaote SpA, Carestream Health, and Clarius Mobile Health.

Drop us an email at:

Call us on:

+91 7666513636