Jan 05, 2026

The report “Artificial Intelligence in Fintech Market By Technology (Machine Learning, Natural Language Processing, Robitic Process Automation, Deep Learning, Computer Vision, Predictive Analytics), By Deployment Mode(Cloud-Based, On-Premises), By Application (Fraud Detection & Risk Management, Credit & Loan Management, Algorithmic Trading, Wealth Management, Customer Support & Virtual Assistants), By End-Users (Banks & Financial Institutions, FinTech Companies, Insurance Companies, Asset Management & Investment Firms, Retail & Corporate Enterprises)” is expected to reach USD 67.22 billion by 2033, registering a CAGR of 17.76% from 2026 to 2033, according to a new report by Transpire Insight.

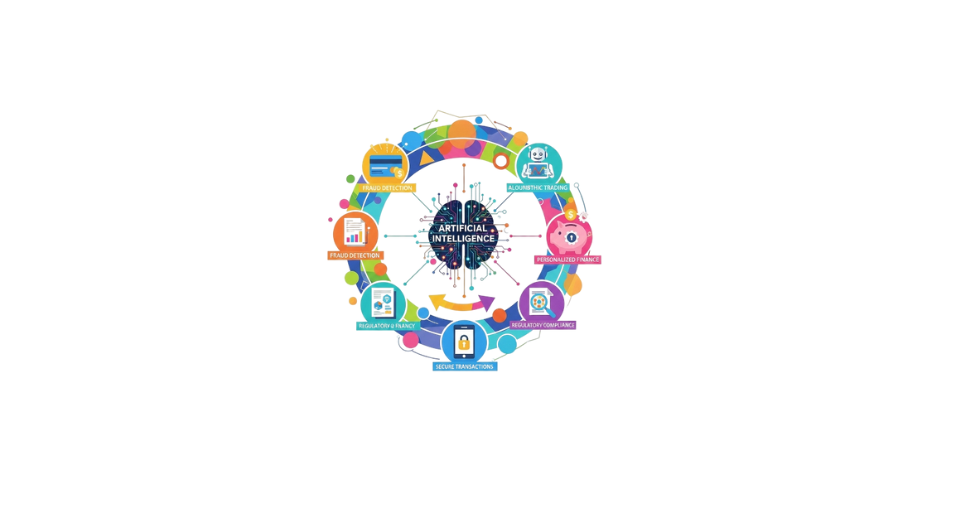

Nowhere else has technology spread faster than in finance, where smart systems help banks and startups work better. These tools shape how people interact with money by making support quicker and more accurate. Instead of old methods, firms now rely on pattern-finding software that learns from activity over time. Some tasks once done by hand happen instantly thanks to automated routines guided by rules. Fraud checks used to take days; today, they finish before a transaction ends. Data flows nonstop through models trained to spot irregularities others miss. Customers expect speed, so responses must feel instant and relevant every single time. Behind screens, algorithms sort behavior patterns to guide decisions without human delay. As phone-based banking grows, smarter logic becomes less optional, more routine. Personal advice comes not from guesswork, but analysis of real habits and choices made daily.

Out in front, machine learning shapes how systems predict outcomes, backing key tasks like spotting fraud or judging credit risk. Moving beyond that, artificial intelligence finds its way into trading bots, managing money, chat helpers, along with meeting legal rules, helping finance players respond quicker, think sharper, and adapt better. Tied closely to cloud setups now, these tools stretch further without costing more, roll out fast, and take hold easily in banks, startups in finance, insurers, and even asset shops.

A growing need for smarter ways to interact with customers, quicker decisions on the spot, while making routine tasks run automatically. Financial institutions plus tech startups alike put resources into artificial intelligence so workflows become smoother, mistakes made by people happen less often, rules set by regulators stay followed. Tools like image recognition systems, neural networks that learn deeply, along with natural language processing open doors to checking documents faster, powering up automated helpers in conversations, even shaping how trades execute through complex math models. With more users embracing these tools day after day, progress in AI applied to finance will likely keep climbing steadily, bringing new ideas and broader applications well into the years ahead.

The Machine Learning segment is projected to witness the highest CAGR in the Artificial Intelligence in Fintech market during the forecast period.

According to Transpire Insight, Machine learning stands out, expected to grow faster than other areas in AI for finance. Its strength lies in forecasting trends, judging credit risk, spotting scams, and guiding automated trades. Banks and digital finance firms now lean heavily on these systems. They feed them vast amounts of information, searching for hidden signals. Decisions happen quickly, shaped by what the data reveals.

Beyond simple tasks, machines now handle intricate workflows on their own, cutting down human errors along the way. Because they learn patterns over time, predictions around money trends grow sharper with each cycle. When linked to tools that study behavior or spot future outcomes, results become far more reliable than before. Speed keeps rising, too; this area outpaces all others in tech growth right now.

The Cloud-Based segment is projected to witness the highest CAGR in the Artificial Intelligence in Fintech market during the forecast period.

With more companies choosing agile, budget-friendly AI setups, cloud-based systems are set to rise fastest. Because they offer quick setup, firms like banks and fintech players can launch tools without delay. These platforms make it possible to connect services smoothly while managing heavy data loads on demand. Real-time analysis becomes easier when everything runs through shared online environments.

Handling heavy-duty AI tasks like spotting fraud, judging credit risk, or powering automated financial advice without loading up on local hardware. A mix of flexibility, lower setup expenses, and smooth growth paths makes it stick. Hybrid approaches fit right in. That pull is shaping how fast firms adopt AI across finance tech today.

The Fraud Detection & Risk Management segment is projected to witness the highest CAGR in the Artificial Intelligence in Fintech market during the forecast period.

According to Transpire Insight, Fraud Detection & Risk Management should grow fastest, thanks to rising scams and digital attacks. Because they spot odd behavior instantly, artificial intelligence tools help banks act early. These systems watch transactions, loans, and credit flows, catching red flags before losses mount.

Machine learning helps companies spot odd payments and stop scams, while meeting rules without delay. Security matters more now, so handling online risks wisely pushes this area ahead of others quickly.

The Bank and Financial Institution segment is projected to witness the highest CAGR in the Artificial Intelligence in Fintech market during the forecast period.

That would be banks and financial firms leaning on AI to run more smoothly, serve customers better, and leave less room for error. These institutions now rely on smart systems to judge credit, catch fraud early, and offer tailored advice. Growth follows where technology fits tightest into daily work.

On top of that, using AI lets banks handle tasks automatically while cutting expenses and staying within legal rules. Putting money into smart systems and data tools makes these institutions front-runners in the evolving world of fintech.

The North America region is projected to witness the highest CAGR in the Artificial Intelligence in Fintech market during the forecast period.

Fueled by a thriving fintech scene, North America may see the steepest rise in AI within financial tech. Digital banking runs deep here, giving smart systems room to grow fast. In the United States, machine learning grabs attention money flows into models that forecast behavior. Tools shaped by artificial intelligence are reshaping how banks interact with users. Progress doesn’t slow; it builds quietly beneath everyday transactions.

Fueled by rules that encourage progress, oceans of data, and tech giants setting up shop, finance players from startups to big banks are moving fast into artificial intelligence. What stands out here is how fresh ideas meet strong systems plus steady cash flow, pushing North America ahead as the region where AI in finance grows quickest.

Key Players

Top companies include IBM Corporation, Microsoft Corporation, Google LLC, AWS, Salesforce Inc., SAP SE, Oracle Corporation, Intel Corporation, Accenture Plc, Cognizant, NVIDIA, Stripe, Feedzai, and Socure

Drop us an email at:

Call us on:

+91 7666513636