Market Summary

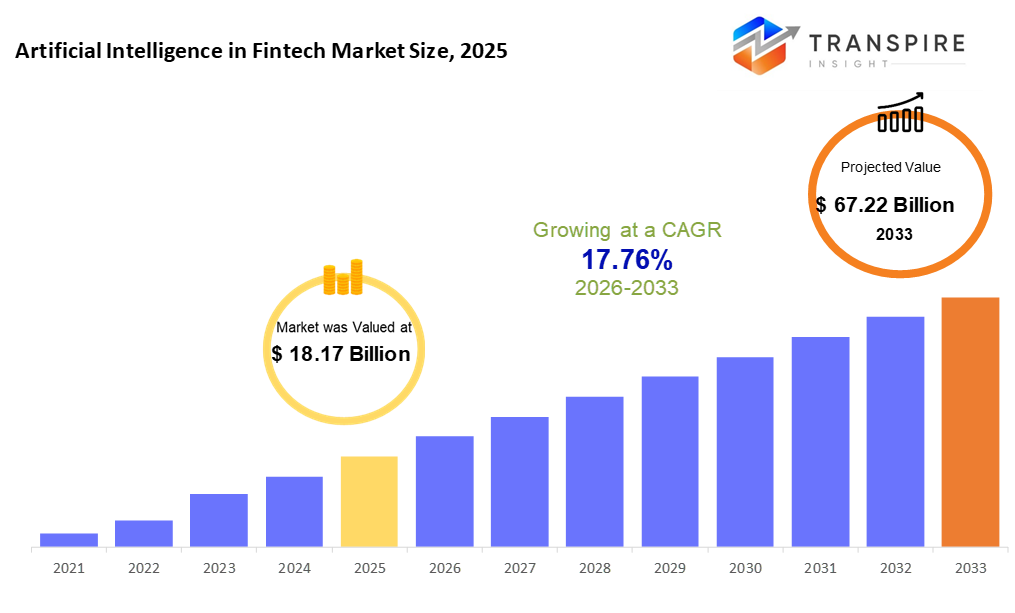

The global Artificial Intelligence in Fintech market size was valued at USD 18.17 billion in 2025 and is projected to reach USD 67.22 billion by 2033, growing at a CAGR of 17.76% from 2026 to 2033. The strong growth is driven by rapid digital transformation in financial services, rising demand for fraud detection, risk management, and personalized customer experiences. Additionally, increasing adoption of machine learning and cloud-based AI platforms by banks and fintech companies is accelerating market expansion at a robust CAGR through 2033.

Market Size & Forecast

- 2025 Market Size: USD 18.17 Billion

- 2033 Projected Market Size: USD 67.22 Billion

- CAGR (2026-2033): 17.76%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 45% in 2026. Banks here were quick to adopt AI tools. The region stays ahead because of a lively fintech scene. Rules are clear, which helps new tech grow. Progress thrives where policy meets innovation.

- That comes mainly from the United States. Credit scoring is shaped with smart algorithms same origin. Robo-advisors guiding financial choices also trace back there. Investment flows strongest from that one country.

- Fueled by new tech in finance, the Asia Pacific moves ahead fast. Digital banks are spreading widely here, changing how people access money services. Pushed forward through efforts to include more citizens in the system, progress takes root. Innovation keeps gaining ground across countries, large and small.

- Machine Learning shares approximately 40% in 2026. Machine learning takes the lead. Predicting patterns helps spot fraud before it spreads. Credit decisions get sharper through data trends. Customer habits come into focus, not by guessing but by analyzing behavior. Insights emerge where they mattered most, hidden until now.

- Cloud-based deployment is expanding the quickest. Its growth comes from the ability to scale smoothly. Integration happens without heavy effort. Running it demands less daily spending. Flexibility meets practicality.

- Fraud detection takes the lead when banks want fast alerts about risks. Financial players focus on spotting threats right away, making this area grow first.

- Fueled by a push for modern banking tools, institutions now back AI through tech upgrades that prioritize safety. Behind every move lies a focus on smoother operations, shaped by real needs in finance.

A sudden jump in AI use marks today's FinTech scene, with banks, startups, and investors turning to smart systems that cut expenses while speeding things up. Because these tools learn patterns, they now handle tasks once done by people, spotting scams, judging loan risks, and even guiding investments. Behind the scenes, voice recognition and automated workflows quietly reshape how money moves. As more customers bank from phones, demand grows for instant, accurate digital help. Firms building payment apps or lending platforms find value in forecasts powered by data history. Efficiency isn’t the only pull; clients expect smoother interactions, pushing adoption further.

Machine Learning and Predictive Analytics dominate because they handle money-related data well. Because patterns matter, machines improve by studying past numbers, spotting risks before they grow. This learning powers better choices in lending, stops scams, and weighs dangers carefully. When it comes to guessing what customers might do next or when markets shift, one tool leads: analysis that forecasts outcomes. Decisions happen more quickly when backed by clear signals instead of guesses. Behind every smart move in finance today, there's likely one of these two at work.

Out in the open digital space, moving away from local servers is becoming common because growth becomes easier when systems stretch alongside demand. Banking tech setups now tap into online AI tools that live far from office walls, cutting setup expenses while making data responses immediate. Instead of choosing one path, some teams blend both worlds, keeping tight control where needed yet reaching for elastic resources when possible. This mix helps meet strict safety rules without slowing down new tool rollouts across finance areas.

A growing push toward custom money solutions alongside smarter ways to talk with customers. Chatbots run by artificial intelligence, digital helpers, plus advisory tools guided by algorithms boost how people interact, speed up replies, while giving advice that fits each person. Another angle cameras powered by smart systems spot patterns, machines learn complex behaviors, these help check documents, confirm identities using body traits, and even trade stocks without human hands. With lenders, tech finance players, insurers, and fund managers weaving AI deeper into daily work, growth seems likely to keep moving ahead, bringing fresh methods along for years to come.

Artificial Intelligence in Fintech Market Segmentation

By Technology

- Machine Learning

A computer uses rules to study money patterns. These rules spot odd behavior in transactions. One rule helps judge if someone should get a loan. Predicting shifts in markets is another task it handles. Hidden connections in numbers guide its conclusions.

- Natural Language Processing

Chatbots understand human speech because of Natural Language Processing. Machines respond like helpers due to this tech that also comes from NLP.

- Robotic Process Automation

A machine takes over dull tasks in finance, handling things like checking customer details. One example is making sure rules are followed without human effort every time. Loan decisions can also move faster because of it. Repetition fades when software steps in quietly.

- Deep Learning

Computers that learn like brains now help judge who gets loans. These systems also catch sneaky financial tricks by spotting odd patterns. Trading decisions happen faster when machines study past moves to predict what comes next.

- Computer Vision

A machine watches pages, checking names against faces. It sees who you are by how you look. Watching every move during money exchanges keeps things in line. Eyes of code spot mismatches that humans might miss.

- Predictive Analytics

Futures peeking shows where markets might go, how buyers could act. Money dangers ahead come into view before they hit hard.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- Cloud-Based

A single click opens access to tools that live online. These systems grow easily when more power is needed. Working from anywhere becomes possible without extra hardware. Bills stay lower since nothing needs buying upfront.

- On-Premises

Right where it is needed inside company walls, software lives on local machines. Control stays close. Information feels safer here. Some prefer keeping things near.

By Application

- Fraud Detection & Risk Management

Fraud detection kicks in where risk grows, smart systems spot odd patterns before trouble spreads. These tools guard money flows by learning what looks wrong over time. Where threats shift fast, responses adapt just as quickly. Not every alert means danger, yet each gets checked without fail.

- Credit & Loan Management

Faster decisions come from smart systems that learn your financial habits. These tools check risk without old-fashioned guesswork. One moment you apply, the next a machine weighs your history. Speed hides behind every quick yes. Rules adapt, not just repeat. Waiting fades when software works overnight. Clearer patterns mean fewer delays. Loans move like messages now, almost instantly.

- Algorithmic Trading

Computers make trades fast, guided by artificial intelligence that reads market shifts as they happen.

- Wealth Management & Robo Advisory

Algorithms step in, quietly adjusting holdings over time. What fits your goals gets picked without loud promises or flashy terms.

- Customer Support & Virtual Assistant

Helping users through automated chats that learn as they go. These tools handle questions fast without needing a person each time. Machines now guide people using smart replies shaped by past talks. Quick fixes come from programs trained on common problems. Support feels smoother when answers show up instantly. Behind it all, systems adapt quietly based on what users ask.

By End-Users

- Banks & Financial Institutions

Starting off, banks and financial groups lead in adopting AI tools. These organizations apply artificial intelligence mainly to handle risks better. Customer support sees changes through automated systems. Fraud detection gets a boost, too. Mostly, these users rely on smart software to stay ahead. Their main goals include safer transactions plus smoother operations. Handling money demands constant oversight. AI helps track unusual activity quickly. Decisions once slow now happen faster. Trust builds when problems are caught early.

- FinTech Companies

Some FinTech firms use artificial intelligence to create new products. These tools help tailor customer experiences differently. Efficiency in daily operations grows when machines handle tasks. One result is smoother workflows behind the scenes.

- Insurance Companies

Firms that sell insurance now use smart software to handle payouts and judge potential dangers, because it helps them respond faster. Machines help sort through requests instead of people doing everything by hand, which cuts delays. Customer questions get answered more quickly when automated helpers step in alongside human staff.

- Asset Management & Investment Firm

Funds and investment groups apply artificial intelligence to trade automatically, forecast market shifts, and improve how they manage collections of assets.

- Retail & Corporate Enteprises

Firms handling shoppers or big clients now tap smart systems to track money moves, check borrowing status, and manage cash tasks. These tools shift how teams handle daily finance work behind the scenes.

Regional Insights

Fueled by widespread use of mobile banking, the AI in the FinTech scene across the Asia Pacific keeps gaining ground. Think China, India, Japan, and Australia leading the charge, each building stronger fintech networks with help from national digital programs. Not far behind, countries like Indonesia, Malaysia, Thailand, and Vietnam are seeing a surge in smart tech within new banks and finance apps. While Beijing and New Delhi push artificial intelligence into fraud checks and loan assessments, smaller hubs experiment just as fast. Digital wallets learn user habits. Lenders adjust risk models on the fly.

Ahead of most regions, North America holds firm, fueled by sharp financial systems and deep tech spending. Machine learning now runs quietly through United States banks, shaping forecasts and handling client interactions at scale. Not far behind, Canada leans into smarter fraud checks and automated help tools within finance platforms. Meanwhile, Mexican institutions inch forward, testing AI for loan evaluations and transaction monitoring. Together, these shifts anchor the region’s weight in the worldwide FinTech landscape with innovation not just present but active.

Across Europe, such as the United Kingdom, Germany, and France, and parts of Latin America, plus areas in the Middle East and Africa, more firms now use artificial intelligence step by step. Banking tech evolves fast because rules exist that allow innovation while keeping things stable. Places outside Western Europe, including Brazil, Mexico, and Argentina, are slowly building smarter systems too. In nations such as the United Arab Emirates, South Africa, and Saudi Arabia, finance apps gain tools that detect scams or handle paperwork without humans. Progress shows up most where mobile money spreads, and people trust digital transactions a bit more each year.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 27, 2025 – Kira raised $6.7M to help companies launch embedded AI fintech products.

(Source: Generic and Artificial Intelligence in Fintech initiatives https://www.gabionline.net/pharma-news/new-denosumab-and-ustekinumab-Artificial Intelligence in Fintech-launches-in-us-canada-and-japan

- June 5, 2025 – Ant International launched a new AI platform for the Fintech sector.

(Source: https://www.retailbankerinternational.com/news/ant-international-ai-platform-fintech/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 18.17 Billion |

|

Market size value in 2026 |

USD 21.40 Billion |

|

Revenue forecast in 2033 |

USD 67.22 Billion |

|

Growth rate |

CAGR of 17.76% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

IBM Corporation, Microsoft Corporation, Google LLC, AWS, Salesforce Inc., SAP SE, Oracle Corporation, Intel Corporation, Accenture Plc, Cognizant, NVIDIA, Stripe, Feedzai, and Socure |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Machine Learning, Natural Language Processing, Robotic Process Automation, Deep Learning, Computer Vision, Predictive Analytics By Deployment Mode(Cloud-Based, On-Premises) By Application (Fraud Detection & Risk Management, Credit & Loan Management, Algorithmic Trading, Wealth Management, Customer Support & Virtual Assistants) By End-Users (Banks & Financial Institutions, FinTech Companies, Insurance Companies, Asset Management & Investment Firms, Retail & Corporate Enterprises) |

Key Artificial Intelligence in Fintech Company Insights

Big players rarely stand still. IBM pushes deep into finance tech with tools like Watson, smart analysis systems built for spotting risks, catching fraud, and faster support handling. These models grow easily, fit big banks or smaller finance groups aiming to stay within rules, find odd patterns, and run more smoothly where data piles high. Instead of locking options down, their AI works inside clouds or private servers, keeping protection strong while moving through different financial networks. Teamups with other innovators plus constant testing in labs keep IBM ahead - not loud, just steady in shaping how money workflows think tomorrow.

Key Artificial Intelligence in Fintech Companies:

- IBM Corporation

- Microsoft Corporation

- Google LLC

- AWS

- Salesforce Inc.

- SAP SE

- Oracle Corporation

- Intel Corporation

- Accenture Plc

- Cognizant

- NVIDIA

- Stripe

- Feedzai

- Socure

Global Artificial Intelligence in Fintech Market Report Segmentation

By Technology

- Machine Learning

- Natural Language Processing

- Robotic Process Automation

- Deep Learning

- Computer Vision

- Predictive Analytics

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Fraud Detection & Risk Management

- Credit & Loan Management

- Algorithmic Trading

- Wealth Management

- Customer Support & Virtual Assistants

By End-Users

- Banks & Financial Institutions

- FinTech Companies

- Insurance Companies

- Asset Management & Investment Firms

- Retail & Corporate Enterprises

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636