Jan 06, 2026

The report “AI-Driven Fraud Prevention Market By Component (Solution, Services), By Deployment Mode(Cloud-Based, On-Premises), By Technology (Machine Learning, Deep Learning, Behavioral Analytics, Natural Language Processing, Network Analysis, Real-Time Detection Engines), By Application (Payment Fraud Detection, Identity Theft, Insurance Fraud, Money Laundering Detection, E-Commerce & Retail Fraud)” is expected to reach USD 101.12 billion by 2033, registering a CAGR of 15.47% from 2026 to 2033, according to a new report by Transpire Insight.

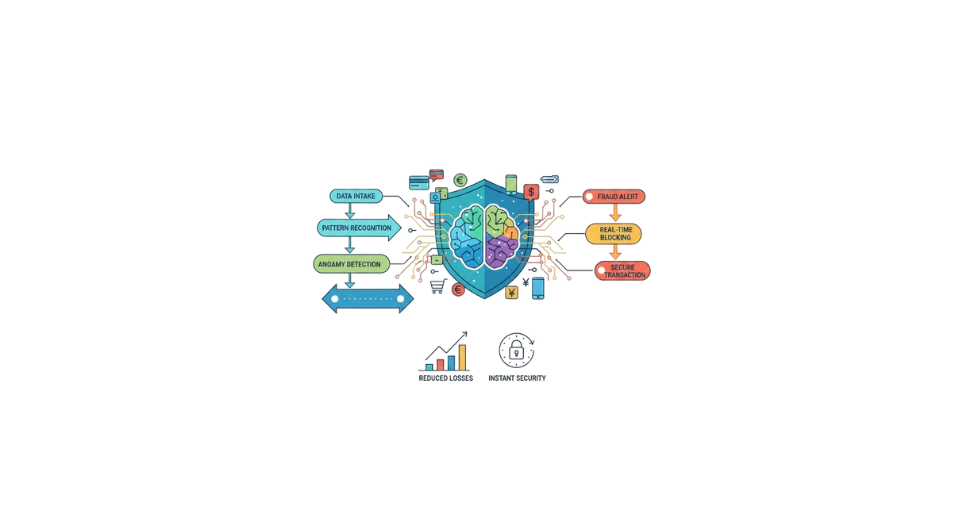

Out there, spotting scams has started leaning heavily on smart tech. These tools come alive by studying how people act during transactions, digging into massive piles of information without slowing down. Instead of just following fixed rules, they adapt using pattern recognition learned over time. They catch those faster than older methods ever could. Behind the scenes, complex math models scan every move, flagging risks before damage spreads. Real-time alerts pop up when something feels off, even if it looks normal at first glance. Systems grow sharper with each event, quietly improving their own accuracy.

Instead of just one method, these tools mix machine learning with deep learning, using behavior patterns and connection mapping to get sharper results without so many errors. As activity unfolds moment by moment, the system jumps into action, blocking scams right when they happen, yet still saving details for later review or audits. Some companies run everything through online servers; others keep things internal, depending on growth plans, privacy concerns, or legal rules. The choice shifts based on what each group truly requires.

From banking to health care, one system fits many fields. Because internet payments grow faster every day, companies turn to smart tools that spot sneaky behavior before harm spreads. When risks change shape quickly, being ready matters more than reacting late.

The Solutions segment is projected to witness the highest CAGR in the AI-Driven Fraud Prevention market during the forecast period.

According to Transpire Insight, one part of the AI fraud prevention market offers tools built on artificial intelligence to spot and stop scams as they happen. Running on machine learning, these platforms study how people act, map connections between actions, and then flag odd behavior during transactions. Most work across websites, apps, and payment systems without slowing things down. Instead of fixed rules, they adapt by absorbing fresh information every day. Over time, their alerts get sharper because they remember what past threats looked like. Speed grows alongside precision when patterns shift overnight.

Growth in the solutions area looks strongest ahead, driven by a sharper focus on tools that stop fraud before it happens. Companies now favor smart software that runs on its own instead of relying on people or slow processes. These systems help cut down financial losses while also reducing errors that flag honest transactions as suspicious. Another trigger: more purchases happen online, where digital wallets and instant transfers dominate daily activity. Fintechs keep expanding, bringing new ways to pay but also opening fresh gaps for attackers. As scams grow smarter, using tricks that adapt quickly, the pressure builds to deploy defenses that learn just as fast. Across banking, retail, and tech sectors, one trend stands out: static methods fall short, leaving room for responsive, data-fed models to take hold.

The Cloud-Based segment is projected to witness the highest CAGR in the AI-Driven Fraud Prevention market during the forecast period.

Out in the open digital world, spotting sneaky fraud moves often leans on tools that live online instead of inside company walls. Access comes easy when businesses tap into these web-powered setups; there's no need to buy piles of hardware first. Updates roll in quietly while decisions happen quickly, due to constant streams of fresh info flowing through. Jumping between apps and services feels smooth because connections form naturally across different tech spaces. Speed matters most where money shifts fast - think phone payments, internet shopping, or new finance players building their footing.

Growth looks likely in cloud-based systems over the coming years, fueled by companies turning to cloud tools for their digital upgrades. Because these setups scale easily, firms can adapt fast - especially when dealing with new scam methods and heavier loads of transactions. Remote operations keep spreading, which pushes even small players to rely on cloud-powered AI to guard against fraud. That factor weighs heavily now. Choosing hosted platforms is not just convenient anymore - it fits into bigger plans. Many see it as essential.

The Machine Learning segment is projected to witness the highest CAGR in the AI-Driven Fraud Prevention market during the forecast period.

According to Transpire Insight, starting off, the machine learning part of AI-powered fraud prevention works by applying algorithms to study past and live data, spotting trends, odd behaviors, or red flags. Instead of just following fixed rules, these models handle massive, messy data sets, catching familiar scams along with new ones nobody has seen before. Across different areas - like checking payments, confirming identities, or watching transactions they have become common tools. Effectiveness is higher here because patterns shift, yet the system adapts without needing constant updates.

A constant shift in how fraud works pushes it to evolve. Firms now lean on these models more because they spot threats better, flag fewer honest actions by mistake, and leave room for instant choices. More online activity piles up every day, demanding tools that think fast without help. That pressure fuels uptake across fields where catching deception matters most.

The Payment Fraud Detection segment is projected to witness the highest CAGR in the AI-Driven Fraud Prevention market during the forecast period.

When money moves, systems watch closely. A web of smart tools tracks every transfer through cards, apps, or bank logins. Instead of waiting, decisions happen instantly. If something feels off, alarms go up silently. Machines learn what normal looks like by studying countless past actions. Odd breaks from routine trigger deeper checks. Fake payments get caught before damage spreads. Speed matters just as much as accuracy here. Hidden links between distant events come into view only through pattern tracking. Fraud slips through fewer cracks when software adapts constantly. Each transaction carries clues to location, timing, and amount, all weighed without delay. Not all odd behavior means crime, but each case gets reviewed fast. Digital wallets face the same scrutiny as plastic cards. Behind the scenes, learning never stops, feeding better judgments.

Growth looks likely here over the coming years, driven by the fast rise of phone and online payments. As transactions climb higher, so do clever scams aimed at breaking into payment networks. That shift pushes banks and companies to lean on artificial intelligence for spotting threats quicker without slowing down users. Smooth protection matters just as much as speed when systems respond in real time.

The North America region is projected to witness the highest CAGR in the AI-Driven Fraud Prevention market during the forecast period.

Across North America, tech-savvy banks, online stores, and insurers lead the charge in using artificial intelligence to fight fraud. Advanced internet systems here give companies an edge when rolling out new security tools. Big spending on cyber defenses fuels rapid adoption in key industries. Firms keep pace with shifting scams by turning to smart software that learns over time. This part of the world stays ahead partly because its finance and tech fields are deeply connected. Growing reliance on digital transactions pushes more businesses to act fast.

Even though trends shift fast, North America keeps moving ahead because companies are turning to smarter tools like artificial intelligence and live data tracking to stay ahead of scams. Because rules around security keep tightening, firms find themselves pushed toward better systems. Working more closely with tech partners helps them handle bigger threats across entire industries.

Key Players

Top companies include IBM Corporation, FICO, SAS Institute Inc., Experian Plc, ACI Worldwide, NICE Actimize, Oracle Corporation, SAP SE, Microsoft Corporation, Signifyd, SEON, Forter, and Sift.

Drop us an email at:

Call us on:

+91 7666513636