Market Summary

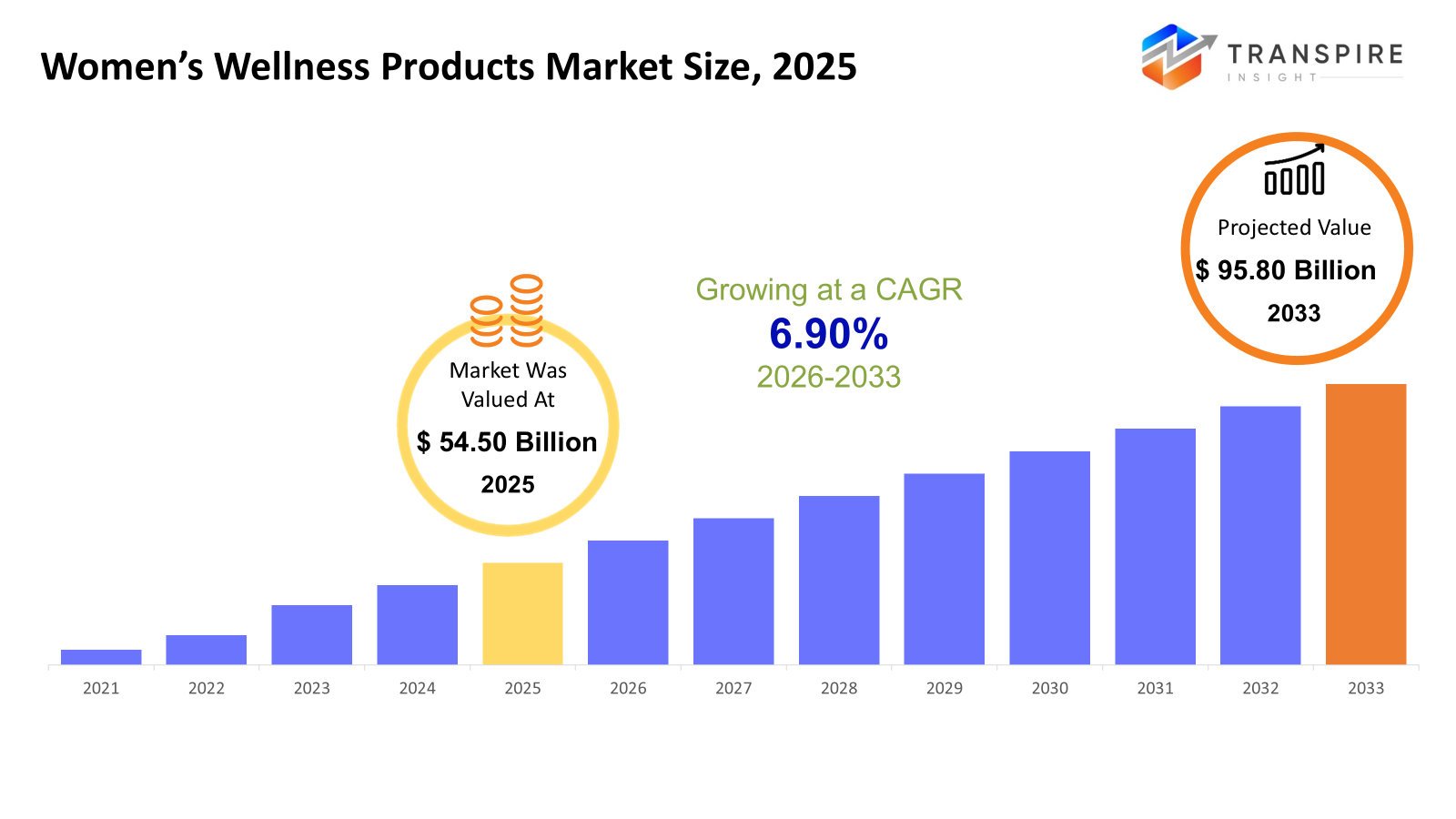

The global Women’s Wellness Products market size was valued at USD 54.50 billion in 2025 and is projected to reach USD 95.80 billion by 2033, growing at a CAGR of 6.90% from 2026 to 2033. More pressure to keep drug, biotech, and medical product spaces free from germs. As biologic drugs, shots that prevent disease, and new kinds of treatments get made more often, companies turn to adaptable, tightly managed rooms you can build like puzzle pieces. Rules about safety and consistency have gotten tougher. Factories now spend more on smarter room designs just to stay within limits.

Market Size & Forecast

- 2025 Market Size: USD 54.50 Billion

- 2033 Projected Market Size: USD 95.80 Billion

- CAGR (2026-2033): 6.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 35% in 2026. North American folks tend to pay close attention to their well-being, which feeds into widespread use of preventive measures. That mindset, combined with a steady appetite for vitamins and similar products, keeps the region at the top. Strong consumer interest pushes the market forward, not just trends or short-term shifts.

- United States, fueled by broad online shopping trends, America's region pushes ahead. Health advice grows sharper there, thanks to modern systems. Reproductive care gains ground, riding that momentum forward.

- Fueled by greater attention to women's well-being, the Asia Pacific region sees rapid growth. Rising personal spending power plays a role here. Access to wellness items and dietary supplements keeps widening across the area.

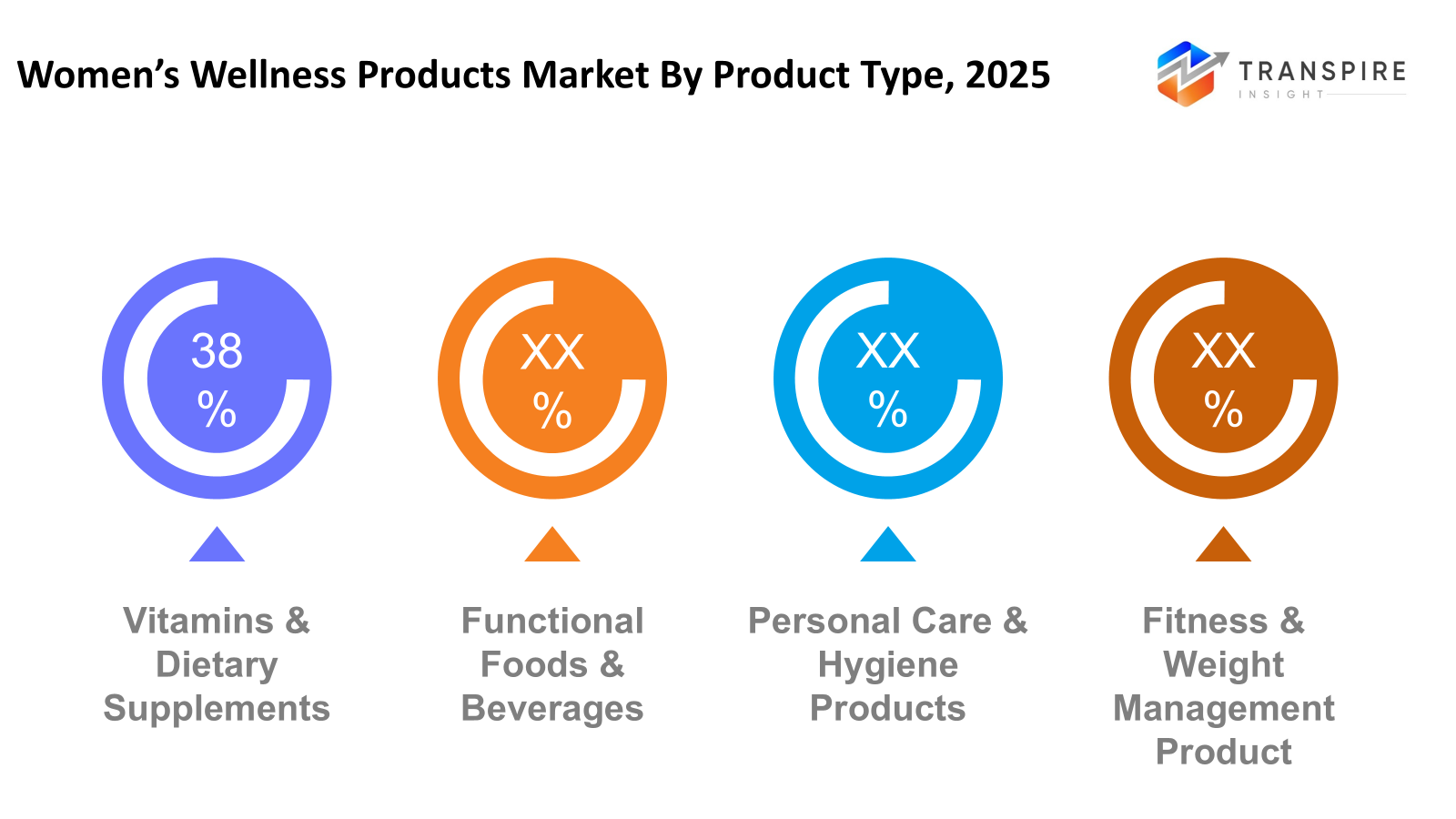

- Vitamins & Dietary Supplements share approximately 40% in 2026. Fueled by everyday choices, vitamins and dietary supplements dominate because people reach for them when thinking about staying well. Immunity support pulls interest strongly, yet family planning concerns also steer buyers their way. Wellness trends keep demand steady, even as habits shift across seasons.

- Most people take vitamins and minerals because they help keep the body running smoothly. These nutrients show up in daily routines of all ages, doing quiet work behind the scenes. From young kids to older adults, many rely on them just to stay balanced. Mostly basic upkeep, filling gaps when food falls short. Often chosen without fanfare, they support wellness before problems start.

- Most people still pick tablets or capsules because they are simple to store. They last a long time without going bad. Taking them each day fits smoothly into routines.

- Women today show growing interest in solutions for their menstrual cycles, trying to conceive, or navigating life after childbearing years. This shift shapes what they look for in wellness offerings.

More women now pay attention to staying healthy before problems arise, especially when it comes to hormones and feeling good each day. Because of this shift, more people look for items that help with fertility, a strong immune system, and wellness at every age. Energy gets a boost, and nutrition gaps close due to the everyday use of vitamins, special foods, and drinks made for the body's needs.

Daily routines include items that help people feel clean and look their best. From lotions to shampoos, these things handle skin, hair, periods, and personal comfort without fuss. Protein powders or shakes show up more often when someone wants energy or strength during movement. Women now pay closer attention to how they move, eat, and make strong choices shaped by real-life demands. Products shift with habits, quietly matching what bodies actually need day after day.

Now here comes a shift toward mind and thinking health, where items aim at calming nerves, aiding rest, or sharpening thought. Instead of synthetic fixes, many turn to plant-based powders, resilience-boosting herbs, or earth-sourced pills meant to steady moods, lift concentration, or balance inner states. People lean more into whole-life care, linking body rhythms, head clarity, and heart calm as one woven thread.

Better forms like chewy gummies or quick-dissolve powders show up where it counts. Not just pills anymore, capsules, drinks, and even flavored mixes help more folks stick with routines. Thanks to wider availability, picking them up happens in drugstores, online shops, or niche wellness spots without hassle. Instead of treating isolated issues, today’s options blend vitamins, skincare support, and daily habits into one picture. Women’s well-being gets attention across ages, shaped by what actually fits real lives.

Women’s Wellness Products Market Segmentation

By Product Type

- Vitamins & Dietary Supplements

From time to time, certain nutrients help keep energy steady. Some of these come in small forms you swallow daily. They can play a part in staying resilient when seasons change. A few support balance during life's natural cycles. Not everyone gets enough from food alone.

- Functional Foods & Beverages

Wellness gets a boost when everyday eats pack extra nutrients. Energy levels rise through specially fortified sips and bites. That comes from what you consume daily. Think meals that do more than fill stomachs. These items work behind the scenes, quietly supporting body rhythms. Not magic - just smart tweaks to familiar favorites.

- Personal Care & Hygiene Products

Fresh routines start here, cleansers, lotions, shampoos designed around real needs. Flow days covered with pads, cups, and gentle wipes made for comfort. Private moments are handled quietly through trusted formulas that work without fuss. Solutions shaped by daily life, not trends.

- Fitness & Weight Management Products

Shaking up your routine might mean trying protein mixes that fit how you move. Some turn to ready-made meals when cooking feels like too much. Energy helpers come into play if stamina runs low during workouts. These picks often pair well with daily movement goals. What works shifts from person to person, moment to moment.

To learn more about this report, Download Free Sample Report

By Ingredient Type

- Vitamins & Minerals

From time to time, certain tiny helpers step in, vitamins and minerals keep your body fighting strong against illness. These quiet players also hold bones together when pressure builds. When energy shifts happen inside you, they help manage the flow without drawing attention.

- Herbal & Botanicals Extracts

From plants come extracts that help steady hormones. These natural pieces of green life bring calm instead of chaos. Energy rises when roots and leaves join the mix. Calm settles in through botanical whispers, not force. Hormones find rhythm without sharp turns. Nature's role shows quietly here, no noise, just presence.

- Probiotics & Prebiotics

Supplements promoting gut health and digestive wellness.

- Omega-3 & Fatty Acids

Heart, mind, plus skin often feel better when omega-3s are part of daily intake. These fats show up in certain foods that quietly fuel the body's needs.

- Protein & Amino Acids

From time to time, protein steps in to help maintain strong muscles. It quietly backs your daily physical performance through amino acids. These building blocks also keep metabolism ticking without drawing attention. Strength is not built overnight - consistency does part of the work. Each day, these components support what movement sets in motion.

By Formulation

- Tablets & Capsules

Easy-to-take pills that fit into everyday routines. These small shapes carry nutrients without fuss. Some dissolve fast, others release slowly. Their firm form makes handling simple. Portability comes naturally with these compact versions. Each dose stays stable until used.

- Powder & Granules

Packed into shakes or sprinkled on meals, powders and granules show up in plenty of high-protein picks. Some choose them for workouts, others just to fill gaps at dinner. Found in tubs or pouches, these forms blend easily when mixed right. Texture varies, but most dissolve without clumps if stirred well.

- Liquids & Syrups

Liquid options flow smoothly into daily routines, suiting every age without hassle. These syrup formats meet specific health goals while staying simple to take.

- Gummies & Chewable

They taste good. That makes sticking to routines easier, especially for many females. Flavor helps. So does texture - soft, simple to take. Preference grows when it feels less like medicine. Acceptance rises without the struggle. Smooth experience matters just as much.

By Application

- Reproductive Health & Hormonal Balance

Periods, trying to conceive, or life after childbearing solutions are tuned to each phase. Moving through monthly cycles with fewer disruptions. Changes later in life met with steady support. Shifting hormones are handled without upheaval. Bodies are adapting with less strain.

- Immunity and General Wellness

Staying well often begins with what you put on your plate. Sometimes roots, leaves, or seeds make a difference. A steady supply of key nutrients helps the body do its job. Plants have long played a role in everyday resilience. Small daily choices add up over time. What grows from the earth can support what lives on it.

- Bone & Joint Health

Joints move more easily when support comes from within. Strength builds where minerals meet daily care. Movement stays smoother over time, given steady attention. Structure holds firm when nourishment runs deep.

- Weight Management & Fitness

Finding balance in daily movement starts with how we fuel the body. Instead of chasing quick fixes, some turn to tools that help handle fat more efficiently. Energy levels often rise when support comes from smart choices. Performance during activity sometimes improves without needing extra effort. What works today might shift tomorrow - change is part of the process.

- Mental & Cognitive Health

Built for calm minds, these picks ease tension while supporting rest. Sleep gets smoother when brain fog lifts through steady focus helpers. Clarity grows where daily mental strain once slowed thinking. Restful nights come easier with blends meant to quiet overactive thoughts. Sharpness stays longer using natural compounds aimed at the mind function. Daily balance shifts toward better concentration without sudden crashes. Thoughts untangle themselves given time plus consistent nutritional backing.

Regional Insights

Home to major drug makers and bioscience innovators, North America leads in cleanroom tech adoption. Strong research networks push progress across the sector. United States factories set the pace with massive output of biological medicines. Strict rules shape how spaces are built and run. Newer, flexible room designs gain ground thanks to funding boosts. Efficiency matters just as much as meeting regulations. Growth thrives where innovation meets demand.

Across Europe, steady interest comes from well-known pharma centers like Germany, Switzerland, France, and the United Kingdom. Tough rules help shape the market, while fresh ideas in adaptable cleanroom setups keep things moving. Money flowing into biologic drugs, vaccines, and niche labs adds momentum. Partnerships between government and private players, along with teamwork that crosses national borders, push newer cleanroom tech forward throughout the area.

Fast changes are shaking up Asia Pacific, thanks to bigger drug and bioresearch factories, stronger backing from national leaders, plus more money flowing into medical facilities. In places like China, India, and Japan, spending jumps on flexible, advanced cleanrooms needed to follow strict rules and make vaccines, biological medicines, and germ-free items. Modern upgrades and room to grow give the area an edge, making it a key player in cleanroom tech development ahead.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 6, 2025 – Dove launched a women’s wellness range on Amazon.

(Source:https://www.globalcosmeticsnews.com/dove-launches-womens-wellness-range-on-amazon/

- March 21, 2024 – D2C brand Revaa launched a range of products for Women’s wellness in India.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 54.50 Billion |

|

Market size value in 2026 |

USD 60.00 Billion |

|

Revenue forecast in 2033 |

USD 95.80 Billion |

|

Growth rate |

CAGR of 6.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Amway Corporation, Bayer AG, Herbalife Nutrition Ltd., GNC Holdings Inc., Nature’s Bounty Co., Nestlé Health Science, Blackmores Limited, Swisse Wellness Pty. Ltd., Pfizer Inc., Nature Made (Pharmavite), NOW Foods, USANA Health Sciences, Jamieson Wellness, Himalaya Wellness Company, Vitabiotics Ltd., Olly (Unilever brand), and Nu Skin Enterprises, Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Vitamins & Dietary Supplements, Functional Foods & Beverages, Personal Care & Hygiene Products, Fitness & Weight Management Products), By Ingredient Type (Vitamins & Minerals, Herbal & Botanical Extracts, Probiotics & Prebiotics, Omega-3 & Fatty Acids, Protein & Amino Acids), By Formulation (Tablets & Capsules, Powder & Granules, Liquids & Syrups, Gummies & Chewable), By Application (Reproductive Health & Hormonal Balance, Immunity & General Wellness, Bone & Joint Health, Weight Management & Fitness, Mental & Cognitive Health) |

Key Women’s Wellness Products Company Insights

Women everywhere turn to Amway for wellness essentials shaped by real science, not trends. From immune support to daily beauty routines, their product lineup answers varied needs without clutter. Science guides every formula, no guesswork, just ingredients studied for impact. Instead of chasing fads, the brand builds solutions grounded in long-term health goals. Its network thrives through direct access, blending face-to-face outreach with online ease. Research fuels progress here; labs stay busy refining what works. Because trust grows slowly, consistency matters more than flashy promises. Each item reflects a commitment to purity, backed by checks most skip. Customers keep coming back, not because they are pushed but because results speak clearly. Innovation moves quietly under steady exploration, not sudden leaps. Wellness is not sold as perfection; it shows up as small, lasting shifts. Global reach comes not from slogans but from a reliable presence across regions. Personalized approaches emerge naturally when listening drives creation. Quality control runs deep, shaping choices before bottles even fill. Growth follows where integrity leads, one honest conversation at a time.

Key Women’s Wellness Products Companies:

- Amway Corporation

- Bayer AG

- Herbalife Nutrition Ltd.

- GNC Holdings Inc.

- Nature’s Bounty Co.

- Nestlé Health Science

- Blackmores Limited

- Swisse Wellness Pty. Ltd.

- Pfizer Inc.

- Nature Made (Pharmavite)

- NOW Foods

- USANA Health Sciences

- Jamieson Wellness

- Himalaya Wellness Company

- Vitabiotics Ltd.

- Olly (Unilever brand)

- Nu Skin Enterprises, Inc

Global Women’s Wellness Products Market Report Segmentation

By Product Type

- Vitamins & Dietary Supplements

- Functional Foods & Beverages

- Personal Care & Hygiene Products

- Fitness & Weight Management Products

By Ingredient Type

- Vitamins & Minerals

- Herbal & Botanical Extracts

- Probiotics & Prebiotics

- Omega-3 & Fatty Acids

- Protein & Amino Acids

By Formulation

- Tablets & Capsules

- Powder & Granules

- Liquids & Syrups

- Gummies & Chewable

By Application

- Reproductive Health & Hormonal Balance

- Immunity & General Wellness

- Bone & Joint Health

- Weight Management & Fitness

- Mental & Cognitive Health

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636