Market Summary

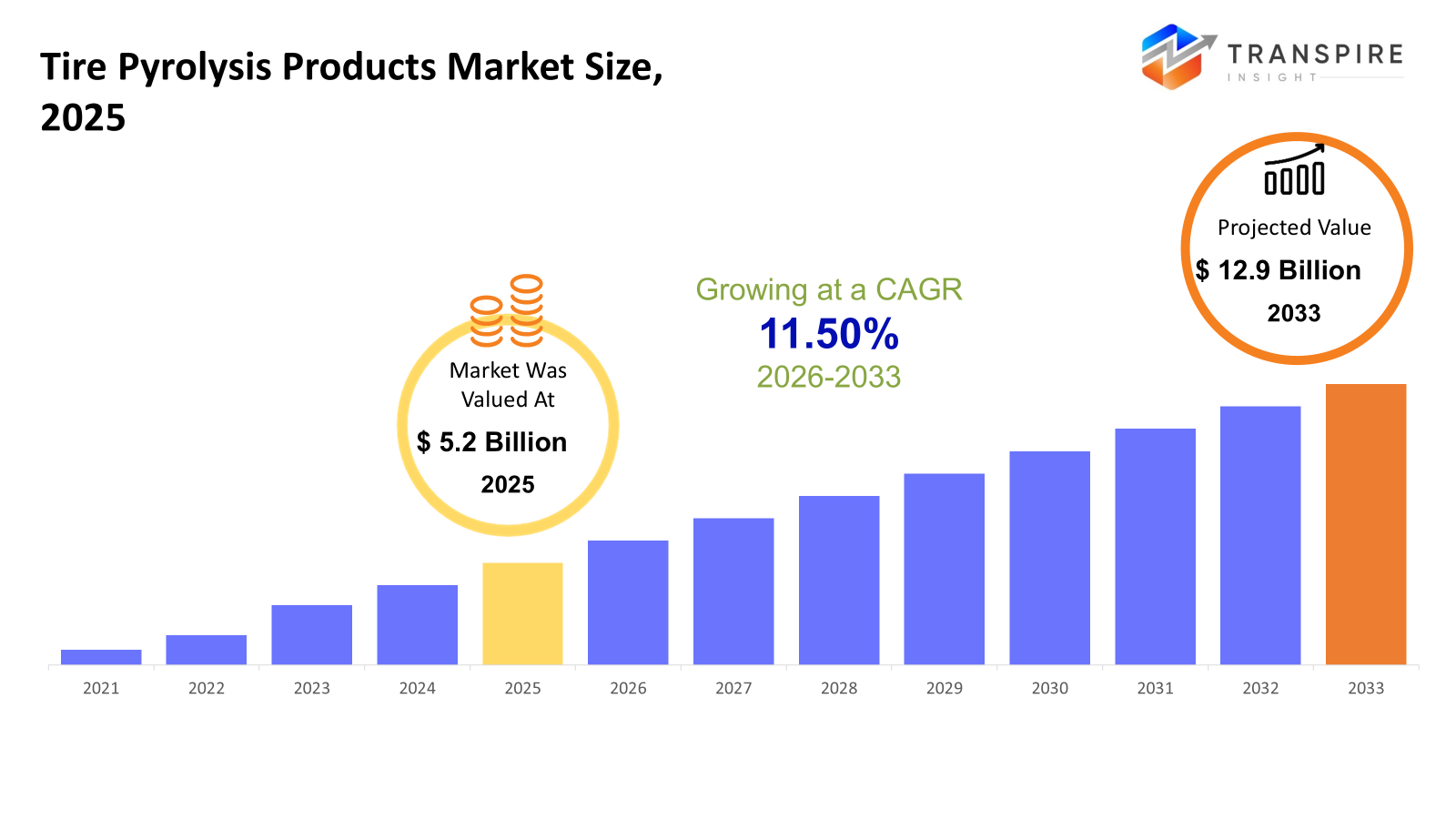

The global Tire Pyrolysis Products market size was valued at USD 5.2 billion in 2025 and is projected to reach USD 12.9 billion by 2033, growing at a CAGR of 11.50% from 2026 to 2033. Increased demand for sustainable fuel alternatives, as well as recyclates, associated with stringent government regulations on environmental issues, fuels the continuous growth of this market. Advancements in continuous as well as semi-continuous pyrolysis technology, increasing investments in pyrolytic equipment, growth of car as well as industrial markets, especially in developing countries, all help in stabilizing CAGRs.

Market Size & Forecast

- 2025 Market Size: USD 5.2 Billion

- 2033 Projected Market Size: USD 12.9 Billion

- CAGR (2026-2033): 11.50%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The region of North America is observing rapid development in terms of large-scale continuous pyrolysis plants, and USA is the forerunner in technology development for production of TPO and RCB, with stringent recycling norms and energy demands from industries.

- Regional innovation is spearheaded in the United States, which invests in sophisticated continuous pyrolysis technology, secures offtake agreements that span several years with tire manufacturers, and is developing applications for carbon black in the automotive and industrial industries through sustainability-based directives.

- Asia Pacific dominates the world in terms of production, with key countries like China and India focusing on utilizing high-volume continuous and semi-continuous manufacturing facilities to generate raw materials like TPO, rCB, and syngas utilized in automotive, chemical, and industry sectors, due to the high rate of industrialization and energy consumption in the region.

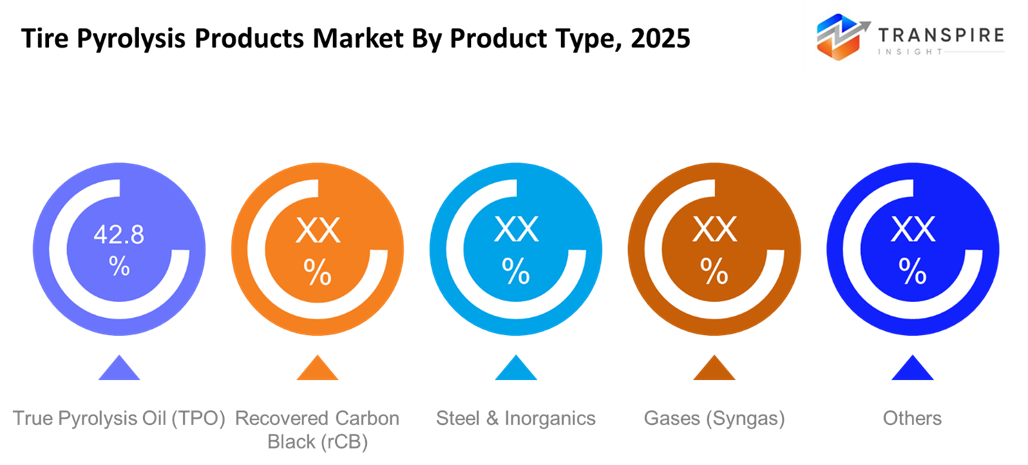

- However, True Pyrolysis Oil maintains its position as the primary product type driven by the energy price volatilility around the world and the expanding demand for a clean alternative in many industries.

- Batch, continuous, and semi-continuous operations are merging into one another, ensuring continuous operations, which can be conducted on a large scale, thus improving the efficiency and profitability of operations in both emerging and established markets.

- Plants of a medium and large scale will still dominate investments in terms of scale, efficiency in energy consumption, and the ability to supply to the industrial and automotive sector.

- The automotive segment continues to be the largest end-use segment due to the manufacture of tires and the use of synthetic rubber, in addition to the increasing global focus on recycling and the reduction of the carbon footprint.

So, Tire Pyrolysis Products Market is dedicated to the use of waste tires to generate valuable products such as True Pyrolysis Oil (TPO), Recovered Carbon Black, steel, and syngas through the process of pyrolysis. The Tire Pyrolysis Products Market is expanding with the increase in environmental norms and the generation of waste tires along with the demand for new sources of energy in various sectors. There is also an increase in technology with continuous and semi-continuous methods of carrying out the process of pyrolysis in developed and emerging economies. TPO is an essential source of revenue, used as fuel and chemical feedstocks, and rCB is more fully integrated into tires, coatings, and plastics, providing an environmentally friendly alternative to virgin carbon blacks. Steel recovery facilities provide support in steel recycling economics, whereas energy availability in the form of "syngas," which may be grid-based or plant-based, makes the operation more independent. Cost competitiveness, mainly over traditional modes like landfills or incinerators, is another primary driver for the market. There’s more prevalence of medium or large-scale plants over small-scale plants. Small-scale plants are still relevant, though.

Thus, the growth of the market is affected by certain elements such as industrialization, energy consumption, automobile industry growth, and circular economy programs. The developing markets are engaging themselves in capacity expansion, whereas the developed markets are looking to upgrade technologies and increase the optimum product output.

Tire Pyrolysis Products Market Segmentation

By Product Type

- True Pyrolysis Oil (TPO)

The most widely used outcome of tire pyrolysis is TPO, also known as tire oil, used as fuel or feedstocks. It is the leading player in the tire oil market due to various applications in the generation of fuels. An increase in oil demand coupled with price volatility encourages investment in tire oil production, thus becoming the best choice for small- and large-scale businesses.

- Recovered Carbon Black (rCB)

The importance of sustainable alternative material, i.e., rCB, is increasing within tire, plastic, and paint industries due to its increasing potential and cost-effectiveness of reusing material. The sustainable aspect of material with BASE regulations enhancing circular economy promotes its growth curve.

- Steel & Inorganics

Steel used in tires offers a secondary source of earnings and a support base in recycling economics. This market, which ranks smaller than that of TPO or rCB, is crucial to sustainability and in compliance with environmental directives concerning tire waste.

- Gases (Syngas)

The use of syngas produced during pyrolysis is now being applied in generating in-plant energy or electricity. The importance of syngas can be enhanced in continuous or semi-continuous pyrolysis plants because energy efficiency is considered crucial. The adoption rate is higher in plant-scale uses that promote energy self-sufficiency.

- Others

This category includes minor by-products such as those produced for chemical intermediates and special additive oils, although this is a minor product, it is important in achieving overall plant profitability.

To learn more about this report, Download Free Sample Report

By Process

- Batch Process

Batch processing is an adaptable and cost-effective system for small-scale plants. Batch processing is commonly practiced in emerging markets with prevailing conditions of capital constraints and low volume processing. The limitation of batch processing is its relatively low capacity of production.

- Continuous Process

Continuous process operation is preferred for large-scale manufacturing due to its advantages of increased efficiency and quality of production. Continuous processes are preferred for mature markets and are important for industries, producing TPO, rCB, and syngas.

- Semi-Continuous Process

Semi-continuous systems integrate advantages of both batch and continuous processes offering flexibility with high output rates. They typically apply in mid-scale plants, especially in regional market situations where demand increases, though still not large-scale.

By Scale

- Small Scale Plants

Small scale industries serve a small or local market, sometimes through batch processing. Small scale industries demand low investment and can allow new players to test the feasibility of the industry in the market, although the profit can be moderate, depending on the cost of feedstock material.

- Medium Scale Plants

In medium scale plants, a compromise is maintained regarding capital and output costs. Often using semi-continuous and continuous processes, they cater effectively to regional industrial demand and local automotive recycling needs.

- Large Scale Plants

These are quite huge plants, where the focus is mainly bulk production, optimized for the highest production of TPO, as well as rCB. The continuous type of process is what represents this, aiming to provide economies of scale including energy savings.

By End Use

- Automotive

The automobile sector is the biggest end-user of rCB and TPO. This requirement stems from sustainability drives and government regulations aimed at recycling waste tires.

- Industrial

The fuel being employed here is TPO and syngas for the manufacturing industries. This segment enjoys benefits of saving fuel and is increasing its presence in industries with high energy consumption.

- Chemical Manufacturing

There has been a rise in chemical manufacturers' use of pyrolysis oil as a feedstock in various chemical processing activities. Chemical processing comprises a wide range of chemical applications with high-value utilization.

- Paints & Coatings

Carbon black recovered from the pyrolysis process can be utilized in paints, inks and coatings and can represent a more eco-friendly alternative. Its usage will likely expand in environmentally friendly states.

- Construction & Transportation

TPO and rCB can be used for some construction material or road-laying items. Though their demand is relatively lower emerging markets for infrastructure expansion can be a growing concern.

- Others

Other end-use segments would be energy generation, plastics and specialties. Growth would be opportunistic driven by inventions and local-demand-driven models.

Regional Insights

The market in North America is characterized by restrictive rules on the environment, making it highly recalcitrant to recycling technology, favoring large-scale continuous technology, with the U.S. market leading, followed by Canada and then Mexico. In Tier 1, large-scale operations compromises in industrial-scale production of TPO, as well as rCB, the rest serve confined purposes in energy recovery processes. In Europe, high regulatory support is available in terms of sustainable waste management in regions like Germany, the United Kingdom, France, Spain, and Italy. Tier 1 regions concentrate more on large-scale pyrolysis plant technology to be used in the automotive and chemical industries, whereas in the rest of Europe, pyrolysis technology at a medium scale is used to meet the requirements of local industries.

Countries in the Asia Pacific dominate the market for tire pyrolysis production and consumption volumes. These countries are China, India, Japan, South Korea, and Australia/New Zealand. Tier 1 countries focus on investing heavily in continuous production units to manufacture TPO and rCB on a large scale, while Tier 2 countries extend their semi-continuous and batch production units. South America is developing through medium-scale plants in both Brazil and Argentina, while smaller plants in the rest of the region meet the localized energy and industrial needs. The Middle East & Africa present an increase in large-scale operations in Saudi Arabia, the UAE, and South Africa, while smaller projects are being deployed across emerging nations in order to support energy recovery and circular economy initiatives.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 2025, Scandinavian Enviro Systems AB has made an official public announcement to its investors, the public, informing them that the first of the five vital reactors involved in the investigation has already been delivered, awaiting assembly in its recycling facility based in Sweden, specifically in the city of Uddevalla, meant specifically for the end-of-life tyre recycling procedure as done in its pyrolysis technology.

- In January 2025, Bridgestone Corp has officially announced its plan for a new demonstration plant to carry out precise pyrolysis on end-of-life tyres at its plant in Seki City, Gifu, Japan. The move is a part of a quest to improve horizontal tyres recycling by producing tyre oil and carbon black from used tyres to be used in tyre recycling. It is part of its sustainable endeavor in relation to its Mid-Term Business Plan 2024-2026.

(Source:https://www.bridgestone.com/corporate/news/2025013001.html)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 5.2 Billion |

|

Market size value in 2026 |

USD 6 Billion |

|

Revenue forecast in 2033 |

USD 12.9 Billion |

|

Growth rate |

CAGR of 11.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Klean Industries, Scandinavian Enviro Systems, Pyrolysis Technologies LLC, Black Bear Carbon B.V., EcoGreen Enterprises, Novum Energy Australia Pty Ltd, Entyr Limited, Enespa AG, Niutech Environment Technology Corporation, Delta-Energy Group, City Circle Group (CCG), Bolder Industries, Waverly Carbon Ltd, Reoil SP.o.o., Pyrum Innovations AG |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (True Pyrolysis Oil (TPO), Recovered Carbon Black (rCB), Steel & Inorganics, Gases (Syngas), Others), By Process (Batch Process, Continuous Process, Semi‑Continuous Process), By Scale (Small Scale Plants, Medium Scale Plants, Large Scale Plants) and By End Use (Automotive, Industrial, Chemical Manufacturing, Paints & Coatings, Construction & Transportation, Others) |

Key Tire Pyrolysis Products Company Insights

Klean Industries, is recognized as one of the world leaders in providing advanced solutions and technologies required for the process of tyre pyrolysis, with its focus centered mostly around the design and supply of modular and continuous process solutions for generating valuable recovered carbon black and oil products. The patented process of the company is recognized as an efficient method for facilitating the process of material recovery at an industrial level with enhanced levels of material conversion efficiency. The company has access to a diversified geographical portfolio across Europe, North America, and Asia, with strategic partnerships facilitating its presence across an increased number of plants. The focus of the company on energy-based solutions positions it at an advanced level compared with its competitors.

Key Tire Pyrolysis Products Companies:

- Klean Industries

- Scandinavian Enviro Systems

- Pyrolysis Technologies LLC

- Black Bear Carbon B.V.

- EcoGreen Enterprises

- Novum Energy Australia Pty Ltd

- Entyr Limited

- Enespa AG

- Niutech Environment Technology Corporation

- Delta-Energy Group

- City Circle Group (CCG)

- Bolder Industries

- Waverly Carbon Ltd

- Reoil SP.o.o.

- Pyrum Innovations AG

Global Tire Pyrolysis Products Market Report Segmentation

By Product Type

- True Pyrolysis Oil (TPO)

- Recovered Carbon Black (rCB)

- Steel & Inorganics

- Gases (Syngas)

- Others

By Process

- Batch Process

- Continuous Process

- Semi‑Continuous Process

By Scale

- Small Scale Plants

- Medium Scale Plants

- Large Scale Plants

By End Use

- Automotive

- Industrial

- Chemical Manufacturing

- Paints & Coatings

- Construction & Transportation

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr.png)

APAC:+91 7666513636

APAC:+91 7666513636