Market Summary

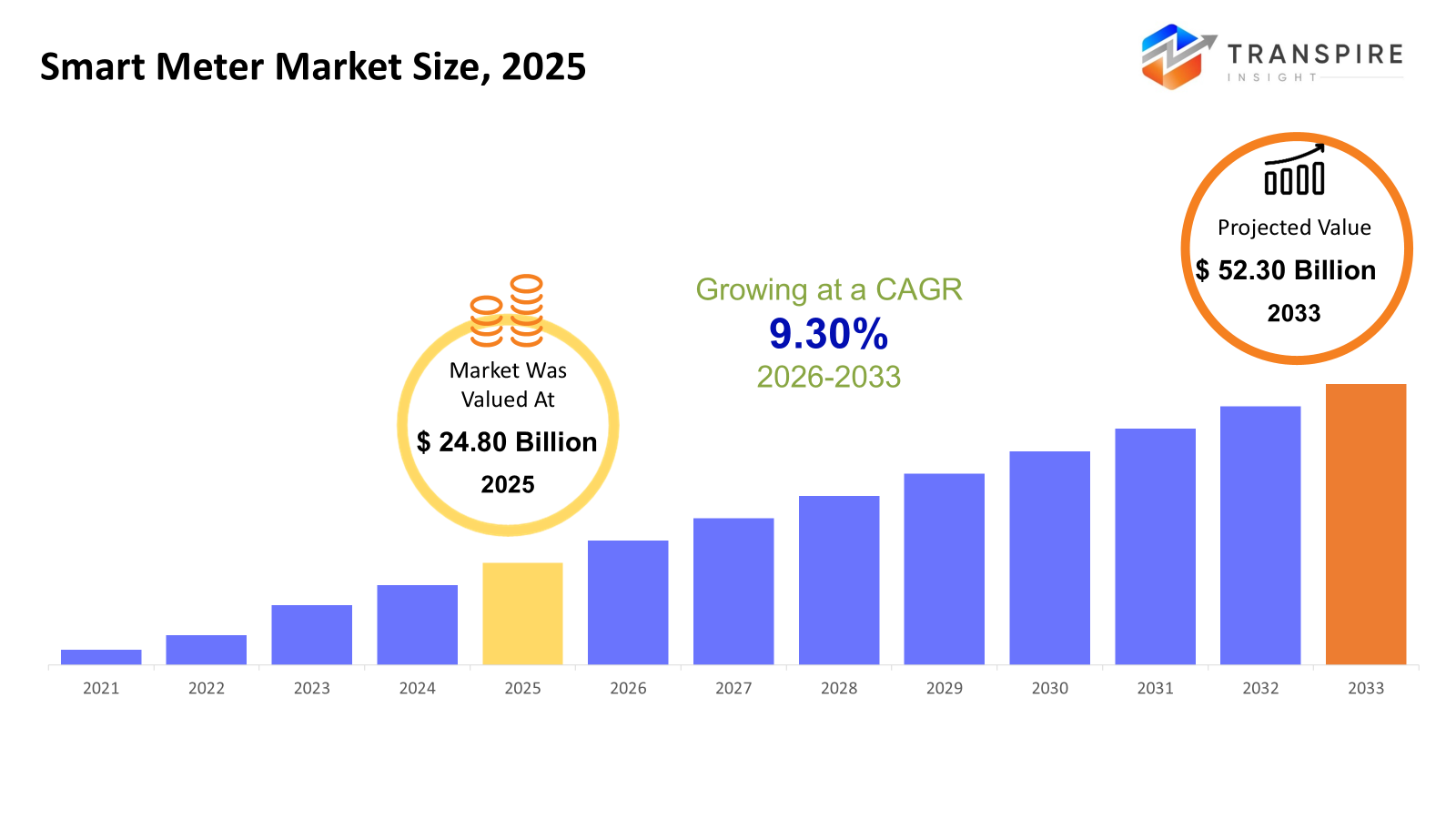

The global Smart Meter market size was valued at USD 24.80 billion in 2025 and is projected to reach USD 52.30 billion by 2033, growing at a CAGR of 9.30% from 2026 to 2033. Growth in the global smart meter market keeps building, fueled by a need for precise energy tracking, live updates on usage, plus seamless invoicing in homes, businesses, and factories. Electric models take center stage; they help power providers upgrade networks and roll out systems that measure consumption more effectively, cutting waste along the way. Rules from authorities lend momentum; many nations now require upgrades or fund projects tied to smarter electricity grids. On top of that, people pay closer attention to saving energy and managing expenses, which makes these devices feel less like options and more like tools they want to use.

Market Size & Forecast

- 2025 Market Size: USD 24.80 Billion

- 2033 Projected Market Size: USD 52.30 Billion

- CAGR (2026-2033): 9.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 30% in 2026. Grid updates in North America gain momentum when utilities spend on infrastructure. Backed by rules that shape energy use, progress moves forward even without big policy pushes. Where state or federal rewards exist for smarter meters, changes take root more easily. Support grows quietly where funding lines appear.

- From coast to coast, power companies in the United States have rolled out millions of smart meters. These devices track electricity use in real time, feeding data into systems that help manage supply more effectively. While other regions trail behind, North America sees widespread integration through established grid upgrades. Large utility providers rely on detailed analysis tools to adjust operations based on live information streams.

- In the Asia Pacific, rapid growth comes from vast numbers of people living close together. Urban areas grow quickly here, shaping new ways cities function each year. Smart planning pushes change forward across neighborhoods and regions alike. Government efforts back systems that modernize how energy moves through communities.

- Electricity Smart Meter share approximately 45% in 2026. A fresh wave of metering tech spreads through power networks. Utilities update aging systems, meeting rules that demand precise usage records. Clearer insight into energy flow becomes possible. Oversight bodies push these changes forward. Monitoring the grid improves without extra delays. Accuracy shapes how services adapt. Rules nudge adoption steadily ahead.

- Utilities are now building networks that talk back and forth. These systems share live updates instead of waiting. Data flows both ways, helping track usage as it happens. Equipment upgrades let companies respond faster. Decisions come from current numbers, not guesses. More insight appears when signals move in sync. Networks like these shape how power gets managed day to day.

- Out in cities, radio frequency mesh systems are spreading fast, built to grow without breaking down. Their strength shows where meters pack tightly into neighborhoods. Not every tech handles crowding so well, yet these networks keep signals moving. Performance stays steady even when demand spikes unexpectedly. What sticks around tends to adapt, just like this setup does.

- Keeping track of power use is growing more common. People and companies now pay closer attention to how much energy they use because saving matters. Watching usage helps spot waste. Costs go down when habits shift. Clear data makes choices easier. Utilities adjust supply based on real patterns. Efficiency becomes a shared goal without saying it out loud.

Now here comes the shift, how we track power, gas, or water use keeps changing fast due to smarter tools. These devices hand live updates straight to providers and people at home without any delay. Instead of someone showing up each month, readings happen on their own through invisible links across distance. Mistakes drop off when bills match the actual flow instead of estimates made by guesswork. Behind the scenes, systems run more smoothly since staff handle fewer trips and paperwork piles. Users feel there is too little back-and-forth about numbers that once seemed unclear. Pushing these into homes feeds broader plans like greener grids and responsive urban networks, spreading widely now. Cities start building smarter simply because meters got wiser first.

Now machines talk both ways, thanks to better chips and smarter software inside smart meters. Because of this shift, power providers watch how electricity moves, spot odd spikes, then adjust flow without waiting. On the receiving end, people see exactly when and where they use more juice, which quietly nudges habits toward saving. Hidden behind these updates is a web of automated switches that tighten control over blackouts or surges. When meters link up with self-correcting grids, the whole system bends but does not break under pressure.

It is not just rules pushing change; a rising sense of environmental responsibility plays its part too, nudged forward by policies aiming to cut emissions and manage resources more thoughtfully. These devices step into the picture when power adjustments are needed, easing pressure on grids while quietly backing efforts to save energy. Utilities are not alone; households benefit as systems adapt, matching usage patterns without drawing extra attention. What keeps these tools relevant is not flash or promise, but steady performance where waste shrinks, and supply stays consistent.

Out front, big tech firms mix with local businesses selling different kinds of meters, ways to send data, and tools that study usage patterns. Instead of going it alone, companies often team up with power suppliers while pouring money into research and building tailored systems for homes, offices, and factories. Near the horizon, as grids get smarter and energy tracking turns digital, these smart meters stick around quietly helping track resources clearly, fairly, and without waste.

Smart Meter Market Segmentation

By Meter Type

- Electricity Smart Meters

Nowhere is tech more common than in homes, shops, stores - smart meters track power there. These gadgets spread fast because they handle electric bills without help. Factories use them just like apartments do. Their reach keeps growing, where energy gets used. Most places picking new systems go straight for these.

- Gas Smart Meters

Folks find these meters useful because they track usage right, spot leaks early, then send data straight to providers. Billing updates without someone needing to show up. Performance stays steady even in tricky weather. Reports come through clearly, which helps manage the supply better overall.

- Water Smart Meters

Nowadays, cities rely on Water Smart Meters more often to track how much water people use. These devices help cut down waste without needing constant oversight. Automation in billing becomes easier when data flows steadily from each meter. Urban areas find them useful simply because they work quietly behind the scenes. Municipal systems adapt well once the meters are in place. Efficiency grows even if changes seem small at first glance.

To learn more about this report, Download Free Sample Report

By Component Type

- Advanced Metering Infrastructure

Smart meters rely on a network called Advanced Metering Infrastructure. This setup allows constant updates plus instant messaging between homes and power providers. Information flows both ways without delay. The system runs nonstop, capturing usage details as they happen. Utilities stay informed through continuous digital links. Real-time tracking becomes possible because of this connection. Two-way exchanges support accurate monitoring. Such infrastructure keeps the whole process running smoothly.

- Communication Modules

From meters to data hubs, RF, PLC, or cellular links carry information safely through wireless signals, power lines, and sometimes mobile networks. Each path keeps details locked down while moving them where they need to go. These modules make sure updates reach displays, systems, and people without leaks along the way.

- Data Management Systems

Running through meters, huge amounts of information are handled by systems so companies can study usage patterns. Billing becomes possible when these tools organize readings correctly. Forecasting need relies on how well such platforms manage flow over time.

By Communication Technology

- RF Mesh

Out in cities and towns, RF Mesh shows up a lot where steady wireless links matter most. Signal hops between nodes without missing beats during live exchanges. Where buildings crowd together, this setup keeps data moving on time. It handles traffic day after day just by linking devices to devices. Real-world use proves it works when signals must travel block after block.

- PLC

Using the wires already in place, Power Line Communication sends data through electrical networks instead of needing new cables. This cuts down on setup expenses while skipping extra hardware needs.

- Cellular

Out in distant spots, cell signals like GSM or 4G now link things without a hitch. Though once limited, coverage pushes further - thanks to upgrades over time. Where cables fail, wireless steps in quietly, doing the job. Not long ago, reaching far places felt tricky; today, it runs smoother than expected. With each leap in tech, blank zones shrink just a bit more.

- Others

Apart from mainstream options, things like Wi-Fi or Zigbee handle specific tasks, linking devices nearby inside homes or offices. While not built for long distances, these systems fit neatly where close contact matters most between gadgets.

By Application

- Energy Monitoring & Management

From how people use power to where it goes, watching the flow shows habits. Spotting shifts happens when data paints a clear picture instead of guesses. Better choices come once patterns emerge through steady observation. Efficiency rises because small changes add up without needing big efforts.

- Load Management & Demand Response

Facing high usage times, power providers adjust flow using smart systems that ease strain on the grid. Instead of boosting output, they shift the timing of energy use to smooth spikes across the network. This helps avoid expensive upgrades while keeping lights on during busy hours.

- Billing & Revenue Management

When systems handle meter data automatically, they cut mistakes that cost money. Invoices land correctly because readings move straight into billing without delays. Errors fade when human steps shrink across the process.

- Grid Automation & Smart Grid Integration

When sunlight powers homes, the system keeps track of power flow without delay. Sometimes a glitch shows up; this setup spots trouble fast. Instead of waiting, adjustments happen on their own. Renewable inputs join smoothly because connections adapt as needed. Monitoring runs constantly, yet quietly in the background.

Regional Insights

A wave of upgrades across North America has made smart meters common, thanks to tech progress and rules pushing cleaner energy use. Holding the lead, the United States rolls out these devices widely, backed by systems that allow constant data flow between homes and power providers. Instead of just installing hardware, utilities here build smarter grids that adjust based on real-time usage patterns. Canada follows close behind, adding more digital meters not only for power but also for monitoring water use in cities. Growth creeps forward there, guided less by federal pushes and more by local utility decisions and aging infrastructure needs.

Smart meter use spreads widely throughout Europe, covering power, gas, and water systems, thanks to firm rules and green policies. The United Kingdom, Germany, and France push ahead with modern grid projects aimed at saving energy. Driven by goals to cut carbon emissions, digital tools shape how energy gets managed here. Instead of standalone functions, equipment must work together smoothly across networks. Data analysis takes priority for providers who also link their grids closely with wind, solar, and other clean sources.

The biggest surge happens across Asia Pacific, powered by fast-moving city expansion, growing factories, backed up by national drives toward intelligent urban setups, plus upgraded power grids. China, India, and Japan lead the shift, rolling out millions of digital electric meters, embracing next-gen measurement systems at scale. More people need power, outdated networks get upgrades, attention grows around saving energy, pushing momentum forward. Meanwhile, developing nations in Southeast Asia start pouring funds into smarter ways to track electricity and manage water usage. Growth spreads quietly through necessity, shaped by change happening on multiple fronts.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 3, 2026 – Odisha Govt launched smart meter drive for homes, small businesses.

(Source:https://ommcomnews.com/odisha-news/odisha-govt-launches-smart-meter-drive-for-homes-small-businesses

- July 9, 2025 – KSEB to launched app-based installation drive for smart meters in govt buildings.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 24.80 Billion |

|

Market size value in 2026 |

USD 28.00 Billion |

|

Revenue forecast in 2033 |

USD 52.30 Billion |

|

Growth rate |

CAGR of 9.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Itron, Landis+Gyr, Siemens, Schneider Electric, Honeywell International, ABB, Sensus (Xylem), Kamstrup, Elster Group (Honeywell), Aclara Technologies (Roper Technologies), Toshiba Corporation, General Electric, Mitsubishi Electric, Echelon Corporation, Oracle Utilities, and Badger Meter |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Meter Type (Electricity Smart Meters, Gas Smart Meters, Water Smart Meters), By Component Type (Advanced Metering Infrastructure, Communication Modules, Data Management Systems), By Communication Technology (RF Mesh, PLC, Cellular, Others), By Application (Energy Monitoring & Management, Load Management & Demand Response, Billing & Revenue Management, Grid Automation & Smart Grid Integration) |

Key Smart Meter Company Insights

Itron stands out when talking about smart meters worldwide. This firm builds tools that track power, gas, and water with precision. Instead of just selling devices, it delivers full setups: hardware, network links, plus software to make sense of collected information. Operations stretch wide, touching utility providers from United States cities to rural towns in Australia and big hubs across Europe. Intelligence inside electrical grids matters more every year, so does cutting waste; these areas happen to be where the business shines brightest. Cities growing smarter by the day often rely on what this team puts together behind the scenes.

Key Smart Meter Companies:

- Itron

- Landis+Gyr

- Siemens

- Schneider Electric

- Honeywell International

- ABB

- Sensus (Xylem)

- Kamstrup

- Elster Group (Honeywell)

- Aclara Technologies (Roper Technologies)

- Toshiba Corporation

- General Electric

- Mitsubishi Electric

- Echelon Corporation

- Oracle Utilities

- Badger Meter

Global Smart Meter Market Report Segmentation

By Meter Type

- Electricity Smart Meters

- Gas Smart Meters

- Water Smart Meters

By Component Type

- Advanced Metering Infrastructure

- Communication Modules

- Data Management Systems

By Communication Technology

- RF Mesh

- PLC

- Cellular

- Others

By Application

- Energy Monitoring & Management

- Load Management & Demand Response

- Billing & Revenue Management

- Grid Automation & Smart Grid Integration

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636