Market Summary

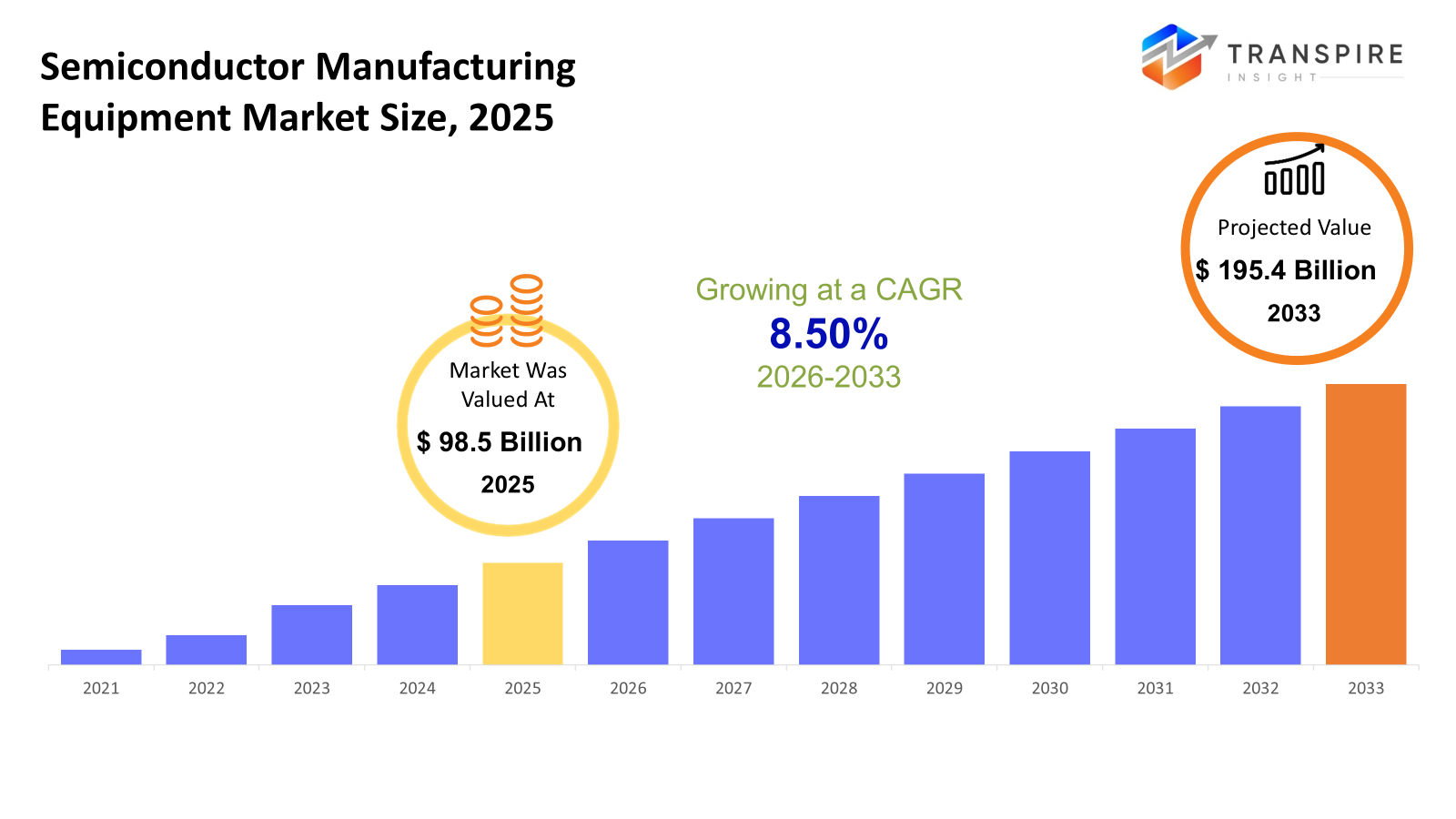

The global Semiconductor Manufacturing Equipment market size was valued at USD 98.5 billion in 2025 and is projected to reach USD 195.4 billion by 2033, growing at a CAGR of 8.50% from 2026 to 2033. The Semiconductor Manufacturing Equipment industry as a whole also demonstrates constant CAGRs fueled by the increasing demand for sophisticated electronics in AI, Automotive, Telecommunications, and Industrial applications. The increasing number of process nodes, transformation to a 2.5D & 3D IC format, and the increasing number of fab capacity expansions worldwide are driving investments in front-end & back-end equipment. Government initiatives for worldwide semiconductor localizations also accelerate equipment investments, although further improvements in fab yields through automation & process optimizations keep driving equipment replacement cycles worldwide.

Market Size & Forecast

- 2025 Market Size: USD 98.5 Billion

- 2033 Projected Market Size: USD 195.4 Billion

- CAGR (2026-2033): 8.50%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has emerged as an important location for high-end semiconductor fabrication, especially in terms of front-end equipment used in semiconductor wafer fabrication. The leading country in high-performance computing chips and AI chips is the United States.

- United States, a North American nation, is a significant driver for front-end and back-end equipment markets because of research-driven advanced 3D IC manufacturing operations, and high-capacity Equipment investments include lithography, etching, deposition, and measurement systems for complex layouts of semiconductors.

- Asia Pacific comprises the major SME market, led by China, Taiwan, South Korean, and Japanese manufacturers of logic devices, memory devices, and packages. Volume production equipment, technological advancements, as well as various government assistance schemes, make front-end as well as back-end equipment popular.

- Front-end equipment has maintained the leading market segment, supported by lithography equipment, deposition equipment, and etch equipment used in 2.5D and 3D ICs, artificial intelligence chips, and automotive semiconductors.

- 3D IC processing drives dimension growth because of stacking and high-density layouts. TSV processing equipment, bonding equipment, and heat management equipment have become increasingly important to support AI, HBM memory, and high-performance chips.

- It is driven by application demand from semiconductor fabrication facilities and foundries, and the requirement for high-volume front-end and back-end equipment to sustain efficiency and quality for the type of chip being produced.

- Automotive & EVs lead end-use equipment consumption due to requirements for power electronics devices, sensors, and ADAS processor devices in these applications. Reliable production and advanced package technologies in this end use promote overall market growth.

So, The Semiconductor Manufacturing Equipment Market is a collection of equipment and tools used from start to finish for the manufacturing of the semiconductor product itself at the wafer fabrication, assembly, testing, or at the packaging stage. Increasing use of AI, IoT, automotive, and 5G is driving investments in semiconductor manufacturing equipment with the ability to handle complex semiconductor architecture. Rising electronic products continue to fuel this market for semiconductor equipment. The front-end tools, including lithography, deposition, and etching machines, accelerate R&D in scale and performance in devices, and back-end machinery facilitates reliable and effective packaging, testing, and inspection processes in devices. Technologies such as 2.5D and 3D IC devices accelerate the need for high-throughput machines with automation integration, which are mandatory in leading companies producing devices in the industry. The developments in supply chain and regional fab investments improve manufacturing scale and pave ways for growth. Market growth further gets support from the efforts of governments across the world in favor of regional semiconductor production, in the Asia Pacific and the North America regions in particular. The increased demand for energy-saving, highly reliable semiconductors in the automotive, industrial, healthcare, and telecom markets can further fuel the use of equipment in the industry. Innovation, industry 4.0 adoption, and yield optimization are the factors driving the CAGR growth of the industry during the forecast period.

Semiconductor Manufacturing Equipment Market Segmentation

By Equipment Type

- Front‑End Equipment

Among these, front-end tools play an important role in the fabrication process of wafers: lithography, deposition, and etching. These systems are necessary to guarantee that circuit patterns will be correct and properly functioning. In the face of increasing high-volume and high-density chip demands, manufacturers are considerably investing more in advanced machinery for the front-end.

- Back‑End Equipment

Behind the entire assembly, packaging, test, and inspection are performed by the back-end equipment. In particular, semiconductor devices are constantly shrinking in size and increasing in complexity, so precision back-end tools are crucial to ensuring that advanced packaging and MEMS devices reach their performance and reliability goals.

To learn more about this report, Download Free Sample Report

By Dimension

- 2D IC

2D IC processing is dominant in traditional 2D IC fabrication. It has been seen that equipment used in 2D processes has an enduring demand within the market.

- 5 IC

2.5D ICs combine multiple dice in interposers, enhancing performance without resorting to 3D complexities. Handling and bonding tools and equipment are required to support demand in high-performance computing and artificial intelligence chips.

- 3D IC

3D ICs have their layers stacked vertically to achieve maximum density and speed. The demand for 3D integration tools, through-silicon vias (TSVs), and cooling solutions continues to increase due to applications in high-end memory and AI.

By Application

- Semiconductor Electronics Manufacturing

Electronics manufacturing equipment: The manufacturing of wafers and ICs requires significant electronics manufacturing equipment. Specialized equipment enhances performance, reduces production costs, and increases yields. This makes it an essential tool for market leaders.

- Semiconductor Fabrication Plant/Foundry

Foundries require high-throughput equipment to handle multiple customers with varying design needs. Investments in automation, deposition, and lithography tools particularly support efficiency and competitiveness in chip manufacture for other companies.

- Testing & Inspection

Reliability testers and inspection tools are necessary for reliable device functionality as well as for quality. However, these needs are driven by the increased complexity of smaller chips.

By End Use

- Consumer Electronics

Devices such as smartphones and wearable technology create a demand for varied semiconductor components. Machines that promote efficient mass production with quality requirements form a significant equipment need in this market.

- Automotive & EV

Automotive and electric vehicle-related segments require reliable and high-performance semiconductor devices. Product lines that enable and support power electronics devices and sensors and ADAS devices are rising due to the increasing electrification and autonomy of the automobile industry

- Industrial & Manufacturing

Energy & Mining Industrial electronics need to work with rugged and reliable semiconductors. Compliant equipment hardware supports rugged processes for manufacturing successfully for harsh environments as well as demanding applications.

- Telecommunications and Networking

Growth in telecom infrastructure leads to the need for high-speed processors and optical devices. High-end lithography tools and deposition and testing equipment are also required for the production of 5G networking equipment.

- Healthcare and Medical Devices

Medical electronics involve precise semiconductors. Such semiconductors are manufactured through special machinery to be of high quality and small size to meet healthcare safety standards.

- Aerospace & Defense

Aerospace and defense applications require extreme reliability and long lifetimes for their semiconductors. Then there are equipment manufacturers that help to supply ruggedized chips for precision applications.

Regional Insights

North America led by the United States is home to leading fabs and research-based silicon ecosystems. Canada and Mexico have assembly, packaging, and testing capability, meeting the regional demand for chips. Europe includes analysis of the UK, France, Germany, Spain and Italy, driven by the automotive electronics, industrial automation and high-reliability segments while the Rest of Europe relies on niche fab and packaging. The Asia Pacific witnesses the highest number of semiconductor fabricated in the world, thanks to the presence of China, Taiwan, Japan, South Korea and India which support sophisticated research and development in Australia & New Zealand. Large-scale production equipment for logic, memory, and packaging technologies stimulates the Asia Pacific semiconductor equipment market whereas the Rest of Asia Pacific experiences a steady growth in nascent fabrication plants and assembly facilities. The South America category, consisting of Brazil, Argentina and the Rest of South America, develops semiconductor technology for use in industrial electronics and automotive parts the adoption of the testing equipment, assembly equipment, is slow.

The MEA market, catered to countries like Saudi Arabia, UAE, and South Africa, has been growing thanks to relevant investments in tech, applications related to aerospace, as well as modernization efforts. The rest of this market serves niche requirements related to semiconductors, emphasizing assembly as well as testing. The whole region's progress relies on initiatives related to infrastructure development, along with collaborations from major worldwide suppliers to ensure greater penetration within this sub-region.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Taiwan Semiconductor Manufacturing Company posted record profits, giving investors greater confidence in the industry as a whole. It is worth noting that the company intends to raise its capex expenditure by as much as 37% in 2026, supporting the demand for cutting-edge equipment used in the manufacturing of logic and memory chips.

(Source:https://www.businessinsider.com/tsmc-earnings-profit-record-chip-stocks-ai-trade-avgo-nvda-2026-1)

- January 2026, The investment of $165 billion committed to the U.S. market by the Taiwan Semiconductor Manufacturing Company (TSMC) involves the expansion of its Arizona fabs and the construction of fabrication plants and an R&D center. This is primarily the factor responsible for the enormous purchase of semiconductor manufacturing equipment in the region of North America.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 98.5 Billion |

|

Market size value in 2026 |

USD 110 Billion |

|

Revenue forecast in 2033 |

USD 195.4 Billion |

|

Growth rate |

CAGR of 8.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ASML Holding N.V., Applied Materials, Inc., Lam Research Corporation, KLA Corporation, Tokyo Electron Limited, SCREEN Holdings Co., Ltd., Nikon Corporation, Canon Inc.,Hitachi High‑Tech Corporation,Advantest Corporation Teradyne, Inc., ASM International N.V.,Ferrotec Holdings Corporation, Cohu, Inc., Naura Technology Group Co., Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Equipment Type (Front‑End Equipment, Back‑End Equipment), By Dimension (2D IC, 2.5D IC, 3D IC), By Application (Semiconductor Electronics Manufacturing, Semiconductor Fabrication Plant/Foundry, Testing & Inspection) and By End Use (Consumer Electronics, Automotive & EV, Industrial & Manufacturing, Telecommunications & Networking, Healthcare & Medical Devices, Aerospace & Defense) |

Key Semiconductor Manufacturing Equipment Company Insights

ASML Holding N.V. is the primary global manufacturer of advanced lithography solutions, especially extreme ultraviolet (EUV) lithography solutions that are required for the production of cutting-edge semiconductor chips at sub-7nm nodes. ASML’s near monopolistic power in EUV lithography makes it a driving force for AI-related applications, High Performance Computing applications, as well as mobile logic chip production. Such monopolistic power makes ASML a crucial force for the production of next-generation semiconductor chips despite the lithography solutions manufacturer facing difficulties regarding the export of its solutions across different geopolitics.

Key Semiconductor Manufacturing Equipment Companies:

- ASML Holding N.V.

- Applied Materials, Inc.

- Lam Research Corporation

- KLA Corporation

- Tokyo Electron Limited

- SCREEN Holdings Co., Ltd.

- Nikon Corporation

- Canon Inc.

- Hitachi High‑Tech Corporation

- Advantest Corporation

- Teradyne, Inc.

- ASM International N.V.

- Ferrotec Holdings Corporation

- Cohu, Inc.

- Naura Technology Group Co., Ltd.

Global Semiconductor Manufacturing Equipment Market Report Segmentation

By Equipment Type

- Front‑End Equipment

- Back‑End Equipment

By Dimension

- 2D IC

- 5D IC

- 3D IC

By Application

- Semiconductor Electronics Manufacturing

- Semiconductor Fabrication Plant/Foundry

- Testing & Inspection

By End Use

- Consumer Electronics

- Automotive & EV

- Industrial & Manufacturing

- Telecommunications & Networking

- Healthcare & Medical Devices

- Aerospace & Defense

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636