Market Summary

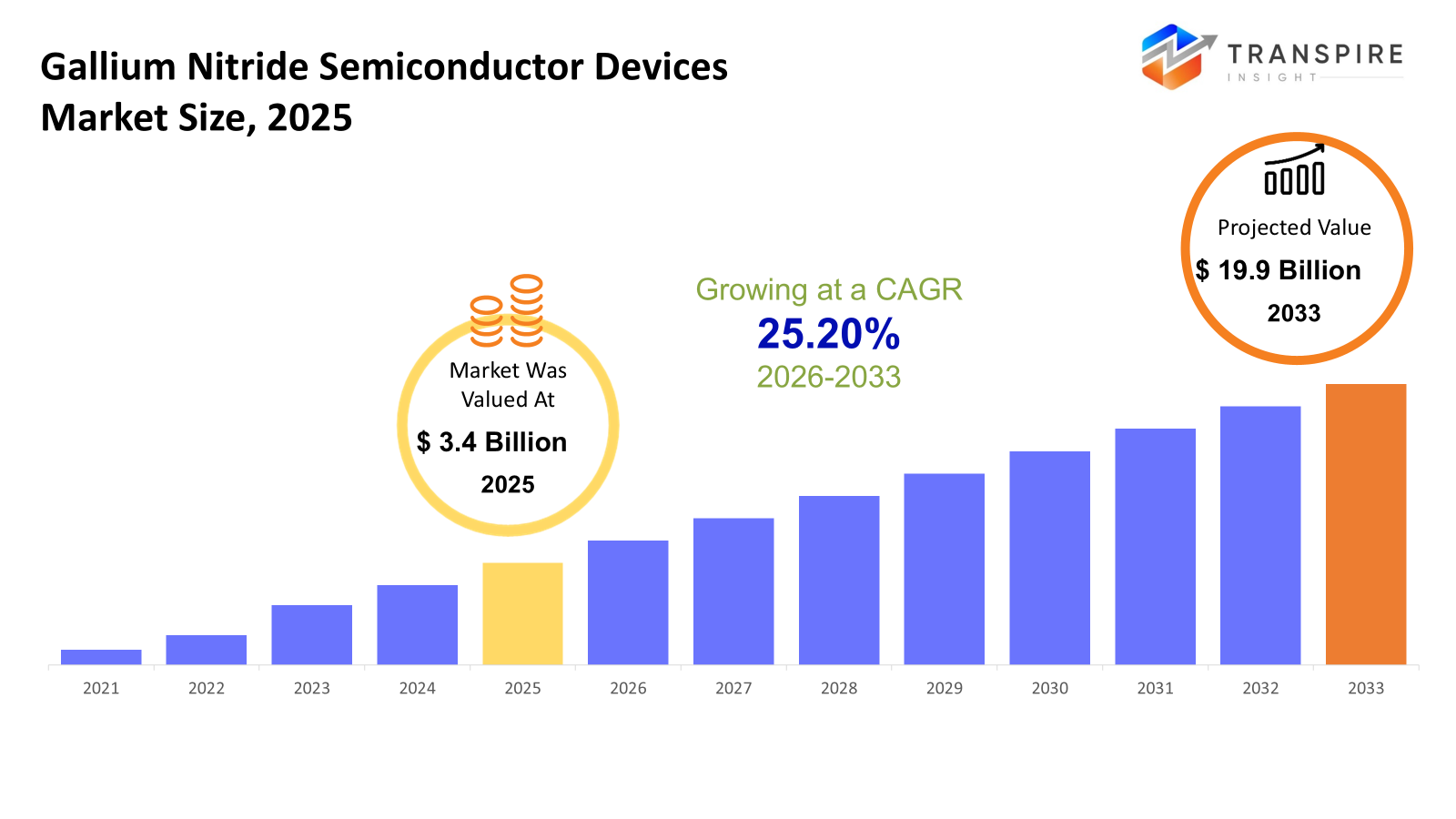

The global Gallium Nitride Semiconductor Devices market size was valued at USD 3.4 billion in 2025 and is projected to reach USD 19.9 billion by 2033, growing at a CAGR of 25.20% from 2026 to 2033. The market for Gallium Nitride Semiconductor Devices is experiencing substantial CAGR owing to the increasing consumption of efficient power electronics, the implementation of 5G networks, and the rising use of electrified vehicles. GaN offers faster switching times, resistance to heat, and space efficiency, making it suitable for various uses in autos, communications, and industry. At the same time, the price decline with the growing wafer diameter is fueling commercialization.

Market Size & Forecast

- 2025 Market Size: USD 3.4 Billion

- 2033 Projected Market Size: USD 19.9 Billion

- CAGR (2026-2033): 25.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is clearly leading the charge in the usage of GaN, due primarily to the earlier commercialization of the technology, as well as the military spend, and data center efficiency enhancements.

- The innovation hub for GaN technology still remains in the United States, which is backed by excellent R&D environments, government grants, and market demand for electric vehicle power electronics, fast charging solutions, and 5G base stations, enabling a smooth migration from silicon to wide-bandgap semiconductors.

- Asia Pacific has the strongest growth momentum; it benefits from massive production of consumer electronics in the region and the growing production of EVs in the Chinese and Japanese markets, in addition to heavy investment in the development of the 5G and renewable energy sectors in the region.

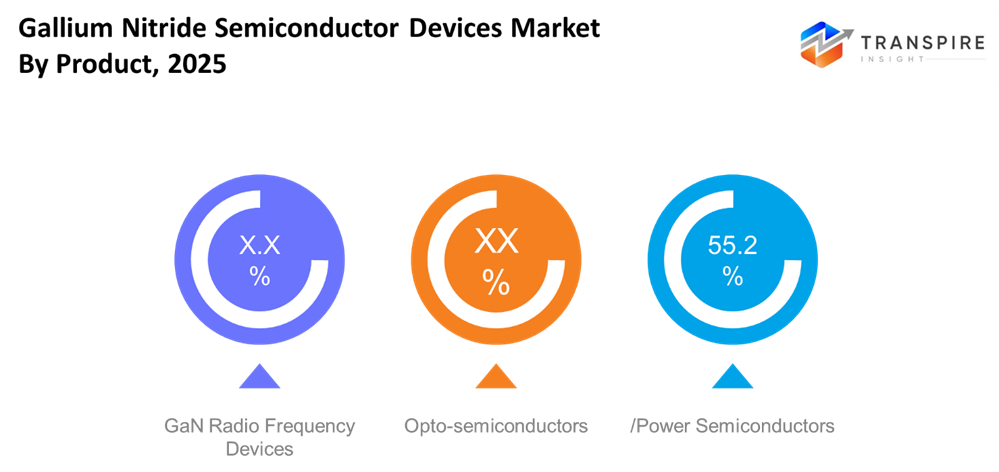

- Power Semiconductors lead in the products segment due to the increasing demand for efficiency, size reduction in power conversion, and minimal heating in the automotive, data centers, and industrial motor drive markets, where GaN technology surpasses silicon.

- The component market is led by transistors because of their importance in high-frequency switching and RF amplification, which help in designing compact systems and have increased power density in telecommunication, automotive power trains, and industrial automation systems.

- 6inch wafers are on the verge of becoming the most preferred manufacturing technology as they offer a good blend of yield optimization and cost-effectiveness. This move will make a breakthrough for the increased adoption of 8inch wafers.

- Automotive is currently the most rapidly expanding application area, as GaN technology allows for reduced weight of onboard chargers, higher switching speed in inverters, and overall higher vehicle efficiency.

So, The market for Gallium Nitride Semiconductor Devices is an extremely important area in the global wide band gap semiconductor market, providing significantly improved electrical characteristics when compared to silicon semiconductor devices. GaN semiconductor material supports higher switching frequencies, lower power losses, and superior heat management. The market is being driven by structural changes triggered by the need for electrification, digitalization, and the implementation of high frequency communication systems. GaN semiconductors are increasingly being used for electric vehicle applications, renewable energy solutions, data center solutions, and 5G communication solutions, as the trend of energy efficiency is being emphasized across various industries, and as a result, the advantages of GaN materials over silicon carbide and silicon are being increasingly reinforced.

Advances in the manufacturing of GaN semiconductors through the use of larger wafer diameters and advancements in epitaxial growth processes, which have reduced the cost of manufacturing, are making it feasible to integrate them even in mass-market electronics. Consequently, it can be said the adoption trend in the GaN semiconductor devices market is shifting from niche integration to mainstream adoption.

Gallium Nitride Semiconductor Devices Market Segmentation

By Product

- GaN Radio Frequency Devices

These are the preferred chips used in the development of the latest communication systems, such as 5G base stations, satellite communications, and defense radar systems—namely, GaN RF devices. They are favored for their efficiency, robust operation under extreme environments, and clean operation at higher frequencies when contrasted with silicon.

- Opto-semiconductors

This portfolio comprises GaN LEDs, laser diodes, and photodetectors, which are important components for lighting, display, and optical communication. They are widely applied due to their ability to function efficiently, last longer, and consume less power.

- Power Semiconductor

GaN power devices have been widely used in compact power supplies with high efficiency, EVs, chargers, and industrial converters. These devices come in smaller packages with increasing power handling abilities, which is why data center giants as well as EV manufacturers have shown interest in such devices.

To learn more about this report, Download Free Sample Report

By Component

- Transistor

GaN transistors are the main components in high frequency and power switching. GaN transistors are lighter, faster, and cooler than their silicon FET counterparts. GaN has emerged due to its improved efficiency and reduced power losses in power conversion applications. GaN transistors cater to various needs

- Diode

GaN diodes provide low forward voltage and fast recovery times, offering efficiency gains in rectification circuits and power converters. GaN diodes are being introduced in switching power supplies and fast power electronics.

- Rectifier

These devices are more efficient and generate less heating while turning AC into DC than silicon devices. In renewable energy and fast charging applications, GaN rectifiers contribute to the reduction of energy losses and compactness of the entire system.

- Power IC

By integrating power stages with control logic in GaN semiconductors, Power ICs provide more intelligent and compact solutions for energy conversion in consumer electronics and industrial automation applications. They form a step towards turn-key energy-efficient modules.

- Others

It comes with ancilliary chips such as drivers, sensors, and speciality components which render GaN technology self-contained. They are still Dakshire in applications such as instruments and mixed-signal modules.

By Wafer Size

- 2-inch

Early production of GaN relied on the processing of smaller wafers. This allowed for easier entry into the market for specialty products. Although still important for such products, this market is slowly moving to bigger sizes.

- 4-inch

The sweet spot in GaN fabs currently, 4-inch wafers strike a good balance between the efficiency of manufacturing and the yield of wafers. They lead in manufacturing power and RF devices due to their advantages in terms of processing and lower costs.

- 6-inch

6As the demand increases, the 6-inch wafers become popular as they enable more devices to be packed on the wafer, which is an attractive option due to the low cost per device.

- 8-inch

The future frontier: With the future of GaN technology on the horizon, the industry looks towards the use of 8-inch wafers in the coming years in an effort to achieve increased economies of scale. 8-inch wafers are also in the sights of the leading GaN foundries in the coming

By End Use

- Automotive

GaN technology encourages the shift towards electrification, and the boosting converter, on-board charger, and power train inverters are faster, more efficient, and lighter due to GaN technology, which increases the range and reduces the heat of EVs.

- Television/Radio Entertainment

Applications ranging from rapid charging to laptops and gaming products are made possible by GaN, which provides more performing, more compact, and cooler power supply solutions compared to their silicon counterparts.

- Defense & Aerospace

High-frequency RF circuits, radar systems, and power electronics ruggedized for harsh environments benefit from GaN’s characteristic of handling extreme environments and losing less power. This is particularly important for life-critical functions.

- Healthcare

In medical imaging and diagnostic equipment, the accuracy and efficiency of GaN technology assist the imaging procedure and maintain the dimensions of power electronics minimal.

- Industrial & Power

Large industrial drives, robotics, and energy applications employ the use of GaN in efficient motor drives, power supplies, and renewable energy systems, among others, where reliability and loss savings are essential.

- Information and Communication Technology (ICT)

It is perhaps the core area of GaN technology growth at present and includes 5G and beyond, Wi-Fi infrastructure, and data centers where high-frequency RFs and efficient power electronics play important roles.

- Others

Rising applications in the area of smart grids, Internet of Things nodes, and specialty electronics are also turning to GaN, as the cost versus performance is improving and allowing it to move from concept to reality.

Regional Insights

North America as a mature and innovation-driven market, where the United States occupies the position of a Tier-1 contributor because of its strong defense, aerospace, EV, and telecom investments. Canada and Mexico serve as Tier-2 regions, supporting automotive manufacturing and cross-border electronics supply chains. Europe shows stable adoption driven by automotive electrification, industrial automation, and integration of renewable energy resources led by the two-wheeler nations of Germany, United Kingdom, and France as Tier-1, while Spain, Italy, and Rest of Europe sit on Tier-2 with gradual GaN penetration across industries and power infrastructure.

The regional market which is growing at the fastest rate is contributed by Asia Pacific, dominated by Tier-1 countries: China, Japan, South Korea, and India. Such countries gain by large-scale electronic manufacturing, EV manufacturing, and 5G deployments. Australia, New Zealand, and the Rest of Asia Pacific are the Tier-2 markets with emerging infrastructure and energy investments. The emerging market, South America, ranks Tier 1 with Brazil and Tier 2 with Argentina and Rest of South America, which is driven mostly by the renewable and industrialization segments. The Middle East and Africa is at the nascent stage of adoption, driven mainly by smart infrastructure and diversification of energy resources in countries like Saudi Arabia, the UAE, and South Africa.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, UK company Space Forge has announced it has produced high-temperature plasma on board its satellite ForgeStar-1, and this represents the first commercial production of semiconductors in space and could lead to GaN semiconductors with optimized atomic structure.

- In October 2025, Vertical Semiconductor, a new firm spun out of the Massachusetts Institute of Technology, on Wednesday stated it has secured $11 million in investments to develop a chip solution that can more efficiently supply electricity to artificial intelligence servers. Vertical produces chips using a compound called gallium nitride, which is a rival of silicon and the key material in a new venture being headed up by chip designer Nvidia.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.4 Billion |

|

Market size value in 2026 |

USD 4.2 Billion |

|

Revenue forecast in 2033 |

USD 19.9 Billion |

|

Growth rate |

CAGR of 25.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Infineon Technologies AG, Wolfspeed, Inc., Qorvo, Inc.,GaN Systems Inc.,Efficient Power Conversion Corporation (EPC), Transphorm Inc.,Texas Instruments Incorporated, Navitas Semiconductor Corporation, Nexperia Holding B.V., STMicroelectronics N.V., ROHM Semiconductor Co., Ltd., MACOM Technology, Solutions Holdings, Inc., Mitsubishi Electric Corporation, NXP Semiconductors N.V., Fujitsu Limited |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product (GaN Radio Frequency Devices, Opto-semiconductors, Power Semiconductors), By Component (Transistor, Diode, Rectifier, Power IC, Others), By Wafer Size (2-inch, 4-inch, 6-inch, 8-inch), By End Use (Automotive, Consumer Electronics, Defense & Aerospace, Healthcare, Industrial & Power, Information & Communication Technology, Others) |

Key Gallium Nitride Semiconductor Devices Company Insights

Infineon Technologies AG is one of the most prominent forces in the GaN semiconductor devices market in terms of their in-depth knowledge of power electronics and extensive commercial presence. Infineon aggressively developed their GaN solutions in the automotive-grade and industrial power sectors while leading the development of GaN-on-Si and 300mm wafer manufacturing to reduce expenses and increase volumes. Infineon’s focus on enhancing their manufacturing prowess, specifically in Malaysia and the worldwide GaN ecosystem, helped to increase the strength of their supply chain and prepare Infineon to take full advantage of the fast-growing adoption of GaN powerment technology in the electric vehicle, renewable energy, and data center power markets.

Key Gallium Nitride Semiconductor Devices Companies:

- Infineon Technologies AG

- Wolfspeed, Inc.

- Qorvo, Inc.

- GaN Systems Inc.

- Efficient Power Conversion Corporation (EPC)

- Transphorm Inc.

- Texas Instruments Incorporated

- Navitas Semiconductor Corporation

- Nexperia Holding B.V.

- STMicroelectronics N.V.

- ROHM Semiconductor Co., Ltd.

- MACOM Technology Solutions Holdings, Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Fujitsu Limited

Global Gallium Nitride Semiconductor Devices Market Report Segmentation

By Product

- GaN Radio Frequency Devices

- Opto-semiconductors

- Power Semiconductors

By Component

- Transistor

- Diode

- Rectifier

- Power IC

- Others

By Wafer Size

- 2-inch

- 4-inch

- 6-inch

- 8-inch

By End Use

- Automotive

- Consumer Electronics

- Defense & Aerospace

- Healthcare

- Industrial & Power

- Information & Communication Technology

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636