Market Summary

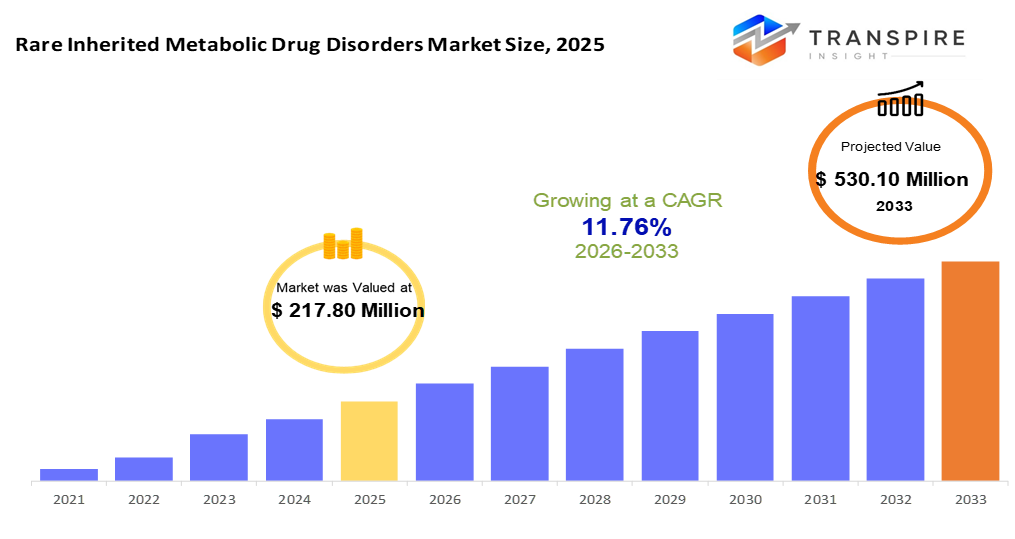

The Rare Inherited Metabolic Disorder Drug Market shift suggests the industry could reach roughly $ 530.10 million in 2033. Demand for RIMD drugs grows because more people recognize the diseases, genetic testing improves, and expanded newborn screenings help catch issues sooner. Spotting problems early means patients start treatment faster, especially where health services are well established. Besides, clear benefits like special drug status, quicker approval paths, or protected market time push companies to develop therapies even when few patients exist. With major gaps in care and no cures available for many conditions, pressure stays high to deliver new solutions.

Market Size & Forecast

- 2025 Market Size: USD 217.80 Million

- 2033 Projected Market Size: USD 530.10 Million

- CAGR (2026-2033): 11.76%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has approximately market share will be 43% in 2026. North America leads the pack thanks to top-notch medical systems, widespread use of enzyme treatments along with gene therapy, and strong support for rare disease drugs.

- The U.S. is tops region due to wide-ranging baby tests, solid insurance payouts, and quick use of targeted treatments for metabolic conditions.

- Asia Pacific grows quickest thanks to higher health spending, better testing options, more knowledge about illnesses, and improved treatment availability.

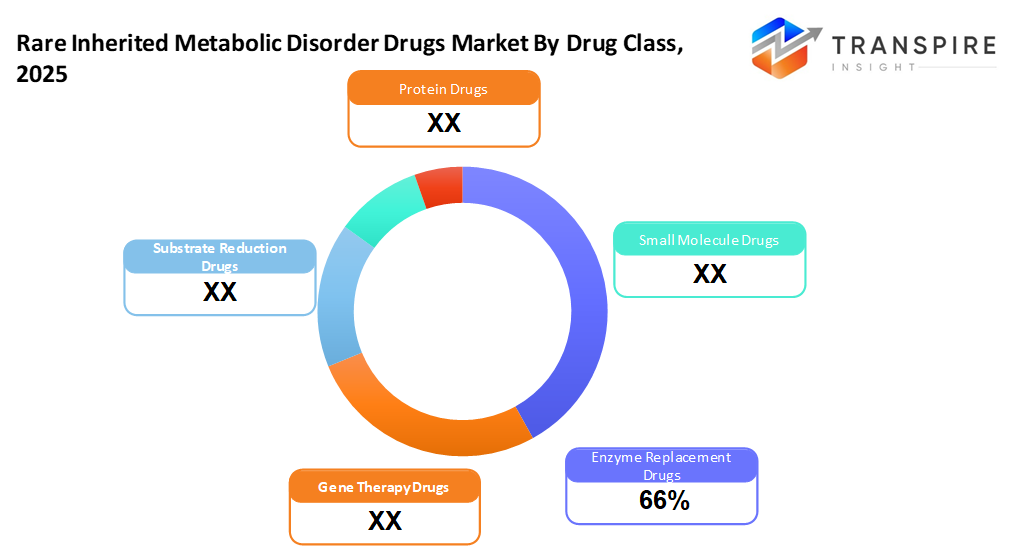

- Enzyme Replacement Drugs has market share of approximately 66% in 2026. Enzyme replacement meds still top the list, backed by solid results in treating various inherited metabolic conditions. Their use keeps growing as more diseases are added to approved treatments.

- Most biologics need shots into veins or under the skin, so this method’s top choice when it works best that way.

- Marketed drugs dominate since authorized treatments, known to work safely, still form the core of care.

- Lysosomal storage disorders boost market demand, as more cases are spotted now, while several treatments already cleared for use become accessible.

The market of plug-in electric vehicles (PEV) is becoming one of the most important aspects of the developing automotive market globally, supported by the shift towards low-emission and efficient transport. Plug-in electric cars, battery electric ones, and plug-in hybrids are getting more and more popular because they are more environmentally friendly, less expensive to operate, and have better vehicle performance. The market’s shape comes from steady tech progress, while big car makers play a major role.

The push for plug-in electric cars keeps growing, since governments, buyers, and companies now focus more on cutting down CO2 output along with fossil fuel use. Shifting toward electric rides gets help from clear rules, financial perks for buying EVs, plus a stronger public sense of environmental care. On top of that, pricier gas and better city transit setups are boosting sales across personal and business vehicle sectors.

Regarding a market structure, the battery electric cars are becoming more popular than plug-in hybrid models in terms of full-electric functionality and zero tailpipe emissions. The most commonly used type of battery is the lithium-ion battery, which has continued to be supported by advancements in energy efficiency and durability. Locally, the developed markets are highly adopting because of their established infrastructure and policy backing, whereas the emerging economies are rapidly growing their electric vehicle ecosystem.

The market of plug-in electric vehicles is evolving and becoming more and more subject to investment in the electrification of vehicles, production capacity, and the environment. Automakers are expanding their electric vehicle offerings to meet the varied consumer demands as alliances in the value chain are boosting innovation. In the long run, battery, vehicle affordability, and charging accessibility will continue to enhance the spread of plug-in electric vehicles around the world.

Rare Inherited Metabolic Disorder Drug Market Segmentation

By Drug Class

- Enzyme Replacement Drugs

- Enzyme replacement meds dominate due to this group being around the longest because they actually work for several metabolic conditions.

- Gene Therapy Drugs

- Gene therapy meds are growing quickly due to more treatments in the works that might fix diseases for good, while opening new paths in care.

- Substrate reduction Drugs

These are gaining ground, not replacing enzymes, but working alongside them, especially for lysosomal conditions.

- Small-molecule Drugs

This holds a big spot because they’re taken by mouth, which helps hit exact health issues with focused effects on metabolism.

- Protein Drugs

Increasing adoption in niche metabolic indications with specific protein-based therapeutic needs.

To learn more about this report, Download Free Sample Report

By Route of Administration

- Parenteral

Most often used because many medicines need a shot, such as proteins or special treatments that go straight into the body through needles.

- Oral

More people now choose tiny-molecule treatments because they’re easier to use. Also, cutting down on substances helps manage symptoms better day-to-day.

- Intrathecal

Emerging route for CNS-targeted treatments addressing neurological manifestations of metabolic diseases.

By Clinical Development

- Market Drugs

Market drugs take the biggest slice due to proven treatments that doctors already trust and use every day.

- Late-stage trials (Phase III)

strong upside since top contenders are close to greenlighting for major uses while momentum builds behind promising options.

- Early trials (Phase I–II)

A growing range of new ideas in gene, enzyme, or nucleic acid treatments.

- Preclinical candidates

These are gaining ground quickly since researchers test new treatment ideas along with fresh biological targets

By Indication

- Lysosomal storage disorders

This area’s got the biggest share, plus it's where most treatments already cleared by regulators are found.

- Urea Cycle Disorders

progress keeps building because treatments are getting sharper, while detection gets better over time - thanks to smarter methods blending research with real-world use.

- Amino Acid Disorders

Getting more attention since gene tests now find more cases.

- Organic acidemias

More studies now focus on how toxins affect metabolism, while treatments aim to improve results.

- Peroxisomal disorders

A growing focus as scientists explore new therapies. Efforts in research are picking up speed lately.

Regional Insights

North America still leads the rare inherited metabolic disorder drug scene, holding the biggest chunk thanks to solid medical systems, good insurance paybacks, and early use of proven plus new treatments. The U.S. pushes this growth backed by clear rules like FDA perks for rare disease meds, widespread baby testing at birth, and a steady flow of approved or trial-phase drugs. Canada adds its part through government-backed health efforts, along with better access to expert clinics. Meanwhile, Mexico’s role is rising slowly - more cases are being spotted now, so more people are starting treatment.

Europe takes up a big chunk of the worldwide market, thanks to organized health services and unified rules set by the EMA, while more people learn about rare conditions. Countries like Germany, the U.K., or France drive most of the need; these places have solid programs for treating metabolic issues plus push early diagnosis. Meanwhile, nations such as Italy, Spain, and the Netherlands are slowly opening wider access to treatments like enzyme replacements or small-drug options, since their local policies on rare diseases and payment models keep improving, which helps the area grow at a reliable pace.

The Asia Pacific area is growing faster than anywhere else, driven by more spending on health care, better testing setups, plus wider knowledge about rare genetic disorders. Countries like China, Japan, and South Korea - top-tier ones - are ahead in using injectable and pill-based treatments; meanwhile, places such as India and parts of Southeast Asia, including Singapore or Malaysia, are catching up fast thanks to public funding and stronger specialized clinics. In Latin America, especially Brazil and Mexico, along with areas in the Middle East and Africa like Saudi Arabia, the UAE, or South Africa, progress is slow but real, as medical services boost newborn checks, track rare illnesses, and bring in medications for uncommon diseases, even if reaching them isn't as easy as in wealthier zones.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 1, 2024 – Otsuka Pharmaceutical acquired Jnana Therapeutics Inc.

(Source: Jnana Therapeutics https://www.jnanatx.com/otsuka-pharmaceutical-to-acquire-jnana-therapeutics-inc/

- October 2022 – Alexion, AstraZeneca, and rare disease acquired LogicBio® Therapeutics to accelerate growth in genomic medicine.

(Source: Astra Zeneca https://www.astrazeneca-us.com/media/press-releases/2022/alexion-astrazeneca-rare-disease-to-acquire-logicbio-therapeutics-to-accelerate-growth-in-genomic-medicine.html#!

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 217.80 Million |

|

Market size value in 2026 |

USD 243.41 Million |

|

Revenue forecast in 2033 |

USD 530.10 Million |

|

Growth rate |

CAGR of 11.76% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key company profiled |

Sanofi S.A., Takeda Pharmaceutical Company Ltd, BioMarine Pharmaceutical Inc., Amicus Therapeutics Inc., Alexion Pharmaceutical, Ultragenyx Pharmaceutical Inc., Avrobio Inc., Orphazyme A/S, Pfizer, Johnson & Johnson, Sigilon Therapeutics Inc., JCR Pharmaceutical Co. Ltd, Regenxbio Inc., Denali Therapeutics Inc., Bellicum Pharmaceutical, Lysogene, and Others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Drug Class (Enzyme Replacement Drugs, Gene Therapy Drugs, Substrate Reduction Drugs, Small Module Drugs, Protein Drugs), By Route of Administration (Parenteral, Oral, Intrathecal), By Clinical Development (Marketed Drugs, Late-Stage Clinical Phase III, Early-Stage Clinical Phase I-II, Preclinical Candidates), By Indication (Lysosomal Storage Disorders, Urea Cycle Disorders, Amino Acid Metabolic Disorders, organic Acidemias, Peroximal Disorders), |

Key Rare Inherited Metabolic Disorder Drug Company Insights

Sanofi S.A. operates worldwide in the medicine field, particularly tackling rare genetic metabolic issues via its Sanofi Genzyme division - this part zeroes in on lysosomal storage problems, including Gaucher, Fabry, Pompe, MPS, along with ASMD. Back in 1991, they rolled out the initial enzyme treatment for Gaucher disease; ever since, they’ve launched several approved treatments such as Cerezyme®, Fabrazyme®, Aldurazyme®, Nexviazyme®/Nexviadyme®, and Xenpozyme® targeting different metabolism-related illnesses. The firm keeps growing its research into uncommon diseases by exploring new small-molecule drugs plus advanced enzyme options, while teaming up with gene testing efforts and patient databases to speed up detection and boost health outcomes.

Key Rare Inherited Metabolic Disorder Drug Companies:

- Sanofi S.A

- Takeda Pharmaceutical Company Ltd

- BioMarine Pharmaceutical Inc.

- Amicus Therapeutics Inc.

- Alexion Pharmaceutical

- Ultragenyx Pharmaceutical Inc.

- Avrobio Inc.

- Orphazyme A/S

- Pfizer

- Johnson & Johnson

- Sigilon Therapeutics Inc.

- JCR Pharmaceutical Co. Ltd

- Regenxbio Inc.

- Denali Therapeutics Inc.

- Bellicum Pharmaceutical

- Lysogene

Global Rare Inherited Metabolic Disorder Drug Market Report Segmentation

By Drug Class

- Enzyme Replacement Drugs

- Gene Therapy Drugs

- Substrate Reduction Drugs

- Small Module Drugs

- Protein Drugs

By Route of Administration

- Parenteral

- Oral

- Intrathecal

By Clinical Development

- Marketed Drugs

- Late Stage Clinical Phase III

- Early Stage Clinical Phase I-II

- Preclinical Candidates

By Indication

- Lysosomal Storage Disorders

- Urea Cycle Disorders

- Amino Acid Metabolic Disorders

- organic Acidemias

- Peroximal Disorders

Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636