Market Summary

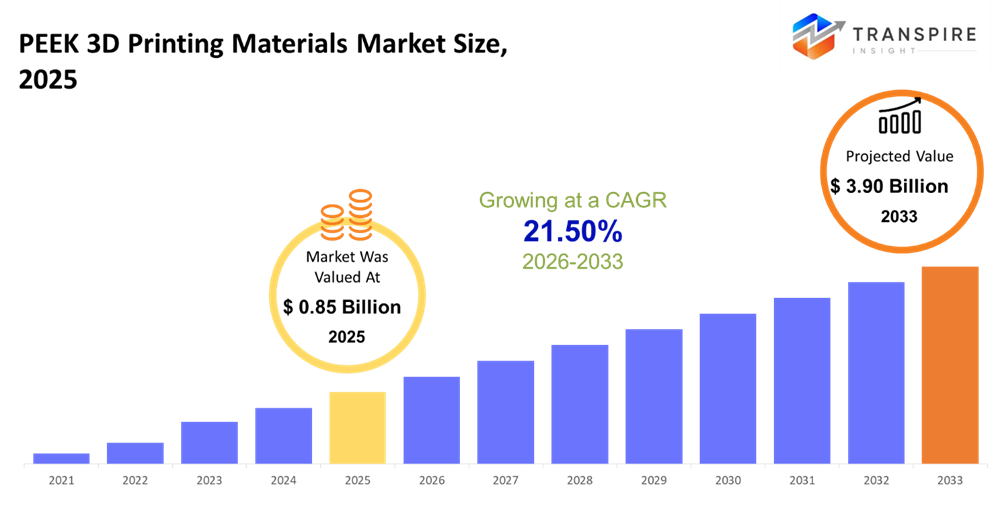

The global PEEK 3D Printing Materials market size was valued at USD 0.85 billion in 2025 and is projected to reach USD 3.90 billion by 2033, growing at a CAGR of 21.50% from 2026 to 2033. Growing use of high-performance thermoplastics in additive manufacturing for mission-critical applications, growing PEEK qualification for end-use parts, growing aerospace and medical demand, and consistent advancements in high-temperature 3D printing hardware reliability and material consistency all contribute to the market's CAGR growth.

Market Size & Forecast

- 2025 Market Size: USD 0.85 Billion

- 2033 Projected Market Size: USD 3.90 Billion

- CAGR (2026-2033): 21.50%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Strong R&D investment, early industrial 3D printing adoption and sophisticated aerospace, defense and medical manufacturing ecosystems all contribute to North America's sustained PEEK material consumption for certified, high-value applications needing traceability, repeatability and adherence to strict performance standards.

- The United States continues to be North America's main growth engine due to defense modernization initiatives, growing medical implant production and the quick adoption of high temperature additive systems by aerospace suppliers all of which increase demand for premium PEEK filaments and powders.

- The fastest growth trajectory has been observed in Asia Pacific, which is fueled by growing domestic aerospace programs, growing industrial bases in China, Japan and South Korea and an increase in the use of advanced polymers in the production of electronics and automobiles all of which are aided by government initiatives encouraging the adoption of additive manufacturing.

- North America market has a strong emphasis on R&D and commercial pilot projects that are accelerating incorporation of PEEK 3D Printing Materials in quantum computing, spintronic devices and defense systems supported by federal funding and robust semiconductor infrastructure boosting adoption across both academic and industrial applications.

- With a focus on quantum computing, aerospace electronics and low-power semiconductors the United States leads North America in the deployment of PEEK 3D Printing Materials. Research institutes, startups and established tech companies work together to support early stage commercialization, accelerating innovation and application readiness.

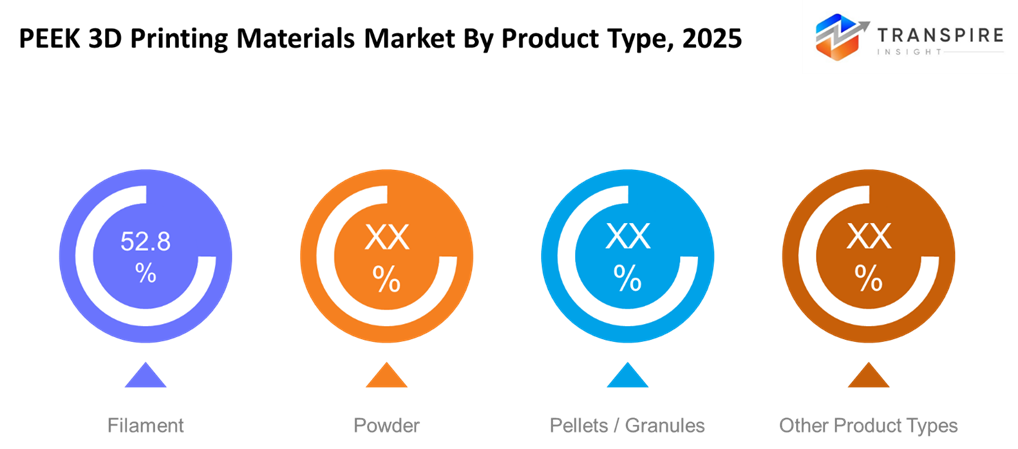

- Filament remains the top product segment due to its processing stability, broad compatibility with industrial FDM systems and suitability for both prototyping and functional parts enabling manufacturers to balance performance, cost control and predictable mechanical properties in demanding environments.

- Because it provides scalable manufacturing, reduced system complexity and consistent part quality for PEEK components particularly in aerospace tooling, automotive fixtures and bespoke medical devices needing high thermal and chemical resistance fused deposition modeling is the most widely utilized method.

- Aerospace and defense lead end-use demand as PEEK enables lightweight, flame-resistant and high strength components, supporting fuel efficiency targets and lifecycle cost reduction while meeting strict certification and reliability requirements that favor premium additive manufacturing materials.

So, High-performance thermoplastic materials designed for high-temperature additive manufacturing methods are included in the PEEK 3D printing materials industry. PEEK can be used in situations where traditional polymers don't work because of its remarkable mechanical strength, chemical resistance, and thermal stability. Filaments, powders, and pellet forms designed for various additive technologies are available on the market.

The advancement of additive manufacturing from prototyping to production is directly related to market expansion. PEEK is being used more and more by industries to produce tooling, functional parts, and specialized components that need to have extended service lives and tight tolerances. Feasible application cases are increasing because to advancements in printer technology, process management, and material compositions. Trends in supply-chain resilience and sustainability also help the market. Lead times are shortened, localized production is made possible, and material waste is decreased via PEEK additive manufacturing. These benefits are especially important in industries like aerospace, medicine, and manufacturing where competition depends on performance, customisation, and quick iteration.

PEEK 3D Printing Materials Market Segmentation

By Product Type

- Filament

Due to its proven compatibility with industrial FDM systems and comparatively reduced qualification barriers when compared to powders or pellets, PEEK filament dominates the industry. Because they provide a compromise between performance and processing predictability, filament formats are frequently used for both prototyping and production parts in industries like aerospace and medical devices.

- Powder

As SLS technology advance, PEEK powder is becoming more popular because it allows for complicated shapes with better mechanical qualities and great precision. The viability of this market is growing beyond prototype into low-volume, high-performance part production thanks to advancements in powder particle design and laser-process stabilization.

- Pellets / Granules

Pellet and granule forms are crucial for developing pellet-fed extrusion systems and hybrid production workflows, albeit having a reduced revenue share. In industrial settings where throughput and cost per part are important, they are being investigated more and more because they provide increased throughput and materials recycling potential.

- Other Product Types

This category comprises unique blends tailored for particular uses as well as reinforced grades (such as PEEK filled with glass or carbon). These variations serve advanced engineering use cases by meeting specific needs for rigidity, thermal conductivity, or biocompatibility.

To learn more about this report, Download Free Sample Report

By Technology

- Fused Deposition Modeling (FDM)

Because suitable printers are widely available and filament supply chains are well-established, FDM continues to be the most popular technology for PEEK 3D printing. Consistent demand is driven by its versatility for both functional parts and prototypes, particularly in aerospace and automotive interiors.

- Selective Laser Sintering (SLS)

For the production of complicated high-strength parts that need exceptional mechanical uniformity SLS is becoming more and more crucial. Applications with strict tolerances are supported by SLS's capacity to use PEEK powder especially in medical equipment and aircraft ducting.

- Other AM Technologies

For PEEK, emerging technologies including binder jetting, material jetting and advanced extrusion hybrids are still in the early phases of adoption. They promise faster cycle times or better resolution but before they are widely used in industry, materials and processes must be refined.

By End-Use Industry

- Aerospace & Defense

PEEK's superior strength-to-weight ratio and great heat resistance make it the most popular application area. Airframers employ PEEK for structural internals, tool fixtures, and thermal management elements that reduce aircraft weight and enhance fuel efficiency with tight certification standards driving material selections.

- Medical & Healthcare

PEEK is appealing for implants, surgical equipment, and patient-specific devices due to its chemical resistance and biocompatibility. PEEK materials are being more widely used in healthcare production, especially in the bespoke implant market due to regulatory clearances and clinical validation processes.

- Automotive

PEEK is used by the automobile industry to satisfy the growing need for lightweight, high-temperature-resistant parts, particularly in EV powertrains and under-hood applications. Fuel economy and electrification trends boost growth, even though penetration is smaller than in aircraft.

- Electronics & Industrial Components

PEEK materials meet the needs for great dimensional stability, chemical resistance, and electrical insulation in industrial machinery and electronics. Typical applications that profit from the design freedom of additive manufacturing include connectors, housings, and precision fittings.

- Other

It includes industries with specialized high-performance part needs, such as consumer products, oil and gas, and energy. Here, adoption is catalytic due to the need for performance above traditional thermoplastics and the demand for customization.

Regional Insights

North America is a developed and innovative market, with Canada and Mexico supporting demand through industrial production and regional supply chains, while the United States leads adoption through manufacturing in the aerospace, defense and healthcare industries. High-value material usage is reinforced by robust certification regimes. Aerospace, automotive and industrial engineering are the main drivers of PEEK utilization in Europe, which is growing steadily thanks to Germany, the UK and France. Italy and Spain are two Southern European nations that contribute through the production of medical devices and specific industrial uses.

Asia Pacific is the fastest-growing area, with South Korea's sophisticated industrial base coming in second behind China and Japan's increasing aerospace and electronics sector. Emerging markets like Australia, New Zealand and India are bolstered by increased R&D spending and additive manufacturing projects. South America is still a growing market, with Brazil being the biggest contributor because of industrial and automotive demand, while Argentina and other nations exhibit slow adoption linked to contemporary manufacturing.

South Africa supports specialty engineering and industrial manufacturing use cases, while Saudi Arabia and the United Arab Emirates lead the Middle East and Africa in early-stage growth through industrial diversification and energy-related applications.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2024, The commercial launch of Victrex's LMPAEKTM granule and powder solutions, which improve 3D printing and composite capabilities with lower melting temperatures and wider processing windows, was verified.

(Source:https://www.victrex.com/en/news/2024/lmpaek-granules-and-powders?)

- In October 2023 , For cutting-edge medical 3D printing applications, Evonik unveiled new VESTAKEEP carbon-fiber reinforced PEEK filaments that offer enhanced strength and biocompatibility for implant use.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.85Billion |

|

Market size value in 2026 |

USD 1.00 Billion |

|

Revenue forecast in 2033 |

USD 3.90 Billion |

|

Growth rate |

CAGR of 21.50% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Victrex plc, Solvay S.A., Evonik Industries AG, Arkema S., Ensinger Gm, Lehvoss Gro, Jiangsu Junhua High Performance Specialty Engineering Plasti, 3DXTE, Stratasys Lt, INTAMSYS Technology Co., Lt, Roboze S.p., Zortrax S., Shenzhen Polymaker 3D Printi, Materials Co., Lt, Shenzhen eSUN Industrial Co., Lt, BASF 3D Printing Solutions GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Filament, Powder, Pellets / Granules, Other Product Types), By Technology (Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), Other AM Technologies), By End-Use Industry (Aerospace & Defense, Medical & Healthcare, Automotive, Electronics & Industrial Components, Other) |

Key PEEK 3D Printing Materials Company Insights

Victrex plc is a well-known world leader in PEEK 3D printing materials due its high-performance thermoplastic innovation and decades of polymer experience. The company's PEEK filaments and powders are designed for demanding industrial, medical, and aerospace applications where chemical resistance, strength and thermal stability are essential. Victrex’s vertically integrated production and stringent material certification enable for consistent quality and end-use reliability, separating it from many competitors. Its market reach is increased and adoption in certified manufacturing environments is supported by extensive worldwide distribution channels and strategic partnerships with printer manufacturers.

Key PEEK 3D Printing Materials Companies:

- Victrex plc

- Solvay S.A.

- Evonik Industries AG

- Arkema S.A.

- Ensinger GmbH

- Lehvoss Group

- Jiangsu Junhua High Performance Specialty Engineering Plastics

- 3DXTECH

- Stratasys Ltd.

- INTAMSYS Technology Co., Ltd.

- Roboze S.p.A.

- Zortrax S.A.

- Shenzhen Polymaker 3D Printing Materials Co., Ltd.

- Shenzhen eSUN Industrial Co., Ltd.

- BASF 3D Printing Solutions GmbH

Global PEEK 3D Printing Materials Market Report Segmentation

By Product Type

- Filament

- Powder

- Pellets / Granules

- Other Product Types

By Technology

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Other AM Technologies

By End-Use Industry

- Aerospace & Defense

- Medical & Healthcare

- Automotive

- Electronics & Industrial Components

- Other

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr.png)

APAC:+91 7666513636

APAC:+91 7666513636