Market Summary

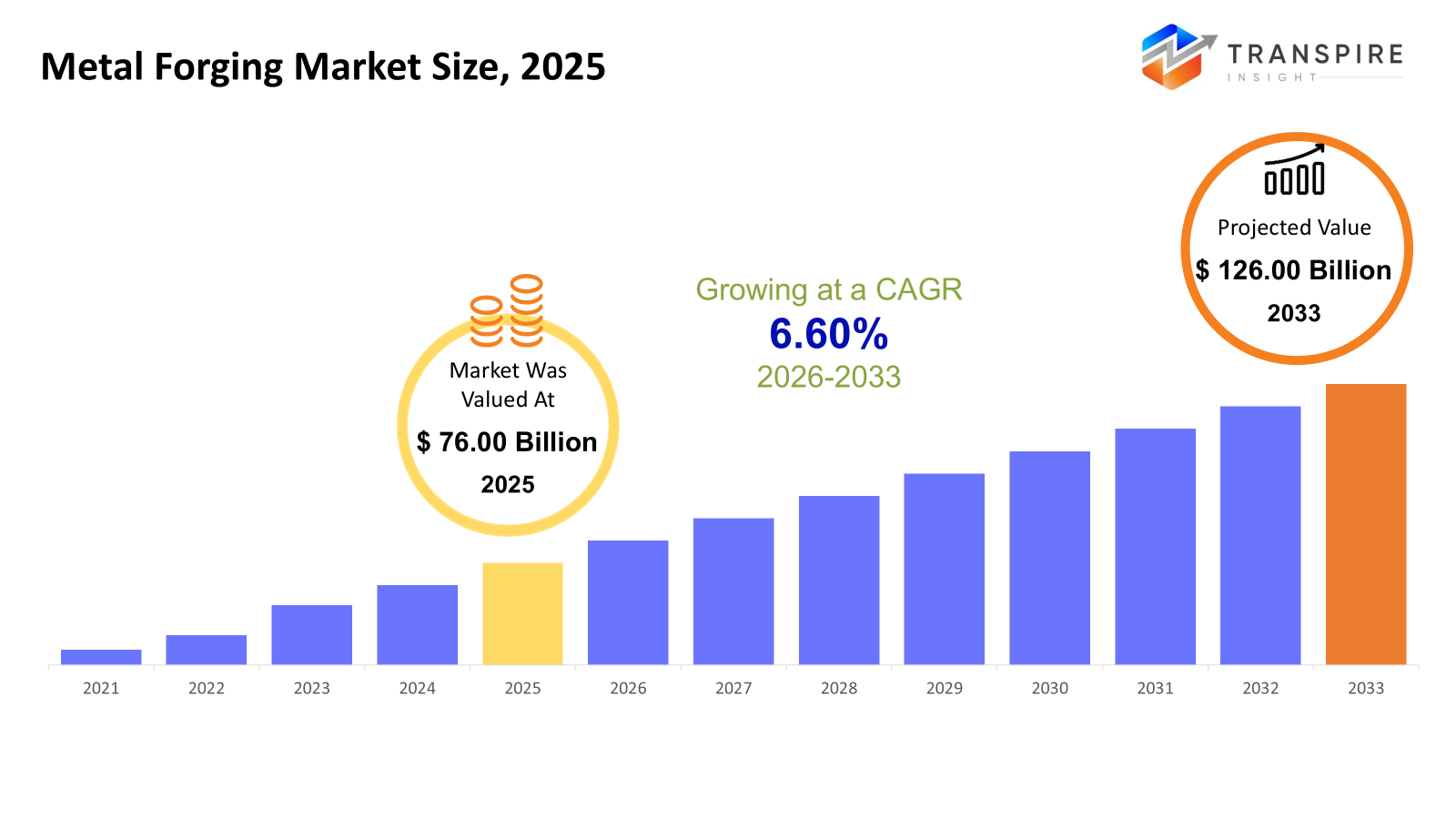

The global Metal Forging market size was valued at USD 76.00 billion in 2025 and is projected to reach USD 126.00 billion by 2033, growing at a CAGR of 6.60% from 2026 to 2033. Infrastructure investments, growing use of lightweight materials, and the demand for industrial and automotive gear all contribute to the metal forging market's compound annual growth rate. Automation-driven productivity gains, energy sector modernization, and aerospace revival all contribute to increased output efficiency and sustainable long-term growth momentum.

Market Size & Forecast

- 2025 Market Size: USD 76.00 Billion

- 2033 Projected Market Size: USD 126.00 Billion

- CAGR (2026-2033): 6.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- While investments in automation and high-value alloy forgings support productivity increases and margin growth throughout established forging facilities, North America continues to profit from reshoring of manufacturing, consistent automotive output, and defense spending.

- Due to its aerospace programs, demand for commercial vehicles, infrastructure expenditure, and growing use of automated and precision forging to meet labor shortages and quality consistency standards, the United States continues to be the key growth engine in North America.

- The fastest-growing region is Asia Pacific, which is driven by industrialization, infrastructure development, and large-scale automobile production. South Korea and Japan concentrate on high-precision and specialty alloy forgings, while China and India drive volume demand.

- Due to its applicability for high-volume, complicated components—especially in the automotive and aerospace industries, where OEM cost and performance criteria are aligned with dimensional accuracy, material efficiency, and repeatable quality—closed-die forging continues to hold a dominant position.

- As manufacturers prioritize lightweighting, fuel efficiency, and electric vehicle range while maintaining structural strength, aluminum and aluminum alloy forgings exhibit increased growth, replacing traditional steel forgings in some automotive and aerospace applications.

- Precision forging is becoming more and more popular for high-value parts in automobile drivetrains, aerospace structures, and industrial equipment as manufacturers seek to cut down on machining, material waste, and manufacturing lead times.

- Due to ongoing vehicle production, electrification trends, and the need for forged powertrain, suspension, and safety-critical components that demand exceptional mechanical qualities, automotive and commercial vehicles continue to be the largest end-use market.

So, In comparison to cast or machined parts, the metal forging market produces formed metal components using compressive force that have greater strength, fatigue resistance, and structural integrity. Forgings are vital in applications where safety and mechanical dependability are crucial. Automotive, aerospace, industrial machinery, energy, construction, and transportation are just a few of the industries served by the market. Demand trends closely mirror cycles of car production, infrastructure development, and industrial output. The range of applications is growing thanks to developments in forming processes and materials. Competitive dynamics are changing as a result of technological advancements toward automated, precise, and energy-efficient forging processes. High-value alloys, lightweight materials, and process optimization are becoming more and more important to manufacturers in an effort to increase profits, satisfy legal requirements, and support sustainability goals.

Metal Forging Market Segmentation

By Forging Process

- Open-Die Forging

For big, simple-shaped parts with great structural integrity, open-die forging is frequently utilized. Oil and gas applications, power generation, and heavy machinery are the main drivers of demand. Although the method has limited dimensional precision, it offers minimal tooling costs and size flexibility. Growth remains steady in capital-intensive industries.

- Closed-Die Forging

High-volume production is dominated by closed-die forging because of its exceptional dimensional accuracy and reproducibility. The need for intricate, high-strength components is driven by the automotive and aerospace industries. Adoption is supported by material efficiency and productivity benefits despite higher tooling costs. Globally, this market sector has a sizable market share.

- Rolled Ring / Seamless Forging

In order to create seamless rings with improved grain flow and fatigue resistance, rolled ring forging is essential. Aerospace constructions, wind turbines, gears, and bearings are a few examples of applications. Growth is supported by the growing need for large-diameter, high-performance rings. Both industrial growth and renewable energy are beneficial to the segment.

- Hammer Forging

Medium-scale production requiring controlled deformation is the main application for hammer forging. It offers versatility across materials and component geometries. Industrial machinery and aftermarket parts sustain the moderate demand. However, automation tendencies are causing acceptance to progressively decline.

- Cold Forging

High surface polish, dimensional accuracy, and material usage are made possible by cold forging. It is widely utilized in precision components, automotive parts, and fasteners. Reducing energy use helps achieve sustainability objectives. Lightweighting and the need for mass production are what propel growth.

- Others

Roll forging, press forging, and upset forging are other forging techniques. Based on shape and performance requirements, these techniques cater to specialized applications. Demand is still application-specific, allowing for customization in the industrial and automotive sectors. Their relevance is increased by technological optimization.

By Material

- Carbon Steel

The most popular forging material is still carbon steel because of its mechanical strength and affordability. It is widely used in industrial, construction, and automotive machinery. Market supremacy is maintained by steady demand from infrastructure and automobile manufacturing. Margins are somewhat impacted by price fluctuation.

- Alloy Steel

Forgings made of alloy steel have improved heat tolerance, wear resistance, and toughness. They are favored in high-stress industries like heavy machinery, oil and gas, and aerospace. Performance-critical components are what generate demand. In line with industrial advancements, this segment exhibits consistent expansion.

- Aluminum & Aluminum Alloys

Lightweighting tendencies in the automotive and aerospace industries are supported by aluminum forgings. Adoption is fueled by a high strength-to-weight ratio and resistance to corrosion. Demand is greatly increased by the adoption of electric vehicles. Globally, the segment shows significant growth potential.

- Stainless steel

Forgings made of stainless steel are prized for their durability and resistance to corrosion. Applications include the marine, chemical processing, and energy sectors. In operations in difficult environments, demand is steady. Compared to carbon steel, penetration is limited by higher material costs.

- Titanium & Superalloy

High-temperature, aerospace, and defense applications all make use of titanium and superalloys. Premium cost is justified by superior strength, fatigue resistance, and thermal stability. Demand is high-value yet volume-limited. Growth is correlated with defense spending and aerospace recovery.

- Magnesium & Other Specialty Materials

Advanced lightweight applications in the automotive and aerospace industries are supported by these materials. Because of the expense and complexity of processing, adoption is still niche. Investments in R&D are increasing viability. Innovation in materials and cost cutting are essential for long-term growth.

By Technology

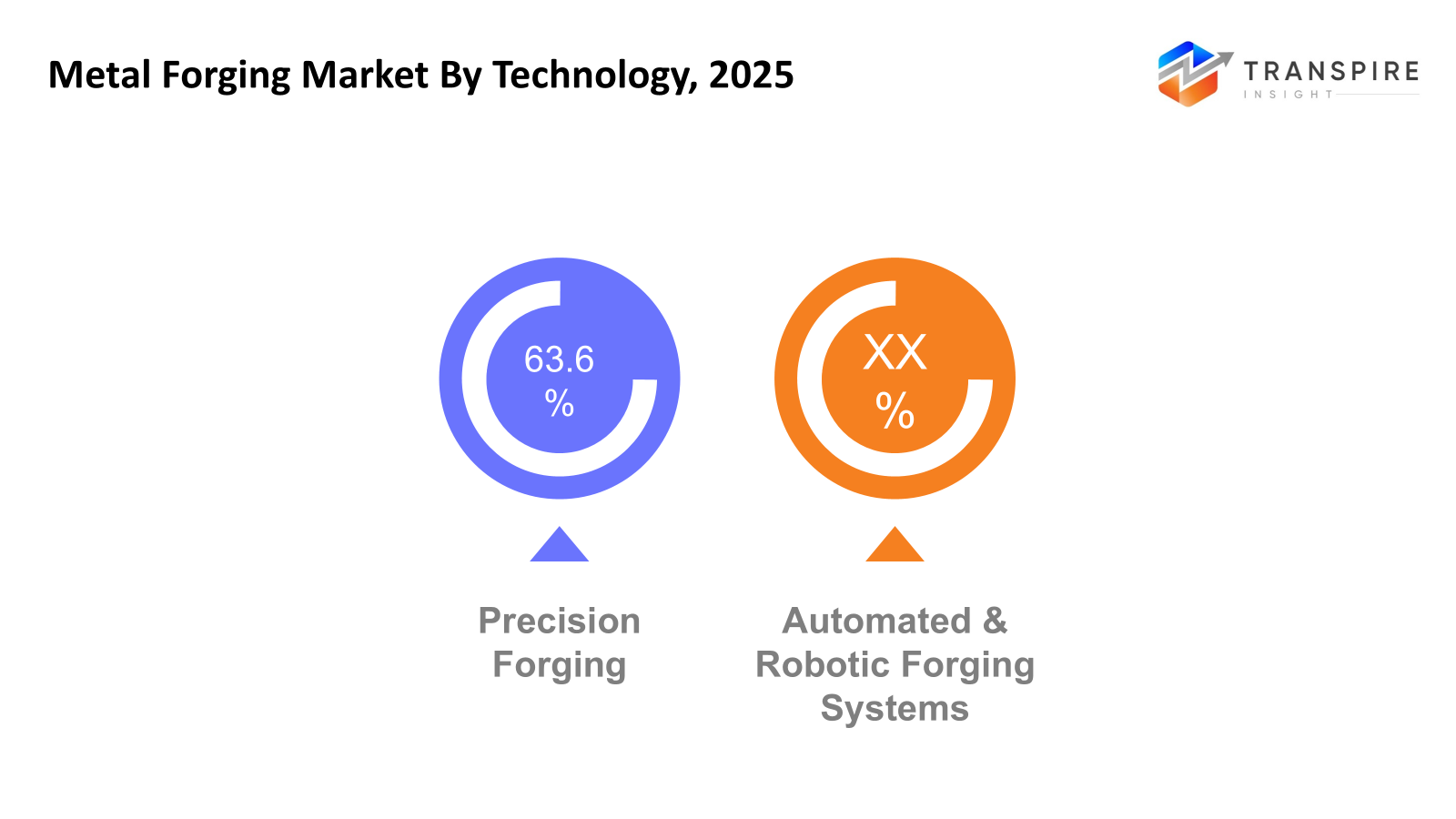

- Precision Forging

Precision forging reduces material waste and post-processing. High-accuracy parts for aerospace and automotive applications are supported. Efficiency and cost-optimization objectives generate demand. In high-volume production settings, adoption is rising.

- Automated & Robotic Forging Systems

Automation improves worker safety, productivity, and uniformity. In developed markets, adoption is increasing to make up for labor shortages. Penetration in small facilities is limited by high capital investment. Integration of Industry 4.0 is consistent with long-term growth.

To learn more about this report, Download Free Sample Report

By End-Use Industry

- Automotive & Commercial Vehicles

Driven by engines, drivetrains, and chassis components, this is the largest end-use segment. Material selection is influenced by EV manufacturing and lightweighting. Large-scale forging operations are supported by volume demand. Short-term growth is impacted by cyclical automobile manufacturing.

- Aerospace & Defense

Strict quality control and high-performance materials are necessary for aerospace forgings. Aircraft manufacturing and defense upgrades are the main drivers of demand. Margin is high but volumes are lower. Stable demand is ensured by extended production cycles.

- Industrial Machinery

For heavy industrial equipment, forged components offer durability. Demand is influenced by developments in infrastructure investment and manufacturing. With industrial automation, growth is still modest. Aftermarket demand is driven by maintenance and replacement.

- Railway / Transportation

High-strength forgings are needed for wheels, axles, and couplings in railway applications. Demand is supported by government spending on rail infrastructure. Growth is driven by policy and varies by location. Long service life reduces the need for replacements.

- Oil & Gas / Energy & Power Generation

Drilling equipment, flanges, and valves all require forging. Exploration activity and energy prices affect demand. Baseline demand is stable thanks to power generation. Long-term growth dynamics are impacted by the energy transition.

- Construction & Heavy Equipment

Forgings are used to create load-bearing parts for construction equipment. Urbanization and infrastructure development are correlated with demand. Volume growth is driven by emerging markets. Cyclicality is still a major obstacle.

- Others

Consumer electronics, marine, and agriculture are further end-use industries. Demand is application-specific and dispersed. These market niches let producers diversify. Growth is consistent but constrained in scope.

Regional Insights

North America is a developed yet technologically sophisticated market, with Canada and Mexico serving as Tier 2 manufacturing and supply-chain support hubs and the United States as a Tier 1 subregion driven by demand for automobiles, aerospace, and defense.Europe is a precision-driven market, with advanced automotive and industrial sectors supporting Tier 1 nations like Germany, the UK, France, Italy, and Spain. The rest of Europe functions as Tier 2 with selective capacity increase.

China, Japan, India, and South Korea are Tier 1 markets in Asia Pacific, which is the largest and fastest-growing area. While Australia, New Zealand, and the rest of Asia Pacific constitute Tier 2 growth markets, these nations are the main drivers of both volume and technology. While Argentina and the rest of South America continue to be Tier 2 with cyclical investment patterns, South America is growing moderately, with Brazil leading the way as a Tier 1 market with demand for automobiles and construction. With Saudi Arabia, the United Arab Emirates, and South Africa as Tier 1 markets propelled by energy and infrastructure projects, the Middle East and Africa is a developing region. The rest of MEA is still Tier 2 with project-based demand unpredictability.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, Following agreements with Pratt & Whitney Canada for the supply of high-performance forged components, Bharat Forge Ltd. declared that it will establish a new advanced ring mill specifically for aerospace applications. The plant will use state-of-the-art technology to create aero-engine forgings that meet international standards, strengthening the company's aerospace manufacturing presence and expanding India's capacity to produce high-value forged goods.

(Source:https://www.bharatforge.com/assets/pdf/investors/notice/SE-Intimation-Press-Release-30july.pdf)

- In February 2025, Liebherr-Aerospace & Transportation SAS and Bharat Forge Ltd. announced a strategic partnership to build a cutting-edge manufacturing plant in Pune, India. In addition to showcasing both companies' dedication to precision forging and bolstering their worldwide aerospace supply chain presence, the new facility will feature a ring mill and cutting-edge machining capabilities for landing gear and other aircraft components.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 76.00 Billion |

|

Market size value in 2026 |

USD 80.50 Billion |

|

Revenue forecast in 2033 |

USD 126.00 Billion |

|

Growth rate |

CAGR of 6.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Precision Castparts Corp., Howmet Aerospace Inc., Allegheny Technologies Incorporated (ATI), Thyssenkrupp AG, Nippon Steel Corporation, VSMPO-AVISMA Corporation, KOBELCO (Kobe Steel), Aichi Steel, Aubert & Duval (Eramet), Bharat Forge Limited, American Axle and Manufacturing (AAM), AVIC Heavy Machinery, Wanxiang Qianchao, FRISA, Pacific Precision Forging |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Forging Process (Open-Die Forging, Closed-Die Forging, Rolled Ring / Seamless Forging, Hammer Forging, Cold Forging, Others), By Material (Carbon Steel, Alloy Steel, Aluminum & Aluminum Alloys, Stainless Steel, Titanium & Superalloy, Magnesium & Other Specialty Materials), By Technology (Precision Forging, Automated & Robotic Forging Systems) and By End-Use Industry (Automotive & Commercial Vehicles, Aerospace & Defense, Industrial Machinery, Railway / Transportation, Oil & Gas / Energy & Power Generation, Construction & Heavy Equipment, Others) |

Key Metal Forging Company Insights

One of the top forging companies in the world, Precision Castparts Corp. specializes in high-performance parts for the defense, power generation, and aerospace industries. The business, which is well-known for its proficiency in superalloy and titanium forged parts, enjoys the advantages of sophisticated forging capabilities that satisfy exacting quality and dependability requirements. Its incorporation with Berkshire Hathaway offers technical investments both strategic and financial backing. Important engine disks, structural pieces, and specialty forgings that fetch large margins and long-term contracts are all part of Precision Castparts' product line. Its competitive position in the face of changing aerospace and industrial demand is strengthened by ongoing investments in precision and isothermal forging technologies.

Key Metal Forging Companies:

- Precision Castparts Corp.

- Howmet Aerospace Inc.

- Allegheny Technologies Incorporated (ATI)

- Thyssenkrupp AG

- Nippon Steel Corporation

- VSMPO-AVISMA Corporation

- KOBELCO (Kobe Steel)

- Aichi Steel

- Aubert & Duval (Eramet)

- Bharat Forge Limited

- American Axle and Manufacturing (AAM)

- AVIC Heavy Machinery

- Wanxiang Qianchao

- FRISA

- Pacific Precision Forging

Global Metal Forging Market Report Segmentation

By Forging Process

- Open-Die Forging

- Closed-Die Forging

- Rolled Ring / Seamless Forging

- Hammer Forging

- Cold Forging

- Others

By Material

- Carbon Steel

- Alloy Steel

- Aluminum & Aluminum Alloys

- Stainless Steel

- Titanium & Superalloy

- Magnesium & Other Specialty Materials

By Technology

- Precision Forging

- Automated & Robotic Forging Systems

By End-Use Industry

- Automotive & Commercial Vehicles

- Aerospace & Defense

- Industrial Machinery

- Railway / Transportation

- Oil & Gas / Energy & Power Generation

- Construction & Heavy Equipment

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636