Market Summary

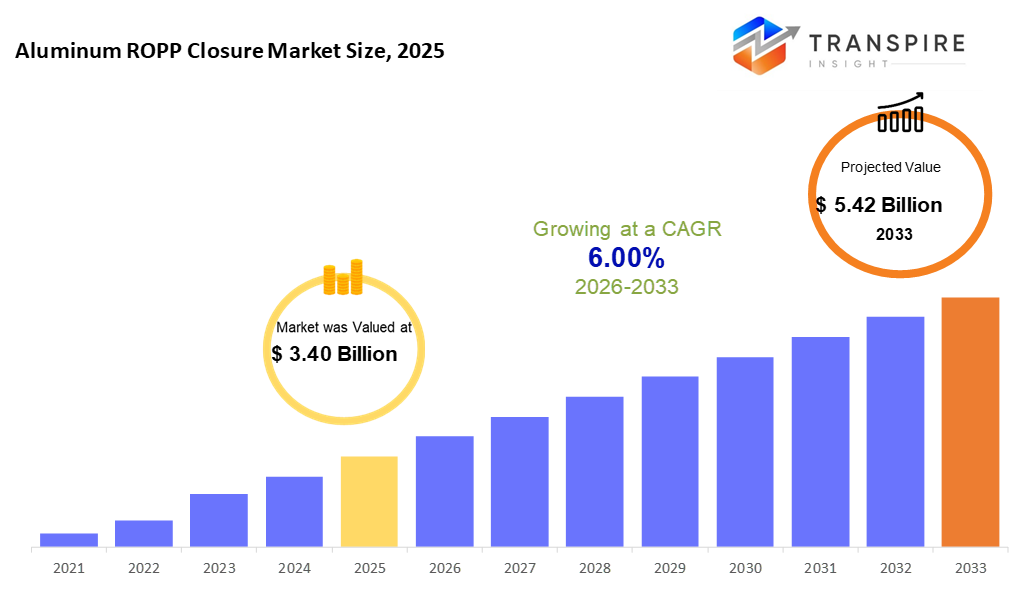

The global Aluminum ROPP Closure market size was valued at USD 3.40 billion in 2025 and is projected to reach USD 5.42 billion by 2033, growing at a CAGR of 6.00% from 2026 to 2033. The market growth is driven by increasing demand for sustainable, lightweight, and tamper-evident packaging solutions in the food, beverage, and pharmaceutical industries. Additionally, rising adoption of aluminum ROPP closures for improved product safety, shelf life, and convenience is supporting steady market expansion.

Market Size & Forecast

- 2025 Market Size: USD 3.40 Billion

- 2033 Projected Market Size: USD 5.42 Billion

- CAGR (2026-2033): 6.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 35% in 2026. Across North America, demand rises where bottled drinks and medicine fill shelves, and safety rules shape how they are made. What flows through pipelines here meets tight controls, pushing production forward.

- Fueled by high-end wines, spirits take center stage in America's packaging growth, with closures showing signs of interference mattering most here. Nutraceuticals ride the same wave, quietly shaping demand without much notice.

- From Asia Pacific, growth speeds up as more people buy sealed foods and drinks while medicine and skincare makers spread out.

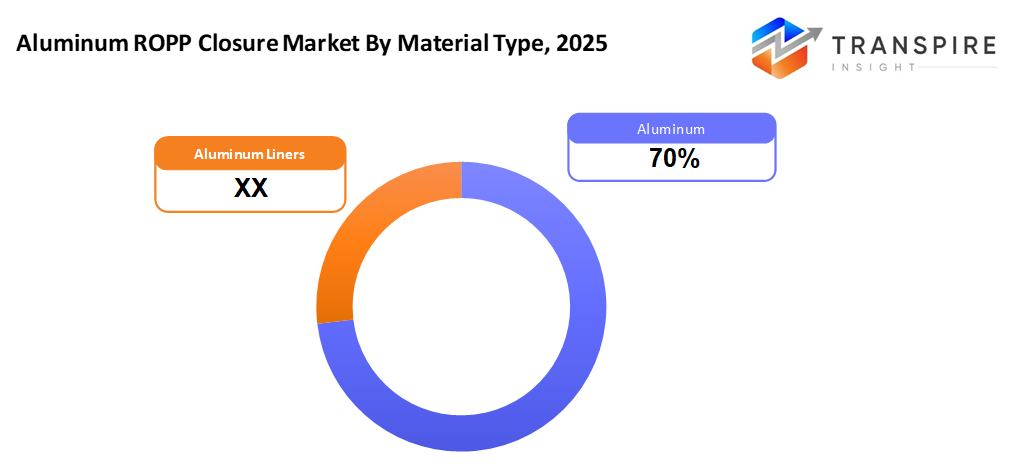

- Aluminum shares approximately 70% in 2026. That is why aluminum tops the list. Its light body makes it a go-to choice. Recycling fits right into its strengths, too. Rust hardly touches it, which keeps performance steady over time.

- Folks tend to reach for the medium caps between 28 and 38 millimeters - when sealing drink, food, or medicine containers. These fit a whole range of common bottle openings you’d find on shelves.

- Fueled largely by wine, spirits, juices, and sodas, beverage makers claim the largest share of user demand.

Starting, aluminum ROPP caps play a key role in today’s packaging world, especially for drinks, medicines, food items, and beauty products. Not heavy at all, these closures resist rust while showing clear signs if opened before purchase. Because they can be recycled easily, more companies keep turning to them. Sealing tightly matters, and that is exactly what these lids do well. Keeping content fresh comes naturally with such reliable protection. These covers fit right into those plans. Across continents, demand keeps rising for good reason.

What's pushing market growth is not just one thing; it is how more people drink bottled juice, soda, wine, or liquor, needing caps that seal tightly and show if someone opened them. Not far behind, medicine bottles for syrup or liquid drugs use aluminum ROPP lids because rules demand clean, safe packaging. The same goes for certain foods and beauty products companies pick these closures not only to keep items fresh but also because they look good on shelves.

Nowadays, new liner materials plus fresh coating techniques help caps fit tighter on various bottles. Moving ahead, custom designs make these closures work more smoothly across many liquid types. On another note, people choose more sustainable options, so aluminum ones gain ground against plastic. Because recycling matters more today, this shift fits well within worldwide green goals.

Even with room to grow, shaky aluminum costs and weak recycling setups in certain areas could slow things down, affecting price and uptake. Still, fresh chances might come from rising interest in high-end packs, new cap designs, and then spreading into developing parts of the Asia Pacific and Latin America.

Aluminum ROPP Closure Market Segmentation

By Material Type

- Aluminum

Lighter than most metals, aluminum takes the lead. Rust resistance gives it an edge. Recycling fits smoothly into its role. A mix of practical traits keeps demand steady.

- Aluminum with Liners

Sealed, aluminum containers with inner liners work well when keeping contents safe from air. These hold freshness longer, especially useful for items that react easily. Protection comes from the mix of metal and liner working together behind the scenes.

To learn more about this report, Download Free Sample Report

By Closure Type

- Small (<28mm)

Common pick for medicine jars plus tiny fluid holders. Tight seals matter most here - often seen where precision counts.

- Medium (28-38mm)

A typical size between 28 and 38 millimeters often shows up. Drinks, meals, or mid-sized wraps usually take this form.

- Large (>38mm)

That size handles thick liquids and special foods, because a wide mouth makes filling easier. Containers like that also work well for creams and lotions needing generous access.

By End-User

- Beverages

Fueled largely by demand for wine, spirits, and juices, beverages take the top spot among user industries. Packaging needs here shape the biggest share of usage across sectors.

- Pharmaceuticals

Medicine makers need secure wraps that show if someone opened them. Safety rules push a constant need for trustworthy seals around pills and liquids.

- Food

Sauces, oils, and condiments now include more food elements for easier handling plus longer shelf life. Safety matters too; people want fewer worries when eating. What shows up on shelves reflects that shift quietly. Simpler prep at home helps explain the trend. Not everything changes fast, but this does. New habits form without much notice most days.

- Cosmetics & Personal Care

Fragrances, moisturizers, or plant-based oils are seeing rising use in beauty routines. People choose them more often now for daily grooming habits.

- Others

Filled with substances that need tight seals, these work where leaks can not happen. Liquids meant for careful handling find stability here. Chemical setups rely on them when safety matters most.

Regional Insights

A steady appetite for bottled drinks, medicines, and health supplements plays a big role. In that area, the United States stands out because tight safety rules push innovation. Evidence of tampering matters more now. That drives closure choices. So does the rising taste for top-tier wines, liquors, and performance-focused drinks. Factories here can deliver at scale thanks to modern setups. On top of that, people expect greener packaging. This mindset fuels change.

Across Europe, nations like Germany, France, and Italy set the pace in using aluminum ROPP caps for drinks, medicines, and niche food items. Because environmental concerns shape choices here, metal tops often replace plastic ones. Strong traditions in making food, drinks, and cosmetics feed a steady need on top of strict rules that favor secure, reliable sealing. Quality matters more when safety cannot be risked.

China, India, Japan, and Southeast Asian nations lead the surge in the Asia Pacific, where demand climbs fast for bottled drinks and medicines. Growth ticks upward in Latin America, backed by steady expansion in how food and drink get made and sold. Across the Middle East and Africa, new interest takes root as companies begin using modern containers for liquids and health products. Factories rise quickly here, wallets grow heavier there, and people notice greener options. This mix pushes change forward. Each place moves at its own pace, yet similar forces shape their paths.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 17, 2025 – Nipra highlights aluminum and crown closure capabilities amid premiumization trends.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.40 Billion |

|

Market size value in 2026 |

USD 3.60 Billion |

|

Revenue forecast in 2033 |

USD 5.42 Billion |

|

Growth rate |

CAGR of 6.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

CapandSeal, Silgan Closures, Amcor, Sacmi, Vipra, Reon Packaging, Bottles-Closures, Continental Crowns and Closures, AROL, Hefei Biopin Import & Export Trading Co. Ltd, Global Bottle Cap, Hicap Closure, Guru Metal Industries, Mohan S Packaging |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Aluminum, Aluminum with Liners) By Closure Type(Small <28mm, Medium 28-38mm, >38mm ) By End-User (Beverages, Pharmaceuticals, Food, Cosmetics & Personal Care, Others) |

Key Aluminum ROPP Closure Company Insights

Amcor Plc delivers aluminum ROPP caps along with adaptable and firm packaging used worldwide. Instead of just making containers, they build features into their closures that show if someone has opened them this helps keep goods safer for longer. Because people want greener options now, the business pushes recycled content and ways to reuse materials after use. While some companies struggle to reach far places, Amcor moves smoothly across borders thanks to its factories and delivery routes spread widely. Among firms dealing in metal bottle tops, few match its scale or consistency.

Key Aluminum ROPP Closure Companies:

- CapandSeal

- Silgan Closures

- Amcor

- Sacmi

- Vipra

- Reon Packaging

- Bottles-Closures

- Continental Crowns and Closures

- AROL

- Hefei Biopin Import & Export Trading Co. Ltd

- Global Bottle Cap

- Hicap Closure

- Guru Metal Industries

- Mohan S Packaging

Global Aluminum ROPP Closure Market Report Segmentation

By Material Type

- Aluminum

- Aluminum with Liners

By Closure Type

- Small <28mm

- Medium 28-38mm

- >38mm Autoimmune Diseases

By End-User

- Beverages

- Pharmaceuticals

- Food

- Cosmetics & Personal Care

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636