Market Summary

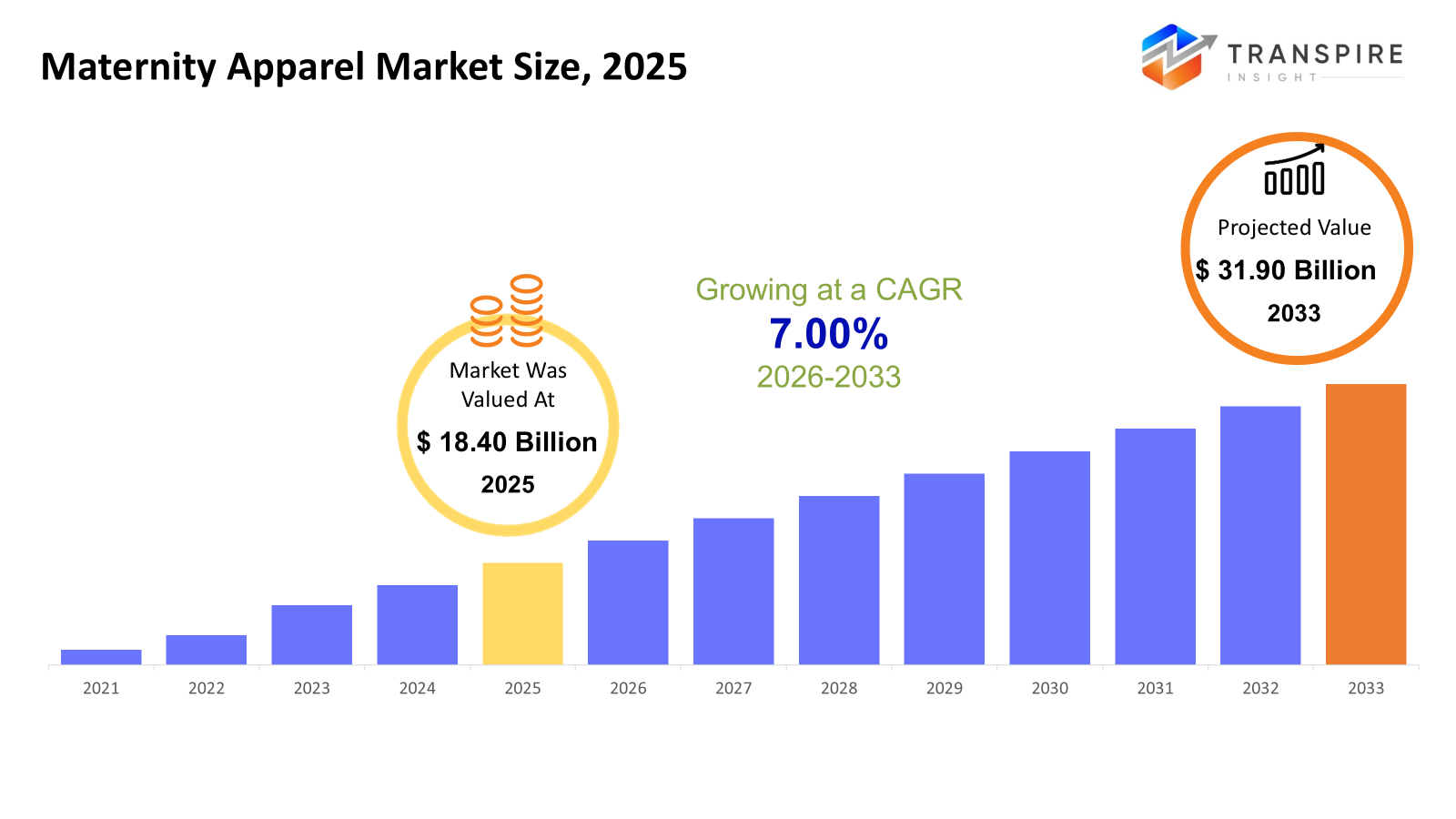

The global Maternity Apparel market size was valued at USD 18.40 billion in 2025 and is projected to reach USD 31.90 billion by 2033, growing at a CAGR of 7.00% from 2026 to 2033. The maternity apparel market is experiencing steady growth supported by increasing awareness of specialized pregnancy clothing designed for comfort, functionality, and health support. The need for stylish maternity clothing is increasing in both developed and emerging nations, as is the number of women entering the labor. Adoption has accelerated due to increased accessibility and product diversity brought about by the growth of e-commerce platforms and direct-to-consumer brands. Long-term market expansion is also supported by growing disposable income and a growing focus on lifestyle comfort and prenatal wellbeing.

Market Size & Forecast

- 2025 Market Size: USD 18.40 Billion

- 2033 Projected Market Size: USD 31.90 Billion

- CAGR (2026-2033): 7.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- While the United States leads innovation through premium product offerings, brand presence, and strong e-commerce penetration supporting consistent regional market growth, North America exhibits stable demand supported by strong retail infrastructure, high consumer awareness, and widespread adoption of specialized maternity apparel.

- Strong online retail ecosystems, frequent product launches, and rising demand for comfortable yet stylish clothing solutions support the US market's high level of fashion consciousness and consumer preference for multipurpose maternity clothing that can be worn both during pregnancy and after giving birth.

- The Asia Pacific market is expanding quickly due to factors like a large population, rising urbanization, rising disposable income, and growing awareness of maternity comfort. China and India are major contributors, as evidenced by their growing online retail channels and rising adoption of reasonably priced maternity clothing.

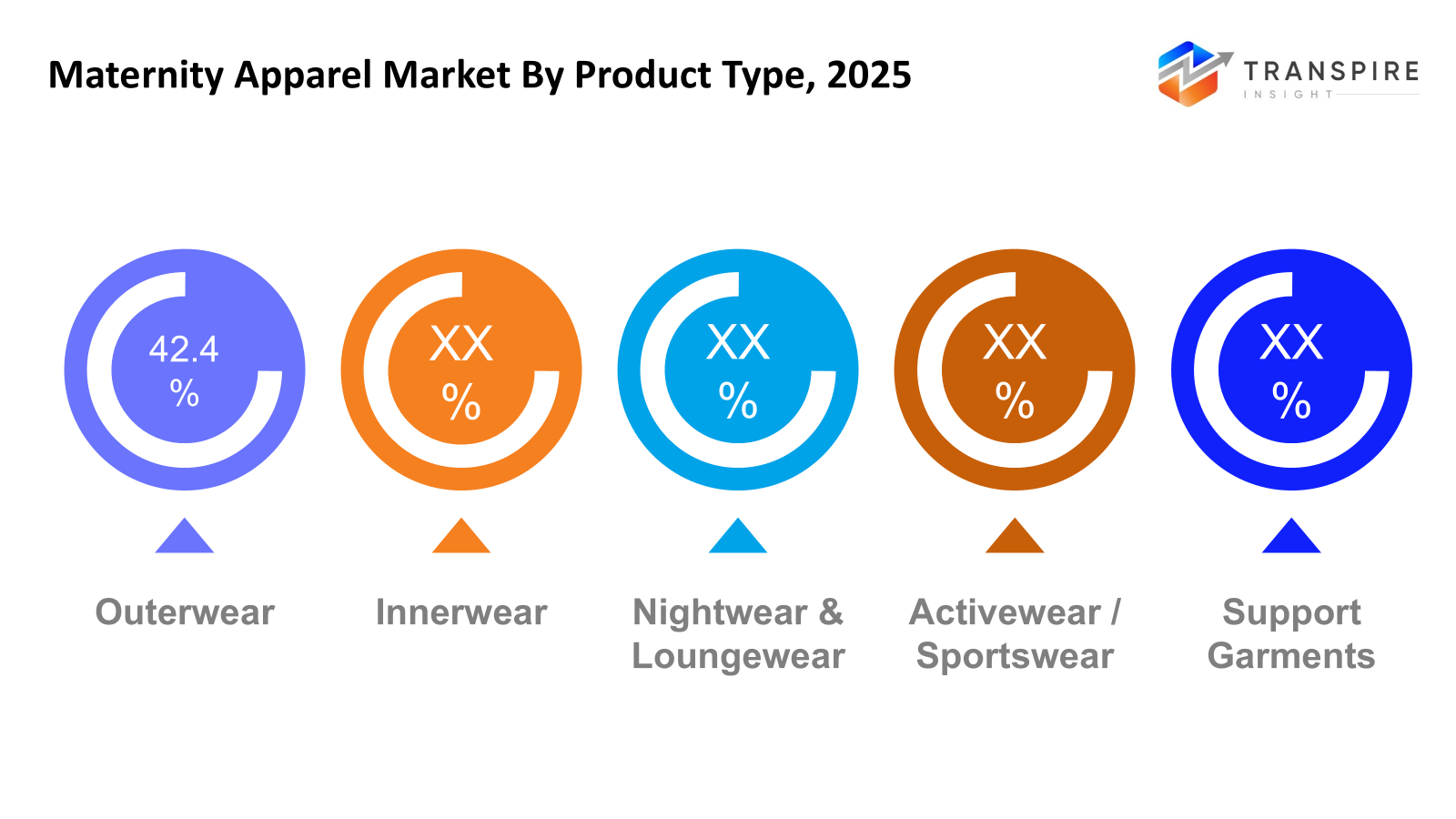

- The most popular product category is still outerwear because consumers prefer adaptable and often worn items like dresses, shirts, and leggings, and brands emphasize stretchable materials and adaptive designs that promote comfort, usefulness, and prolonged wear throughout the course of pregnancy.

- Due to its everyday usability and comfort-driven buying habits, casual wear dominates the application segment. This is reinforced by shifting lifestyle trends and a rise in the demand for adaptable apparel that can be worn in a variety of settings, including homes, informal social gatherings, and daily activities, among pregnant consumers worldwide.

- Because of its softness, breathability, and skin-friendly qualities, cotton is still the fabric of choice. Additionally, growing consumer awareness of pregnancy discomfort and sensitivity is fueling a steady demand for natural and lightweight fabric materials across a variety of product categories.

- Due to their convenience, greater product range, and simplicity of price comparison, online and e-commerce channels are becoming the fastest-growing distribution segment. This allows companies to reach a larger customer base and facilitates rapid adoption in both established and emerging maternity apparel markets.

So, The maternity clothing market includes a segment of garments, which cater to physical changes during pregnancy and ensure comfort, flexibility, and functional support. The products include outerwear, innerwear, active wear and support garments created in accordance with the changing need profiles of the consumers in the prenatal and postnatal stages. The market has gradually moved from a functional-based approach in garment design to fashion-based, where comfort is merged with style and adaptability. Increasing awareness among expecting mothers about specialized maternity wear that makes them more comfortable and agile has been driving market growth. Increased participation by women in the workforce and higher demand for both professional and casual maternity wear have led to product diversification. The use of stretchable fabrics, adjustable designs and multi-functional clothing that may be worn even after pregnancy is now increasingly targeted by producers.

Moreover, digital retail expansion has transformed buying behavior significantly, allowing customers to have greater variety access in maternity wear from entry-level to high-end. Increasing attention to sustainability and organic fabrics is driving product innovation, especially in the premium segments. The trend of consumer preference for comfort driven and lifestyle oriented clothing allows the maternity apparel market to persistently showcase stable and long-term growth.

Maternity Apparel Market Segmentation

By Product Type

- Outerwear

Outerwear is found to be a significant segment in the maternity clothing market driven by the volumes in regular wear and frequency of purchase, as maternity figures form a considerable portion of these changes during pregnancy. Additionally, the desire for fashion in pregnancy clothing acts as a major contributor to the growth of the outerwear segment.

- Innerwear

The requirement for comfort, support, as well as physiological changes during the pregnancy stage and nursing stages, forms a significant driver for the requirement and consumption of innerwear. For example, the design of a maternity bra as well as a nursing bra includes greater flexibility and softness, meeting the comfort requirements. The concept of mother apparel is becoming increasingly important, fueling growth.

- Nightwear & Loungewear

Nightwear and loungewear items have gained significance due to the increasing focus on comfortable wear and the rise of home-based lifestyles. Comforting quality, i.e., softwear that is stretchable, has come to determine consumer demand due to the changing needs of the body and the need for ease of movement. Multifunctional items have added to the category, which also considers post-pregnancy and nursing comfort.

- Activewear / Sportswear

Activewear has been observing a sluggish growth on account of growing awareness about prenatal fitness and wellness. Expectant mothers are rapidly adapting to low intensity exercises, thereby demanding form-fitting apparel for support and flexibility. The manufacturing process involves moisture-wicking fabrics and an ergonomic design to maintain comfort and keep the expectant mother mobile. Growth is good in urban markets where health awareness is generally higher.

- Support Garments

Pregnancy support garments like belly bands and support leggings help alleviate physical discomfort during pregnancy. These products offer abdominal and back support, thereby enhancing posture and reducing strain. The segment is growing due to increasing recommendations by medical professionals and consumer awareness about physical support during pregnancy. Innovations in light and breathable materials are a further boost for the segment.

To learn more about this report, Download Free Sample Report

By Application

- Casual Wear

Casual wear dominates the application segment owing to high daily usage and comfort-oriented buying behavior. There is a focus on practical clothes that can be worn during routine activities during the entire course of pregnancy. Availability of more fashion maternity wear that is also functional supports demand. The frequency of replacement with change in body size during pregnancy is high, boosting the segment.

- Workwear/ Formal Wear

Workwear demand is also impacted by better workforce participation of pregnant working women and changing workplace attires. Professional maternity wear focuses on comfort without compromising on the formal appearance of the wearer. Inclusive corporate culture with flexible dress code policies supports growth. Companies are coming up with designs that can be used both at offices and semi-formal occasions.

- Activewear / Fitness Wear

The increasing prenatal fitness activities, which have become an essential part of the maternal healthcare routine, are still expanding the application of activewear. Apparel for stretching, breathability, and supporting endurance comes into play. Increasing awareness related to physical well-being during pregnancy contributes toward segment growth. Demand is higher in developed and urban markets where fitness cultures are more established.

- Intimate Apparel & Sleepwear

It is driven by comfort, functionality, and nursing convenience. The products are designed to facilitate body changes and ease the breastfeeding process. The increased focus on health, hygiene, and relaxation also impacts the segment. This segment is also driven by the rising demand for premium maternity essentials.

- Occasion / Party Wear

The occasion wear segment constitutes a small, yet expanding trend in the maternity wear marketplace, as maternity clothing becomes more style-centric. The trend is driven by consumer demands for fashionable, yet aesthetically appealing clothing for social events. Designers are launching trend-led maternity wear collections that offer adjustable silhouettes. The trend is further fueled by considerable disposable income and social media’s influence on consumer trends.

By Fabric

- Cotton

Cotton still remains the first choice of fabric due to its breathability, softness and skin-friendly properties. Because comfort and less skin irritation are key priorities for pregnant consumers, demand is high. Applications are found across categories like casual wear, innerwear, and nightwear. Its affordability and availability support its widespread adoption.

- Spandex / Elastane blends

Spandex and elastane blends have widespread applications because of their stretch and recovery properties. These fabrics accommodate body change while retaining garment structure. Demand is particularly prominent in activewear, innerwear, and fitted outerwear. Greater focus on mobility and flexibility during pregnancy contributes to segment growth.

- Polyester blends

Polyester blends are finding increased acceptance due to their strength resistance to wrinkling, and economic viability. Because of these reasons, manufacturers also utilize these fabrics for durability and low maintenance. The segment is also benefiting from advancements in moisture management technologies. It is widely used in workwear and performance-related apparel.

- Denim

Denim-based maternity wear continues to attract consumers who are interested in fashionable attire that is functional as well. Stretch denim assures visitors with enhanced comfort and flexibility, with stretch denim innovations providing comfort for pregnant women. Its popularity is based on casual fashion trends and wardrobe flexibility, with design innovations in stretchable waistbands.

- Sustainable / Organic Fabrics

Sustainable fabrics are also becoming popular, driven by environmental awareness among consumers. Organic cotton, bamboo, and other sustainable fabric blends are being used by premium and niche brands. These are also driven by sustainable purchasing behavior and eco-fashion trends. These will grow in the future due to an increase in sustainable consumer groups.

By Distribution Channel

- Offline Retail

Offline retail continues to hold importance as the consumer prefers physical trials and fabric availability before purchasing the product. The specialty maternity store and the department store offer the consumer personalized services, etc. It is a strong business segment, liked by areas where shopping influences decisions. Retail business, retail growth, and brand outlet support are part of the market presence.

- Online / E-commerce

Online media is experiencing quick growth due to convenience, wider product availability, and competitive pricing. Hence, digital media allows for quick comparison of styles, sizes, and customer reviews. Increasing digitalization, including smartphone usage, will also fuel the expansion of the segment. Moreover, electronic commerce helps brands target underserved markets.

- Direct to Consumer (DTC)

The DTC model continues to grow as a result of the need for companies to be in control of their own pricing, branding, and stakeholder engagement. They use digital platforms to provide customers with personalized experiences and are able to provide a wide range of products only to their customers. The model benefits from the growth in digital marketing and brand loyalty strategies.

Regional Insights

North America, being a mature market for maternity wear, operates on high consumer awareness for premium and branded products in countries such as the US, Canada, and Mexico. Among these, the US holds the highest market share in the region, owing to the current retail infrastructure and online penetration, followed by Canada, which is largely driven by sustainable products and comfortable wear, and Mexico, which is experiencing growth through increasing retail access and consumer demand. Europe shows consistent market demand backed by fashion-driven consumers, as well as rising trends towards green maternity wear in Germany, the United Kingdom, France, Spain, Italy, and the rest of the European countries. Western European countries drive the market because of their relatively high disposable income levels as well as a good retail presence, while the rest of the European countries show moderate market development.

Consequently, the regions with the fastest growth rates are Asia Pacific, led by China, India, Japan, South Korea, and Australia/New Zealand, respectively, followed by South America, which comprises countries such as Brazil and Argentina. The gradual growth rate in the region is attributed to urbanization, the rise in middle-class populations, and the rise in birth rates. In addition, the rise in e-commerce platforms and the availability of maternity wear are the leading contributors to the growth rate in the Asia Pacific region. Similarly, the growth rate in the Middle East/Africa region, which comprises countries such as Saudi Arabia, the United Arab Emirates, and South Africa, is attributed to urbanization, the rise in the number of people using maternity comfort wear, and the rise in e-commerce platforms in the region.

To learn more about this report, Download Free Sample Report

Recent Development News

- March 2024, H&M has pointed out the continuous expansion of their maternity and nursing product line as a move towards their sustainability and design strategy. The company has placed much emphasis on the use of sustainable materials, improved comfort-focused design, and multi-stage product offerings for pregnant women. This strategy towards meeting the maternity fashion requirements has been characteristic of H&M’s move to include this product line in their women’s collections rather than a standalone segment, thereby meeting the growing need for maternity fashion.

(Source:https://www.htfmarketintelligence.com/press-release/global-clothing-for-pregnant-women-market)

- In October 2023, Seraphine also announced a continued product rollout plan with a focus on occasion wear, nursing-friendly clothing, and comfort-focused maternity wear. This strategy will also see an increase in investment for design innovation and internationalization across both e-commerce and bricks and mortar platforms. This plan is aimed at improving brand positioning to appeal to young consumers with modern tastes and preferences for fashionable maternity clothing.

(Source:https://blog.seraphine.com/introducing-new-london-maternity-store-marylebone-high-street)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 18.40 Billion |

|

Market size value in 2026 |

USD 19.80 Billion |

|

Revenue forecast in 2033 |

USD 31.90 Billion |

|

Growth rate |

CAGR of 7.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Seraphine Group Limited, Destination Maternity Corporation, Mothercare plc, H & M Hennes & Mauritz AB, ASOS plc, Gap Inc., Nike, Inc., Adidas AG, Thyme Maternity (Reitmans (Canada) Limited), Ingrid & Isabel, LLC, Hatch Collection LLC, Isabella Oliver Limited, PinkBlush Maternity, Boob Design AB, Ripe Maternity Pty Ltd |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Outerwear, Innerwear,Nightwear & Loungewear, Activewear / Sportswear, Support Garments), By Fabric (Casual Wear, Workwear / Formal Wear, Activewear / Fitness Wear, Intimate Apparel & Sleepwear, Occasion / Party Wear), By Fabric (Cotton, Spandex / Elastane blends, Polyester blends, Denim, Sustainable / Organic fabrics) and By Distribution Channel (Offline Retail, Online / E-commerce, Direct-to-Consumer (DTC)) |

Key Maternity Apparel Company Insights

Seraphine Group Limited's premium-focused product line and well-known worldwide brand give it a dominant position in the maternity clothing industry. Fashion-led maternity clothing that combines comfort, practicality, and modern design sets the brand apart and appeals to both working and lifestyle-focused customers. Consistent brand penetration is supported by its omnichannel retail strategy, which includes robust online distribution and a global presence in North America and Europe. The focus on sustainable materials and partnerships with public figures have improved brand recognition even more. In addition to allowing for lifetime customer retention, the company's emphasis on postnatal and nursing clothing expansion places it in a competitive position within the ever changing maternity apparel market.

Key Maternity Apparel Companies:

- Seraphine Group Limited

- Destination Maternity Corporation

- Mothercare plc

- H & M Hennes & Mauritz AB

- ASOS plc

- Gap Inc.

- Nike, Inc.

- Adidas AG

- Thyme Maternity (Reitmans (Canada) Limited)

- Ingrid & Isabel, LLC

- Hatch Collection LLC

- Isabella Oliver Limited

- PinkBlush Maternity

- Boob Design AB

- Ripe Maternity Pty Ltd

Global Maternity Apparel Market Report Segmentation

By Product Type

- Outerwear

- Innerwear

- Nightwear & Loungewear

- Activewear / Sportswear

- Support Garments

By Application

- Conventional

- Organic / Natural / Clean-label

By Fabric

- Cotton

- Spandex / Elastane blends

- Polyester blends

- Denim

- Sustainable / Organic fabrics

By Distribution Channel

- Offline Retail

- Online / E-commerce

- Direct-to-Consumer (DTC)

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636