Market Summary

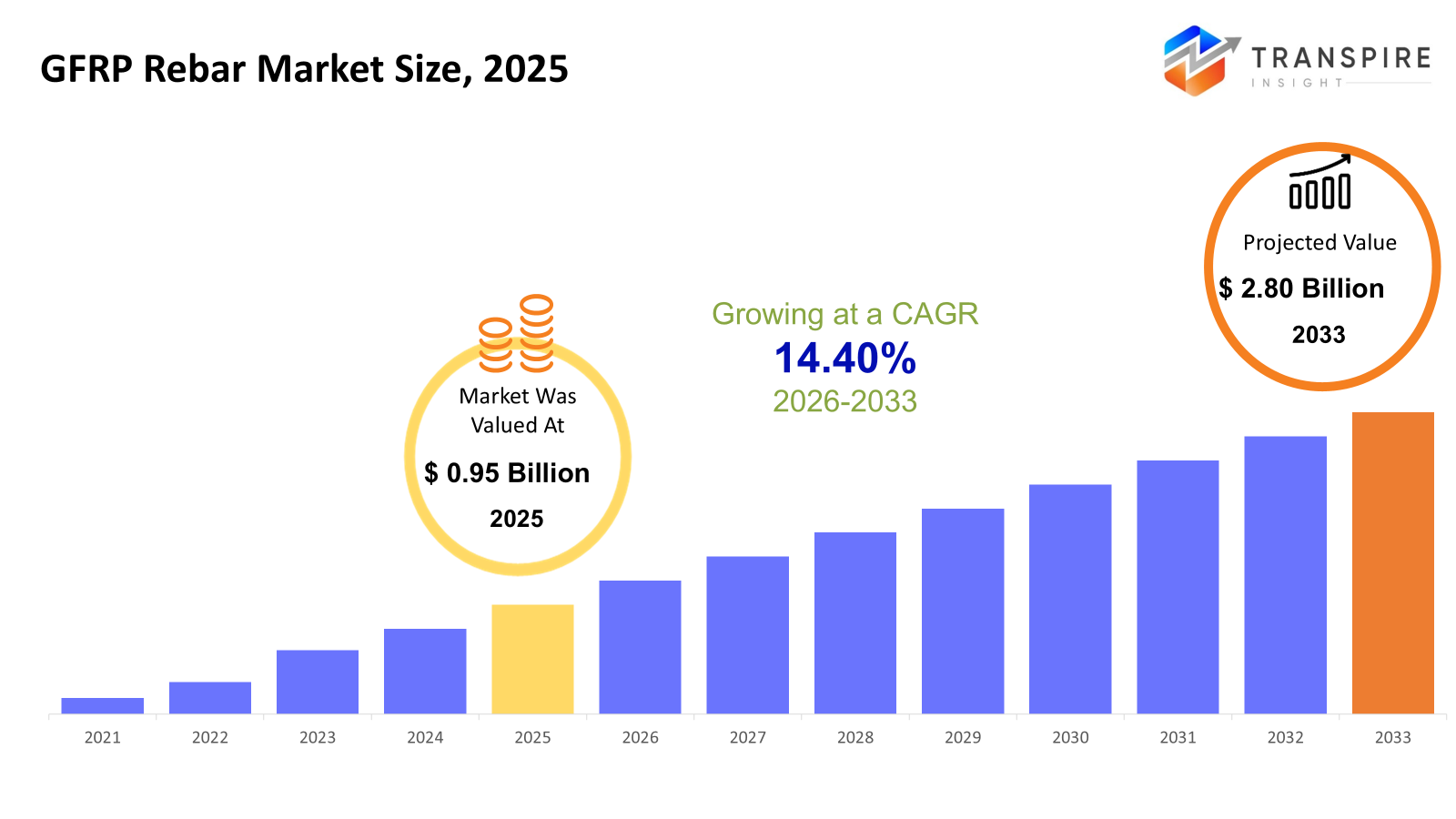

The global GFRP Rebar market size was valued at USD 0.95 billion in 2025 and is projected to reach USD 2.80 billion by 2033, growing at a CAGR of 14.40% from 2026 to 2033. Rising infrastructure rehabilitation activities, as well as concerns about corrosion-based infrastructure maintenance costs, are boosting the demand for GFRP rebars. Its longer lifespan, as well as reduced maintenance costs, is fueling its demand at a steady rate, especially in transportation, marine, and water management infrastructure.

Market Size & Forecast

- 2025 Market Size: USD 0.95 Billion

- 2033 Projected Market Size: USD 2.80 Billion

- CAGR (2026-2033): 14.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America continues to see steady demand growth, supported by infrastructure rehabilitation programs and increased acceptance of corrosion-resistant reinforcement materials. Meanwhile, the regulatory focus on lifecycle cost optimization and durability improvements encourages wider adoption of composite reinforcement solutions across transportation and utility projects.

- The United States continues to be a vital contributor, with the drive coming from bridge repair initiatives, the growth of the highway expansion programs, and the rising engineering inclination for non-corrosive materials. These have supported the long-term adoption of GFRP rebar in the public infrastructure projects with the aim of reducing maintenance expenditure by extending structural lifespan.

- The Asia Pacific has been marked by faster market growth, driven by rapid urbanization, intensive infrastructure investments, and increasing awareness of value-added construction materials. China and India will continue to drive demand, while developed markets will focus on durability and resilience in transport and coastal protection infrastructure.

- The vinyl ester resin segment, which dominates the market trends, offers superior corrosion resistance properties and mechanical performance, making it one of the most appropriate options for marine, transportation, and water infrastructure projects, as durability and maintenance savings continue to be prominent factors for contractors and developers alike.

- #4 bar size continues to lead demand trends, as this balance of strength and ductility is appropriate for residential and commercial constructions. The size of the bars can support cost-efficient reinforcement solutions to various infrastructure projects of mid-scale.

- The ongoing trend of using highway and bridge construction as a major application area is expected to be driven by a rise in investment in infrastructure and the need to find materials that can withstand environmental deterioration, improving their lives and reliability.

- The infrastructure segment of the infrastructure end-user segment continues to experience robust growth because of the increasing need for durable, maintenance-friendly infrastructure construction materials, which results in the increased uptake of GFRP rebar for use in bridge construction, highway construction, and utilities.

So, The GFRP rebar market refers to the section of the market that deals with glass fiber reinforced polymer reinforcement bars, which can serve as alternatives to steel bars in construction. GFRP composites display high tensile strength along with resistance to corrosion and low weight. This makes it feasible to incorporate these materials in construction projects, especially those located in harsh environments. Awareness regarding cost efficiency and durability is good for the GFRP industry. The market is gaining momentum with increasing investment in infrastructures and the need for enhancing the structural longevity with reduced maintenance requirements. GFRP rebar usage is also increasing in bridges, marine structures, and water treatment plants, where corrosion resistance is a major concern. Advances in technology are enhancing the reliability of the product and expanding the overall scope of usage in commercial and industrial construction activities.

Increasing focus is being given to environmentally conducive building practices, which is also aiding in the expansion of the market. There is an increase in the usage of technologically advanced products particularly reinforcement materials. There has been an increase in the usage of advanced reinforcement materials which will aid in the expansion of the market due to enhanced sustainability.

GFRP Rebar Market Segmentation

By Resin Type

- Vinyl Ester

The dominance of vinyl ester resin in the GFRP rebar market is underpinned by its superior corrosion resistance and chemical durability. This resin tends to perform pretty well in harsh environments, be they marine or wastewater infrastructures. Higher mechanical strength with longer lifecycle performance supports its adoption in critical infrastructure projects.

- Polyester

- Polyester resin-based GFRP rebars provide cost-effectiveness with sufficient structural strength under non-aggressive environmental conditions. The applications are primarily residential and light commercial construction. Price sensitivity is signaling steady demand for polyester variants in emerging markets.

- Epoxy

Epoxy resin has strong adhesion properties and an improved resistance to fatigue. It finds application in specialized industrial and high-load areas. Although it is of a relatively higher cost, its performance advantages make it suitable for technically demanding projects.

To learn more about this report, Download Free Sample Report

By Bar Size

- #3

#3 bars are usually used for light structural and residential work. The size of these bars is too small to be used for most construction applications. The demand is derived from small construction activities.

- #4

- #4 size has a substantial market share due to its middle ground between strength and versatility. It is commonly used in residential foundations and commercial slabs. The size accommodates medium load requirements.

- #5

#5 bars are used in mid-scale commercial and infrastructure projects. The material offers increased tensile properties for structural components. Increased urban infrastructure projects drive demand for the segment.

- #6

#6 bars are typically employed in heavy commercial and infrastructure-building ventures. They provide greater durability. Bridges and transportation systems often require #6 bars.

- #7 and above

These larger sizes are mainly used in heavy-duty infrastructure projects. High strength and resistance to corrosion make these materials fit for bridges, marine structures, and large-scale foundations. These materials are demanded based on public infrastructure investments.

By Application

- Highway and Bridge Construction

This segment holds a significant share, considering the increasing infrastructure projects of modernization. The corrosion resistance of GFRP rebar increases its lifespan when in a salt environment. Government projects facilitating transportation create markets.

- Marine Structures

In terms of marine applications, GFRP’s corrosion resistance to salt water is advantageous. The material is used to develop piers and docks, and coastal reinforcement projects. Increasing development of coastal infrastructure is paving the way for market segment expansion.

- Water Treatment Plants

Chemical resistivity enhances GFRP rebar usability in the construction of wastewater and desalination plants. GFRP rebar ensures minimal maintenance and overall cost. Increasing investment in environmental infrastructure drives demand.

- Residential Construction

Adoption is rising in housing foundations and slabs because of the benefits offered. Light weight helps in easy installation. Urbanization trends support steady consumption.

- Commercial Construction

Commercial buildings also adopt GFRP, which is essential for enhancing longevity and minimizing maintenance. Cost optimization for the lifespan of buildings also drives the construction sector. Expanding office and retail space continues to boost demand.

- Industrial Construction

Given the environment that is corrosive, industrial facilities require high-performance reinforcement. GFRP rebar reduces downtime and structural degradation. Investments in the manufacturing and energy sector contribute to growth.

- Others

Tunnels, parking structures, and specialty applications also are included. Regulatory standards and innovative construction techniques drive adoption. Niche markets offer opportunities for incremental growth.

By End-User

- Infrastructure

Infrastructure is the largest end-use sector because of the vast public investment in it. Bridges, roads, and public utilities use ever more non-corrosive reinforcement. Long useful service life is one of the most important selection criteria.

- Construction

General construction involves residential and commercial projects. For lightweight handling and durability, the builders go for GFRP. Adoption is very gradually expanding beyond the traditional steel reinforcement.

- Industrial

Industrial end-users demand reinforcement solutions resistant to chemicals and heavy loads. GFRP improves the impermeability of concrete in aggressive environments, reducing maintenance requirements. Growth goes hand in hand with the expansion of industrial facilities.

- Marine

The most important requirements for marine end-users are resistance to corrosion and durability. Various coastal development and port modernization projects increase consumption. Supporting adoption are regulatory standards that promote the usage of durable materials.

- Others

This includes utility, energy, and specialty engineering. Demand depends on conditions for any particular project and environmental concerns. With technological changes, this category could be expanded even further.

Regional Insights

North America is a mature market, developing on the basis of strong infrastructure rehabilitation programs, as well as early adoption of advanced composite materials. The United States heads regional demand, impelled by the reconstruction of bridges, whereas corrosion-resistant reinforcement in transport and marine infrastructure is emphasized in Canada. Partial, step-by-step adoption has been characteristic of Mexico, in line with the modernization of the building industry. Europe follows with steady growth, driven by sustainability regulations and stringent standards on construction durability. Germany, the United Kingdom, France, Spain, and Italy are investing in infrastructure upgrades for higher returns and reduced maintenance in the longer term. Rest of Europe contributes through growing intake from coastal and industrial construction projects demanding corrosion-resistant materials.

The Asia Pacific emerges as the fastest regional market since quick urbanization and large-scale infrastructural development in China and India have greatly accelerated. Japan and South Korea develop high-performance construction materials that can show seismic resilience, while Australia and New Zealand focus on marine and coastal infrastructure durability. In other parts of Asia Pacific, adoption is rising, facilitated by expanding construction activities. In the case of South America, a moderate rate of development is witnessed due to infrastructure projects completed in Brazil and Argentina, particularly within transportation and construction sectors. The fluctuations have had impacts on development schedules, while the rest of South America is witnessing gradual acceptance of advanced types of reinforcement within selective infrastructure projects.

This region, Middle East & Africa, is fueled by large infrastructure projects, particularly in Saudi Arabia and United Arab Emirates. In this region, harsh weather conditions provide opportunities to drive customers toward materials resistant to corrosion, whereas steady growth is seen in South Africa, as well as in the rest of the region, due to development in industrial and utility infrastructure.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, Announcing another important milestone regarding the successful internal pilot implementation of Group Dextra patented invention Durabar GFRP reinforcement carpet in its factory in Thailand to assess performance under continuous industrial loads, in preparation to bring to the market such an innovative application.

- In August 2025, Pultron Composites announced key senior appointments to its business development and sales leadership team, with a focus on driving the adoption of its Mateenbar GFRP rebar solutions across Australia's infrastructure and construction sectors to extend asset life and reduce maintenance costs in harsh corrosive environments, such as marine and wastewater projects.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.95 Billion |

|

Market size value in 2026 |

USD 1.10 Billion |

|

Revenue forecast in 2033 |

USD 2.80 Billion |

|

Growth rate |

CAGR of 14.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Dextra Group, Pultron Composites, Schöck Bauteile GmbH, Pultrall Inc., Kodiak Fiberglass Rebar, Neuvokas Corporation, Sireg S.P.A., Hughes Brothers Inc., Composite Rebar Technologies, Armastek, FiReP Rebar Technology, B&B FRP Manufacturing Inc., BP Composites Ltd., Fibrolux GmbH, and Röchling Group |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Resin Type (Vinyl Ester, Polyester, Epoxy), By Bar Size (#3, #4, #5, #6, #7 and Above), By Application (Highway and Bridge Construction, Marine Structures, Water Treatment Plants, Residential Construction, Commercial Construction, Industrial Construction, Others) and By End-User (Infrastructure, Construction, Industrial, Marine, Others) |

Key GFRP Rebar Company Insights

Dextra Group is known for its leadership in the GFRP rebar business and is a well-established name in the manufacturing of high-performance ASTEC and Durabar rebars for infrastructure and marine projects. Dextra's diverse product range of corrosion-resistant and lightweight structurals, unlike traditional steel rebar products, finds greater acceptance in engineering specifications seeking longer product lifespan and lower maintenance cost. Dextra's facilities in Asia, which are ISO certified, and the quality management systems in place enable the company to create regional and project-level brand positioning in both mature and emerging markets. Dextra's investment in R&D activities and customized support systems, along with its contributions to infrastructure projects, attest to the company's competitive strength and leadership.

Key GFRP Rebar Companies:

- Dextra Group

- Pultron Composites

- Schöck Bauteile GmbH

- Pultrall Inc.

- Kodiak Fiberglass Rebar

- Neuvokas Corporation

- Sireg S.P.A.

- Hughes Brothers Inc.

- Composite Rebar Technologies

- Armastek

- FiReP Rebar Technology

- B&B FRP Manufacturing Inc.

- BP Composites Ltd.

- Fibrolux GmbH

- Röchling Group

Global GFRP Rebar Market Report Segmentation

By Resin Type

- Vinyl Ester

- Polyester

- Epoxy

By Bar Size

- #3

- #4

- #5

- #6

- #7 and Above

By Application

- Highway and Bridge Construction

- Marine Structures

- Water Treatment Plants

- Residential Construction

- Commercial Construction

- Industrial Construction

- Others

By End-User

- Infrastructure

- Construction

- Industrial

- Marine

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636