Market Summary

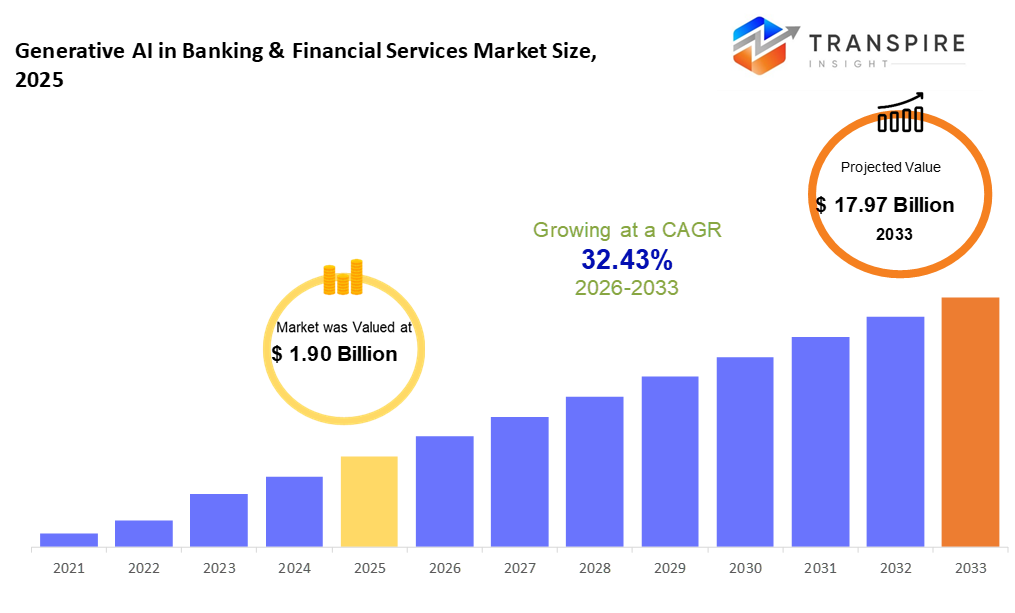

The global Generative AI in Banking & Financial Services market size was valued at USD 1.90 billion in 2025 and is projected to reach USD 17.97 billion by 2033, growing at a CAGR of 32.43% from 2026 to 2033. Driven by the increasing adoption of large language models for customer engagement, automation, and personalized financial services across banks and fintechs. Additionally, strong cloud adoption, rising demand for operational efficiency, and accelerated digital transformation initiatives are fueling the market’s high CAGR through 2033.

Market Size & Forecast

- 2025 Market Size: USD 1.90 Billion

- 2033 Projected Market Size: USD 17.97 Billion

- CAGR (2026-2033): 32.43%

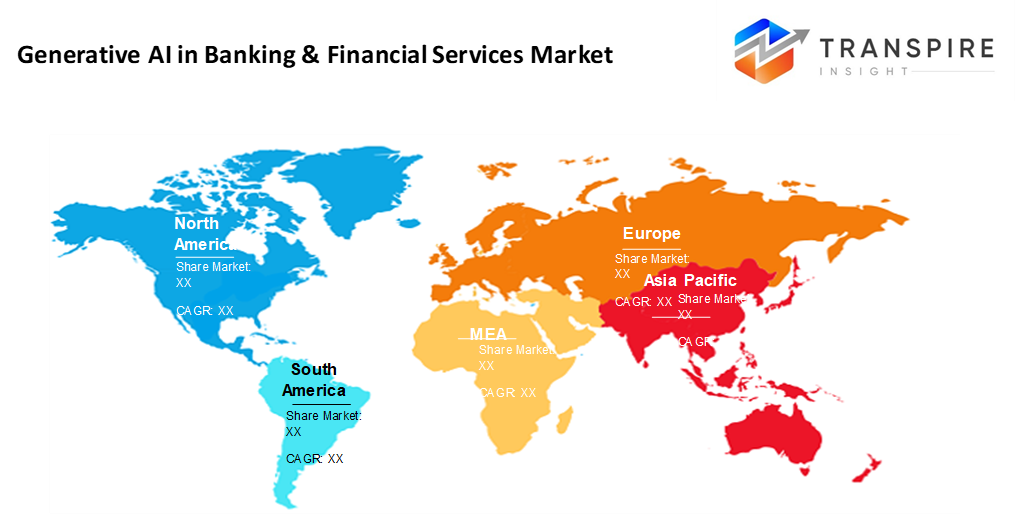

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 52% in 2026. Still ahead, North America holds the biggest portion thanks to strong funding in artificial intelligence, well-built financial tech networks, and a fast uptake of new generative tools across many areas.

- Fueled by heavy investment in research, the United States. shapes direction across the region. Its extensive cloud-based AI networks form a backbone for constant innovation. In banking and financial tech, new generative systems take hold faster than expected. Strength here does not come from one factor alone it builds through layers of capability stacked over time.

- In Asia Pacific, down under and across the sea, tech-savvy users are turning to apps for money tasks. New tools pop up where phones meet banking needs. Leaders back smart systems that learn, pushing changes fast. Growth surges where signals reach farthest

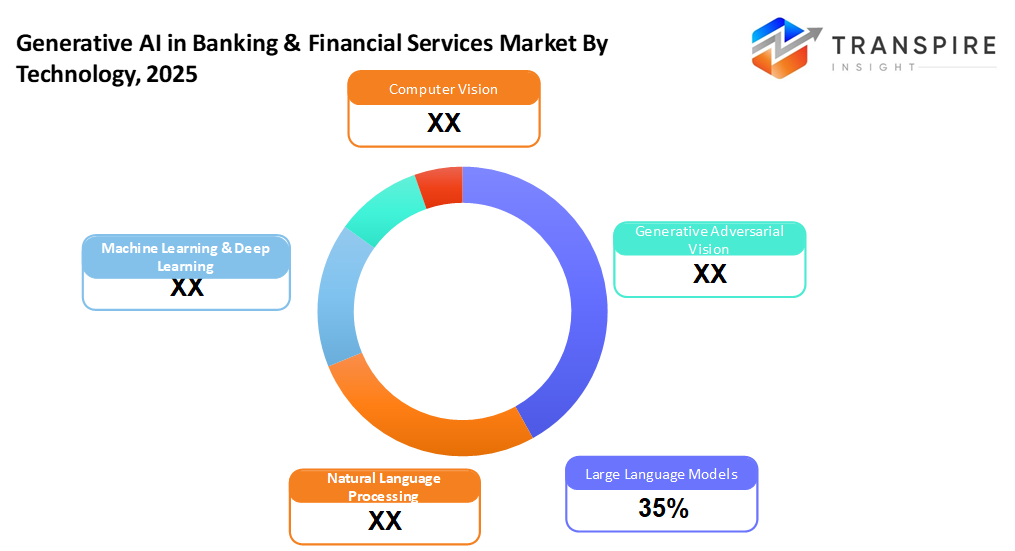

- Large Language Models share approximately 37% in 2026. Mainly large language models. These systems shape how machines write and respond. Instead of basic replies, they enable fluid conversations. Think chatbots that sound human. Automated reports now form themselves, pulled from raw data. Companies connect with users through tailored messages. Progress here means quicker responses and fewer errors. The core engine behind it all: pattern recognition at massive scale.

- Fueled by cloud power, deployment skips heavy hardware scaling and becomes smooth, setup gets quicker, costs drop as models live online.

- Banks want round-the-clock help for clients, so they are turning to smart chatbots. These AI helpers answer questions anytime, without delays. Growth spikes here because service never stops. Firms see fewer gaps when humans and machines work together. Client needs get met faster now. That shift pushes support tools ahead of other uses. Speed matters most where customers are involved.

- Modern banking relies on new tech, with big investments pushing how services work today. Core players act fast, using smart tools so they do not fall behind newer rivals. Digital change spreads through branches because staying current matters more now.

A wave of change sweeps through banks and finance, powered by smart systems that think and respond like humans. These tools shape reports, answer questions, refine service speed, plus guide choices with live data. Instead of old routines, firms now lean on pattern-spotting software that learns over time. From chatbots to behind-the-scenes analysis, language-driven machines help customers without waiting. Digital shifts push faster results, while users expect instant replies tailored just for them. Growth kicks up because delays fade, accuracy lifts, and tasks once manual turn seamless.

Some banks now use smart software that writes like a person, handling tasks from answering questions to spotting suspicious transactions. This tech runs nonstop, giving replies that fit the situation, so help arrives whenever needed. Instead of waiting, customers get quick guidance through digital helpers built into apps and websites. Behind the scenes, machines sort through piles of reports, emails, and numbers to find hidden patterns. One moment it checks loan risks, next it prepares summaries for legal rules. Speed matters here - decisions happen quicker because systems learn from messy real-world data. Not every task fits this tool, yet many teams rely on it daily. Results show fewer delays, tighter oversight, and smarter moves.

Out in the open on cloud platforms, deployment speeds up because systems can stretch when needed, adapt easily, change shape without hassle, yet keep expenses low. This helps companies plug generative AI into current tech setups fast. Big names in finance, especially banks, lead the pack since they pour money into upgrading through artificial intelligence just to hold their ground against agile new fintech rivals. As algorithms get sharper, rules become clearer, confidence grows around self-running tools for money matters take root slowly, but surely, the space where generative AI meets banking feels ready to expand steadily across the years ahead.

Generative AI in Banking & Financial Services Market Segmentation

By Technology

- Large Language Models

A powerful kind of artificial intelligence writes text almost like a person would. These systems handle conversations, create documents, or send messages without help. One moment they are answering questions, next they draft entire summaries. Think of them as smart machines trained on vast amounts of written material. Their responses often sound natural, even though no real understanding is involved.

- Natural Language Processing

Computers read or create words as people do, handling questions, records, and maybe spotting patterns. That is what happens when systems grasp how we speak.

- Machine Learning & Deep Learning

Patterns show up more clearly when systems learn over time. Because of this, guesses about what happens next get sharper in money-related tasks. Decisions gain support from models trained on past behavior. These tools reshape how information flows through financial work. Outcomes improve not by magic but by repetition and adjustment.

- Computer Vision

A machine sees what a camera captures. It checks IDs by comparing faces. Banks use it to handle payments from images of checks. Security systems confirm who you are through your eyes or face.

- Generative Adversarial Networks

Picture two computer programs locked in a game. One tries to fake images or numbers that look real. The other guesses whether they are genuine or made up. Over time, the faker gets better at fooling the judge. These systems create pretend datasets instead of borrowing actual user details. They help test how software handles edge cases. Training simulations run on artificial examples built from scratch. Risk assessments happen without touching private records.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- Cloud-Based

Hosted in the cloud, these generative AI models scale easily while offering smooth API access. Real-time tasks run fast due to flexible setup and quick rollouts. Their design favors responsiveness without heavy infrastructure demands.

- On-Premises

Running things locally suits organizations that need tight oversight. Where data stays private matters most. Rules must be followed without exception.

By Application

- Customer Support & Virtual Assistants

When it comes to helping users, smart chatbots step in anytime, offering answers, guidance, or tailored suggestions without pause. These digital helpers stay online always, ready to respond whenever someone needs assistance.

- Fraud Detection & Risk Management

Spotting scams gets easier when smart systems notice odd patterns. These tools learn what looks wrong by studying past behavior. Instead of waiting, they act fast when something seems off. Because habits change, the software adapts without needing a reset. Unusual activity stands out faster than before. What once took hours now happens in moments. Learning from new data keeps the process sharp. Mistakes drop when machines highlight risks early.

- Credit Scoring & Underwriting

From a fresh angle, machines now judge who can pay back loans by learning patterns in huge sets of numbers. Instead of old methods, smart systems spot risks through hidden trends most people miss. These tools shape lending choices without human guesswork taking over.

- Personalized Banking & Financial Advisory

A fresh take on money guidance shows up right when you need it. Smarter choices come from learning your habits over time. Decisions get clearer with tools that watch how funds move. Advice shifts as life changes, staying close to your real goals. Insights appear not because they are scheduled, but because patterns emerge. Wealth steps forward quietly through small, informed moves.

- Trading Portfolio and Wealth Management

From smart tools that shape investing plans comes help in sorting risks, building better portfolios. One step at a time, choices get clearer through machine learning support. Mix in personal goals, adjust for uncertainty, and let patterns guide decisions. Not magic, just smarter number crunching behind the scenes. Results shift as markets move, responses stay quick, tailored without fuss.

By End-Users

- Banks

Fueled by demand, banks lead in applying generative AI - shaping how they interact with customers, manage threats, and streamline workflows. Their role? Setting pace through real-world integration across daily functions.

- Financial Institutions

Banks, credit unions, and insurers each use artificial intelligence to handle rules, study information flows, and then predict uncertainties. One moment focused on regulations, next crunching numbers, always adjusting forecasts based on shifting patterns.

- FinTech companies

Some FinTech firms move fast, building new tools through generative AI that work inside apps, phones, or online services. These startups adapt quickly, shaped by smart tech woven into everyday financial tasks.

- Insurance Companies

Firms that provide coverage now apply smart systems to handle payouts faster. Processing new policies gets smoother through learning machines. Talking to clients becomes simpler with digital helpers. Guessing future problems improves using pattern detection tools.

- Asset Management & Investment Firms

For asset managers and investment companies, artificial intelligence can uncover patterns that shape how trades are built. These tools help predict shifts in markets rather than just follow them. Decisions about portfolios gain depth when machine learning highlights hidden trends. Insights emerge not from gut feeling but from data processed at speed. Outcomes often improve when models adjust faster than human analysis allows.

Regional Insights

Out front, North America takes the lead in generative AI within banking and finance. Led by the United States and Canada, grouped as Tier 1, with Mexico just behind in Tier 2. A head start on smart tech, solid cloud systems, and big-name AI players. The United States drives most momentum here. Banks there now rely heavily on language models, using them to handle customer queries, detect fraud, and ease regulatory tasks. Meanwhile, up north, Canadian firms steadily weave similar tools into online banking and investment services. Down south, Mexico builds pace not yet at full stride but showing promise through fresh fintech efforts and smarter financial platforms.

Across parts of Europe, like the United Kingdom, Germany, and France, banks are using generative AI more because rules favor digital money services and there's steady funding for tech upgrades. Leading the way, the United Kingdom relies heavily on smart chatbots and custom advice systems that guide users through finances. Close behind, German institutions lean into tools that monitor risks, while French ones emphasize following legal standards smoothly. In southern and eastern areas - including Italy, Spain, and Nordic nations the pace is slower but growing as firms turn to AI for smoother workflows and better interactions with clients. This shift gains strength where startup activity in finance technology is on the rise.

Across the Asia Pacific, home to China, Japan, India, and Australia at the core, plus emerging hubs like Singapore, Indonesia, Thailand, and Vietnam, growth in finance tech outpaces the rest of the world. Rising use of digital banking pushes progress, along with vast populations seeking new tools, supported by national programs embracing artificial intelligence. In China and India, systems that generate responses or decisions are rolling out widely across payment platforms, loan processing, and mobile money apps. Meanwhile, Japan and Australia turn attention toward automated investment guidance and smarter rule-following processes powered by machines. Smaller but fast-moving economies in Southeast Asia see rising energy as young financial technology companies and newly launched digital banks adopt these smart models to offer flexible, tailored solutions to more people.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 16, 2025 – Danske Bank further strengthens generative AI focus with new leadership appointments.

(Source: https://danskebank.com/news-and-insights/news-archive/news/2025/16062025

- May 13, 2024 – Temenos launched the first responsible generative AI solution for core banking.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.90 Billion |

|

Market size value in 2026 |

USD 2.52 Billion |

|

Revenue forecast in 2033 |

USD 17.97 Billion |

|

Growth rate |

CAGR of 32.43% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Amazon Web Services, OpenAI, Anthropic, Bloomberg, Cohere, Databricks, DataRobots Inc., Glia Technologies, Google LLC, H2O.Ai, IBM Corporation, Kasisto Inc., Microsoft Corporation, NVIDIA Corporation, Oracle Corporation, SAP SE, Capgemini SE, and Accenture Plc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Large Language Models, Natural Language Processing, Machine Learning & Deep Learning, Computer Vision, Generative Adversarial Networks) By Deployment Mode(Cloud-Based, On-Premises) By Application (Customer Support & Virtual Assistants, Fraud Detection & Risk Management, Credit Scoring & Underwriting, Personalized Banking & Financial Advisory, Trading Portfolio & Wealth Management) By End-Users (Banks, Financial Institutions, Fintech Companies, Insurance Companies, Asset Management & Investment Firms), |

Key Generative AI in Banking & Financial Services Company Insights

OpenAI, Inc. is a leading innovator in generative AI, best known for itsGPT series of large language models that power advanced conversational and analytical applications in banking and financial services. Its technologies are widely adopted to automate customer support, generate real-time insights, and enhance compliance and reporting workflows. OpenAI’s models assist financial institutions with tasks ranging from personalized advisory to intelligent document summarization, improving both operational efficiency and user engagement. Partnerships with cloud and fintech platforms further extend its reach across the financial ecosystem, making it one of the most influential players in the generative AI landscape.

Key Generative AI in Banking & Financial Services Companies:

- Amazon Web Services,

- OpenAI Inc.

- Anthropic

- Bloomberg

- Cohere

- Databricks

- DataRobots Inc.

- Glia Technologies

- Google LLC

- Ai

- IBM Corporation

- Kasisto Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- SAP SE

- Capgemini SE

- Accenture Plc

Global Generative AI in Banking & Financial Services Market Report Segmentation

By Technology

- Large Language Models

- Natural Language Processing

- Machine Learning & Deep Learning

- Computer Vision

- Generative Adversarial Networks

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Customer Support & Virtual Assistants

- Fraud Detection & Risk Management

- Credit Scoring & Underwriting

- Personalized Banking & Financial Advisory

- Trading Portfolio & Wealth Management

By End-Users

- Banks, Financial Institutions

- Fintech Companies

- Insurance Companies

- Asset Management & Investment Firms

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636