Market Summary

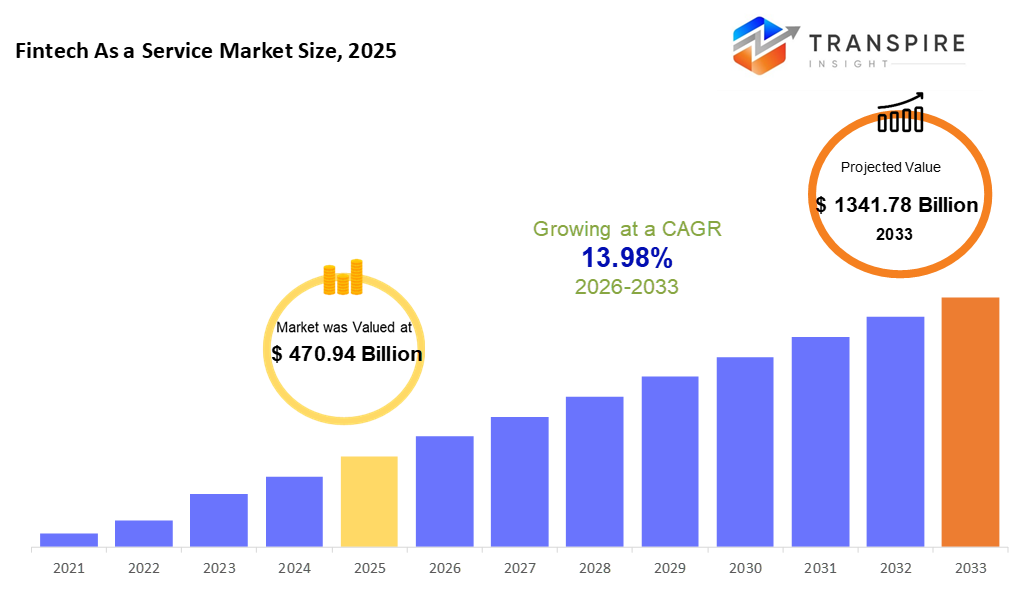

The global Fintech as a Service market size was valued at USD 470.94 billion in 2025 and is projected to reach USD 1341.78 billion by 2033, growing at a CAGR of 13.98% from 2026 to 2033. The FinTech as a Service market is expanding rapidly due to the accelerating adoption of digital payments, embedded finance, and API-based banking solutions across enterprises and financial institutions. Additionally, rising cloud deployment, regulatory support for open banking, and growing demand for scalable, cost-efficient financial infrastructure are driving sustained market growth through 2033.

Market Size & Forecast

- 2025 Market Size: USD 470.94 Billion

- 2033 Projected Market Size: USD 1341.78 Billion

- CAGR (2026-2033): 13.98%

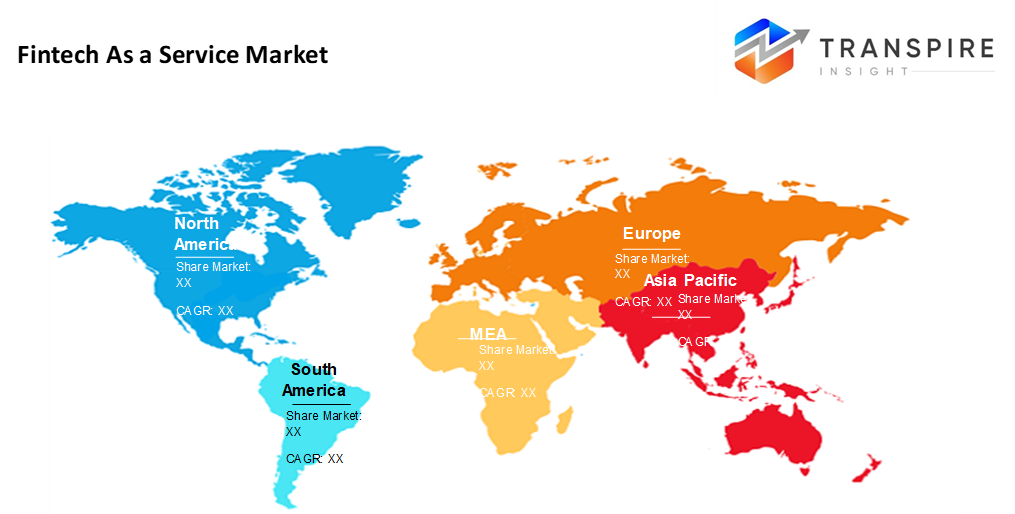

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 38% in 2026. Fueled by cutting-edge fintech setups, North America holds the top spot in the FaaS arena. Regulatory maturity helps shape its edge in this regard. Cloud reliance runs deep across industries this does not hurt either. Strength builds on strength when systems align so tightly.

- Fueled by fast uptake of BaaS, the United States drives regional expansion. Embedded financial tools take hold here earlier than elsewhere. Real-time payments are gaining ground at a strong pace across the country.

- Mobile users lead growth across Asia Pacific, where new banking efforts meet quick advances in digital finance tools. This area expands faster than others thanks to shifting habits, wider access, and tech leaps reshaping how money moves.

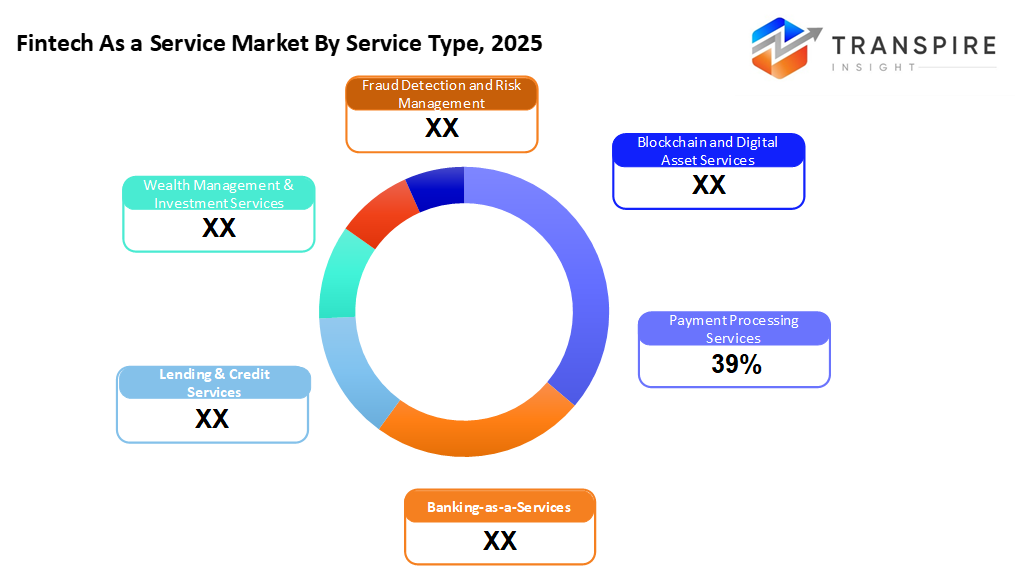

- Payment Processing shares approximately 40% in 2026. Payment processing stands out in the FaaS space because digital transactions are now common worldwide. Real-time movement of money shapes how services evolve across borders. This shift sticks around, not just passing through.

- Easy scaling plays a part. Fintech links up quicker here. The system runs on APIs that cut costs. Power grows without heavy investment. Infrastructure adapts fast when demand shifts.

- Big companies lead the market because they update old tech by adopting Function-as-a-Service tools, ubiquitous among banks, shifting infrastructure. Yet it is these established players who move first when new frameworks emerge.

- Mobile payments push digital wallets ahead. Contactless buying shapes how people pay now. E-commerce growth fuels this shift steadily. Most usage ties back to these trends clearly.

The global FinTech as a Service (FaaS) market is experiencing rapid growth as financial institutions and enterprises shift toward API-based, modular financial solutions to remain competitive in the digital economy. FaaS allows organizations to quickly deploy services such as payments, banking, lending, and compliance without developing complex backend infrastructure. This approach significantly reduces time-to-market while enabling scalable and customizable financial offerings.

Rising adoption of digital payments, mobile wallets, and real-time transaction platforms is a major factor driving market expansion. Payment processing and Banking-as-a-Service solutions are increasingly used by banks, fintech startups, and non-financial companies to support seamless customer experiences and omnichannel transactions. Additionally, the growing popularity of embedded finance is enabling businesses across retail, e-commerce, and transportation to integrate financial services directly into their platforms.

Technological innovation plays a crucial role in shaping the FaaS market, with cloud computing, artificial intelligence, and blockchain technologies enhancing efficiency, security, and transparency. Cloud-based deployment dominates due to its flexibility and cost advantages, while AI-driven fraud detection and risk management tools address rising concerns around cybersecurity and regulatory compliance. Blockchain-enabled services are also gaining traction for cross-border payments and digital asset management.

Regionally, North America holds the largest market share, supported by a well-established fintech ecosystem, high cloud adoption, and favorable regulatory initiatives. Meanwhile, the Asia Pacific is witnessing the fastest growth, driven by rapid digitization, financial inclusion efforts, and a large mobile-first population. Strategic partnerships between traditional banks and fintech providers, along with continuous regulatory advancements, are expected to sustain the strong growth of the FinTech as a Service market through the forecast period.

Fintech As a Service Market Segmentation

By Service Type

- Payment Processing Services

Still out front when it comes to earnings, companies want smooth online transactions, especially across countries. Payment handling stays strong because moving money digitally matters more every day.

- Banking-as-a-Services

Out of nowhere, Banking-as-a-Service is gaining speed. Fintechs jump in, while traditional banks follow close behind. Instead of old systems, they now rely on APIs to build flexible financial tools. Open banking is not just a trend, it quietly become the base. Modular setups replace one-size-fits-all models. Progress shows up in small steps, yet adds up fast.

- Lending & Credit Services

Fueled by digital tools, lending grows as machines assess risk faster. Loans now start online, smooth and quick. Scoring credit has turned automatic, helping decisions snap into place. Buy-now-pay-later slips into stores, travel, and even healthcare. Sector by sector, it sticks. Not magic, just shifts in how money moves. Growth shows up where tech meets trust.

- Wealth Management & Investment Services

More people are turning to automated advice platforms instead of traditional methods. Digital tools now handle investments once managed by humans alone. Machines guide choices where face-to-face meetings used to dominate. Simple interfaces replace complex paperwork for many clients. Technology steps in where personal brokers once stood. Investors accept algorithm-driven plans more readily today than before

- Fraud Detection & Risk Management

Fraud keeps rising, so firms now lean on AI tools during customer checks to spot risks early.

- Blockchain & Digital Asset Services

These systems learn fast, adapting before problems grow large. On another front, blockchain steps into banking workflows where trust matters most. Settlements gain speed when records are shared across nodes securely. Tokens begin standing in for real assets, reshaping how value moves behind the scenes. Infrastructure quietly shifts to support these new forms of ownership.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- Cloud-Based

Cloud-based systems pull ahead because they grow easily, cost less over time, and work smoothly with modern financial tech setups. This shift marks a clear pattern across the industry today

- On-Premises

Staying put on-site remains typical for strict finance outfits focused on keeping data close. Common move

- Hybrid Deployment

Firms mix on-site systems with online services more often now. Still needing firm rules while using outside servers helps push that trend forward.

By Organization Size

- Large Enterprises

Faas sees strong uptake among big companies aiming to update outdated tech stacks while improving how digital services reach users. A widespread pattern in larger organizations

- Small & Medium Enteprises

Faster access for smaller businesses begins with simpler tools. One way is using digital links that cut setup time. These connections lower expenses over time. Getting started becomes easier when systems talk directly. Cost drops happen as setups grow smarter. Entry into markets speeds up without heavy investment. Efficiency rises when processes link smoothly.

By Application

- Digital Payment & Wallets

Fueled by rising smartphone use, digital payment apps are gaining ground quickly. Mobile transactions now feel ordinary to many people. Contactless methods ride that shift, pushing wallet services forward. Growth here outpaces other uses, pulled along by convenience.

- Embedded Finance

Finance tucked inside everyday apps changes how businesses earn. One step beyond basic transactions, it opens new paths for income. Not just banking, part of a larger shift across fields

- Lending & Credit Management

Lending moves faster now because online systems handle loans differently. Machines decide who gets credit, changing how things worked before. Speed grows where paperwork once slowed everything down

- Personal & Business Finance Management

What people do with money, both personal and business, leans more on apps that help plan spending. Not just local but global moves of cash now rise fast through tech like blockchain and open banking links, cutting transfer fees.

Regional Insights

One big piece of the FinTech-as-a-Service world lives in North America, along with Europe, where banks have been around a while, people pay digitally more often, and rules are clear. Getting into cloud-powered money tools fast helped a lot, so did weaving finance quietly into apps, plus hosting many fresh financial tech creators. Over in Europe, things move differently. Rules like PSD2 opened up bank data through APIs, which pushed companies to compete harder and reach customers across borders without old barriers slowing them down.

Down south of Asia, things move quickly. Digital shifts spark change where phones lead daily life. Think China, then India, followed by busy nations nearby each seeing more need for online payments, instant loans, and pay wallets. Shopping moves online, apps grow big, demands rise. Rules set by officials help new finance tech spread faster. Public efforts push cashless habits. Behind it all, platform use climbs without pause.

Out in Latin America, more people now use digital wallets because banks have not reached everyone just yet. Instant payments and new kinds of loans are catching on fast there, too. Over in the Middle East and Africa, money flowing into fintech startups has picked up lately. Governments back projects that push digital money tools, helping things grow. Mobile phones become a go-to for handling finances across both areas. Growth does not roar; it builds quietly through steady steps forward. Forecast years ahead show these places adding consistent momentum worldwide.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 5, 2025 – Ant International launched a new AI platform for the fintech sector.

(Source: https://www.retailbankerinternational.com/news/ant-international-ai-platform-fintech/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 470.94 Billion |

|

Market size value in 2026 |

USD 536.78 Billion |

|

Revenue forecast in 2033 |

USD 1341.78 Billion |

|

Growth rate |

CAGR of 13.98% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

PayPal Holding Inc., Block Inc., Stripe, Mastercard Services, Fiserv, FIS, Adyen, Rapyd, Marqeta, Plaid, Synctera, Mambu, Miquido, VoPay, and Raislr |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Service Type (Payment Processing Services, Banking-as-a-Services, Lending & Credit Services, Wealth Management & Investment Services, Fraud Detection & Risk Management, Blockchain & Digital Asset Services) By Deployment Mode(Cloud-Based, On-Premises, Hybrid Deployment) By Organization Size (Large Enterprises, Small & Medium Enterprises) By Application (Digital Payment & Wallets, Embedded Finance, Lending & Credit Management, Personal & Business Finance Management, Cross Border Remittances |

Key Fintech As a Service Company Insights

One way to look at Stripe is through its tools for handling money online. Businesses across the world rely on it when customers pay over the internet. Instead of just moving cash, the system helps firms keep track of recurring charges, too. Built with coders in mind, each piece fits together like blocks, flexible, clear, and independent. Fraud checks sit alongside invoicing features without slowing things down. Some companies even issue their own cards using what's built into the network. Lending options now exist next to core payment functions. From San Francisco to Singapore, operations run on this framework daily. Big stores, small apps, and finance creators plug in regularly. Security stays tight while systems grow bigger every month. A quiet attention to how developers think. Not flash, just function working quietly behind screens.

Key Fintech As a Service Companies:

- PayPal Holding Inc.

- Block Inc.

- Stripe

- Mastercard Services

- Fiserv

- FIS

- Adyen

- Rapyd

- Marqeta

- Plaid

- Synctera

- Mambu

- Miquido

- VoPay

- Raislr

Global Fintech As a Service Market Report Segmentation

By Service Type

- Payment Processing Services

- Banking-as-a-Services

- Lending & Credit Services

- Wealth Management & Investment Services

- Fraud Detection & Risk Management

- Blockchain & Digital Asset Services

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid Deployment

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- Digital Payment & Wallets

- Embedded Finance

- Lending & Credit Management

- Personal & Business Finance Management

- Cross-Border Remittances

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636